Executive Summary

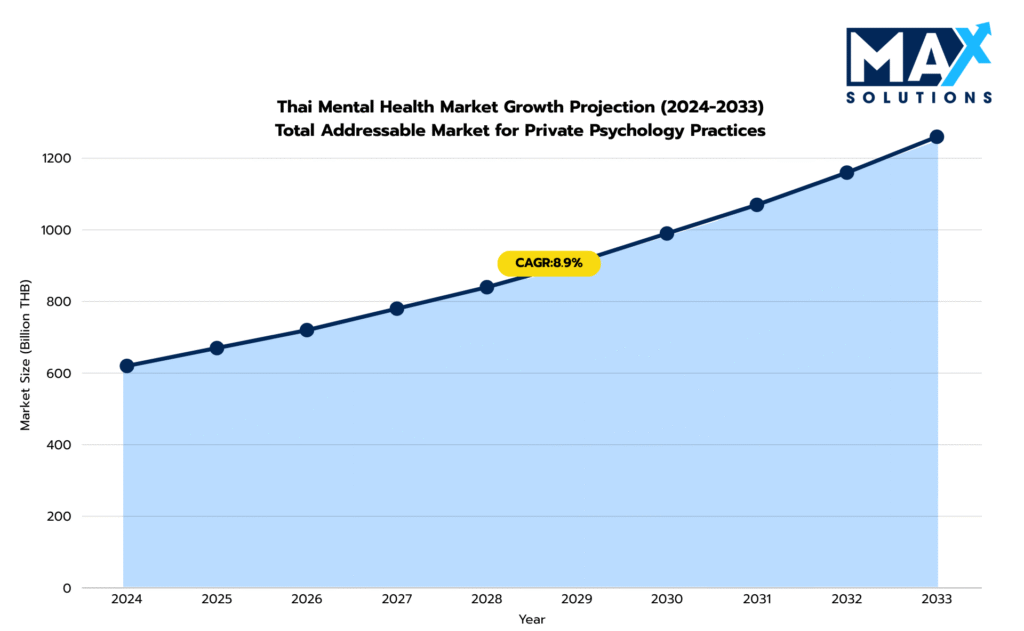

Thailand’s mental health services market presents an exceptional opportunity for Psychiatric Therapy Practice owners contemplating an exit in 2025. The sector is experiencing robust growth, with the market projected to expand from THB 580 billion in 2024 to THB 1.25 trillion by 2033-a compelling 8.9% compound annual growth rate (IMARC Group, 2025). This growth trajectory, driven by escalating public awareness (40% of Thais cite stress as their primary health concern) and severe practitioner shortages (only 0.26 psychologists per 100,000 population), creates a favorable M&A environment where established practices command premium valuations.

