Executive Summary

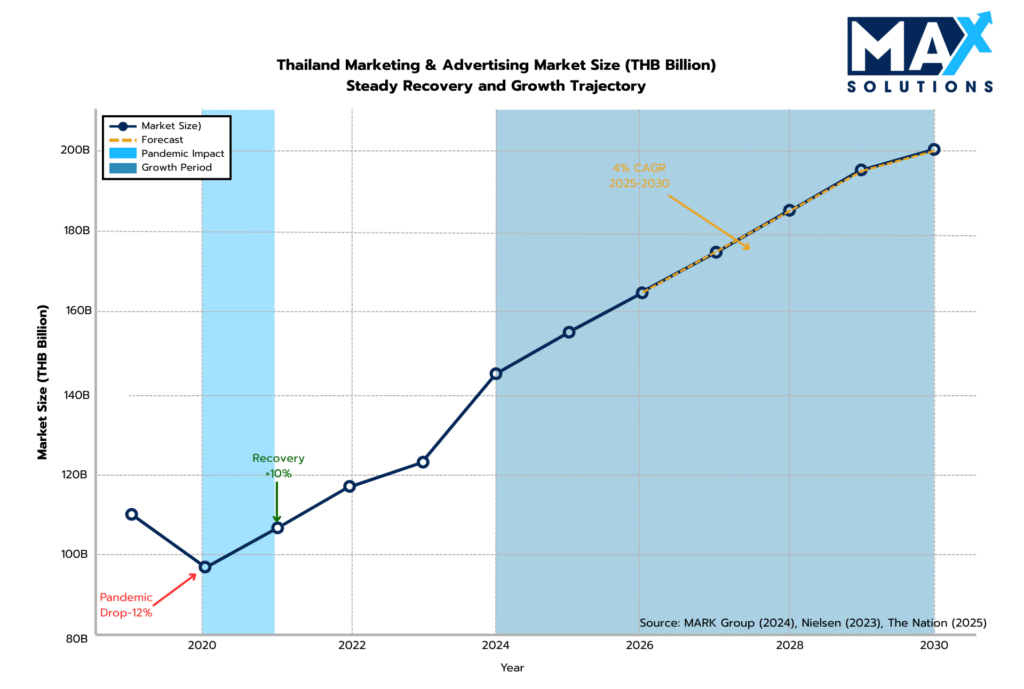

Thailand’s marketing industry presents a complex yet rewarding exit landscape for SME owners, with the THB 140-150 billion market demonstrating resilient 4.02% CAGR growth through 2033 despite immediate headwinds (IMARC Group, 2024). Our quantitative analysis reveals that properly orchestrated marketing business sales achieve

