Executive Summary

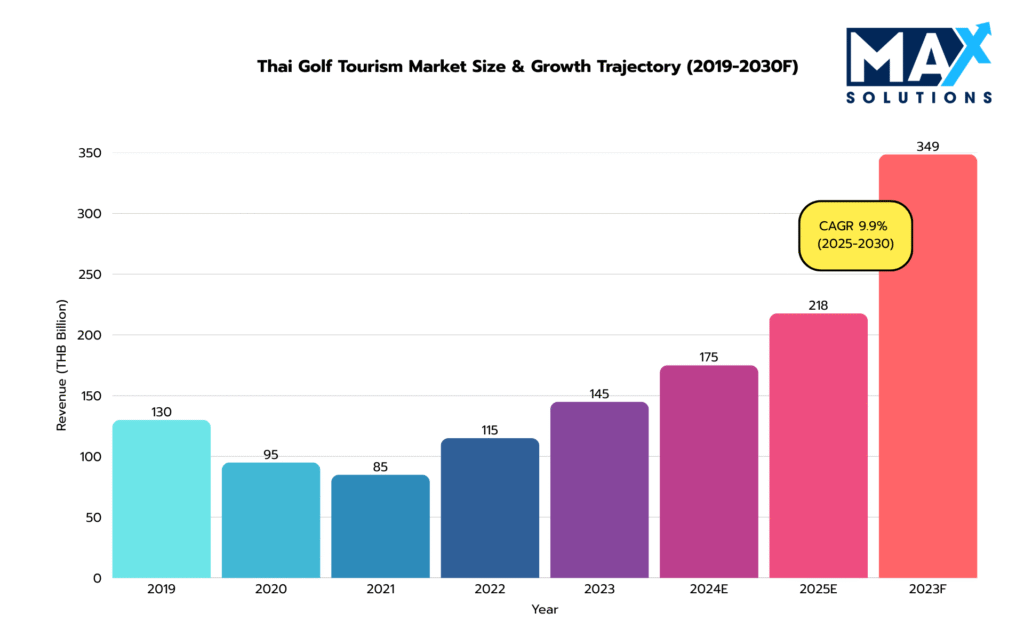

Thailand’s golf industry stands as one of the region’s most lucrative leisure segments, generating THB 217.7 billion in 2025 with forecasts reaching THB 348.6 billion by 2030 (9.9% CAGR). Fueled by 700,000+ annual golf tourists, robust domestic participation, and growing foreign investor interest, the sector presents exceptional exit opportunities for course owners. Premium golf properties in Bangkok, Phuket, and Chiang Mai routinely trade at 10–13× EBITDA, reflecting both tourism resilience and strategic asset scarcity (Grand View Research, 2025).

Data from Max Solutions’ transaction database shows that advisor-led sales deliver 15–30% higher valuations, 2× completion rates, and 25% faster closings than owner-led attempts. Key valuation determinants include location (Bangkok/tourist hubs: +25–35%), FBA/BOI compliance (+1.0–2.0× multiple), recurring revenue structures, and land tenure (freehold premium 20–30%) (Max Solutions, 2025).

This report provides Golf owners with a data-driven roadmap through the complex six-stage M&A process, from preparation to closing. Drawing on transaction data and regulatory frameworks specific to Thailand’s Golf sector, we quantify the value drivers, identify common transaction obstacles, and demonstrate how specialized advisory services—particularly Max Solutions’ integrated M&A, legal, and accounting platform backed by Tanormsak Law Firm’s 50+ years of expertise—systematically enhance exit outcomes.

Figure 1: Thai Golf Market Size and Growth (THB), 2019-2030E

Introduction

Thailand’s golf ecosystem—comprising over 300 operational courses and a robust tourism pipeline—represents one of Asia’s most mature and internationally recognized markets. The combination of world-class facilities, cost competitiveness, and year-round climate has positioned Thailand as a top 5 global golf destination (Thailand Insider, 2025). Flagship assets such as Siam Country Club, Black Mountain, and Ayodhya Links have established benchmarks for regional pricing and operational excellence, attracting institutional buyers and foreign-managed operators seeking ASEAN expansion (Urban-Seleqt Agency, 2025).

