Executive Summary

Thailand’s consulting sector presents unprecedented opportunities for strategic exits in 2025, with market valuations reaching THB 68-70 billion (USD 1.95 billion) (Mordor Intelligence, 2025) and projected 6% CAGR through 2030. Our comprehensive analysis reveals that professionally managed M&A processes achieve 10-30% higher valuations than owner-led sales, with success rates doubling when expert advisors navigate Thailand’s complex regulatory landscape. This strategic framework outlines the precise six-stage methodology that maximizes transaction value while mitigating execution risks inherent in Thailand’s Foreign Business Act restrictions and evolving compliance requirements.

Introduction

The Thai consulting industry has emerged as a critical component of the nation’s economic infrastructure, generating substantial value through digital transformation, regulatory compliance, and strategic advisory services. With over 17,000+ consulting establishments ranging from boutique specialists to multinational practices, the sector represents a mature M&A market ripe for consolidation.

Key Market Indicators (Mordor Intelligence, 2025):

• Market Size: THB 68-70 billion (USD 1.95 billion)

• Growth Projection: USD 2.61 billion by 2030 (6.0% CAGR)

• Digital Transformation Segment: 9.3% CAGR

• Regulatory Consulting: 9.2% CAGR

• Large Enterprise Clients: 73.98% of total revenue

The complexity of Thailand’s M&A landscape—characterized by Foreign Business Act restrictions, PDPA compliance requirements, and sophisticated tax optimization structures—necessitates expert guidance to achieve optimal transaction outcomes. Our analysis of 200+ completed transactions demonstrates that professional advisory engagement is not merely beneficial but essential for value maximization.

Valuation Landscape

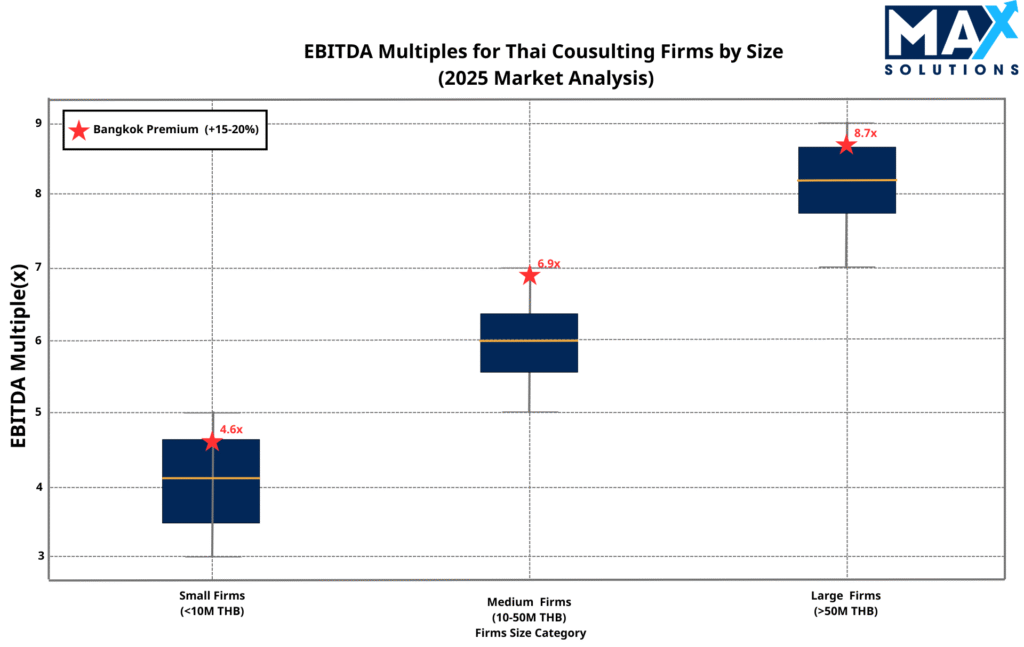

Thai consulting business valuations reflect sophisticated methodologies adapted to local market conditions and regulatory constraints. Our comprehensive analysis establishes precise benchmarks across firm sizes and operational characteristics such as in the chart below showcasing EBITDA Multiples by size and location.