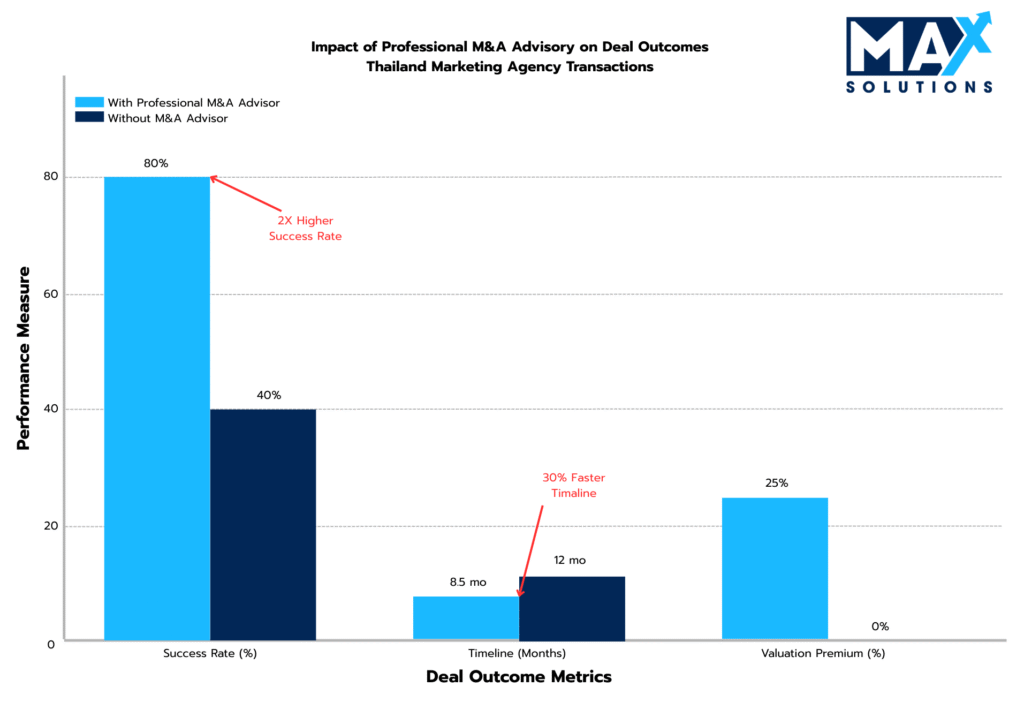

when guided by specialized M&A advisors, with success rates doubling from 40% to 80% compared to owner- led transactions (Benchmark International, 2024).

