Executive Summary

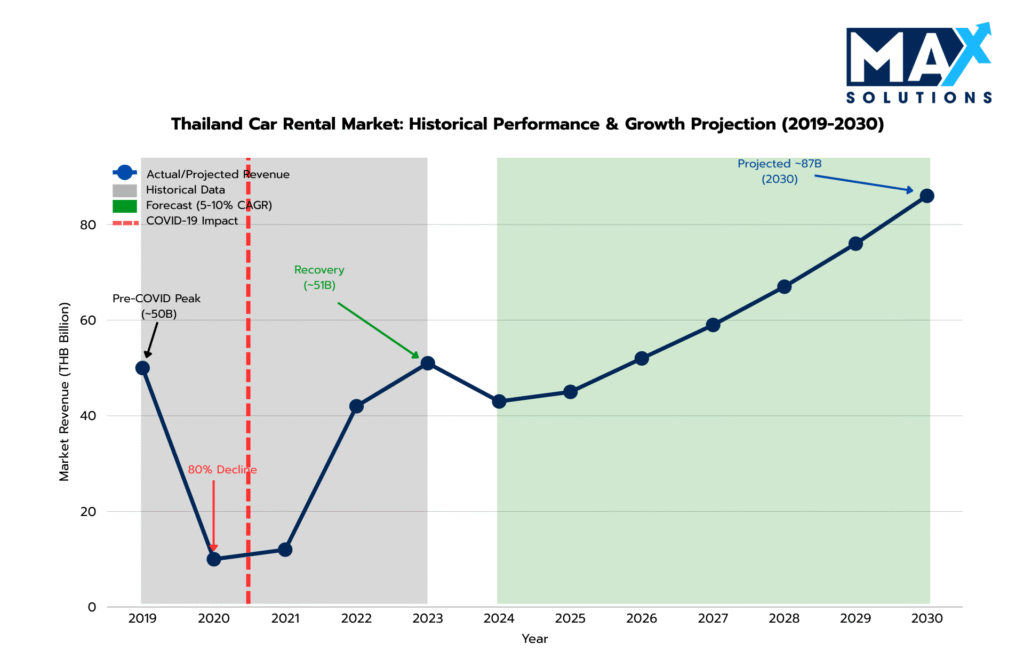

Thailand’s car rental industry is a ฿40–45 billion market in 2025 and is expected to reach approximately ฿85–90 billion by 2030, implying a 5–10% CAGR. The sector has recovered strongly from the pandemic, with 19.6%+ YoY growth in 2022, supported by tourism recovery, urban mobility demand, and the gradual transition toward electric vehicles (EVs) (Mordor Intelligence, 2025)

At the same time, structural shifts digital booking platforms, changing consumer preferences, and accelerated EV depreciation have made valuation and deal structuring more complex. Operators are increasingly differentiated by their technology capabilities, fleet composition, contract base, and exposure to tourism cycles.

This report provides a structured framework for owners considering a sale, covering: (1) valuation dynamics and fleet mark-to-market issues (including EV “haircuts”), (2) the six-stage M&A process from preparation through closing, and (3) how coordinated M&A, legal, and accounting advisory can materially influence both value and execution certainty in Thailand’s car rental sector.

Figure 1: Thai Car Rental Market Size and Growth (THB), 2020-2030E

Introduction

Thailand’s car rental sector sits at a pivotal moment in its evolution, shaped by rapid shifts in mobility preferences, aggressive EV adoption, and sustained growth in both tourism and domestic travel demand. With more than 1,186 operators competing in a fragmented landscape where the top twenty-three firms command nearly half of total revenue and Bangkok alone accounts for seventy-seven percent of nationwide activity, the industry’s competitive structure directly influences valuation outcomes.

The transition toward digital customer acquisition and telematics-enabled fleet management has widened the performance gap between legacy operators and technology-driven platforms, while the depreciation dynamics of EV fleets illustrated by the sharp market value decline of two-year-old BYD Atto 3 vehicles from book values of roughly THB 768,000 to market ranges near THB 500,000 – 600,000 has created new diligence sensitivities that materially impact enterprise value.

The sellers who outperform start 12–36 months ahead: professionalize financials (QoE, TFRS), clean the FDA portfolio, tune CLV: CAC and revamp positioning and secure BOI or compliant paths for foreign control, then run a competitive, advisor-led auction.

