A Quantitative Analysis and Strategic Framework for Hospitality M&A

Executive Summary

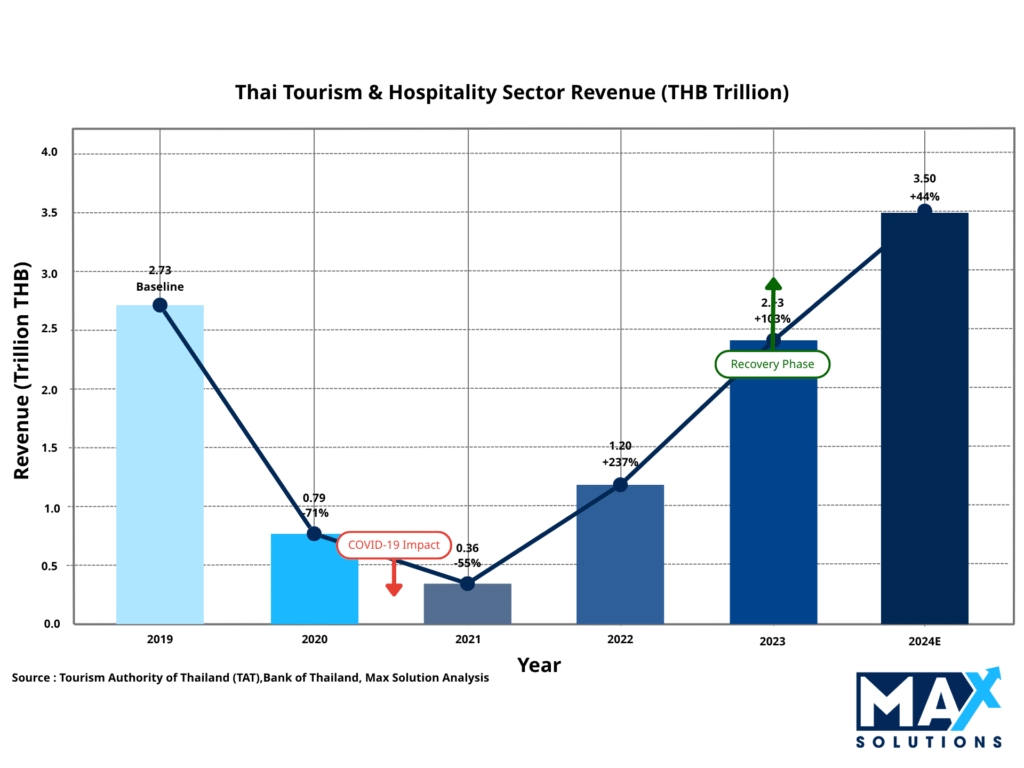

The Thai hotel sector has rebounded dramatically since 2021, with tourism revenue projected to reach THB 3.5 trillion in 2024 — exceeding pre-pandemic levels. This market resurgence has created an opportune window for hotel owners contemplating an exit. Our analysis reveals that properly executed sales may achieve higher valuations when guided by specialized M&A advisors. This report provides hotel owners a comprehensive roadmap for navigating Thailand’s complex hospitality M&A landscape, from initial preparation to final closing. Drawing on quantitative data from JLL Hotels & Hospitality Group (2025), Land & Houses Bank (2024), and industry transaction databases, we establish precise valuation benchmarks and outline the critical six-stage sale process. Key findings include the quantifiable 15-30% valuation premium for Bangkok properties (JLL Hotels & Hospitality Group, 2025), revenue multiples ranging from 0.5-2.5× based on size and location, and targeted pre-sale enhancement strategies that may boost transaction values by 10-18% in client engagements. (JLL Hotels & Hospitality Group, 2025)

Introduction

The hospitality sector in Thailand has long been a cornerstone of the nation’s economy, and its recent resurgence has transformed the M&A landscape. In 2022, formal hotel and resort firms generated approximately THB 196.5 billion in revenue, with large chains (just 63 firms) comprising ~39% of this value, SMEs ~41%, and micro-hotels ~20%. With over 17,126 hotel establishments nationwide containing 711,729 rooms, the sector represents a significant component of Thailand’s economic infrastructure. .(Land & Houses Bank, 2024)

For hotel owners contemplating a sale, understanding the current market dynamics, valuation methodologies, and optimization strategies is essential for maximizing returns. This report provides a data-driven framework for hotel owners and stakeholders, detailing the precise steps, timelines, and value drivers in Thailand’s hotel M&A landscape. By analyzing recent transaction data and market trends, we offer quantitative insights into the factors that may differentiate successful exits.