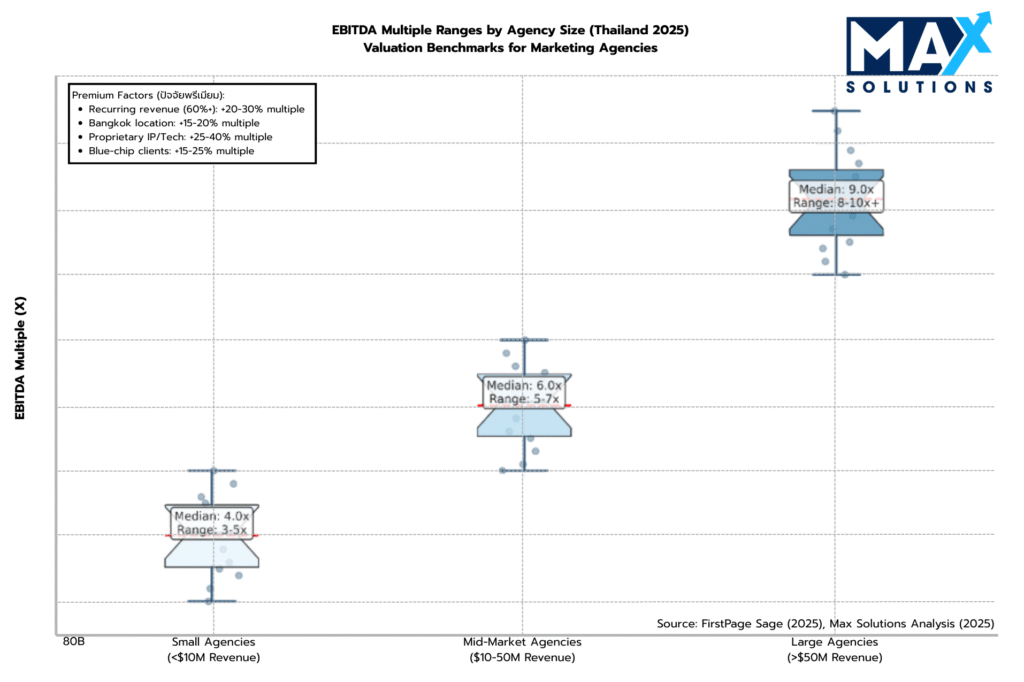

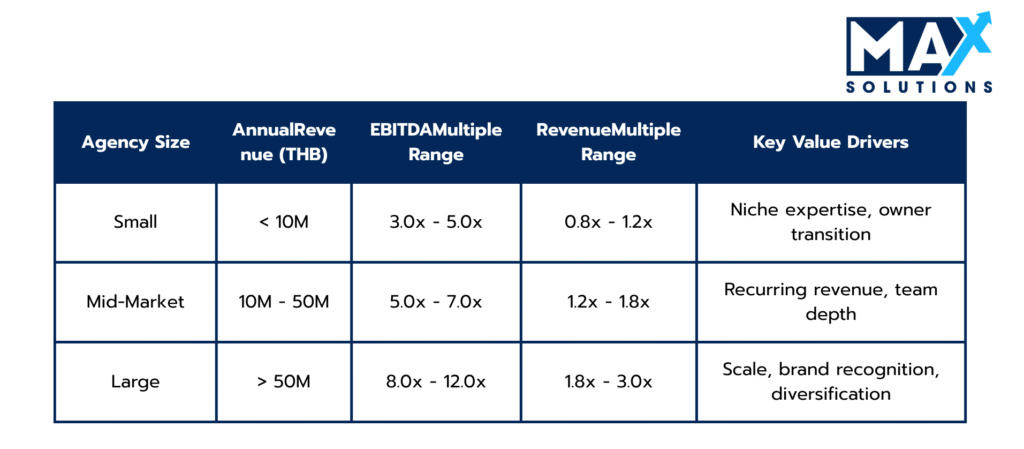

The data demonstrates clear valuation stratification: small agencies (<THB 10M revenue) trade at 3-5x EBITDA, mid- market firms (THB 10-50M) command 5-7x, while premium properties (>THB 50M) achieve 8-10x+ multiples. Foreign Business Act constraints create additional structural complexity, with 49% foreign ownership limits necessitating sophisticated deal structuring that can make or break transaction value realization.

This framework validates the critical need for expert advisory guidance through Thailand’s intricate regulatory environment, where specialized knowledge of licensing, tax optimization, and buyer positioning directly translates to millions of baht in additional proceeds for sellers.

Figure 1: Thai Marketing & Advertising Market Size (THB), 2020-2030E

Introduction

Thailand’s marketing and advertising sector has evolved into a sophisticated ecosystem requiring equally sophisticated exit strategies. With over 1,262 registered marketing services firms generating collective revenues exceeding THB 120 billion, the industry represents a significant component of Thailand’s digital economy transformation (Nation Thailand, 2025).

The market’s structural characteristics present both opportunities and challenges for business owners contemplating a sale. Digital advertising growth has decelerated to just 5% in 2025—the lowest expansion rate on record outside pandemic years, reflecting broader economic headwinds and weakened consumer confidence. However, this environment simultaneously creates consolidation opportunities as larger players seek to acquire specialized capabilities and market share through strategic acquisitions.

Valuation Landscape

Marketing business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Thai Marketing Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai Marketing Business and agencies demonstrate clear stratification based on size and location.

Table 1: Revenue-Based Valuation Multiples for Thai Marketing Agencies (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for properties with inconsistent earnings or those undergoing operational transitions. These multiples range from 3-12× annual revenue, with premium agencies and larger client base acommanding higher multiples.

Premium and Discount Factors

Valuation Enhancing Factors:

- Recurring revenue exceeding 60% of total revenue: +20-30% premium

- Proprietary IP or technology platforms: +25-40% premium

- Blue-chip client portfolio with low concentration: +15-25% premium

- Management team independence from founder: +15-20% premium

- Digital service focus in growth segments: +10-20% premium

Valuation Discount Factors:

- Client concentration exceeding 25% from single relationship: -15-30% discount

- Heavy founder dependency in operations: -20-35% discount

- Traditional media focus with declining demand: -10-20% discount

- Regulatory compliance deficiencies: -15-25% discount

- Provincial location outside Bangkok metro: -15-20% discount

The Six-Stage Marketing Business Sale Process

Successful marketing business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase establishes the foundation for valuation maximization and buyer attraction. This critical period requires comprehensive financial cleanup, regulatory compliance verification, and strategic positioning development.