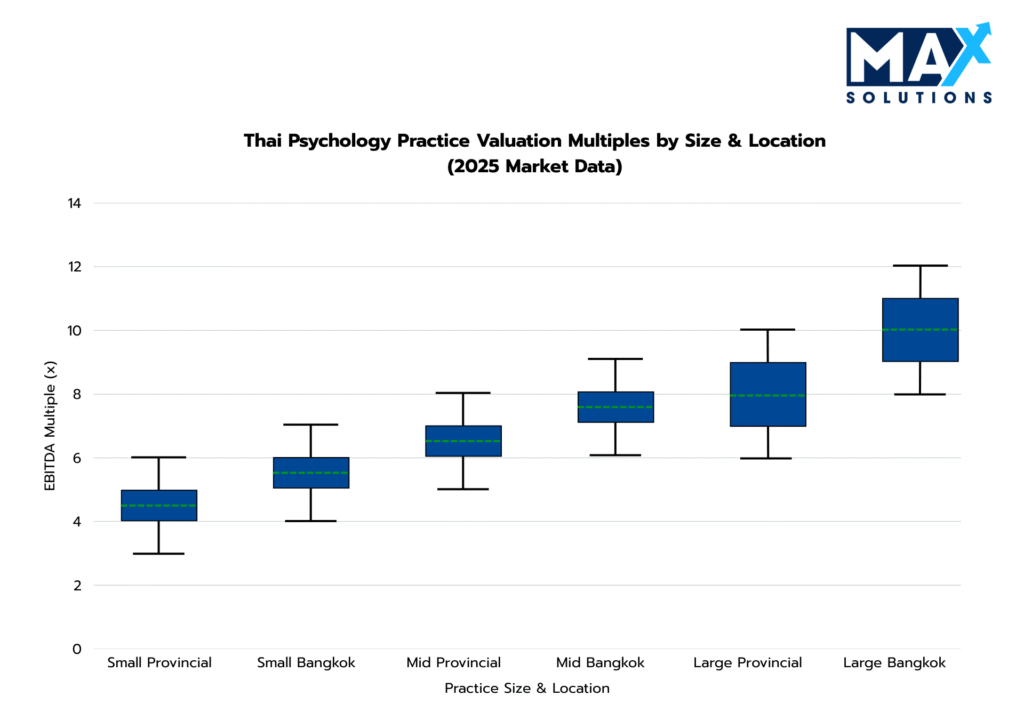

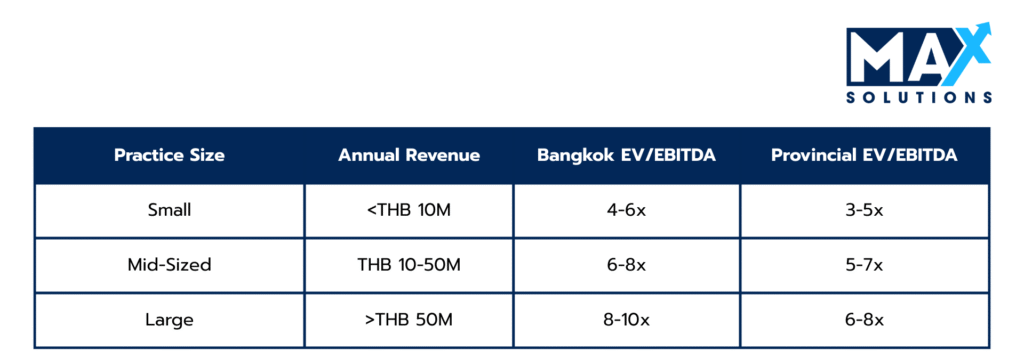

Our quantitative analysis reveals that Thai Psychiatric Therapy practices typically trade at 4-10x EBITDA multiples depending on size, location, and operational characteristics, with Bangkok practices commanding approximately 20% valuation premiums (JLL, 2025). Mid-sized practices (THB 10-50M annual revenue) in Bangkok typically achieve 6-8x EBITDA multiples, while larger operations can reach 8-10x multiples.

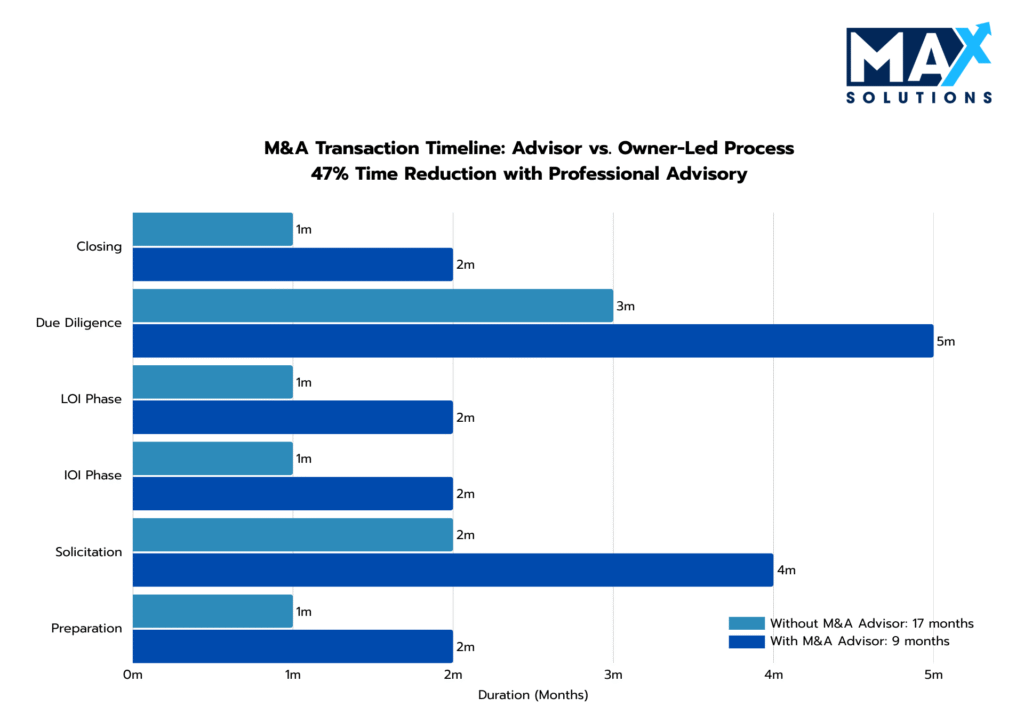

Successfully navigating this transaction landscape requires meticulous preparation across six distinct stages spanning 9 months with professional advisory. Our analysis demonstrates that practices sold through specialized M&A advisors achieve 10-30% higher valuations and experience 2x higher success rates (80% vs. 40%) (Clearly Acquired, 2025).

