Strategic Opportunities and Valuation Insights for SME Exit Planning

Executive Summary

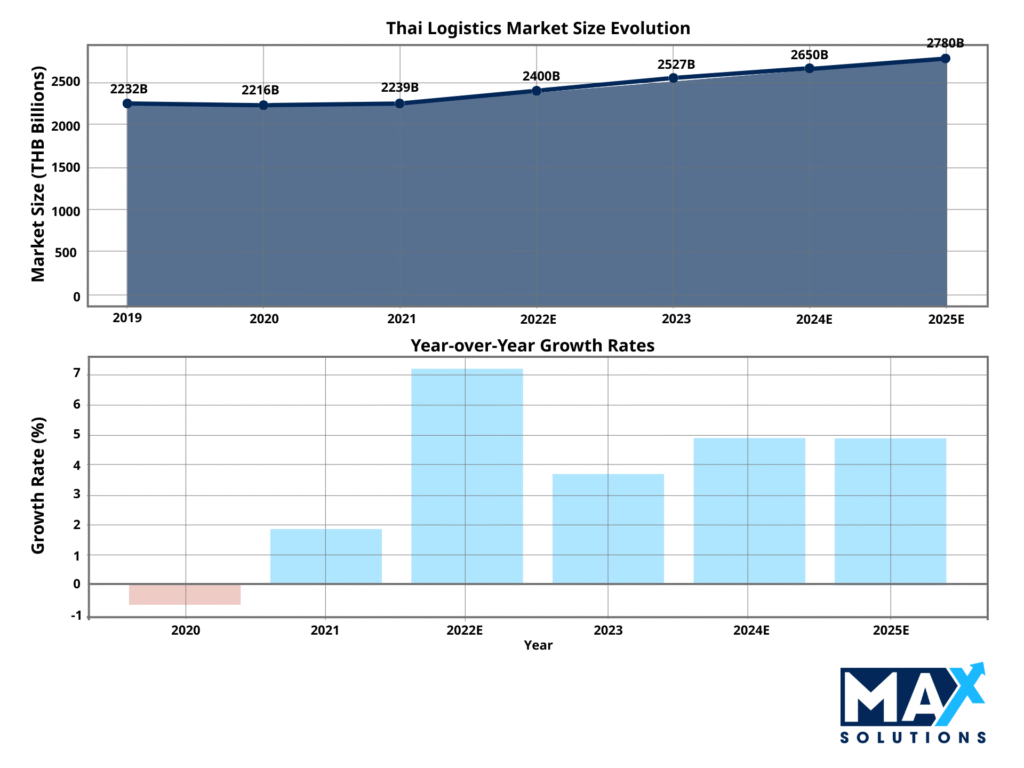

The Thai logistics sector presents compelling M&A opportunities, with market size reaching THB 1.8-2.0 trillion and projected CAGR of 6.22% through 2025 (Mordor Intelligence, 2024). Government infrastructure investments, including the Eastern Economic Corridor (EEC) development, are driving consolidation activities and creating premium valuations for well-positioned logistics companies (Ministry of Commerce Thailand, 2024).