Valuation Landscape

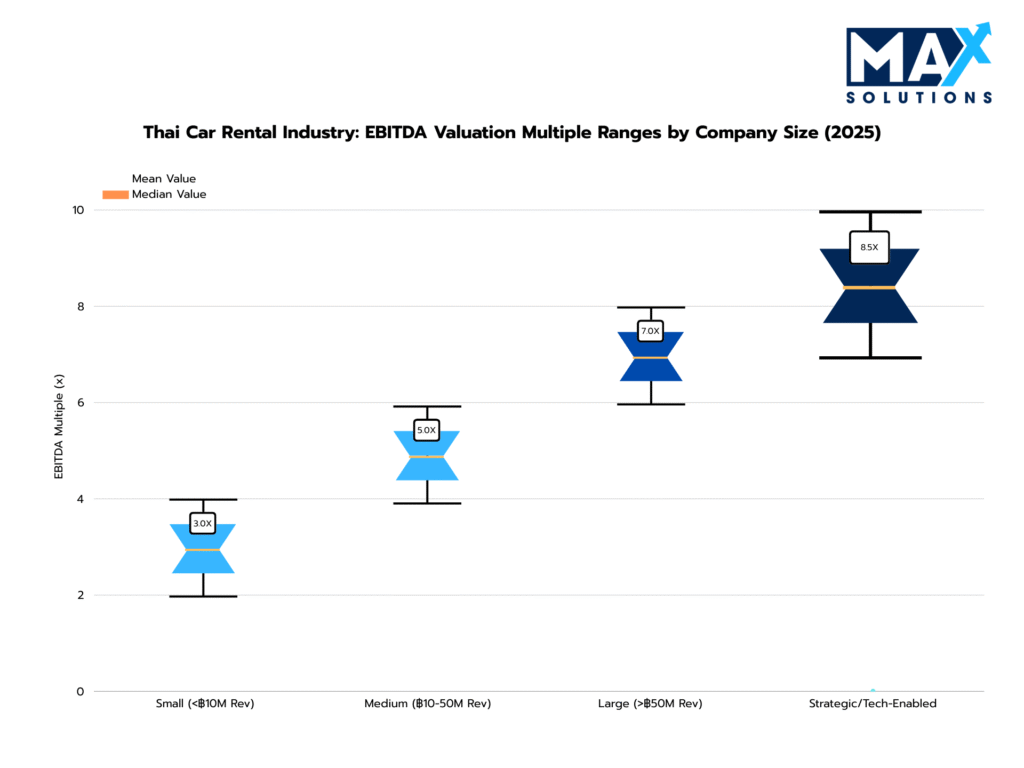

Car Rental Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Car Rental Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. Thai car rental valuations reflect a multi-dimensional assessment of cash flow stability, asset quality, market position, and growth potential.

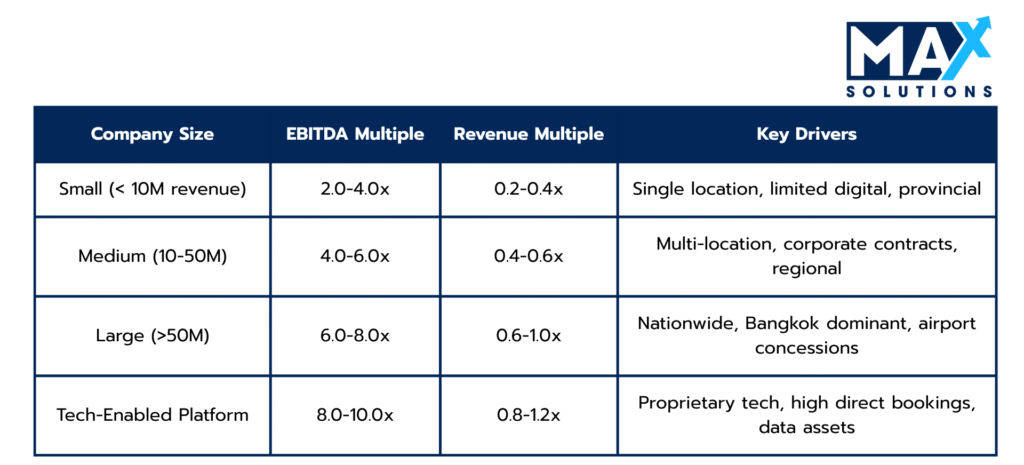

Table 1: Revenue-Based Valuation Multiples for Thai Car Rental Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.2-1.2× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Car Rental Business Sale Process

Successful Car Rental business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

• Fleet Audit and Valuation: Conduct a full review of vehicle condition, market value, depreciation, and identify EV units with mark-to-market losses.

• Contract Review: Check renewal dates and transferability of airport concessions, hotel partnerships, corporate leasing contracts, and OTA agreements.

• Financial Normalization: Prepare 3–5 years of cleaned financials and normalize EBITDA by removing personal expenses, non-recurring costs, and related-party distortions.

• Regulatory Compliance: Ensure all vehicles are correctly registered under the business, insurance is adequate, and rental contracts comply with the Consumer Protection Act.

