Executive Summary

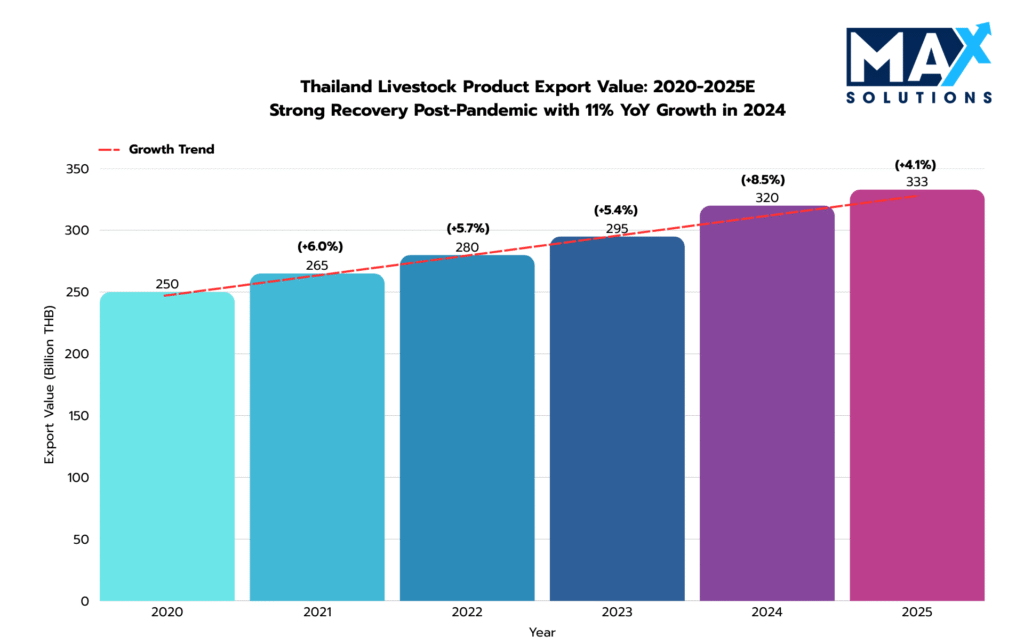

Thailand’s livestock sector represents one of Southeast Asia’s most attractive divestiture markets, driven by robust export growth, rising feed demand, and rapid structural consolidation. The country achieved a record ฿320 billion in exports in 2024 (+11% YoY), projected to reach ฿333 billion in 2025 (Asian Agribiz, 2025). Meanwhile, the compound feed market is valued at USD 6.7 billion and growing at 5.1% CAGR through 2030 (Mordor Intelligence, 2025).