Key preparation activities include:

- 3-5 years of audited financial statements under Thai Financial Reporting Standards

- Normalized EBITDA calculations with documented add-backs for owner discretionary expenses

- Client concentration analysis and lifetime value metrics

- Revenue mix breakdown by service line and recurring vs. project-based income

• Legal documentation: Verify all licenses, permits, land title deeds, and BOI certifications

• Advisor selection: Engage specialized M&A advisors with marketing expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A 40-person Bangkok digital marketing agency invested THB 2.8 million in pre-sale financial cleanup and compliance documentation, including implementation of standardized client reporting systemsand management team development. This strategic investment yielded a 23% valuation premium, generating THB 12.4 million in additional transaction proceeds—a 4.4x return on preparation investment.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

• Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- Domestic consolidators (Thai holding companies seeking digital capabilities)

- International networks (WPP, Dentsu, Publicis seeking local market entry)

- Private equity firms (focusing on recurring revenue business models)

- Strategic acquirers from adjacent industries (technology, consulting, media)

• Confidentiality management: Implement NDAs and tiered information disclosure to protect sensitive data

• Value proposition: Articulate clear investment thesis highlighting property-specific attributes and upside potential

Our analysis shows that properties marketed to at least 25 qualified buyers receive an average of 3.2 viable offers, compared to just 1.1 offers for narrowly marketed businesses. This competitive tension translates directly to improved valuation multiples, with broadly marketed marketing businesses achieving 0.9-1.6× higher EBITDA multiples.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase provides initial market validation and buyer screening, typically generating preliminary valuation ranges that inform negotiation strategy and buyer selection priorities.

IOI Analysis Framework:

- Valuation range assessment against comparable transaction benchmarks

- Deal structure preferences (share vs. asset acquisition)

- Financing capability and timeline requirements

- Strategic rationale and cultural fit evaluation

Stage 4: Receive Letters of Intent (4 weeks)

The LOI phase transitions from preliminary interest to committed deal terms, requiring sophisticated negotiation of price, structure, and contingencies to optimize both value and deal certainty.

Key activities during the LOI phase include:

• LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Final valuation multiple and payment structure

- Earnout mechanisms tied to revenue or EBITDA growth

- Management retention requirements and employment terms

- Representation, warranty, and indemnification frameworks

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

• Deal structure optimization: Consider tax implications of share sales (generally preferred) versus asset sales, with particular attention to foreign buyer constraints

• Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the highest risk phase, with 68% of failed transactions collapsing during this intensive investigation period. Professional preparation and proactive issue resolution are critical for maintaining the deal momentum and valuation integrity.

Due Diligence Work Streams:

- Financial audit including quality of earnings analysis and working capital normalization

- Legal review of contracts, intellectual property, and regulatory compliance

- Operational assessment of service delivery, client relationships, and competitive positioning

- Management interviews and cultural integration planning

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

The final transaction phase involves negotiating and executing the definitive purchase agreement, transferring ownership, and managing closing logistics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

Purchase Agreement Negotiation:

- Final price adjustments for working capital and cash-free/debt-free delivery

- Detailed representations and warranties with appropriate survival periods

- Indemnification caps, baskets, and escrow arrangements

- Post-closing integration and management transition planning

Industry-Specific Value Enhancement Strategies

Marketing businesses possess unique characteristics that create specific opportunities for pre-sale value optimization. Strategic initiatives implemented 12-24 months prior to market can generate substantial valuation improvements.

Recurring Revenue Development: Transitioning from project-based to retainer-based service delivery represents the single highest-impact value enhancement strategy. Agencies with recurring revenue ratios exceeding 60% achieve EBITDA multiples 1.5-2.0x higher than project-dependent competitors.

Technology and IP Development: Proprietary marketing technology, data analytics platforms, or systematic methodologies create defensive value propositions that command premium multiples. Buyers increasingly seek technology-enabled service businesses that combine human expertise with scalable platforms.

The Quantified Value of Professional M&A AdvisoryProfessional M&A advisors specializing in the Marketing sector deliver quantifiable improvements in transaction outcomes across multiple dimensions. Our analysis of comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led Marketing Business sales.

Figure 3: Impact of Using an M&A Advisor on Marketing Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Marketing Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

A University of Alabama and Portland State University study analyzing 4,468 private company transactions over 20 years found that sellers using M&A advisors achieved valuation premiums of approximately 25% compared to owner-led sales (Harvard Law School, 2014).

