Executive Summary

Thailand’s recruitment and HR outsourcing sector has emerged as a critical M&A opportunity in 2025, driven by structural transformation in labor markets, accelerating digital adoption, and aggressive regional consolidation. The industry generated approximately ฿97.27 billion in revenue in 2024, representing 4.4% year-on-year growth (Staffing Industry Analysts, 2025). For business owners contemplating divestiture, the confluence of demographic talent shortages, technology-driven service evolution, and foreign investor appetite particularly from Japanese aggregators has created favorable valuation conditions unprecedented in the past decade.

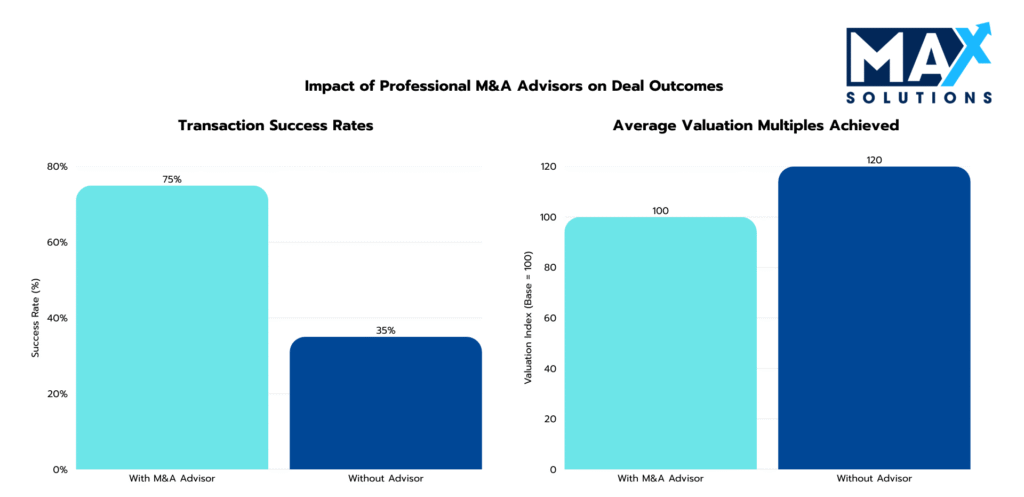

However, successfully monetizing these assets requires navigating Foreign Business Act restrictions (49% foreign ownership cap), rigorous PDPA compliance, and sophisticated valuation methodologies. Thai recruitment firms trade at 3-8× EBITDA multiples (HR Tech platforms: 8-12×), with professionally advised transactions achieving 10-30% valuation premiums and 75% success rates versus 35% for owner-led sales (Axial Research, 2025). This report provides a data-driven roadmap through the complete nine-month divestiture process.

MAX Solutions’ distinctive platform combining M&A expertise with Tanormsak Law Firm’s 50+ years of legal experience and comprehensive accounting services provides Recruitment and HR Outsourcing business owners the strategic advantage necessary to navigate Thailand’s complex regulatory environment while maximizing enterprise value.

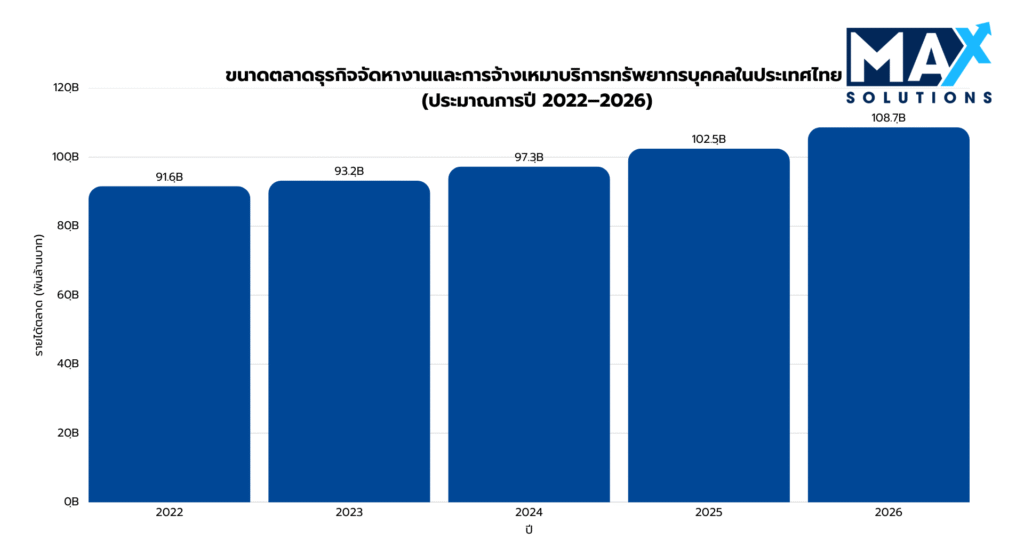

Figure 1: Thai Recruitment and HR Outsourcing Market Size and Growth (THB), 2019-2030E

