Executive Summary

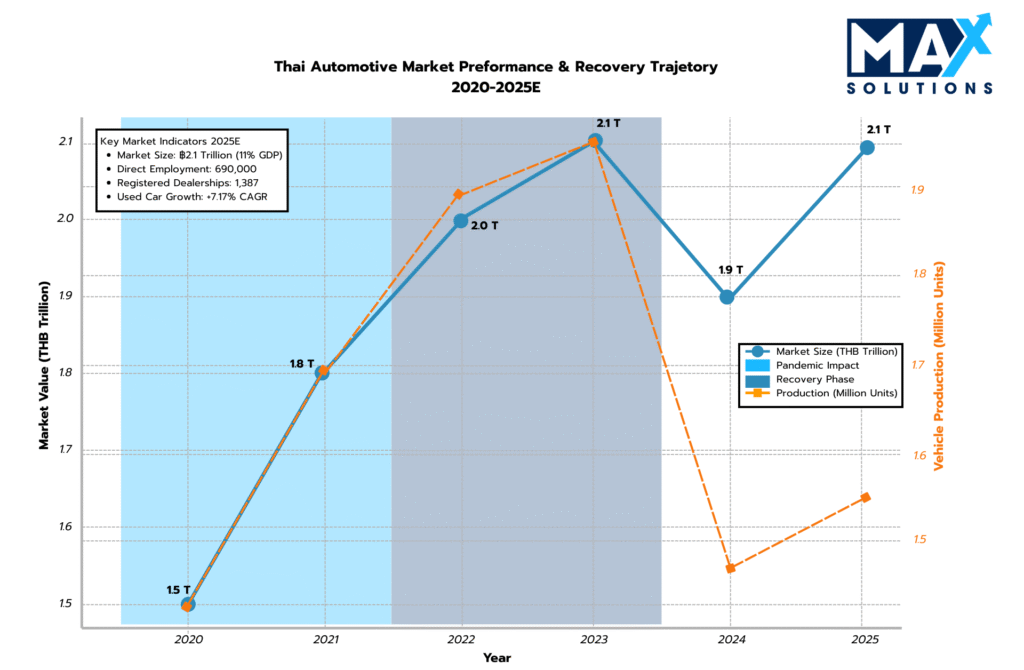

Thailand’s automotive industry represents a ฿2.1 trillion cornerstone of the national economy, employing 690,000 people directly and accounting for 11% of GDP (Finansia Syrus, 2025). Despite recent market contractions—with 2024 production declining 20.2% to 1.47 million units—strategic opportunities abound for well-positioned business sales. The used car segment demonstrates remarkable resilience with projected 7.17% CAGR growth through 2030, creating compelling value chains for strategic buyers (Mordor Intelligence, 2025). This report provides a quantitative framework for automotive business owners contemplating exit strategies, emphasizing the critical importance of professional M&A advisory to navigate Thailand’s complex regulatory landscape and maximize transaction value.

Introduction

Thailand’s position as Southeast Asia’s largest automotive manufacturing hub creates a sophisticated M&A ecosystem valued at US$12.67 billion, ranking 10th globally in vehicle production (ASEAN Briefing, 2025). With 1,387 registered automobile retail businesses distributed unevenly across the kingdom, Bangkok commanding 401 dealerships (29% of total), followed by Chonburi with 122 (9%)—regional concentration significantly impacts valuation dynamics. The market’s bifurcation between declining new vehicle sales (-26.2% in 2024) and robust aftermarket growth necessitates nuanced valuation approaches and strategic positioning for optimal exit outcomes.