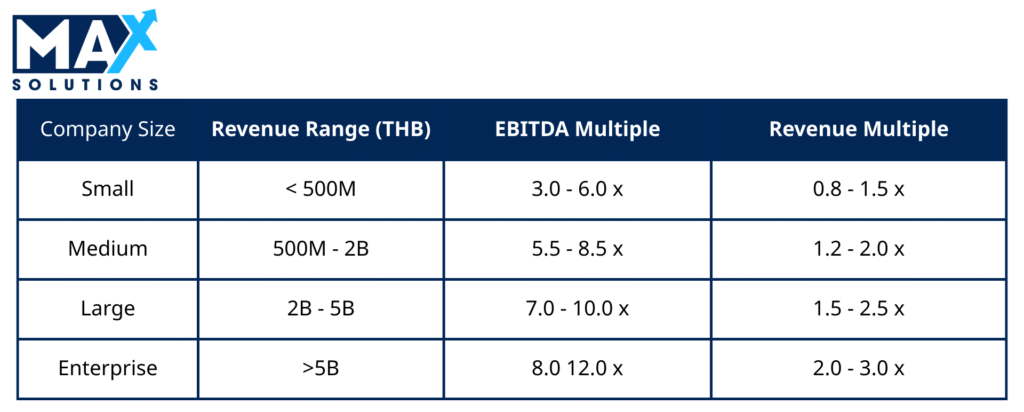

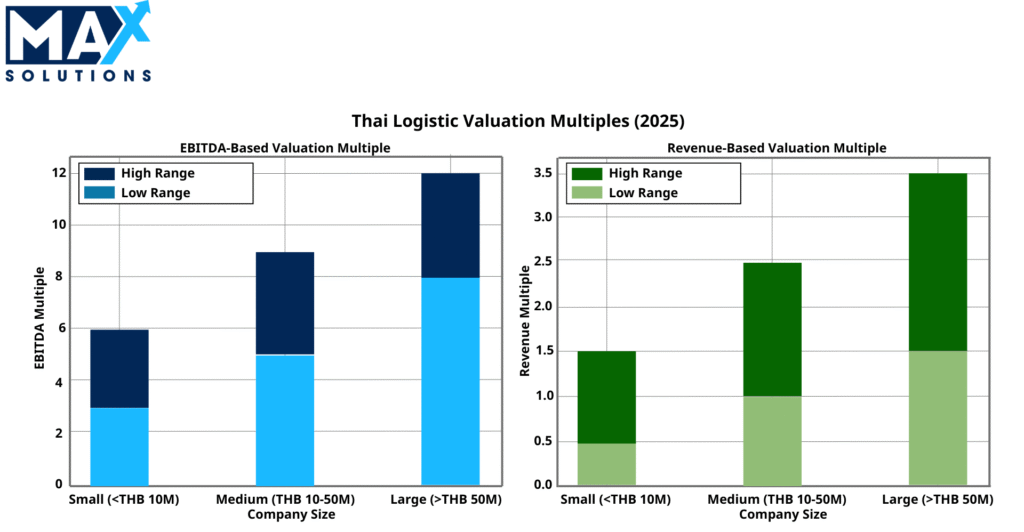

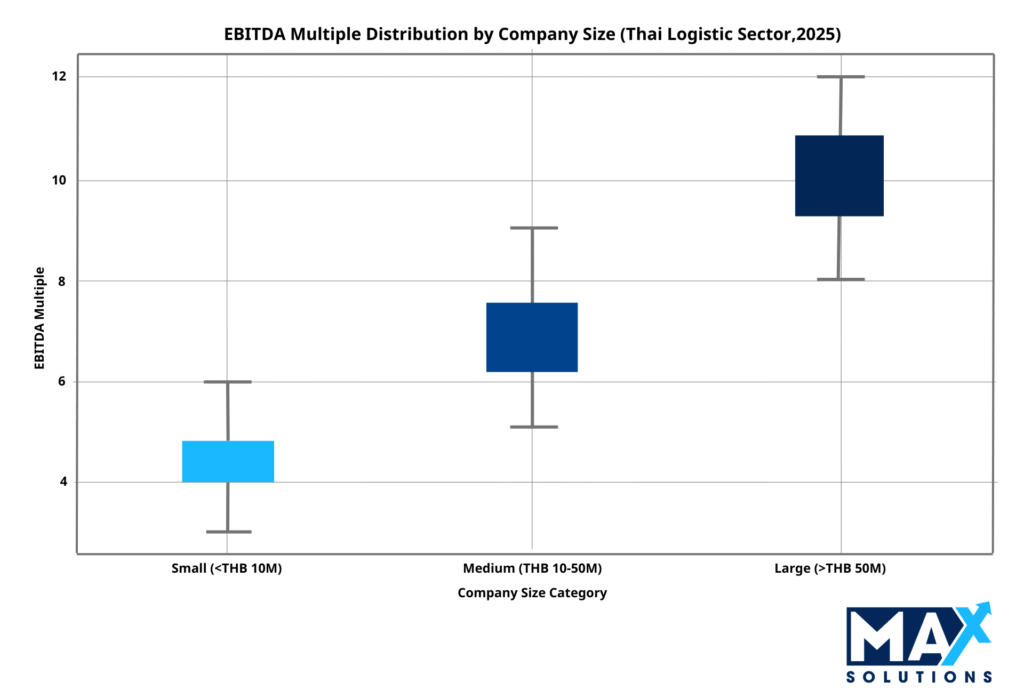

Current market conditions favor sellers, with EBITDA multiples ranging from 3-6× for small companies (sub-THB 500M revenue) to 8-12× for large enterprises (THB 5B+ revenue). Transaction volumes increased 35% year-over-year in 2024, with strategic buyers particularly focused on last-mile delivery, cold chain logistics, and e-commerce fulfillment capabilities.