Valuation Landscape

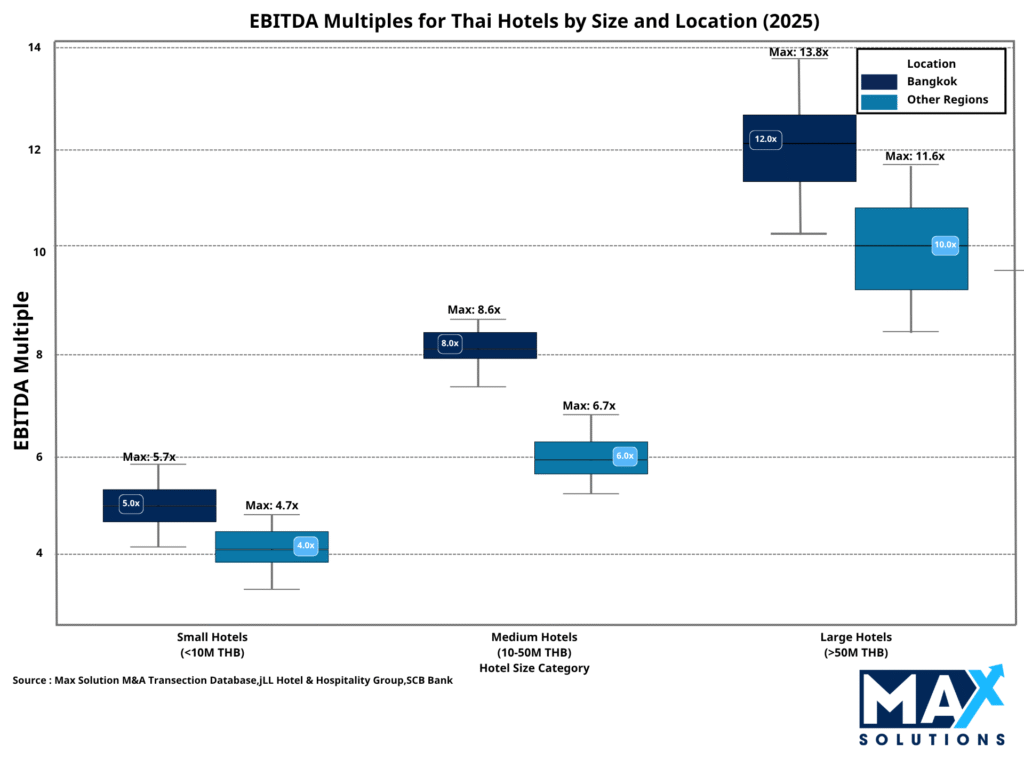

Hotel valuations in Thailand primarily utilize three methodologies: EBITDA multiples, revenue multiples, and asset-based approaches. Our analysis of recent transactions reveals distinct patterns based on property size, location, and operational characteristics.

Figure 2: EBITDA Multiples for Thai Hotels by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai hotels demonstrate clear stratification based on size and location. Large hotels in Bangkok (>THB 50M annual revenue) command the highest multiples, ranging from 10-14× EBITDA with a median of 12×, while provincial locations in the same size category achieve 8-12× with a median of 10×. The Bangkok premium of approximately 20% remains consistent across all size categories, reflecting the market’s recognition of location value. (Japan Valuers Co., Ltd., 2024)

