Executive Summary

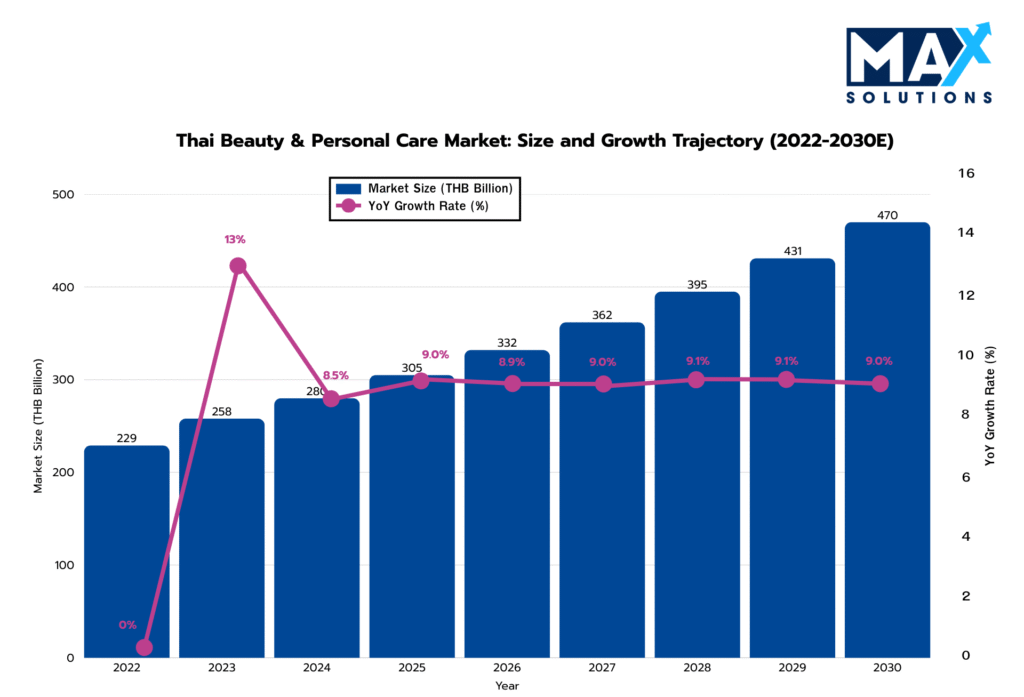

Thailand’s beauty and personal care market is set to reach THB 305 billion in 2025 and continue expanding at an ~11% YoY clip, creating a prime exit window for cosmetics owners (Custom Market Insights, 2025).

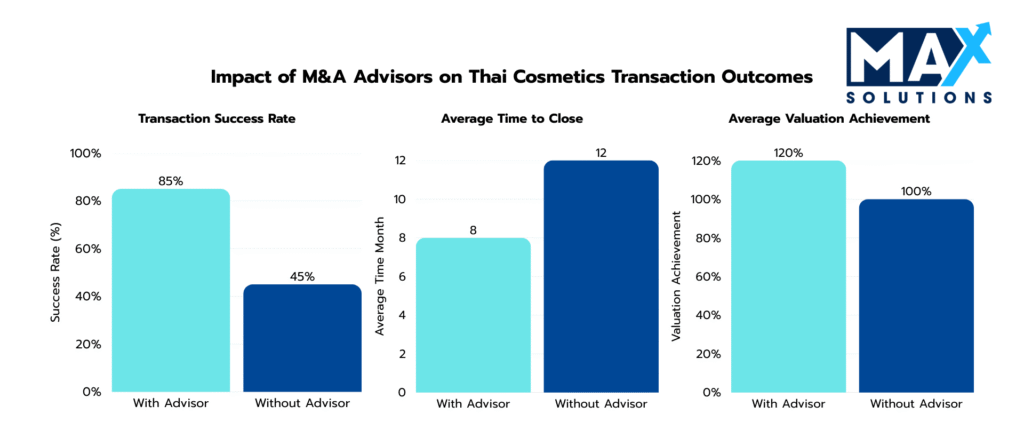

In this environment, valuation outcomes are highly preparation-sensitive: private transactions typically range from 2–4× EBITDA for small firms to 8–12× for high-growth, brand-led companies with clean regulatory portfolios and validated unit economics (e.g., CLV: CAC ≥ 3:1). Advisor-led processes consistently outperform owner-led attempts, delivering 10–30% valuation uplifts, ~2× higher completion rates (≈85% vs. 45%), and ~33% faster closings (IMAP, 2025).