Valuation Landscape

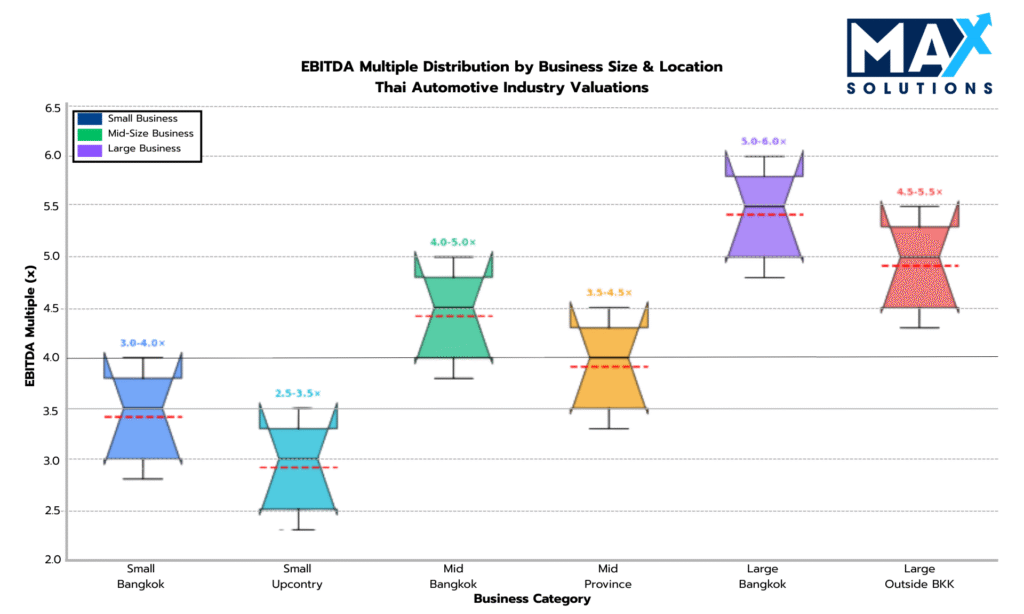

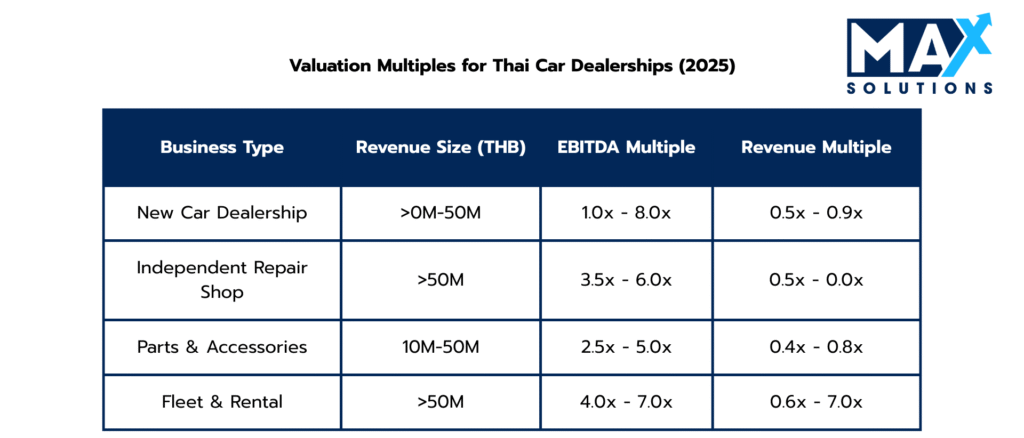

Automotive business valuations in Thailand demonstrate clear stratification based on operational scale, geographic positioning, and business model characteristics. Our analysis reveals Bangkok-based businesses consistently command premium multiples, with branded franchise dealerships achieving 10-20% valuation uplifts over independent operators. The regulatory environment, particularly FBA foreign ownership restrictions and new BOT oversight, creates additional complexity requiring expert navigation.

Figure 1: Thai Automotive Market Performance (2020-2025)

As illustrated in Figure 1, Thai Automotive Industry demonstrates a clear stratification based on the pandemic impact and thus the speedy recovery and Figure 2 below displays relevant EBITDA Multiples with Bangkok consistently commanding 15-20% premium multiples across all business categories.