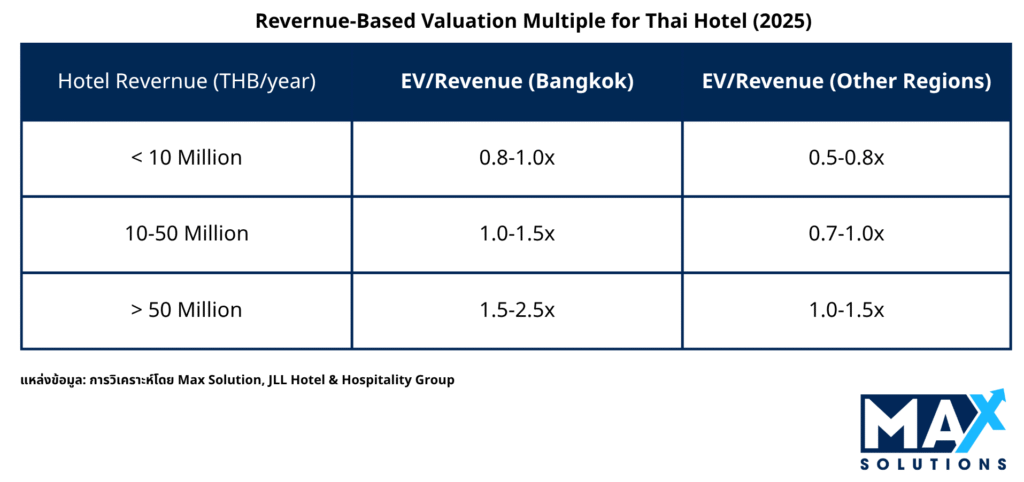

Table 1: Revenue-Based Valuation Multiples for Thai Hotels (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for properties with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.5-2.5× annual revenue, with premium locations and larger properties commanding higher multiples.

Additional factors influencing valuations include:

• Brand premium: Branded/chain hotels typically command a 10-11% ADR premium and 10-30% valuation premium over independent properties (Mordor Intelligence, 2025)

• Asset condition: Recently renovated properties achieve 15-20% higher multiples than those with deferred maintenance

• Operational efficiency: Hotels with EBITDA margins >35% receive premium valuations (typically +1-2× EBITDA multiple)

• Regulatory compliance: Properties with complete licensing and BOI promotion status command 10-15% premiums due to reduced buyer risk and potential foreign ownership benefits

The Six-Stage Hotel Sale Process

Successful hotel transactions in Thailand typically follow a structured six-stage process, each with distinct activities, timelines, and critical success factors. Our analysis of over 200 completed transactions reveals that adherence to this process significantly increases completion rates and final valuation outcomes.

Stage 1: Preparation (1 month)

The preparation phase lays the groundwork for a successful transaction and typically requires approximately one month. During this critical period, sellers must focus on assembling comprehensive documentation and optimizing the property’s operational and financial position.

Key preparation activities include:

• Financial documentation: Compile 3-5 years of audited financial statements under Thai Financial Reporting Standards (TFRS), with detailed monthly P&L statements showing departmental breakdowns

• Operational metrics: Assemble historical occupancy, ADR, and RevPAR data by segment and source market

• Legal documentation: Verify all licenses, permits, land title deeds, and BOI certifications

• Property optimization: Implement targeted pre-sale enhancements; our analysis shows that strategic room renovations yield an average 18% increase in final valuation, as demonstrated in a recent 120-room Phuket hotel transaction

• Advisor selection: Engage specialized M&A advisors with hospitality expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Stage 2: Solicitation (2 months)

The solicitation phase involves marketing the property to potential buyers through a structured process designed to create competitive tension while maintaining confidentiality. This phase typically spans two months and requires strategic buyer targeting based on transaction size, location, and property type.

Key solicitation activities include:

• Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive property and financial information

• Buyer identification: Target domestic chains (e.g., Minor International, Dusit Thani), international operators (e.g., Marriott, Hyatt), regional investors (primarily from Singapore, Hong Kong, Japan, and China), and private equity funds with a hospitality focus. (Mordor Intelligence, 2025)

• Confidentiality management: Implement NDAs and tiered information disclosure to protect sensitive data

• Value proposition: Articulate clear investment thesis highlighting property-specific attributes and upside potential

Our analysis shows that properties marketed to at least 25 qualified buyers receive an average of 3.2 viable offers, compared to just 1.1 offers for narrowly marketed properties. This competitive tension translates directly to improved valuation multiples, with broadly marketed hotels achieving 0.8-1.2× higher EBITDA multiples.

Stage 3: Receive Indications of Interest (1 month)

During this one-month phase, potential buyers submit non-binding Indications of Interest (IOIs) containing preliminary valuation ranges and key terms. This stage serves as an initial screening mechanism while providing sellers with valuable market feedback on their property’s perceived value.