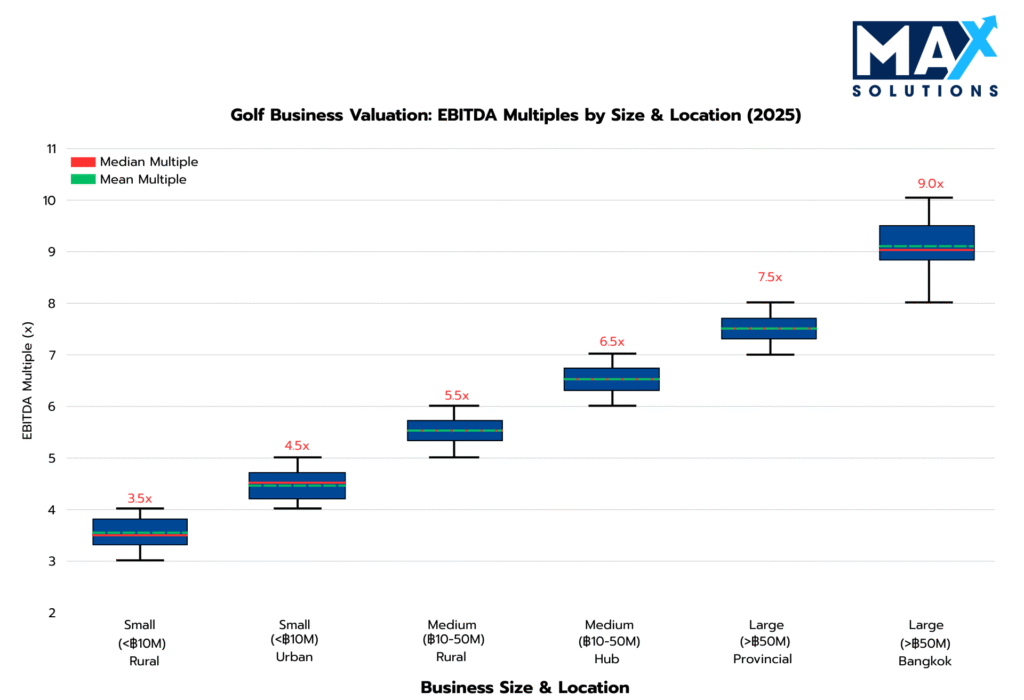

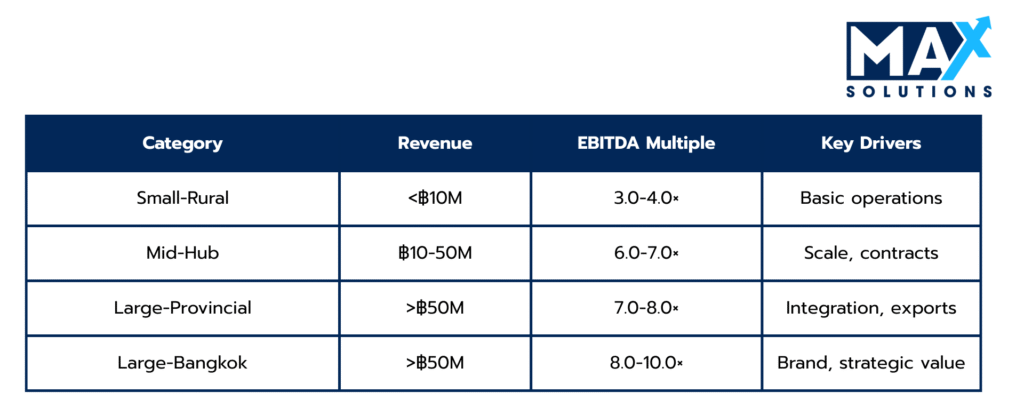

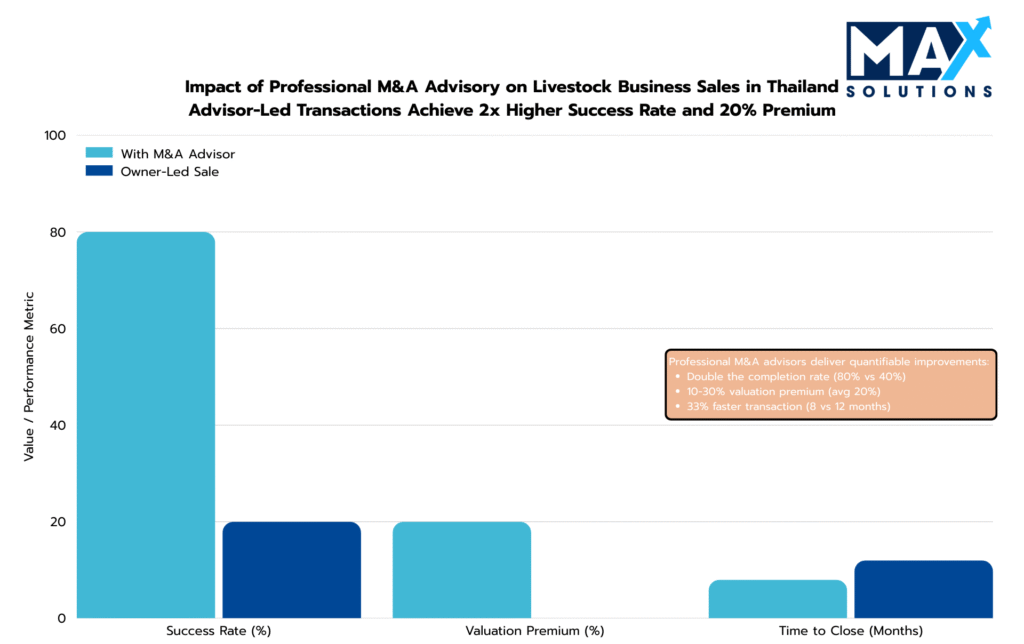

Valuation multiples vary widely—from 3.0–4.0× EBITDA for small rural farms to 8.0–10.0× for large, integrated Bangkok-based operations. The differential reflects scale, compliance, and sophistication rather than size alone—gaps that can be bridged through structured preparation. Professionally managed M&A transactions deliver 10–30% valuation premiums, 80% vs. 40% success rates, and 25–33% faster closings compared with owner-led processes.

This report provides Livestock owners with a data-driven roadmap through the complex six-stage M&A process, from preparation to closing. Drawing on transaction data and regulatory frameworks specific to Thailand’s Livestock sector, we quantify the value drivers, identify common transaction obstacles, and demonstrate how specialized advisory services—particularly Max Solutions’ integrated M&A, legal, and accounting platform backed by Tanormsak Law Firm’s 50+ years of expertise—systematically enhance exit outcomes.

Figure 1: Thai Livestock Market Size and Growth (THB), 2020-2025E

Introduction

Thailand’s livestock industry is a foundational component of the national economy, engaging over two million farms, or roughly 11% of all households. The sector’s concentration is pronounced: leading corporates such as CPF (30% market share) and Betagro (15%) dominate the value chain, while the top five players account for nearly 70% of commercial production. This oligopolistic environment has intensified acquisition demand for mid-market, professionally managed operators, which now represent strategic consolidation targets for both domestic and regional buyers.

Simultaneously, shifting global food supply chains, biosecurity regulations, and traceability requirements are transforming the competitive landscape. AgTech adoption—ranging from IoT-based herd monitoring to feed optimization—has demonstrated >20% labor savings and measurable EBITDA uplift. Buyers increasingly prioritize these efficiency metrics alongside certification standards (GAP, HACCP, and organic compliance) when assessing enterprise value.