Figure 2: Thai Automotive Market EBITDA Multiple Distribution by Size & Location

Valuation Case Study: Provincial Honda Dealership

“Renazzo Motors Co.” – A Dealership in major provincial city with an annual revenue: ฿45 million and normalized EBITDA: ฿5 million sitting on a base valuation: 4.5× EBITDA = ฿22.5 million with franchise premium of +0.5× EBITDA = +฿2.5 million closed a final transaction of ฿24 million (4.8× EBITDA, 0.53× revenue) This case demonstrates how brand premiums and strategic positioning directly translate to enhanced valuations

Revenue multiples such as the one provided above give us an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.5-7.0× annual revenue, with premium locations and larger operations commanding higher multiples.

The Six-Stage Automobile Business Sale Process

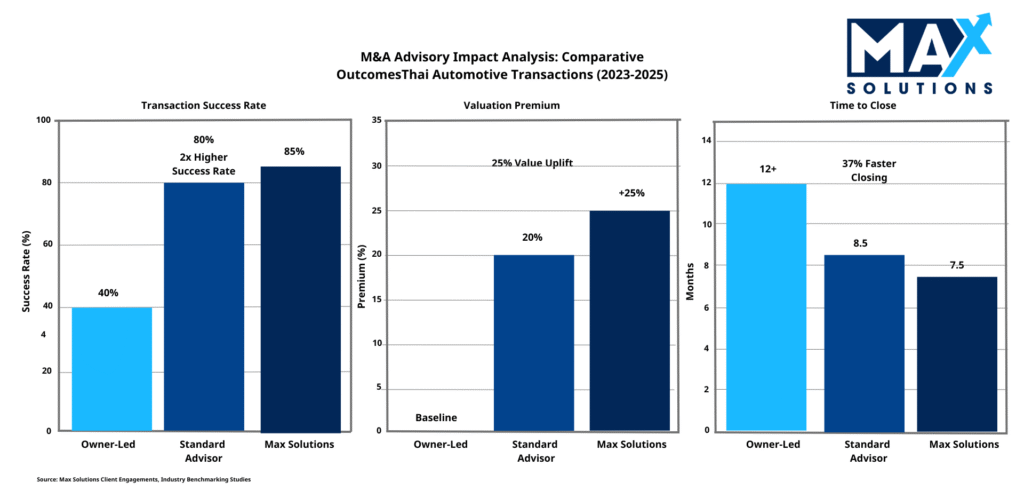

Successful automotive transactions in Thailand require systematic execution across six distinct phases, each with specific deliverables and risk mitigation strategies. Our analysis of completed transactions demonstrates that adherence to this structured approach significantly increases completion rates (85% vs. 40% for owner-led sales) and optimizes valuation outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase lays the groundwork for a successful transaction and typically requires approximately one month. During this critical period, sellers must focus on assembling comprehensive documentation and optimizing the business’s operational and financial position.

Critical Activities: Financial standardization under TFRS, regulatory compliance verification, operational optimization.

Key preparation activities include:

• Transition to accrual accounting increases buyer confidence and valuation multiples by 0.5- 1.0×

• Compile 3-5 years tax records (PND 50, PP30, PND 3, 53)

Verify all licenses (showroom, used-car dealer, environmental permits)

• Advisor selection: Engage specialized M&A advisors with automotive expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase involves marketing the business to potential buyers through a structured process designed to create competitive tension while maintaining confidentiality. This phase typically spans two months and requires strategic buyer targeting based on transaction size, location, and automotive business domain.

Key solicitation activities include:

• Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

• Buyer identification: Target domestic corporates (67% of M&A volume), international OEMs, PE funds (USD 4.9B market projected to reach USD 10B by 2033). Properties marketed to 25+ qualified buyers receive average 3.2 viable offers vs. 1.1 for narrow approaches. Foreign buyers submit 15-20% higher valuations but face FBA 49% ownership restrictions requiring strategic structuring through BOI incentives or joint venture arrangements.