The drivers are disciplined readiness (TFRS financials, QoE, FDA portfolio hygiene), competitive buyer orchestration (20–25+ qualified targets), and tax-efficient structuring (share deals often preferred over asset deals). Max Solutions—integrated with Tanormsak Law Firm (50+ years)—combines M&A, legal, and accounting execution to turn regulatory complexity into price leverage, expand the buyer universe (domestic, regional, and global strategics/PE), and maximize after-tax proceeds./

Figure 1: Thai Cosmetics Market Size and Growth (THB), 2022-2030E

Introduction

Thailand now ranks among ASEAN’s most dynamic beauty markets, rebounding from pandemic lows to a THB 305 billion sector in 2025 and on track to surpass THB 400 billion by 2030. The landscape is fragmented, 6,600+ registered firms, the vast majority SMEs with Bangkok anchoring nearly half of all operators. This fragmentation, plus sustained demand in skincare (≈60% share) and resurgent color cosmetics, underpins a rich pipeline of consolidation and platform-building plays. For sellers, that means real pricing power, if the business is exit-ready (Mahanakorn Partners, 2025).

Readiness is not cosmetic: buyers prize audited, normalized EBITDA, documented unit economics, and FDA-clean SKU portfolios. They also pay up for recurring revenue models, channel diversity (offline/online/export), and operational scalability (GMP, capacity utilization, OEM/ODM reliability). Conversely, gaps in notification renewals, PDPA compliance, or inventory discipline convert directly into valuation haircuts or failed diligence.

The sellers who outperform start 12–36 months ahead: professionalize financials (QoE, TFRS), clean the FDA portfolio, tune CLV: CAC and e-commerce conversion (e.g., 2%→4%), and secure BOI or compliant paths for foreign control, then run a competitive, advisor-led auction.