For owners considering a sale, success now depends on more than operational scale. Key differentiators include financial transparency (TFRS and QoE standards), FBA compliance, and biological asset documentation, which collectively underpin valuation credibility. Within this evolving market, the window for strategic exits remains wide open, particularly as multinational investors and regional feed producers seek Thai footholds.

Valuation Landscape

Livestock Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Livestock Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. The Thai Livestock sector median of 6× EV/EBITDA represents the baseline for private Livestock transactions. However, advisor-optimized deals systematically achieve 6.2-7.5× multiples through competitive tension creation, strategic positioning, and proactive risk mitigation.

Table 1: Revenue-Based Valuation Multiples for Thai Livestock Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 3-10× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Livestock Business Sale Process

Successful Livestock business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financials/QoE: 3–5 yrs TFRS; rebuild Adjusted EBITDA (normalize owner comp, one-offs, biological asset remeasurements; align depreciation).

- Regulatory & Land: FBA audit; unwind nominee risks; verify Chanote/Nor Sor titles or long-term leases; confirm DLD permits, movement certificates, waste/water licenses.

- Ops & Data Pack: Cohort performance (FCR, ADG, mortality), stocking density, throughput, feed hedges, medication/AMU logs, cold-chain KPIs.

- Certifications: GAP, HACCP/ISO 22000, halal where relevant.

- Quick Value Uplifts: AgTech (environment sensors, auto-feeding), biosecurity upgrades, and contract renewals/extensions.