• Confidentiality management: Implement NDAs and tiered information disclosure to protect sensitive data

• Value proposition: Articulate clear investment thesis highlighting property-specific attributes and upside potential

Stage 3: Receive Indications of Interest (4 weeks)

During this one-month phase, potential buyers submit non-binding Indications of Interest (IOIs) containing preliminary valuation ranges and key terms. This stage serves as an initial screening mechanism while providing sellers with valuable market feedback on their business’s perceived value. Successful automotive transactions generate 3-7 IOIs for well-positioned properties.

Key activities during the IOI phase include:

• IOI evaluation: Analyze preliminary valuation ranges, proposed deal structures, financing contingencies, and timeline expectations. Evaluation focuses on financial capability, operational synergies, timeline compatibility, and regulatory compliance capacity.

• Buyer qualification: Assess financial capability, operational experience, and transaction history of potential acquirers. Foreign strategic buyers demonstrate particular interest in businesses positioned within growing segments (used cars, aftermarket services, EV supply chain) versus declining new vehicle sales market.

• Management presentations: Conduct initial meetings between key property management and serious prospective buyers

Stage 4: Receive Letters of Intent (4 weeks)

The Letter of Intent (LOI) phase represents a significant advancement in transaction certainty, as buyers provide more detailed and committed proposals after preliminary due diligence. This phase typically requires one month and culminates in the selection of a preferred buyer for exclusive negotiations.

Key activities during the LOI phase include:

• LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

• Deal structure optimization: Consider tax implications of share sales (generally preferred) versus asset sales, with particular attention to foreign buyer constraints.

LOI selection requires careful analysis of pricing, structure, and execution risk and share sales are strongly preferred over asset sales to avoid 7% VAT burden.

• Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the most intensive and time-consuming phase of the transaction process, typically requiring three months for comprehensive completion. During this period, buyers conduct detailed investigation into all aspects of the property and business operations.

Comprehensive Risk Assessment: 68% of failed automotive deals collapse during this phase. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%). New BOT oversight on vehicle financing (effective December 2025) requires enhanced compliance documentation for hire-purchase/leasing operations.

Key due diligence activities include:

• Financial audit: Detailed review of historical financials, working capital, capital expenditure history, and forward projections

• Legal review: Examination of land titles, licenses, permits, contracts, employment agreements, and potential litigation

• Operational assessment: Analysis of management systems, standard operating procedures, service delivery, and competitive positioning

• Physical inspection: Engineering reports, property condition assessments, and environmental evaluations

• Regulatory compliance: Verification of Dealer License, Foreign Business License (if applicable), BOI certification, and Environmental Impact Assessment compliance

Stage 6: Sign Purchase Agreement (4 weeks)

The final transaction phase involves negotiating and executing the definitive purchase agreement, transferring ownership and managing closing logistics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

• Purchase agreement negotiation: Finalize detailed terms, representations, warranties, indemnifications, and post-closing obligations

• Regulatory approvals: Secure necessary government clearances, particularly for foreign acquisitions requiring Foreign Business License or Board of Investment approval

• Closing mechanics: Establish escrow arrangements, funds transfer protocols, and signing sequences

• Operational transition: Develop detailed plans for management continuity, employee retention, and brand/system transitions

How an M&A Advisor Adds Value

Professional M&A advisors specializing in the automotive sector deliver quantifiable improvements in transaction outcomes across multiple dimensions. Our analysis of comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led automotive sales.

Figure 3: Impact of Using an M&A Advisor on Automotive Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Automotive Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates itself through an integrated advisory approach that combines M&A expertise, legal counsel, and accounting services through our partnership with Tanormsak Law Firm, which brings over 50 years of specialized automotive transaction experience. This integrated model provides several advantages:

• Regulatory expertise: Deep knowledge of Thailand’s complex dealership and workshop licensing, land ownership, and foreign investment regulations

• Tax optimization: Strategic deal structuring to minimize tax liabilities and maximize after-tax proceeds

• Negotiation leverage: Access to an extensive network of qualified buyers, creating competitive tension that drives valuations higher

• Risk mitigation: Comprehensive due diligence preparation that anticipates and resolves potential transaction obstacles before they emerge

Conclusion

The Thai automotive market, despite short-term contractions, offers significant opportunities for well-prepared business exits. Robust growth in used cars, aftermarket services, and EV-related supply chains creates clear valuation premiums for businesses that align with these expanding segments (Mordor Intelligence, 2025; ASEAN Briefing, 2025). Achieving success in this highly regulated and complex M&A environment requires rigorous preparation, disciplined execution through the six-stage sale process, and the guidance of experienced advisors.