Valuation Landscape

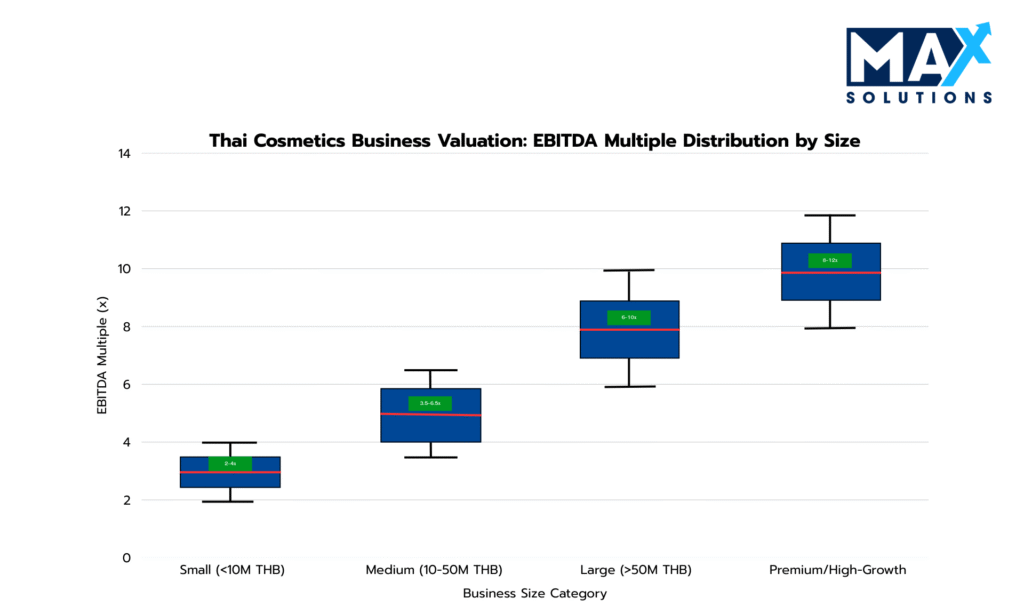

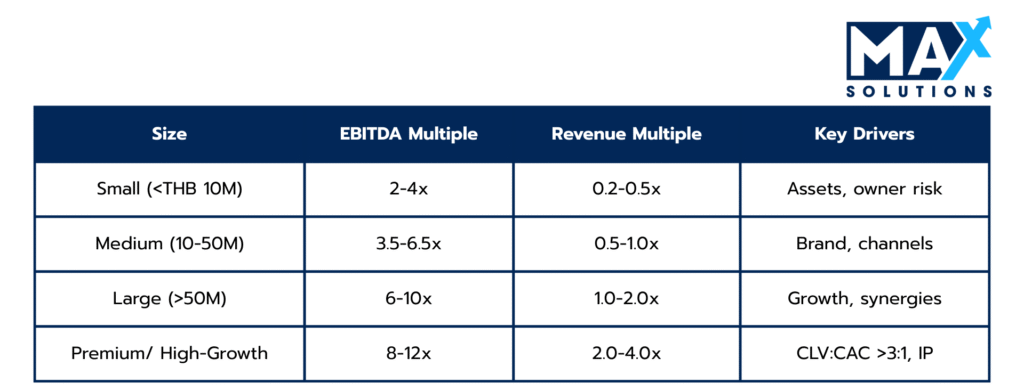

Cosmetics Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Cosmetics Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. Global beauty companies trade at 13-17x EBITDA (2025: 17.2x), but Thai private SMEs face size-based stratification (IMAP, 2025) However, advisor-optimized deals systematically achieve higher multiples through competitive tension creation, strategic positioning, and proactive risk mitigation.

Table 1: Revenue-Based Valuation Multiples for Thai Cosmetics Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.2-4× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Cosmetics Business Sale Process

Successful Cosmetics business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financial hygiene: 3–5 years of Thai Financial Reporting Standards (TFRS) financials; build a clear bridge to normalized EBITDA.

- Regulatory review: Audit every product’s Thai FDA notification; renew anything expiring within 12 months.

- Operating tune-ups: Improve CLV:CAC, push online conversion from ~2% toward 4%, remove low-margin stock-keeping units (SKUs).

- Protect the brand: Confirm trademarks, domains, and creative assets are owned by the company

- Advisor selection: Engage specialized M&A advisors with Cosmetics expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study:A Bangkok skincare brand renewed 11 expiring FDA notifications and normalized EBITDA (removing THB 1.4M in non-recurring expenses), raising valuation from 6x to 7x EBITDA and adding THB 12M.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

- Who to approach:

1) Private equity and venture investors (financial discipline; higher multiples if growth is proven).

2) Thai strategic buyers (distribution and retail synergies).

3) International strategic buyers (ASEAN entry; often pay a premium if BOI permits control). - Materials: One-page anonymous teaser → non-disclosure agreement → 25–35-page confidential information memorandum.

- Competition: Contact 20–25 qualified buyers to create multiple offers; this often adds 0.8–1.2 turns to the multiple.

- Competitive Reach: Target 20–25 qualified buyers; create multi-bid tension (adds 0.8–1.2×).

Case Study: A makeup company marketed to 27 qualified buyers and received 9 inquiries, pushing valuation from 5.5x to 7.8x EBITDA through competitive bidding.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Cosmetics properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Screen IOIs: Tight valuation ranges (<20% spread), cash/financing certainty, 6–9-month closing plans, realistic capex asks.

- What to compare: Price range tightness, cash certainty, speed to close, and a credible path through FBA/BOI rules.

- Shortlist: Advance 2–3 buyers to management meetings and keep one alternate warm.

Case Study: A haircare brand received five IOIs (4.8x–8.0x EBITDA) and selected a 7.2x domestic offer with a 90-day close, avoiding a 6-month regulatory delay from a foreign bidder.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Lock key terms:

1) Price and structure (commonly 70–90% cash at close, 5–15% escrow, and 10–25% performance-based earn-out for 1–3 years).

2) Working-capital target, exclusivity (30–60 days), and retention for key staff. - Taxes: A share sale generally minimizes taxes for sellers (about 0.1% stamp duty). An asset sale often triggers value-added tax and specific business tax, reducing net proceeds.

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A natural cosmetics business secured an LOI with 80% cash at closing, 10% escrow, and 10% earn-out, negotiating a 45-day exclusivity to maintain leverage.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Cosmetics deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial tests: Validate revenue quality, realistic add-backs (buyers reject 20–30% on average), and working-capital needs; check inventory for obsolescence.

- Regulatory tests: Re-confirm Thai FDA notifications, Good Manufacturing Practice, Personal Data Protection Act, and foreign-ownership compliance.

- Commercial/operational tests: Prove CLV: CAC, channel return on ad spend, supplier backup plans, and trademark ownership.

- Vendor DD (sell-side): 4–6 weeks pre-check to eliminate re-trades and preserve headline price.

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A serum manufacturer avoided a THB 9M price cut by renewing FDA filings for four top-selling SKUs and submitting complete formulation documentation.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Cosmetics transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Core contract items: Price mechanics and adjustments, representations and warranties, indemnities (often 10–20% cap with 12–18 month escrow), non-compete for 3–5 years, and a 6–12-month transition plan.