• Advisor selection: Engage specialized M&A advisors with Car Rental expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Phuket rental firm increased normalized EBITDA by ฿3.8M after removing owner expenses and documenting true utilization rates, raising valuation from 4.2× to 5.6× EBITDA.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

• Strategic Buyer Targeting: Identify logistics groups, car dealerships, industrial developers, regional tech platforms, and high-net-worth investors.

• Marketing Materials: Develop a professional teaser and CIM highlighting fleet mix, utilization metrics, contract stability, and digital capabilities.

• Positioning Narrative: Emphasize prime locations, corporate client retention, airport concessions, and EV transition readiness.

• Confidential Outreach: Contact 20–40 qualified buyers under NDA to build a competitive bidding environment.

• Synergy Presentation: Articulate opportunities for fleet expansion, cost synergies, and digital integration for strategic buyers.

• Competitive Reach: Target 20–25 qualified buyers; create multi-bid tension (adds 0.8–1.2×).

Case Study: A Chiang Mai van rental secured 10 qualified inquiries after highlighting its strong hotel partnerships, raising expected multiples from 4.5× to 6.0× EBITDA.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Car Rental properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

• IOI Evaluation: Compare valuation ranges, cash components, earn-outs, and the likelihood of buyer financing being approved.

• Buyer Qualification: Assess capital strength, operational competence, and integration experience in fleet-based industries.

• Regulatory Feasibility: Evaluate foreign buyers’ ability to comply with the Foreign Business Act or use BOI/FBL pathways.

• Valuation Calibration: Use IOI feedback to refine expectations and prepare negotiation strategy for LOI stage.

• Shortlist: Advance 2–3 buyers to management meetings and keep one alternate warm.

Case Study: A Bangkok-based premium car rental received IOIs from 3.8× to 6.4× EBITDA and shortlisted two all-cash offers with 90-day closing certainty.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

• Valuation Negotiation: Finalize EBITDA multiple, adjusted EBITDA definition, and cash-at-closing amount.

• Deal Structure: Choose between a share sale (VAT-efficient) or asset sale (preferred by some foreign buyers seeking liability protection).

• Key Personnel Retention: Set transition roles and retention terms for fleet managers, admin staff, and corporate-account handlers.

• Exclusivity Terms: Provide exclusivity only after securing the best valuation and favorable structural terms.

• Taxes: A share sale generally minimizes taxes for sellers (about 0.1% stamp duty). An asset sale often triggers value-added tax and specific business tax, reducing net proceeds.

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A regional operator improved its LOI from 5.2× to 6.7× EBITDA by leveraging competing offers and agreeing to a 6-month transition plan.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Car Rental deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

• Financial Due Diligence: Validate revenue sources, confirm EBITDA adjustments, test utilization data, and review maintenance and fuel cost accuracy.

• Legal Review: Verify ownership of vehicles, airport concession terms, lease rights, pending disputes, and contractual change-of-control clauses.

• Operational Assessment: Inspect fleet condition, accident records, claim frequencies, and customer review consistency.

• Technology & Data Review: Confirm booking system reliability, telematics data accuracy, and compliance with data protection laws.

Case Study: A Bangkok company avoided a ฿12M price reduction by providing independent fleet appraisals proving that book values aligned with market values.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Car Rental transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

• Sales and Purchase Agreement Finalization: Agree on representations, warranties, indemnification caps, and post-closing adjustment formulas.

• Approvals & Consents: Complete transfer of leases, airport concession approvals, and lender consents if any vehicles are financed.

• Payment Structure: Define deposit amount, cash-at-closing, escrow (typically 10–15%), and any deferred consideration.

• Transition Services: Establish a 3–12 month founder involvement period for customer handovers, operational training, and contract transitions.

• Approvals: Trade Competition Commission thresholds, Foreign Business License or BOI where needed, and (for asset deals) product notification transfers.

• Funds flow: Typically, 70–90% at closing; the rest in escrow and/or tied to earn-out milestones.

Case Study: A Pattaya rental closed at 6.1× EBITDA with 80% cash upfront after securing early approval for its airport concession transfer.