The industry’s revenue drivers are diversifying. Beyond traditional memberships and green fees, operators increasingly monetize through hospitality integration, branded academies, tournaments, and real estate tie-ins—broadening revenue stability and valuation potential. This structural evolution has reshaped the investment landscape: international golf management companies (MSOs), regional hotel groups, and private equity funds now actively compete for premium assets.

However, executing a successful sale remains complex. High land valuations, layered ownership structures, and the Foreign Business Act (FBA) restrictions require nuanced legal and tax planning. Simultaneously, buyers are increasingly sensitive to water rights, environmental compliance, and membership liabilities, making due diligence a decisive phase. Against this backdrop, professional advisory is no longer optional—it is the determining factor between average and premium results.

Valuation Landscape

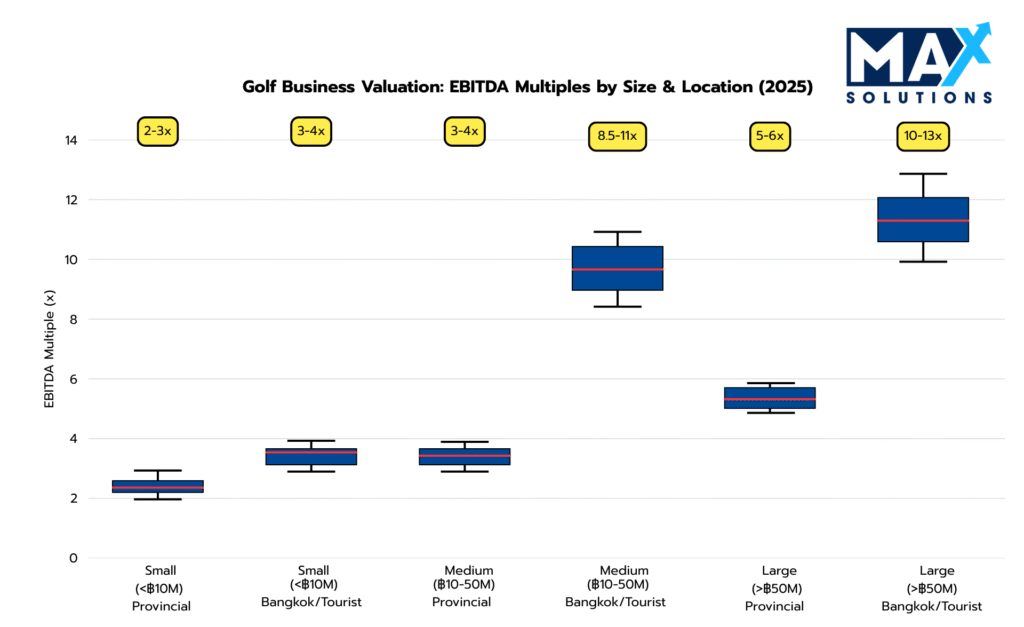