- Approvals: Trade Competition Commission thresholds, Foreign Business License or BOI where needed, and (for asset deals) product notification transfers.

- Funds flow: Typically, 70–90% at closing; the rest in escrow and/or tied to earn-out milestones.

Case Study: A Bangkok cosmetics brand completed its Share Purchase Agreement with a foreign acquirer after aligning on a 3-year non-compete and a 6-month transition services period. The buyer released 75% cash on closing and 25% after working-capital verification, achieving a smooth close with no post-deal disputes.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Cosmetics Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Cosmetics Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

The Thai cosmetics market offers a rare blend of strong growth, broad buyer interest, and clear levers for value creation. Capturing the top end of today’s 8–12× EBITDA private-market range demands more than brand strength: it requires meticulous preparation, regulatory precision, and a structured sale that manufactures competition while minimizing execution risk.

The six-stage playbook, preparation, solicitation, IOI, LOI, diligence, and closing can be executed in ~9 months when front-loaded with QoE, FDA/PDPA hygiene, and unit-economics proof. Quantitatively, advisor-led processes deliver higher prices, higher certainty, and faster outcomes; economically, the 4–7× ROI on professional fees is routine once tax structuring and reduced failure risk are counted.

With Max Solutions’ integrated M&A + legal (Tanormsak) + accounting model, sellers convert complex rules into buyer confidence, expand the pool to global strategics and PE, and optimize net proceeds through smart structuring. If an exit is on the horizon within 12–36 months, the time to begin the readiness sprint and lock in a premium multiple is now.

Frequently Asked Questions (FAQs)

1. What is the typical timeline for selling a cosmetics business in Thailand?

A) The complete M&A process typically spans 9 months across six stages: Preparation (1 month), Solicitation (2 months), IOI Phase (1 month), LOI Phase (1 month), Due Diligence (3 months), and Purchase Agreement/Closing (1 month). However, foreign acquisitions requiring regulatory approval may extend timelines by 1-2 months.

2. How do I determine the value of my cosmetics business?

A) Valuation primarily utilizes EBITDA multiples ranging from 2-4x for small businesses (<THB 10M revenue) to 8-12x for high-growth companies (>THB 50M revenue) with premium unit economics. Revenue multiples (0.2-4.0x) provide alternative benchmarks. Professional valuation considers financial performance, brand equity, regulatory compliance, growth trajectory, and strategic buyer synergies.

3. What regulatory compliance issues should I address before selling?

A) Critical regulatory priorities include: (1) Thai FDA Notification Portfolio audit ensuring all SKUs possess current notifications with 12+ months validity, (2) GMP certification verification, (3) PDPA compliance documentation for customer databases, (4) BOI promotion status if targeting foreign buyers, and (5) complete filing of corporate and tax documents with DBD and Revenue Department.

4. Should I structure the sale as a share sale or asset sale?

A) Share sales strongly favor sellers due to minimal tax impact (0.1% stamp duty) versus asset sales (7% VAT + 3.3% SBT on certain assets), representing 8-12 percentage points in net proceeds. However, foreign buyers may prefer asset sales to avoid inheriting historical liabilities. Professional advisors optimize structure based on buyer profile and tax implications.

5. How can I maximize my business valuation before sale?

A) Pre-sale value enhancement focuses on: (1) EBITDA normalization and 3-5 year financial documentation, (2) achieving CLV:CAC ratios >3:1 through marketing optimization, (3) regulatory portfolio cleanliness (100% current FDA notifications), (4) e-commerce conversion improvement (target 4%), (5) reducing customer concentration, and (6) securing BOI promotion for 100% foreign ownership eligibility.

6. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A) Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Custom Market Insights. (2025). Thailand Beauty and Personal Care Market 2025-2034

- Deloitte. (2025). Transformational M&A Doubles Shareholder Returns

- Emerhub. (2025). Mergers and Acquisitions in Thailand

- IMAP. (2025). Strong Growth in Global Dermatology & Cosmetics Industry

- Mahanakorn Partners. (2025). A Beautiful Opportunity: Cosmetics Industry in Thailand

- PwC Thailand. (2025). Tax M&A Brochure

- Startup Financial Projection. (2025). Core KPIs of Cosmetics Manufacturing

- Thai FDA. (2025). How to Apply for Permission on Cosmetics

- Tokyo Consulting Firm. (2025). Mergers and Acquisitions in Thailand

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th