- Advisor selection: Engage specialized M&A advisors with Livestock expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study:A Ratchaburi swine unit (฿62M revenue) invested ฿2.8M in ventilation sensors, foot-dip stations, and a QoE. Adjusted EBITDA rose ฿6.1M→฿7.4M; with certificates updated and land records clarified, buyer ranges moved from 6.0–6.5× to 7.3–7.6×, equating to ~23% value uplift.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

- Buyer universe: Domestic strategics (CPF, Betagro, GFPT), regional strategics (SG/MY/ID), PE/agri funds; map each buyer’s FBA comfort and biosecurity standards.

- Materials: 1–2-page teaser followed by an NDA thereafter a 20–30-page CIM (cycle economics, KPIs, land/FBA structure, capex plan, ESG).

- Process control: 25–30 targets; staged data room; early landlord/title confirmations; plan site hygiene rules for tours.

- Positioning: Emphasize recurring contracts, biosecurity metrics, AgTech ROI, and export readiness.

Case Study: A poultry grow-out cluster near Nakhon Pathom approached 29 targets; 11 NDAs and 5 site tours produced strong competition. After buyers reviewed mortality/FCR dashboards and contract rollovers, indications stepped from 6.4× → 7.2× EBITDA.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Livestock properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Screen IOIs: Tight valuation ranges (<20% spread), cash/financing certainty, 6–9-month closing plans, realistic capex asks.

- Qualification: Prior closings in livestock, vetting of plant health standards, and clarity on FBA/land structuring.

- Management meetings: Show cohort economics, feed hedge policy, disease-response protocols, and environmental compliance.

- Shortlist: Advance 2–3 bidders balancing price, certainty, and regulatory path.

Case Study: A Chiang Mai ruminant operator received 5 IOIs: domestic processor at 6.9× with quick close, regional buyer at 7.7× contingent on FBL and lease bifurcation. Seller advanced both, using dual-track leverage to keep price and terms improving.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Economics: Price, 10–20% deposit, staged payments; set 30–45-day exclusivity with milestones (legal, land, DLD checkpoints).

- Structure & tax: Prefer share sale for seller tax efficiency; pre-agree land-opco/propco or long-lease where foreign buyers involved; plan treaty relief for WHT.

- Working capital: Define biological asset valuation at cut-off, feed inventory, and live-animal counts; agree mortality/weight reconciliation methodology.

- Covenants: Disease notification, AMU practices, and supply continuity; limited earnout tied to EBITDA or contracted volumes (not just headcount).

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A Bangkok-area integrated poultry site nudged an LOI from 7.5× to 8.3× by agreeing to a small 12-month earnout on contracted tonnage and pre-documenting a propco ground lease to accommodate the foreign buyer’s FBA limits.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Livestock deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial/QoE: Reconcile biological assets, live-weight gains, feed conversion, and shrink; align to bank and processor statements.

- Legal/land/FBA: Title chains, servitudes, lease registrations; DLD permits, waste & water licenses; confirm no nominee risks.

- Operations/compliance: Biosecurity audits, vet records, AMU logs, cold-chain performance, downtime root-cause analysis.

- ESG & risk: Manure handling, groundwater use, odor controls; community relations and claims history.

- Vendor DD (sell-side): 4–6 weeks pre-check to eliminate re-trades and preserve headline price.

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A Chachoengsao feedlot faced a −0.9× re-trade after buyers flagged incomplete water permits; the seller obtained retroactive approvals and third-party hydrology attestation within three weeks, restoring the original 7.1× multiple.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Livestock transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Sales and Purchase Agreement terms: Reps/warranties (land, FBA, DLD, AMU, environmental), indemnities, escrow 10–20% for 12 months or W&I insurance.

- Adjustments: Cash-free/debt-free; NWC true-up inclusive of biological assets, feed inventories, and payables to growers.

- Approvals & mechanics: FBL/BOI (if any), lease novations, processor contract assignments; funds flow with phased tranches for foreign buyers.