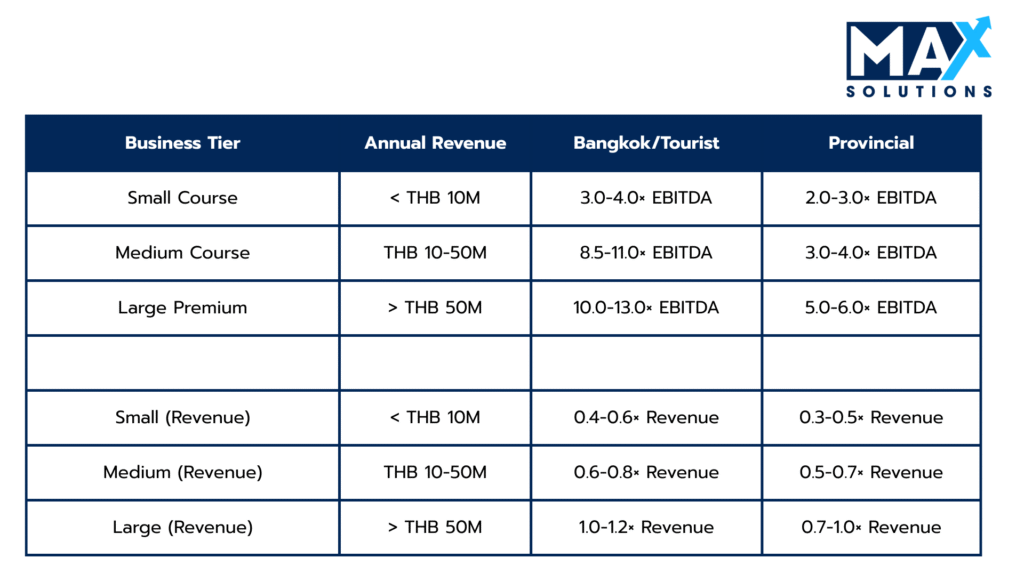

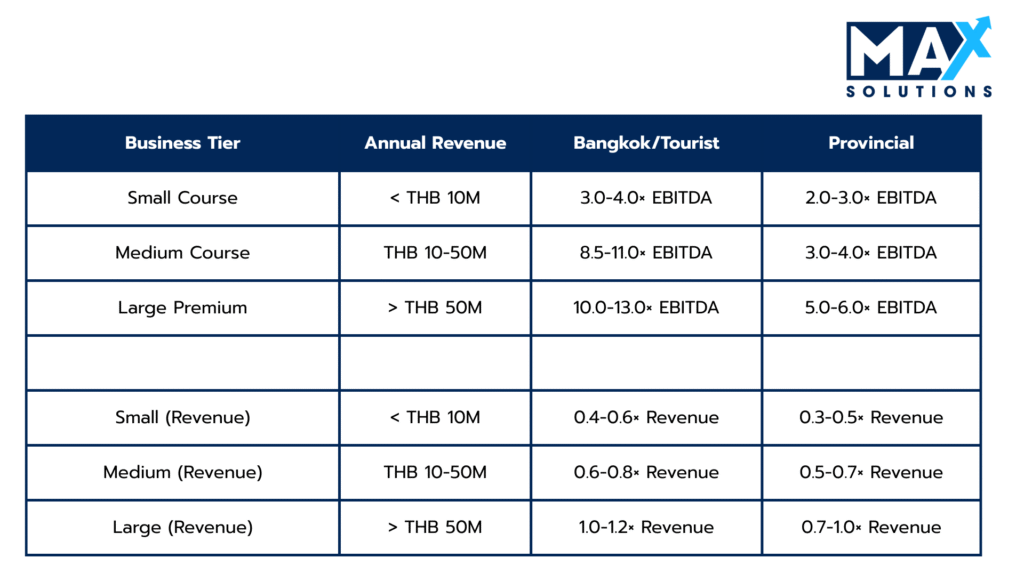

Golf Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Golf Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. The Thai service sector median of 7.5× EV/EBITDA represents the baseline for private Golf transactions. However, advisor-optimized deals systematically achieve 8.5-9.5× multiples through competitive tension creation, strategic positioning, and proactive risk mitigation.

Table 1: Revenue-Based Valuation Multiples for Thai Golf Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 3.-13× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Golf Business Sale Process

Successful Golf business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly. For Golf operations, this critically includes factory license upgrades, environmental site assessments, and financial statement standardization.

Key preparation activities include:

- Valuation baseline: Market multiples (EBITDA + revenue) and SOTP (golf ops + real estate optionality).