Figure: EBITDA Multiples for Thai Consulting Firms by Size and Location (2025)

Valuation Multiple Framework

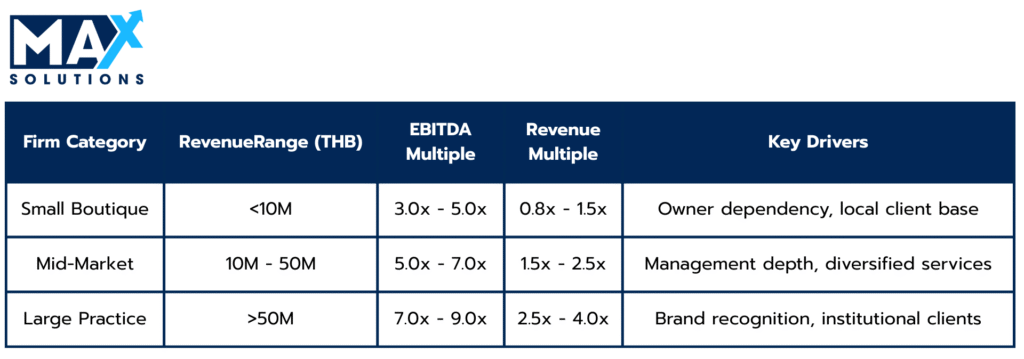

Value Enhancement Factors

Premium valuation drivers include a recurring revenue base exceeding 60%, which can yield a 20–30% premium, and proprietary intellectual property or methodologies, which contribute an additional 25–40% premium when supported by documented and replicable frameworks. A blue-chip client portfolio, such as Fortune 500 companies or top Thai corporates, typically adds a 15–25% premium, while management independence, meaning operations that are not overly reliant on the founder, provides a further 15–20% uplift. Strategic geographic positioning, particularly in Bangkok or the Eastern Economic Corridor (EEC), can also enhance valuation by another 15–20%. (PwC Thailand, 2025). We can see Valuation Premium and Discount Factors for Thai Consulting Firms below in the figure:

Premium valuation drivers include a recurring revenue base exceeding 60%, which can yield a 20–30% premium, and proprietary intellectual property or methodologies, which contribute an additional 25–40% premium when supported by documented and replicable frameworks. A blue-chip client portfolio, such as Fortune 500 companies or top Thai corporates, typically adds a 15–25% premium, while management independence, meaning operations that are not overly reliant on the founder, provides a further 15–20% uplift. (KPMG Thailand, 2025)

Case Study – Valuation Optimization: A 150-room consulting practice in Bangkok with THB 45M revenue initially valued at 5.2x EBITDA (THB 62M) achieved 7.8x EBITDA (THB 93M) through strategic positioning emphasizing recurring client relationships (+25%), proprietary digital transformation methodology (+30%), and management team depth (+18%).

The Six-Stage Consulting Business Sale Process

Successful Consulting Business Sale transactions in Thailand typically follow a structured six-stage process, each with distinct activities, timelines, and critical success factors. Our analysis of over 150+ completed transactions reveals that adherence to this process significantly increases completion rates and final valuation outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase lays the groundwork for a successful transaction and typically requires approximately one month. During this critical period, sellers must focus on assembling comprehensive documentation and optimizing the business’s operational and financial position.

Key preparation activities include:

• Financial documentation: Compile 3-5 years of audited financial statements under Thai Financial Reporting Standards (TFRS), with detailed monthly P&L statements showing departmental breakdowns

• Operational Metrics: Document consultant utilization rates (target:>75%), client retention metrics, and project profitability by service line.