Introduction

Thailand’s recruitment and HR outsourcing market has demonstrated resilient post-pandemic growth, expanding from ฿91.6 billion (2022) to ฿97.27 billion (2024), with contract staffing segments achieving 19-22.8% annual growth rates—the highest in Asia Pacific (Staffing Industry Report, 2024). This expansion reflects fundamental labor market dynamics: unemployment below 1%, accelerating wage inflation (8-12% in technology sectors), and structural talent shortages driven by Thailand’s rapidly aging demographic profile.

The market’s fragmentation creates acquisition opportunities: approximately 3,000 licensed firms operate nationally, with 90.6% classified as small operations (<฿10M annual revenue), 7.4% as mid-market (฿10-50M), and only 2% as large enterprises (>฿50M) (Department of Employment, 2025). Geographic distribution reveals significant provincial presence Eastern Seaboard (33%), Central Region (33%), and Bangkok (21%) reflecting industrial concentration in automotive and electronics manufacturing hubs

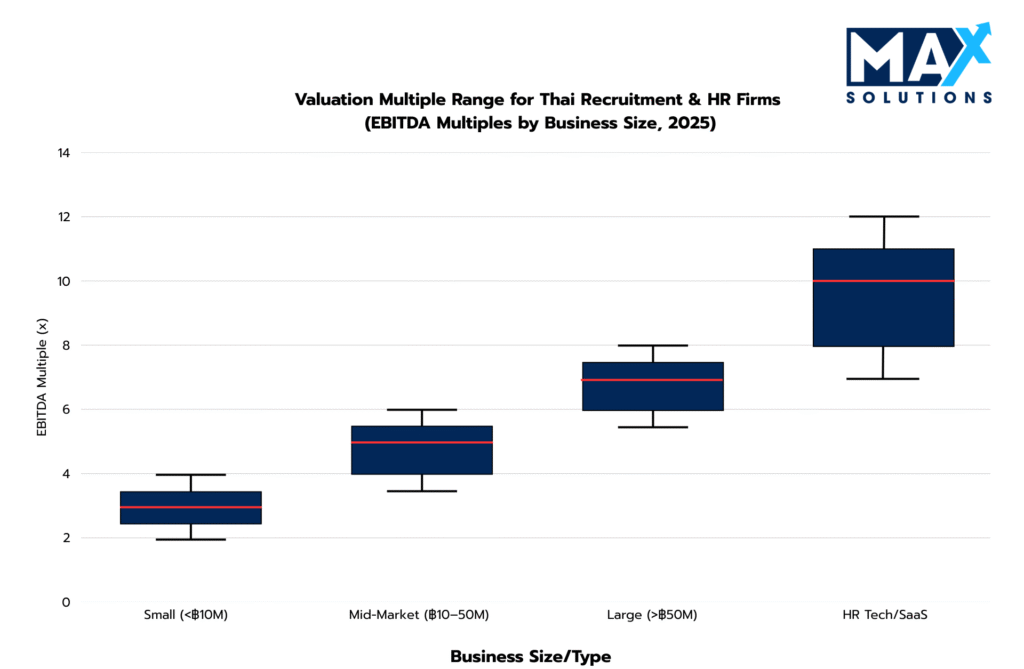

Valuation Landscape

Given the asset-light nature of recruitment businesses—where primary value resides in client relationships, candidate databases, and consultant expertise rather than tangible assets—valuation methodologies center on earnings-based approaches. EBITDA multiples serve as the dominant metric, with Adjusted EBITDA calculations normalizing for owner compensation, discretionary expenses, and one-time costs to reflect sustainable economic earnings (Raincatcher Valuation Guide, 2025).

Figure 2: EBITDA Multiples for Recruitment and HR Outsourcing Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. Thai Recruitment and HR Outsourcing valuations reflect a multi-dimensional assessment of cash flow stability, asset quality, market position, and growth potential.