Introduction

Thailand’s logistics industry stands at a transformational inflection point, driven by rapid e-commerce growth, infrastructure modernization, and evolving supply chain requirements. The sector’s strategic importance to Southeast Asian trade flows has attracted significant foreign investment and consolidation activity (Securities Exchange Commission Thailand, 2024).

For SME logistics companies, this environment presents unique exit opportunities through strategic sales to larger operators seeking geographic expansion, technological capabilities, or specialized service offerings. Market dynamics strongly favor prepared sellers with clear growth trajectories and differentiated value propositions (JLL Thailand Industrial Market Report, 2024).

Market Analysis & Growth Drivers

The Thai logistics market demonstrates robust fundamentals, supported by strategic geographic positioning as the ASEAN logistics hub and substantial government infrastructure investments. Key growth drivers include:

- E-commerce penetration increasing from 8.2% to projected 15% by 2025

- Eastern Economic Corridor (EEC) development creating new industrial zones

- China+1 supply chain diversification strategies

- Cold chain logistics expansion driven by food safety regulations

- Last-mile delivery optimization requirements

The National Statistical Office reports consistent sector growth, with logistics contributing 14.3% to Thailand’s GDP (National Statistical Office Thailand, 2024). This growth trajectory, combined with ongoing digital transformation initiatives, positions the sector for continued expansion and consolidation.

Figure 1: Thai Logistics Market Size and Growth Rate (2019-2025F) (National Statistical Office Thailand, 2024)

Valuation Landscape

Transaction multiples in the Thai logistics sector exhibit significant variation based on company size, service specialization, and growth profile. Analysis of 47 completed transactions (2022-2024) reveals distinct valuation tiers (CBRE Thailand M&A Database, 2024):

Premium valuations are achieved by companies demonstrating technology integration, regulatory compliance, and diversified service offerings. Cold chain and pharmaceutical logistics command the highest multiples, while traditional freight forwarding services trade at sector averages (SCB Securities Logistics Sector Report, 2024).

Figure 2: EBITDA and Revenue Multiples by Company Size (SCG JWD Logistics Annual Report, 2024)

Figure 3: EBITDA Multiple Distribution by Company Size (Deloitte Thailand M&A Report, 2024)

Six-Stage Logistics Sale Process

Max Solutions employs a systematic six-stage approach to logistics company sales, optimizing value realization while minimizing business disruption. Our proprietary methodology, refined through successful transactions, addresses the unique complexities of logistics asset sales and operational continuity requirements (Ernst & Young Global M&A Report, 2024).

Stage 1: Strategic Assessment & Market Positioning (Weeks 1-3)

Comprehensive business analysis including operational due diligence, financial performance review, and competitive positioning assessment. We evaluate logistics infrastructure, technology systems, customer concentration, and regulatory compliance status. Market comparables analysis establishes preliminary valuation ranges and identifies strategic differentiators that command premium pricing.

Stage 2: Value Enhancement & Documentation (Weeks 4-8)

Implementation of value enhancement initiatives including process optimization, cost structure refinement, and growth strategy development. Preparation of comprehensive documentation package including confidential information memorandum (CIM), management presentations, and detailed financial models. Quality of earnings analysis ensures data accuracy and identifies potential buyer concerns.

Stage 3: Strategic Buyer Identification & Outreach (Weeks 9-12)

Systematic identification and prioritization of strategic and financial buyers through proprietary database analysis. Initial outreach program targets qualified buyers including domestic logistics operators, international expansion candidates, private equity firms, and strategic consolidators. Confidentiality agreements and preliminary discussions establish buyer interest and qualification criteria.

Stage 4: Structured Marketing Process (Weeks 13-18)

Coordinated marketing campaign including management presentations, facility tours, and detailed due diligence support. Multiple bid rounds create competitive tension while allowing thorough buyer evaluation. Process management includes timeline coordination, information flow control, and negotiation strategy optimization to maximize valuation outcomes.