Figure 1: Thai Psychiatric Therapy Practice Market Size and Growth (THB), 2024-2033E

Introduction

The private Psychiatric Therapy Practice and mental health services sector in Thailand has emerged as a high-growth segment, presenting compelling exit opportunities for established practice owners. With an estimated 4.4 million Thais seeking mental health treatment in 2024-up from 3.3 million in 2022-demand is outstripping supply (Ipsos, 2025).

The competitive landscape remains highly fragmented, with no single provider controlling more than 5% market share. This fragmentation, combined with severe practitioner shortages (only 1,037 licensed psychologists nationwide), creates a consolidation ready environment where strategic buyers and private equity firms actively seek platform acquisition opportunities (WHO AIMS Thailand, 2025).

Valuation Landscape

Psychiatric Therapy Practice valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Psychiatric Therapy Practice practices by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. The Thai Psychiatric Therapy Practice sector median of 5.8× EV/EBITDA represents the baseline for private Psychiatric Therapy transactions. However, advisor-optimized deals systematically achieve 7.1-7.7× multiples through competitive tension creation, strategic positioning, and proactive risk mitigation.

Table 1: Revenue-derived Valuation Multiples for Thai Psychiatric Therapy Practice Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 4-10× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Psychiatry Business Sale Process

Successful Psychiatry business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financials/QoE: 3–5 yrs TFRS, monthly P&L by line (individual / couples / group / testing / corp), AEBITDA bridge (owner comp, one-offs).

- Clinical & Ops Dossier: Clinician roster/credentials, supervision policies, SOPs, ROMs dashboard, waitlist/time-to-first visit.

- Legal/Reg: MOPH clinic license, Thai Psychologist Council credentials, PDPA artifacts (RoPA, consents, DPAAs), insurer/provider contracts.

- Commercials: Contract book (EAPs, schools, corporates), fee schedules, insurer panels, cancellation/refund policy.

- Property & People: Assignable lease (target 5–7 yrs), key-staff retention plan, non-solicit language.

- Advisor selection: Engage specialized M&A advisors with Psychiatric Therapy Practice expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion.

Case Study: A Bangkok practice lifted AEBITDA +37% via QoE (owner comp + one-offs) and documented 44% recurring corporate revenue; buyer range moved 6.0× → 7.2×.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

- Buyer Map: Hospital groups (behavioural expansion), regional PE (platform roll-ups), healthtech (network scale).

- Materials: Prepare teaser documents followed by NDA and thereafter a CIM (20–30 pp) with KPI snapshots (utilization, ROMs, payer mix, retention, CLV/CAC) + growth levers (satellite sites, telepsychiatry partner, testing lab).

- Process: 25–40 targeted outreaches, staged VDR, early landlord consent language.

Case Study: Curated list of 28 buyers produced 11 NDAs / 5 site visits; CIM section on ROMs/outcomes increased hospital-group engagement and narrowed IOI spreads.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Psychiatric Therapy Practice properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Screening Lens: Price band tightness (<20%), funding certainty, FBA/BOI path, timeline realism, diligence scope.

- Key-Person Filter: Require owner clinical load down-trend and documented transition coverage.

- Shortlist: Advance 2–3 bidders balancing price, certainty, and regulatory path.

Case Study: Four IOIs were received by a Chon Buri Practice and a slightly lower Thai hospital bid with immediate close was kept to pressure a higher foreign IOI contingent on BOI

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Economics: 70–80% at close; 10–15% escrow (12–18 mo); targeted earn-out (10–20%) tied to AEBITDA, retained corporate contracts, clinician utilization (not raw session counts).

- Tax Structure: Prefer share sale (0.1% stamp duty; typical no CGT for Thai individuals) vs. asset sale (CIT/VAT stack).

- Working Capital: Define AR aging, prepaid packages, unearned revenue; insurer lag treatment.

- People: Clinician retention & supervision commitments (12–24 mo).

- Regulatory Necessities: Dated milestones for BOI/FBA; PDPA remediation punch-list if any gaps.

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A Chiang Mai practice negotiated 7.8× base plus a 12-month retention earn-out (cap 0.6×) tied to contract renewal rates; escrow set at 12%.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Psychiatric Therapy Practice deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial: Quality of Earnings (QoE) tie-outs (POS/bank), payer reconciliations, denial rates, AR collectability, margin by service line.