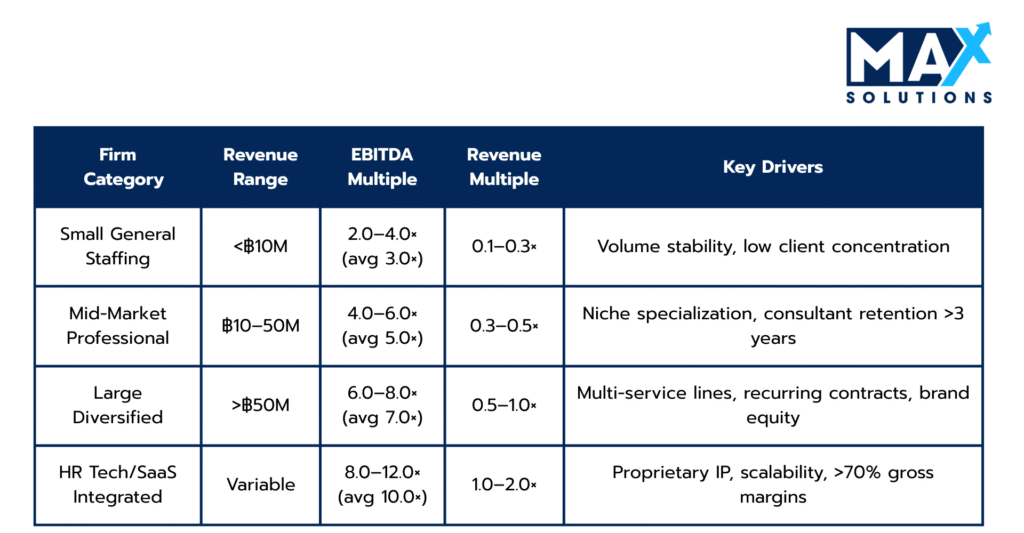

Table 1: Revenue-Based Valuation Multiples for Thai Recruitment and HR Outsourcing Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.1-2× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Recruitment and HR Outsourcing Business Sale Process

Successful Recruitment and HR Outsourcing business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

• Financial Normalization: Compile 3–5 years of TFRS financials and calculate Adjusted EBITDA with clear add-backs for excess owner salary, personal expenses, and one-time costs.

• Tax & Compliance Pack: Organize PND 50 (CIT), VAT (PP.30), and withholding tax records, ensuring they reconcile with management accounts and bank statements.

• Working Capital Review: Analyse DSO (target 45–60 days) and payable cycles to present a stable, “normalized” working capital profile to buyers.

• PDPA Readiness: Audit candidate and client data; implement explicit consent records, retention policies, and compliant cross-border transfer protocols.

• Licensing & Structure: Confirm Department of Employment recruitment licence validity, security deposits, and Thai-director requirements for the licensed entity.

• Advisor selection: Engage specialized M&A advisors with Recruitment and HR Outsourcing expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Bangkok professional recruitment firm lifted normalized EBITDA from ฿4.0M to ฿5.2M after proper add-backs and PDPA clean-up, increasing its valuation range from ฿20M (5×) to ฿31.2M (6×) with stronger buyer confidence.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

• Buyer Mapping: Identify Japanese aggregators, local consolidators, and global staffing brands most active in Thai and regional recruitment acquisitions.

• Positioning & CIM: Develop a confidential information memorandum highlighting niche specializations, recurring contracts, consultant productivity, and technology stack.

• Blind Teaser Outreach: Run an anonymous teaser campaign to 25–40 qualified buyers to gauge interest without exposing the firm’s identity to staff or competitors.

• Confidentiality Management: Secure NDAs before sharing detailed information or arranging management calls and site visits.

• Auction Design: Structure outreach to generate 3–5 serious bidders, creating competitive tension that can add 0.8–1.2× to the achievable EBITDA multiple.

Case Study: A mid-market IT recruitment firm approached 32 targeted buyers and secured 5 active bidders, lifting expected valuation from 5.0× to 6.3× EBITDA after a controlled, advisor-led auction.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Recruitment and HR Outsourcing properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

• IOI Collection: Request non-binding IOIs summarizing valuation range, EBITDA multiple, deal structure (share vs asset), and high-level conditions.

• Valuation Benchmarking: Compare proposed multiples against market ranges for firm size and type, adjusting for location, margins, and client concentration.

• Buyer Qualification: Assess each bidder’s strategic rationale, regional footprint, and track record integrating acquisitions in people-based businesses.