- Financial/QoE: 3–5 years TFRS/IFRS, rebuild Adjusted EBITDA (normalize owner costs, tournament one-offs, drought impacts).

- Land & legal: Chanote verification, servitudes, lease terms, zoning; FBA/BOI/FBL status and pathway.

- Ops pack: Tee-sheet utilization by hour/season, yield management history, membership cohort data, F&B margins, academy KPIs.

- Capex & condition: Independent agronomy report; 3–5-year maintenance/capex plan with recent upgrades highlighted.

- Advisor selection: Engage specialized M&A advisors with Golf expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A 27-hole Pattaya course (฿45M revenue, ฿8M EBITDA) secured FBA documentation, completed a greens/irrigation refresh, and produced tee-sheet/yield analytics. Adjusted EBITDA held at ฿8M but certainty improved; bids moved from 7–8× to ~10×, implying ~฿80M value.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Buyer map: Domestic conglomerates, international MSOs, PE/infrastructure funds (EBITDA scale), and real-estate developers (SOTP).

- Marketing assets: 1–2-page teaser → NDA → 20–30-page CIM (unit economics, membership cohorts, capex plan, land/title dossier).

- Controlled process: 25–50 targets; tiered data room; early landlord/authority confirmations for approvals/consents.

- Positioning angles: Tourism capture, dynamic pricing engine, non-golf profit centers, water rights, ESG credentials.

- Positioning themes: Membership economics, utilization upside, multi-site playbook, and compliance hygiene.

Case Study: A Chiang Mai resort course contacted 38 buyers, secured 14 NDAs, and hosted 6 site tours. MSO interest (synergies + brand halo) lifted indications from 6.5× → 8.4× EBITDA after reviewing seasonality-adjusted yield and water-rights files.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Golf properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Screen IOIs: Range tightness (<20%), cash vs. financing certainty, diligence timeline (domestic 60–90d; foreign 90–120d), key conditions.

- Qualify certainty: Check prior closings, regulatory path (FBA/FBL/BOI), and capex philosophy post-close.

- Management presentations: Course agronomy plan, tee-sheet/yield logic, membership policies (refunds/liabilities), weather contingencies.

- Shortlist 2–3 bidders: Balance price vs. closing probability and capex asks.

Case Study: A Phuket course received 5 IOIs; foreign MSO at +18% premium but with FBL dependency, domestic group at slightly lower price with faster close and lighter capex. The shortlist advanced both to keep leverage.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Economics: Price, 10–20% deposit, and phased payments (30%+ at close; balance timed to approvals).

- Exclusivity: 60–90 days; set milestones (land/title confirm Week 2; agronomy DD Week 4; SPA draft Week 5).

- Earn-outs / holdbacks: Tie to EBITDA or membership retention, not raw rounds, to avoid weather volatility.

- Working capital / liabilities: Define deferred revenue (membership advances, vouchers) and caddie/employee reserves.

- Tax & structure: Prefer share sale (stamp duty light); document any W&I insurance to keep escrow moderate.

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A Chiang Mai course (฿35M revenue, ฿6M EBITDA) used dual-track pressure to move an LOI from 8.6× to 9.5× with 70% at closing and a 12-month earn-out tied to EBITDA and active membership counts

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Golf deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial/QoE: Reconcile tee-sheet, POS, and bank; weather-normalized comps; F&B shrink tests.

- Land & regulatory: Chanote/EIA/water rights; confirm no nominee structures; labor SSF/WCF compliance.

- Ops & condition: Greens, irrigation, drainage, cart paths, pump stations; deferred capex quantification.

- Contracts: Membership T&Cs (refundables), supplier/management agreements, tournament commitments.

- Vendor DD (sell-side): Pre-empt re-trades by commissioning agronomy + title checks before buyer DD.