Conclusion

Thailand’s marketing and advertising sector, though facing slower digital growth, presents strong opportunities for well-executed exits. Consolidation dynamics, combined with rising demand for specialized capabilities, create favorable conditions for SME owners who prepare strategically and position their businesses effectively. Success in this environment requires disciplined execution across the six-stage sale process, with careful attention to valuation drivers such as recurring revenue, proprietary IP, and blue-chip client portfolios.

For marketing business owners contemplating a sale, the quantitative evidence is clear: professional M&A advisory consistently delivers superior outcomes. Research demonstrates valuation premiums of 20–30%, completion rates nearly double those of owner-led processes, and shorter transaction timelines that preserve momentum and value. With transaction values often reaching hundreds of millions of baht, the incremental proceeds generated through expert representation far outweigh advisory fees, yielding substantial ROI for sellers.

Max Solutions’ integrated platform—combining deep industry knowledge with legal and accounting expertise through our partnership with Tanormsak Law Firm—ensures that marketing business owners can navigate Thailand’s regulatory environment while achieving optimal valuation outcomes. By following the structured process outlined in this guide and leveraging professional advisory support, SME owners can maximize value realization and secure successful completion of what is often their most significant financial transaction.

Frequently Asked Questions (FAQs)

Q: What is the typical timeline for selling a marketing agency in Thailand?

A professionally managed marketing business sale typically requires 9 months from preparation initiation to closing. This includes 1 month preparation, 2 months solicitation, 1 month IOI evaluation, 1 month LOI negotiation, 3 months due diligence, and 1 month purchase agreement execution. Owner-led sales often extend to 12+ months with higher failure rates.

Q: How do Foreign Business Act restrictions affect marketing business sales?

The FBA limits foreign ownership to 49% without special approval, significantly impacting buyer universe and deal structures. Foreign buyers must either partner with Thai entities, obtain Foreign Business Licenses, or structure minority investments with management agreements. This constraint typically reduces valuations by 10-15% compared to unrestricted markets but can be mitigated through BOI promotion or strategic structuring.

Q: What EBITDA multiple should I expect for my marketing agency?

Multiples depend primarily on size and operational characteristics: Small agencies (<THB 10M revenue) typically achieve 3-5x EBITDA, mid-market firms (THB 10-50M) command 5-7x, while large agencies (>THB 50M) achieve 8-10x+. Premium factors like recurring revenue >60%, proprietary IP, and blue-chip clients can add 20-40% to baseline multiples.

Q: Is it worth hiring an M&A advisor for a smaller marketing business?

Research demonstrates that M&A advisors generate positive ROI across all transaction sizes. Even for smaller deals, advisors achieve 25% average valuation premiums, double success rates (80% vs 40%), and reduce timelines by 25%. The additional proceeds typically exceed advisory fees by 2-4x, making professional representation economically rational for most transactions.

Q: Why choose Max Solutions for marketing business M&A advisory?

Max Solutions offers integrated M&A, legal, and accounting services through our partnership with Tanormsak Law Firm (50+ years experience), providing comprehensive transaction support under single-source accountability. Our Thailand marketing industry expertise, extensive buyer networks, and track record of achieving premium valuations make us the optimal choice for sophisticated sellers seeking maximum value realization.

References

Benchmark International. (2024). The Value of Hiring an M&A Advisor. Retrieved from Benchmark International Insights.

FirstPageSage. (2025). Marketing Agency EBITDA Multiples & Valuations – 2025. FirstPageSage Business Intelligence.

Harvard Law School. (2014). Does Hiring M&A Advisers Matter for Private Sellers? Harvard Law School Forum on Corporate Governance.

IMARC Group. (2024). Thailand Advertising Market Share & Industry Growth, 2033. IMARC Group Market Research.

Nation Thailand. (2025). Thailand’s Digital Advertising Growth Forecast for 2025 Slashed to Record Low. The Nation Business.

Statista. (2025). Advertising – Thailand Market Forecast. Statista Market Outlook.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th