- Handover: Vet protocols, supply schedules, biosecurity manuals, grower communications, and staff retention plans.

- Transition: Handover agronomy calendar, membership communications, staffing/seasonal labor plan, rate card governance.

Case Study: A Pathum Thani swine operation closed a 7.8× EBITDA share deal with 12% escrow; biological assets were counted and priced at cut-off; processor contracts novated on closing; escrow released clean at month 12 after AMU and environmental reps remained breach-free.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Livestock Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Livestock Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Frequently Asked Questions (FAQs)

Q) What is the typical timeline for selling a livestock business in Thailand?

A) 8-9 months for professionally managed transactions (6 stages: 1m preparation, 2m solicitation, 1m IOI, 1m LOI, 3m DD, 1m closing). Owner-led sales often exceed 12 months with lower success rates (40% vs. 80% advisor-led).

Q) How do Foreign Business Act restrictions impact valuations?

A) FBA limits foreign ownership in agriculture to 49% without BOI promotion, restricting buyer pool and potentially depressing valuations 10-15%. However, proactive compliance structuring—separating land, documenting BOI eligibility, creating secure lease arrangements—actually unlocks 15-20% foreign buyer premiums by reducing regulatory risk.

Q) What EBITDA multiple should I expect for my business?

A) Highly variable: Small rural farms (3.0-4.0×), mid-sized operations in major hubs (6.0-7.0×), large integrated Bangkok-based businesses (8.0-10.0×). Location, scale, technology adoption, recurring contracts, and FBA compliance materially impact multiples. Professional valuation analysis essential.

Q) Should I structure the sale as shares or assets?

A) Generally, share sales offer superior tax treatment—potential capital gains exemption for individuals vs. corporate tax/VAT on assets. However, buyers prefer assets for liability protection and depreciation step-up. Optimal structure depends on tax positions, foreign buyer involvement, and negotiating leverage. Integrated tax-legal-M&A counsel critical.

Q) How much do M&A advisory fees cost, and what’s the ROI?

A) Typical success-based fees (2-5% of transaction value, tiered). ROI is substantial: 10-30% valuation premiums (avg 20%) far exceed fees. Example: ฿50M business achieves ฿60M with advisor (฿10M gain) vs. ฿2-3M advisory cost = ฿7-8M net benefit. Plus doubled success rates and faster closings. Essential investment, not overhead.

Q) What are the biggest risks that derail livestock business sales?

A) Top three: (1) FBA/land ownership issues—nominee structures, unclear titles (41% of failures); (2) Financial transparency problems—biological asset accounting gaps, unreported liabilities (27%); (3) Operational deficiencies—biosecurity lapses, unresolved DLD violations (23%). Professional preparation during Stage 1 mitigates all three.

Q) How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A) Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Asian Agribiz. (2025, August 27). Thailand sets a new record for livestock product exports. https://www.asian-agribiz.com/2025/08/27/thailand-sets-a-new-record-for-livestock-product-exports/

- Capstone Partners. (2025, April). Food M&A coverage report. https://www.capstonepartners.com/insights/food-ma-market-remains-active/

- Equidam. (2025). EBITDA multiples by industry in 2025. https://www.equidam.com/ebitda-multiples-trbc-industries/

- KPMG. (2017). Taxation of cross-border mergers and acquisitions: Thailand. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/01/mergers-and-acquisitions-country-report-thailand.pdf

- Mordor Intelligence. (2025). Thailand compound feed market size & growth analysis 2030. https://www.mordorintelligence.com/industry-reports/thailand-compound-feed-market

- The Bullvine. (2025). The integration advantage: Why producers get better ROI from integrated tech systems. https://www.thebullvine.com/technology/the-integration-advantage/

- Thongkorn, K. (2025). Current situation and future prospects for beef production in Thailand. PMC. https://pmc.ncbi.nlm.nih.gov/articles/PMC6039331/

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th