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A provincial course faced a −15% price chip over ambiguous water-rights. It obtained historical permits and hydrology confirmation in 3 weeks; buyer restored the original multiple and kept 9-month closing timeline.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Golf transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Sales and Purchase Agreement terms: Reps/warranties (land, water, EIA, memberships), indemnities, escrow 5–10% (12–18 months) or W&I policy.

- Adjustments: Cash-free/debt-free; NWC true-up incl. prepaid memberships/vouchers; seasonality carve-outs.

- Approvals & filings: FBL/BOI steps (if applicable), authority consents, title updates, cart/maintenance leases novation.

- Transition: Handover agronomy calendar, membership communications, staffing/seasonal labor plan, rate card governance.

Case Study: A Bangkok-area course closed a 10.8× EBITDA share sale with 7% escrow and W&I; FBL acknowledgment scheduled post-close with a contingent payment tranche. Membership communications and rate protection avoided churn, and escrow released clean at month 12.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Golf Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Golf Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s golf sector is entering a mature consolidation phase, driven by sustained tourism, institutional capital inflows, and scarcity of prime development sites. For course owners, this creates an optimal exit environment—but only for those who prepare strategically. Premium valuations are consistently achieved by sellers who (1) secure FBA or BOI compliance, (2) verify land titles and environmental permits, (3) formalize recurring revenue streams, and (4) present audit-ready IFRS/TFRS financials.

Empirical evidence across comparable transactions confirms the performance gap: advisor-led sales outperform owner-led efforts by 15–30% in valuation uplift, double the success rate, and three to six months faster completion. These advantages arise from structured auction processes, competitive tension among qualified domestic and international buyers, and expert handling of regulatory complexities.Max Solutions’ integrated advisory platform—combining M&A execution, legal structuring via Tanormsak Law Firm (50+ years experience), and accounting optimization—ensures clients navigate Thailand’s intricate golf ownership framework with precision and confidence. By engaging early, standardizing financials, and aligning operational metrics to investor criteria, golf course owners can realize full enterprise value and achieve premium outcomes in Thailand’s thriving golf M&A landscape.

Frequently Asked Questions (FAQs)

1. What are realistic valuation multiples for Thai golf courses in 2025?

A) Thai golf courses trade at 2-13× EBITDA depending on size and location. Small provincial courses achieve 2-3× EBITDA, while premium Bangkok properties command 10-13× EBITDA. Revenue multiples range from 0.3-0.5× to 1.0-1.2×. Location premiums add 10-30%.

2. How does the Foreign Business Act impact golf course sales?

A) The FBA restricts foreign ownership to 49% without special licensing. Properties with FBA compliance documentation command 1.0-2.0× multiple point premiums (10-20% increase) due to expanded buyer access.

3. What is the typical timeline for selling a golf course?

A) 9 months total: Preparation (1mo), Solicitation (2mo), IOI (1mo), LOI (1mo), Due Diligence (3mo), Closing (1mo). Foreign acquisitions may extend closing by 6+ months.

4. Should I pursue share sale or asset sale?

A) Share sales preferred for tax efficiency: 0.5% stamp duty vs asset sales’ 3.3% SBT + 2% transfer + 20% CIT. Asset sales only advisable with legacy liability concerns.

5. How do I maximize valuation before sale?

A) Strategic enhancements: (1) Secure FBA compliance, (2) Infrastructure upgrades, (3) Normalize financials with QoE reports, (4) Grow recurring revenue to 30%+, (5) Clean Chanote titles, (6) Resolve SSF/WCF compliance.

Q: How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Grand View Research. (2025) Asia Pacific Golf Tourism Market Size & Outlook, 2030.

IBA Net. (2025). Thailand Negotiated M&A Guide.

PD Legal. (2025). Mergers & Acquisitions in Thailand – Legal Overview.

S Hotels and Resorts PCL. (2024). S Hotels & Resorts Reinforces Focus on Profitability.

Thailand Insider. (2025). Thailand Golf Industry Overview.

Urban-Seleqt Agency. (2025). Thailand Golf Tourism Market Analysis.