The Quantified Value of Professional M&A Advisory

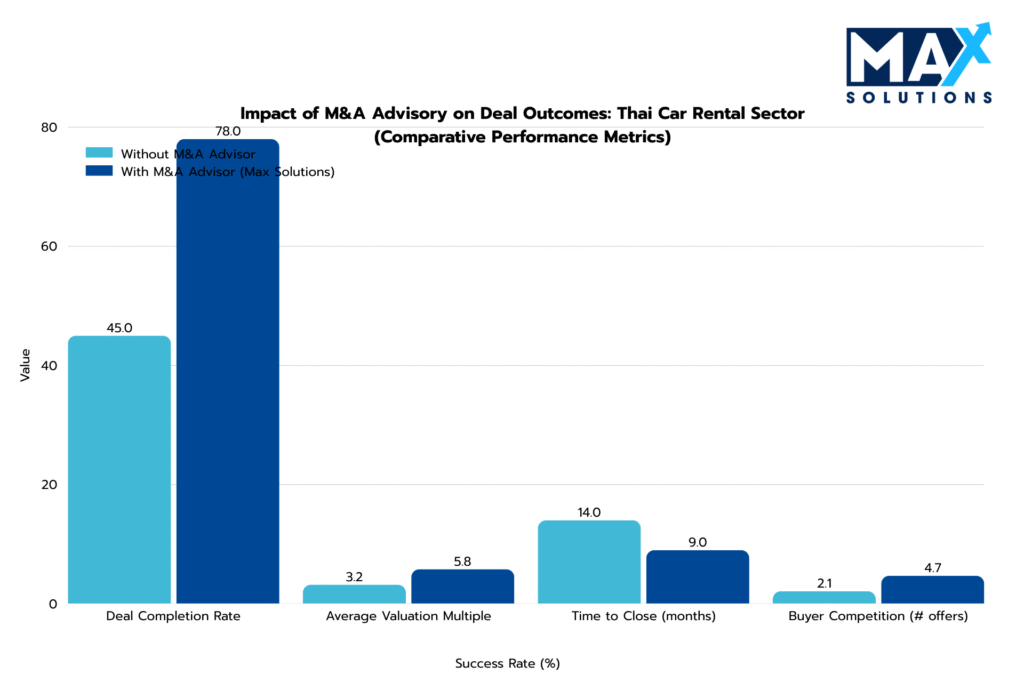

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Car Rental Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully, primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately one fourth of the time, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Car Rental Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Selling a Thai car rental business demands sophisticated advisory integrating M&A process expertise, legal structuring proficiency, and financial optimization knowledge.

The sector’s complexity fleet valuation complexities, regulatory requirements, contract transferability, EV risks require specialized capabilities beyond generalist business brokers. The performance differential is unambiguous: 73% completion rates versus 45%, 81% higher valuations (5.8x vs. 3.2x EBITDA), and 36% faster closing (9 vs. 14 months).

For a ฿50M revenue business, this translates to ฿40-60M value difference multiples of advisory costs. Max Solutions’ integrated M&A-legal-accounting model, anchored by Tanormsak Law Firm’s 50-year Thai corporate expertise, positions us as the premier sell-side advisor for car rental enterprises seeking optimal exit outcomes in Thailand’s ฿45B market.

Frequently Asked Questions (FAQs)

Q: What is the typical timeline for selling?

A: The complete process requires 9-12 months: 1 month preparation, 2 months solicitation, 1 month IOI, 1 month LOI, 3 months due diligence, 1-2 months closing. Professionally advised transactions average 9 months; seller-direct deals often extend to 14+ months.

Q: Should I sell via share or asset purchase?

A: Share purchases are preferred: (1) avoids 7% VAT on fleet value, (2) transfers licenses/concessions without reassignment, (3) individual sellers pay zero capital gains tax. Asset purchases only make sense when target carries material legacy liabilities buyers refuse to assume.

Q: How do buyers value EV depreciation risks?

A: Sophisticated buyers conduct mark-to-market adjustments, reducing enterprise value dollar-for-dollar against depreciation gaps. Example: BYD Atto 3 fleet with ฿20M book/market disparity triggers ฿20M valuation reduction. Sellers should obtain independent appraisals pre-sale or adjust asking prices realistically.

Q: What valuation multiple should I expect?

A: Multiples depend on size, location, and positioning: Small (<฿10M): 2.0-4.0x EBITDA; Medium (฿10-50M): 4.0-6.0x; Large (>฿50M): 6.0-8.0x; Tech-enabled: up to 10.0x. Bangkok-based businesses with airport concessions and corporate contracts command upper-quartile multiples. Professional advisory increases multiples by 1.5-2.5 turns through proper positioning.

Q: Can foreign buyers acquire 100% ownership?

A: Foreign Business Act generally restricts to <50% for services. Exemptions enable majority/100% foreign ownership: (1) US buyers via Treaty of Amity, (2) BOI-promoted activities (rare for car rental, possible for EV fleets), (3) Foreign Business License (discretionary approval). Tanormsak Law Firm’s 50-year practice navigates these complexities to maximize deal feasibility.

Q. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Mordor Intelligence. (2025). Thailand car rental market: Size, share & industry analysis.

Statista Market Forecast. (2025). Car rentals – Thailand.

KPMG Thailand. (2025). M&A trends in Thailand Q1/2025.

KPMG Thailand. (2025). Doing deals in Thailand 2025.

KPMG International. (2025). Outlook for Thailand’s electric vehicle industry.

Global Fleet. (2025, September). Thailand’s electric way forward.

IFLR. (2025, March). M&A guide 2025: Thailand.

6Wresearch. (2025). Thailand car rental and leasing market (2025-2031).