For SME owners contemplating a sale, the evidence is conclusive: professional representation consistently delivers superior outcomes—higher valuations, faster deal completions, and dramatically higher success rates compared to owner-led transactions. With transaction values frequently exceeding hundreds of millions of baht, the 15–35% valuation premium achievable through professional advisory not only offsets costs but also represents exceptional ROI for sellers.

Max Solutions’ integrated advisory platform—combining M&A expertise, legal structuring, and financial optimization—ensures automotive business owners achieve optimal results while navigating Thailand’s unique regulatory and market complexities. By following the structured framework outlined in this guide and leveraging specialized advisory support, SME owners can maximize transaction value and successfully execute what is often the most consequential financial decision of their careers.

Frequently Asked Questions (FAQs)

Q: How do FBA foreign ownership restrictions impact automotive business valuations?

A: The 49% ownership cap can reduce valuations by 10-15% due to limited buyer pool. However, strategic structuring through BOI incentives, manufacturing exemptions, or management agreements can mitigate impacts while maintaining access to foreign strategic premium pricing. Max Solutions’ legal expertise enables creative structuring to maximize foreign buyer participation.

Q: What financial preparations are most critical for maximizing valuations?

A: Key preparations include: (1) TFRS-compliant accrual accounting; (2) Normalized EBITDA calculations removing discretionary expenses; (3) Complete inventory documentation with proper valuation; (4) Technology integration demonstrating operational efficiency. These preparations typically increase multiples by 0.5-1.0× while reducing due diligence risk.

Q: How does the new BOT oversight affect automotive financing businesses?

A: The December 2025 Royal Decree placing vehicle hire-purchase and leasing under BOT supervision requires enhanced compliance for businesses with in-house financing. Proactive documentation preparation maintains valuations while demonstrating regulatory readiness to institutional buyers who value compliance certainty.

Q: What distinguishes Bangkok automotive businesses in valuation terms?

A: Bangkok consistently commands +0.5× higher EBITDA multiples across all categories due to market density, enhanced buyer competition, operational advantages, and superior infrastructure. The capital’s 401 dealerships (29% of national total) create competitive dynamics that drive premium valuations for well-positioned assets.

Q: What is the optimal timing for selling an automotive business in Thailand?

A: Despite 2024 market contractions, businesses positioned in growth segments (used cars with 7.17% CAGR, EV supply chain, aftermarket services) face strong buyer demand. Optimal timing depends on completion of 3–5-year preparation process and individual business fundamentals rather than broader market cycles.

References

ASEAN Briefing. (2025, March 27). Thailand’s automotive industry: A guide for foreign investors.

BOLT ON Technology. (2025). ROI calculator. Equidam. (2025). EBITDA multiples by industry.

Finansia Syrus. (2025, March 19). Thailand automotive: The road is tough. IFLR. (2025, March 11). M&A guide 2025: Thailand.

IMARC Group. (2024). Thailand private equity market overview. Intellify. (2025). Thailand automotive industry outlook 2025-2030. Lex Nova Partners. (2025). Foreign business ownership in Thailand.

Mordor Intelligence. (2025, June 25). Thailand used car market size, share analysis, forecast 2025-2030.

NAVIX Consultants. (2025). Seven steps to increase your company value at sale. Peak Business Valuation. (2025). Valuation multiples for an automotive repair shop. SMMT. (2025, May). Thailand automotive market report.

Statista. (2025, August 7). Automotive industry in Thailand – statistics & facts.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th