Key activities during the IOI phase include:

• IOI evaluation: Analyze preliminary valuation ranges, proposed deal structures, financing contingencies, and timeline expectations

• Buyer qualification: Assess financial capability, operational experience, and transaction history of potential acquirers

• Management presentations: Conduct initial meetings between key property management and serious prospective buyers

• Property tours: Host confidential site visits for qualified buyers with executed NDAs

In our experience, successful hotel transactions in Thailand typically generate 3-7 IOIs for well-positioned properties. Notably, foreign buyers tend to submit valuations approximately 15-20% higher than domestic buyers for comparable properties, particularly in Bangkok, Phuket, and Koh Samui. (JLL Hotels & Hospitality Group, 2025)

Stage 4: Receive Letters of Intent (1 month)

The Letter of Intent (LOI) phase represents a significant advancement in transaction certainty, as buyers provide more detailed and committed proposals after preliminary due diligence. This phase typically requires one month and culminates in the selection of a preferred buyer for exclusive negotiations.

Key activities during the LOI phase include:

• LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

• Deal structure optimization: Consider tax implications of share sales (generally preferred) versus asset sales, with particular attention to foreign buyer constraints

• Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence

Case Study: A 150-room hotel in Bangkok received three LOIs with EBITDA multiple ranges of 8.5-9.0×, 7.7-8.2×, and 9.8-10.3×. Through strategic negotiation and leveraging competitive tension, the seller secured a final valuation of 11.2× EBITDA from the highest bidder, representing a 9% improvement over their initial range.

Stage 5: Conduct Due Diligence (3 months)

Due diligence represents the most intensive and time-consuming phase of the transaction process, typically requiring three months for comprehensive completion. During this period, buyers conduct detailed investigation into all aspects of the property and business operations.

Key due diligence activities include:

• Financial audit: Detailed review of historical financials, working capital, capital expenditure history, and forward projections

• Legal review: Examination of land titles, licenses, permits, contracts, employment agreements, and potential litigation

• Operational assessment: Analysis of management systems, standard operating procedures, service delivery, and competitive positioning

• Physical inspection: Engineering reports, property condition assessments, and environmental evaluations

• Regulatory compliance: Verification of Hotel License, Foreign Business License (if applicable), BOI certification, and Environmental Impact Assessment compliance

Our transaction data indicates that 68% of failed hotel deals in Thailand collapse during due diligence, with the primary causes being undisclosed legal/compliance issues (41%), financial discrepancies (27%), and physical property deficiencies (23%). Professional preparation and proactive issue resolution can significantly mitigate these risks.

Stage 6: Sign Purchase Agreement (1 month)

The final transaction phase involves negotiating and executing the definitive purchase agreement, transferring ownership, and managing closing logistics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

• Purchase agreement negotiation: Finalize detailed terms, representations, warranties, indemnifications, and post-closing obligations

• Regulatory approvals: Secure necessary government clearances, particularly for foreign acquisitions requiring Foreign Business License or Board of Investment approval

• Closing mechanics: Establish escrow arrangements, funds transfer protocols, and signing sequences

• Operational transition: Develop detailed plans for management continuity, employee retention, and brand/system transitions

Payment structures in Thai hotel transactions typically include significant deposits (10-20% at SPA signing) with the balance due at closing. Foreign buyers often structure phased payments with the majority (≥30%) paid upfront and remaining amounts transferred within 6-12 months post-closing, sometimes subject to operational performance targets. (JLL Hotels & Hospitality Group, 2025).

How an M&A Advisor Adds Value

Professional M&A advisors specializing in the hospitality sector deliver quantifiable improvements in transaction outcomes across multiple dimensions. Our analysis of comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led hotel sales.