• Financing & Certainty: Prioritize buyers with strong balance sheets, committed funds, or corporate backing over those reliant on uncertain bank financing.

• Shortlist Formation: Narrow the field to 2–4 serious buyers with attractive terms and credible execution to move into LOI negotiations.

Case Study: A specialist engineering recruiter received 4 IOIs between 4.5× and 6.5× EBITDA and advanced two Japanese aggregators and one Thai listed consolidator offering strong strategic fit and confirmed funding.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

• Headline Economics: Negotiate headline price, agreed Adjusted EBITDA, and target multiple, including minimum upfront cash at closing.

• Deal Structure: Favor share sales to preserve recruitment licences and optimize tax outcomes, while addressing buyer concerns via warranties and indemnities.

• Earn-Out Design: Use 20–40% earn-out tranches tied to EBITDA or key client retention to bridge valuation gaps without over-exposing the seller to future risk.

• FBA & Foreign Ownership: Structure foreign acquisitions within Foreign Business Act limits using BOI promotion, 49% caps, or shareholder agreements where appropriate.

• Exclusivity & Key Terms: Define exclusivity period, governance during diligence, non-compete expectations, and high-level retention arrangements for key

consultants.Case Study: A ฿40M-revenue professional recruiter pushed an initial 4.8× LOI to 6.0× EBITDA by keeping two strategic buyers in competition and accepting a 25% earn-out tied to 18-month EBITDA and top-10 client retention.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Recruitment and HR Outsourcing deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

• Financial Verification: Allow buyer advisors to test revenue recognition, margin stability, add-backs, and tax filings, addressing discrepancies before they become price chips.

• Regulatory & PDPA Review: Provide evidence of Foreign Business Act compliance, valid recruitment licenses, PDPA consent logs, and social security and labor law compliance.

• Client & Contract Analysis: Disclose revenue by client, contract terms, renewal history, and change-of-control clauses to quantify and manage client concentration risk.

• People & Liability Assessment: Map consultant tenure, performance, and unfunded severance obligations, and identify any pending disputes or hidden HR liabilities.

• Data Room Management: Maintain a structured virtual data room and fast response times to keep momentum and reduce opportunities for re-trading.

Case Study: A 45-employee firm avoided a 20% price reduction by quantifying severance liabilities upfront, cleaning PDPA gaps before buyer review, and obtaining advance comfort letters from two top clients.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Recruitment and HR Outsourcing transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

• SPA Finalisation: Agree detailed purchase price mechanics, working capital adjustments, indemnity caps, and survival periods for financial, tax, and regulatory warranties.

• Payment Structure: Confirm deposit, cash at closing, and earn-out schedule, including escrow arrangements and clear triggers for any deferred consideration.

• Non-Compete & Non-Solicit: Define reasonable Thai-market non-compete and non-solicitation terms covering clients and key consultants for agreed periods.

• Regulatory Filings: Complete DBD share transfer filings, update director details, and notify the Department of Employment to maintain licence validity.

• Transition & Handover: Put in place 6–12 month founder transition services and retention bonuses for top-billing consultants to secure smooth client and candidate handover.

Case Study: A Bangkok recruitment firm closed at 6.2× EBITDA with 70% cash up front and a 30% earn-out after agreeing on a 3-year non-compete, consultant retention bonuses, and a structured 9-month founder transition plan.

Value Enhancement Factors for Recruitment & HR Outsourcing Businesses

• Recurring Revenue Contracts: Multi-year MSAs and high renewal rates materially increase multiples versus purely transactional placement models.

• PDPA-Compliant Database: Clean, fully consented candidate and client data is viewed as a high-quality asset rather than a regulatory liability.

• Technology Enablement: Modern ATS, reporting dashboards, and HR Tech components support higher scalability and justify premium EBITDA multiples.

• Client Diversification: Balanced portfolios with no single client above 20–30% of revenue reduce concentration discounts and earn-out pressure.

• Consultant Stability: Strong second-tier management and low turnover among top-billing consultants reduce founder dependency and buyer risk.

• Specialization & Niche Expertise: Focused practices in high-demand verticals (IT, engineering, healthcare, EEC industries) command higher pricing power.