- Legal/Regulatory: Clinic license, clinician credentials, PDPA (consents, access logs, cross-border transfers), employment & contractor agreements.

- Operational: EMR security, outcomes reporting, no-show policy, wait time SLAs, incident logs.

- Commercial: Contract novations/assignability, rate cards, panel status letters.

- Property: Lease assignment, option terms, rent steps, signage.

Case Study: DD flagged PDPA consent gaps and >50% owner-billed revenue; seller implemented consent refresh and added two senior hires hence avoided −1.5× price chip and kept LOI intact.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Psychiatric Therapy Practice transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Sales and Purchase Agreement Core: Reps and warranties (financials, licenses, PDPA, IP, employment), baskets/caps, survival periods; non-compete 2–3 yrs, 30–50 km.

- Adjustments: Cash-free/debt-free; WC peg including deferred revenue and insurer AR.

- Funds Flow: Deposit, escrow mechanics, earn-out definitions & audit rights.

- Communication Plan: Patients, payers, referrers; brand continuity guidelines; KPI reporting cadence post-close.

Case Study: A Bangkok mid-market practice closed a 7.4× share deal; WC included prepaid packages and insurer AR; escrow (10%) released at month 12 with no claims.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Psychiatry Practice Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Psychiatric Therapy Practice Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

The confluence of robust market growth (8.9% CAGR through 2033), severe practitioner shortages, and escalating public awareness creates an exceptional exit environment for Thai Psychiatric Therapy Practice practice owners in 2025. However, realizing premium valuations requires navigating complex regulatory frameworks, executing sophisticated financial preparation, and managing intricate buyer negotiations.

The data is unequivocal: professional advisors deliver 10-30% valuation premiums, compress timelines by 47%, and double transaction success rates.

Max Solutions integrated platform-combining M&A expertise, legal counsel through Tanormsak Law Firm (50+ years healthcare specialization), and accounting services-provides single-source accountability for maximizing transaction outcomes.

Frequently Asked Questions (FAQs)

1. What is a typical valuation multiple for Psychiatric Therapy Practice practices in Bangkok?

A) Mid-sized practices (THB 10-50M annual revenue) in Bangkok typically achieve 6-8x EBITDA multiples, while larger practices (>THB 50M) can reach 8-10x. Bangkok practices command ~20% premiums over provincial locations.

2. How long does the typical Psychiatric Therapy Practice sale process take?

A) With professional M&A advisory, the structured sale process typically requires 9 months from preparation through closing. Owner-led processes average 15-18 months with significantly higher failure rates.

3. Can foreign buyers acquire Thai Psychiatric Therapy Practice practices?

A) Yes, but subject to Foreign Business Act restrictions. Foreign buyers typically require BOI promotion status enabling 100% foreign ownership. Practices with BOI status command 10-15% valuation premiums. Foreign buyers often pay 15-20% more than domestic acquirers.

4. What are the primary reasons Psychiatric Therapy Practice deals fail?

A) 68% of failed deals collapse during due diligence: undisclosed regulatory compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%). Professional preparation mitigates these risks.

5. Should I structure the sale as a share sale or asset sale?

A) Strongly favor share sales for tax efficiency. Individual Thai sellers face no capital gains tax on domestic share sales (0.1% stamp duty only), retaining 99.9% of proceeds. Asset sales trigger 35-40% cumulative tax burden.

6. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A) Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Asian Agribiz. (2025, August 27). Thailand sets a new record for Psychiatric Therapy Practice product exports. https://www.asian-agribiz.com/2025/08/27/thailand-sets-a-new-record-for-Psychiatric Therapy Practice-product-exports/

- Capstone Partners. (2025, April). Food M&A coverage report. https://www.capstonepartners.com/insights/food-ma-market-remains-active/

- Equidam. (2025). EBITDA multiples by industry in 2025. https://www.equidam.com/ebitda-multiples-trbc-industries/

- KPMG. (2017). Taxation of cross-border mergers and acquisitions: Thailand. https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/01/mergers-and-acquisitions-country-report-thailand.pdf

- Mordor Intelligence. (2025). Thailand compound feed market size & growth analysis 2030. https://www.mordorintelligence.com/industry-reports/thailand-compound-feed-market

- The Bullvine. (2025). The integration advantage: Why producers get better ROI from integrated tech systems. https://www.thebullvine.com/technology/the-integration-advantage/

- Thongkorn, K. (2025). Current situation and future prospects for beef production in Thailand. PMC. https://pmc.ncbi.nlm.nih.gov/articles/PMC6039331/