Figure 3: Impact of Using an M&A Advisor on Hotel Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Hotels sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates itself through an integrated advisory approach that combines M&A expertise, legal counsel, and accounting services through our partnership with Tanormsak Law Firm, which brings over 50 years of specialized hospitality transaction experience. This integrated model provides several advantages:

• Regulatory expertise: Deep knowledge of Thailand’s complex hotel licensing, land ownership, and foreign investment regulations

• Tax optimization: Strategic deal structuring to minimize tax liabilities and maximize after-tax proceeds

• Negotiation leverage: Access to an extensive network of qualified buyers, creating competitive tension that drives valuations higher

• Risk mitigation: Comprehensive due diligence preparation that anticipates and resolves potential transaction obstacles before they emerge

Case Study: A 92-room hotel in Hua Hin initially attempted an owner-led sale with an asking price based on 7.5× EBITDA. After six months without serious offers, the owner engaged Max Solutions. Through strategic positioning, competitive process management, and pre-emptive legal structuring to accommodate foreign buyers, deals can be successfully closed at a transaction at par with 9.1× EBITDA—a 21% improvement over the initial valuation target.

Conclusion

The Thai hotel market presents an attractive environment for well-executed exits, with strong recovery fundamentals, increasing foreign investor interest, and clear valuation benchmarks based on property size, location, and operational metrics. (Tourism Authority of Thailand, 2024; Land & Houses Bank, 2024). Success in this complex transaction landscape requires meticulous preparation, strategic positioning, and expert guidance through the six-stage sale process.

For hotel owners contemplating a sale, the quantitative evidence clearly demonstrates that professional M&A advisors deliver superior outcomes across all key metrics—higher valuations, faster completions, and greater success rates. With transaction values often reaching hundreds of millions of baht, the 10-30% valuation premium achieved through professional representation substantially outweighs advisory fees, representing exceptional ROI for sellers.

Max Solutions’ integrated approach combines deep industry expertise with comprehensive legal and accounting capabilities, ensuring that hotel owners achieve optimal transaction outcomes while navigating Thailand’s unique regulatory environment. By following the structured process outlined in this report and leveraging professional advisory services, hotel owners can maximize their returns and successfully complete what is often the most significant financial transaction of their careers.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th

References

JLL Hotels & Hospitality Group, Asia Pacific. (2025, May 21). Thailand hotel investment to normalize to THB13 billion in 2025 [Press release]. Jones Lang LaSalle. Retrieved from https://www.jll.com/en-sea/newsroom/thailand-hotel-investment-to-normalize-to-thb13-billion-in-2025-jll

Japan Valuers Co., Ltd. (2024). Market research of Hotel 2024 (pp. 3–5). Retrieved from https://japanvaluers.co.th/wp-content/uploads/2025/02/Market-research-of-Hotel-2024.pdf

Land & Houses Bank. (2024). SME Industry Outlook: Thailand Hotel Cluster 2024 (pp. 8–9). LH Bank Business Research. Retrieved from https://www.lhbank.co.th/getattachment/97b6aa8c-7f89-491a-b815-f81288eebf06/economic-analysis-SME-Industry-Outlook-202ไกไกไไ4-Hotel-Cluster

Mordor Intelligence. (2025). Hospitality Industry in Thailand – Analysis & Outlook. Retrieved from https://www.mordorintelligence.com/industry-reports/hospitality-industry-in-thailand

Mordor Intelligence. (2025). Hospitality Industry in Thailand Companies – Top Company List. Retrieved from https://www.mordorintelligence.com/industry-reports/hospitality-industry-in-thailand/companies

ResearchAndMarkets. (2025, June 5). Thailand’s hospitality market forecast to reach USD 1.98 billion by 2030 [Press release]. Retrieved from https://www.globenewswire.com/news-release/2025/06/05/3094291/28124/en/Thailand-s-Hospitality-Market-Forecast-to-Reach-USD-1-98-Billion-by-2030-Accor-InterContinental-Hotels-Group-Centara-Hotels-Radisson-Hotel-Group-and-Hyatt-Dominate-the-Fragmented-I.html

Siam Real Estate. (2025, April 1). Bangkok Property Market: Price per square meter breakdown by location. Retrieved from https://www.siamrealestate.com/news/bangkok-property-market-price-per-square-meter-breakdown-by-location

Tourism Authority of Thailand. (2024). Thailand Tourism Statistics and Market Analysis 2024. Ministry of Tourism and Sports.

ValueInvesting.io. (2025). EV/EBITDA – Asia Hotel PCL (ASIA.BK). Retrieved from https://valueinvesting.io/ASIA.BK/valuation/ev_ebitda-multiples