• Regulatory Cleanliness: Up-to-date licences, FBA-compliant structures, and fully funded severance obligations prevent late-stage valuation haircuts.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Recruitment and HR Outsourcing Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully, primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately one fourth of the time, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Recruitment and HR Outsourcing Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Selling a recruitment or HR outsourcing business in Thailand is fundamentally an exercise in converting people, processes, and data into a credible, compliant, and transferable earnings stream. Foreign Business Act limits, entity specific recruitment licensing, unfunded severance obligations, and PDPA exposure around candidate and client databases all sit alongside the usual commercial issues of client concentration, consultant churn, and margin stability.

Transactions typically fail or are repriced sharply when these issues surface late in due diligence, for example when more than 30 percent of revenue is tied to a single client, personal data processing falls outside PDPA guidance or share and license structures cannot support the level of foreign ownership contemplated in the deal.

Within this environment, MAX Solutions offers Recruitment and HR Outsourcing business owners a practical route to maximizing value while controlling risk. By integrating M&A advisory, legal services through Tanormsak Law Firm and specialized accounting support, the firm brings together regulatory navigation under the Foreign Business Act, PDPA and merger control, rigorous financial and tax preparation, and access to relevant buyer networks in one coordinated platform.

Frequently Asked Questions (FAQs)

Q1: What valuation multiples should I expect for my recruitment business?

A: Valuation multiples for Thai recruitment firms typically range from 3-8× EBITDA depending on size, location, and service mix. Small generalist agencies (<฿10M revenue) trade at 2-4×, mid-market professional recruiters (฿10-50M) achieve 4-6×, and large diversified firms (>฿50M) command 6-8×. HR Tech/SaaS-integrated platforms can reach 8-12× multiples. Bangkok location adds 15-20% premium. Key drivers include recurring revenue percentage, client concentration (>30% single-client dependency reduces multiples 1-2×), EBITDA margins, and founder independence.

Q2: How long does the complete sale process take?

A: A professionally managed recruitment firm sale typically requires 9 months from preparation initiation to closing: Preparation (1 month), Buyer Solicitation (2 months), IOI Review (1 month), LOI Negotiation (1 month), Due Diligence (3 months), Purchase Agreement Execution (1 month). Owner-led transactions average 15+ months with significantly higher failure rates (65% vs. 25% for advisor-led).

Q3: Can foreign companies buy 100% of my Thai recruitment business?

A: The Foreign Business Act restricts foreign ownership of recruitment services to 49% without Foreign Business License (rarely granted) or Board of Investment promotion. However, firms with HR technology/software components may qualify for BOI Category 7.9.1.5 (Digital Services), enabling 100% foreign ownership. Most foreign acquisitions structure as 49% equity with preference shares and operational control via shareholders agreements or pursue share sale to Thai-majority entities.

Q4: What are the most common deal-breakers during due diligence?

A: The three most frequent transaction failures are: (1) PDPA non-compliance candidate databases lacking documented consent are considered “toxic assets” and can trigger 20-30% valuation reductions or deal termination; (2) Client concentration risk single clients representing >30% of revenue typically require earn-out structures or cause buyers to withdraw; (3) Undisclosed liabilities particularly unfunded employee severance obligations (up to 400 days wages for long-tenured staff) averaging ฿2-5M for established firms. Proactive legal and financial preparation 12 months pre-sale dramatically reduces these risks.

Q5: Should I structure the sale as shares or assets?

A: Share sales are strongly preferred (80% of recruitment transactions) because: (1) Recruitment licenses are entity-specific and non-transferable in asset deals—buyers must apply for new licenses requiring months; (2) Tax efficiency—individual sellers typically pay no capital gains tax on share sales versus 20% corporate tax + 7% VAT on asset sales; (3) Simplified transaction—business continues as going concern with same contracts, employees, and licenses. Asset sales only occur in special situations (carve-outs, distressed sales, or when buyer specifically requires liability firewall).

Q6. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Axial. Lower Middle Market M&A Study 2025. https://www.axial.net/forum/ma-multiples-report/

- Department of Employment. Licensed Recruitment Agencies Directory 2025. https://www.doe.go.th/en/

- Raincatcher. Staffing Company Valuation Guide. https://raincatcher.com/staffing-company-valuation-multiples/

- Reliant Business Valuation. Customer Concentration Impact Study. https://reliantvalue.com/customer-concentration

- Revenue Department. Tax Guidelines for Share and Asset Transfers. https://www.rd.go.th/english/

- SIA Partners. Global Staffing Transaction Analysis 2024. https://www.siapartners.com/en/insights-and-publications

- Staffing Industry Analysts. Asia Pacific Staffing Market Report 2025. https://www.staffingindustry.com/editorial

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th