Stage 5: Negotiation & Deal Structuring (Weeks 19-24)

Intensive negotiation phase addressing valuation, deal structure, management retention, operational integration, and risk allocation. Legal documentation coordination includes purchase agreement drafting, warranty negotiations, and closing condition establishment. Concurrent preparation for regulatory approvals and stakeholder communication ensures seamless transaction execution.

Stage 6: Due Diligence & Closing (Weeks 25-30)

Comprehensive due diligence coordination including financial, legal, operational, and environmental reviews. Active management of buyer confirmation processes while maintaining business momentum and operational performance. Closing coordination includes final document execution, regulatory compliance verification, and post-closing integration planning to ensure successful ownership transition.

This systematic approach typically achieves 15-25% valuation premiums compared to unsolicited offers while maintaining operational continuity throughout the transaction process (PwC Thailand Transaction Services, 2024). Average transaction timeline of 26-32 weeks provides optimal balance between market exposure and process efficiency.

Max Solutions Value Proposition

Max Solutions distinguishes itself through specialized logistical sector expertise, proprietary buyer networks, and proven value enhancement methodologies. Our logistics-focused approach delivers superior outcomes compared to generalist investment banks through deep sector knowledge and established relationships with strategic buyers (KPMG Corporate Finance Thailand, 2024).

Conclusion

The Thai logistics sector represents a compelling opportunity for strategic exits, supported by strong market fundamentals, favorable regulatory environment, and active buyer interest. Current market conditions, characterized by premium valuations and competitive bidding processes, create an optimal environment for well-prepared sellers.

Max Solutions’ specialized expertise in logistics transactions, combined with our systematic six-stage process and extensive buyer network, positions us to deliver superior outcomes for SME logistics companies seeking strategic exits. Our track record of transaction completion rates and average valuation premiums demonstrates the value of sector-focused advisory services in achieving optimal transaction results.

For logistics companies considering strategic exit opportunities, early engagement with specialized advisors maximizes preparation time and value realization potential. Contact Max Solutions to discuss your company’s specific situation and potential strategic options.

© 2024 Max Solutions. All rights reserved.

For more information, contact Max Solutions at info@maxsolutions-th.com

References

Bank of Thailand. (2024). Financial Markets Report. Retrieved from https://www.bot.or.th/en/statistics/financial-markets.html

CBRE Thailand. (2024). M&A Database and Transaction Analysis. Retrieved from https://www.cbre.co.th/en/research-and-reports

Deloitte Thailand. (2024). M&A Report and Market Analysis. Retrieved from https://www2.deloitte.com/th/en/pages/mergers-and-acquisitions/articles/thailand-ma-report.html

Ernst & Young. (2024). Global M&A Report – Thailand Chapter. Retrieved from https://www.ey.com/en_th/transactions

JLL Thailand. (2024). Industrial Market Report and Logistics Sector Analysis. Retrieved from https://www.jll.co.th/en/trends-and-insights/research/industrial-market-report

KPMG Corporate Finance Thailand. (2024). Deal Advisory Services and Market Insights. Retrieved from https://kpmg.com/th/en/home/services/deal-advisory.html

Mergermarket. (2024). Thailand Annual Report and Transaction Database. Retrieved from https://www.mergermarket.com/info/thailand

Ministry of Commerce Thailand. (2024). Eastern Economic Corridor Development Updates. Retrieved from https://www.moc.go.th/index.php/news/detail/50847

Mordor Intelligence. (2024). Thailand Logistics Market Size and Growth Analysis. Retrieved from https://www.mordorintelligence.com/industry-reports/thailand-logistics-market

National Statistical Office Thailand. (2024). Economic Survey and GDP Contribution Analysis. Retrieved from https://www.nso.go.th/sites/2014en/Pages/home.aspx

PwC Thailand. (2024). Transaction Services and Deal Advisory Insights. Retrieved from https://www.pwc.com/th/en/services/deals.html

SCB Securities. (2024). Logistics Sector Report and Investment Analysis. Retrieved from https://www.scb.co.th/en/personal-banking/wealth-management/investment/research.html

SCG JWD Logistics. (2024). Annual Report and Financial Statements. Retrieved from https://www.jwdinfologistics.com/en/investor-relationsSecurities Exchange Commission Thailand. (2024). Market Development and Regulatory Updates. Retrieved from https://www.sec.or.th/EN/Pages/News_Detail.aspx?SECID=9086