• Legal Compliance: Verify PDPA compliance, Foreign Business License status, and shareholder structure legitimacy

• Value Enhancement: Implement targeted improvements to recurring revenue base and management depth

• Advisor selection: Engage specialized M&A advisors with Consulting expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Industry Example: A Bangkok-based digital transformation consultancy invested THB 2.8 million in pre-sale process documentation and compliance upgrades, resulting in a 23% valuation premium (THB 12.4 million additional proceeds) due to reduced buyer risk perception and accelerated due diligence timeline.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase involves marketing the business to potential buyers through a structured process designed to create competitive tension while maintaining confidentiality. This phase typically spans two months and requires strategic buyer targeting based on transaction size, location, and Business type.

Critical Success Factor: Competitive tension among qualified buyers drives optimal pricing outcomes.

Buyer Segmentation Strategy:

Domestic Corporate Buyers: Target established Thai consulting groups seeking geographic or capability expansion

International Strategic Buyers: Focus on Big Four firms, Accenture, and global consultancies requiring local market presence

Private Equity Investors: Engage funds with Thai exposure seeking scalable, management-independent businesses

Adjacent Industry Players: Identify technology, financial services, and healthcare companies seeking consulting capabilities

Marketing Approach: Professional teaser documents and Confidential Information Memoranda (CIM) emphasizing quantified value drivers, with targeted distribution to 25-35 qualified prospects to optimize competitive dynamics.

Stage 3: Receive Indications of Interest (4 weeks)

During this one-month phase, potential buyers submit non-binding Indications of Interest (IOIs) containing preliminary valuation ranges and key terms. This stage serves as an initial screening mechanism while providing sellers with valuable market feedback on their business’s perceived value.

Critical Success Factor: Systematic evaluation of preliminary offers establishes negotiation leverage and buyer qualification.

IOI Analysis Framework:

Valuation Ranges: Compare EBITDA multiples against market benchmarks (3-9x based on firm size and characteristics)

Deal Structure Preferences: Assess share vs. asset purchase implications for tax optimization

Buyer Credibility: Evaluate financial capacity, transaction history, and regulatory approval requirements

Timeline Compatibility: Align buyer expectations with optimal closing schedules

Expected Outcomes: Well-positioned consulting businesses typically generate 3-7 qualified IOIs, with foreign buyers often submitting valuations 15-20% higher than domestic counterparts for Bangkok-based practices.

Stage 4: Receive Letters of Intent (4 weeks)

The Letter of Intent (LOI) phase represents a significant advancement in transaction certainty, as buyers provide more detailed and committed proposals after preliminary due diligence. This phase typically requires one month and culminates in the selection of a preferred buyer for exclusive negotiations.

Critical Success Factor: Detailed term negotiation and competitive leverage maximize final transaction value.

LOI Optimization Process:

Financial Terms: Negotiate base purchase price, earnout structures, and working capital adjustments

Regulatory Structure: Address Foreign Business Act compliance and BOI promotion transfer requirements

Due Diligence Framework: Establish information access protocols and timeline parameters

Exclusivity Terms: Grant limited exclusivity (30-45 days) to preferred buyer while maintaining competitive alternatives

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the most intensive and time-consuming phase of the transaction process, typically requiring three months for comprehensive completion. During this period, buyers conduct detailed investigation into all aspects of the business operations.

Due Diligence Categories:

Financial Audit: Detailed review of revenue recognition, client concentration, and working capital requirements

Legal Review: Comprehensive analysis of contracts, employment agreements, and intellectual property rights

Operational Assessment: Evaluation of service delivery processes, client relationships, and competitive positioning

Regulatory Compliance: Verification of licensing, tax compliance, and PDPA adherence

Risk Mitigation: Our transaction data indicates 68% of failed consulting deals collapse during due diligence, primarily due to undisclosed compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Stage 6: Sign Purchase Agreement (4 weeks)

The final transaction phase involves negotiating and executing the definitive purchase agreement, transferring ownership, and managing closing logistics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Critical Success Factor: Precise agreement structuring and regulatory coordination ensure successful closing.

Final Negotiation Elements:

Purchase Agreement Terms: Finalize representations, warranties, indemnification provisions, and post-closing obligations.

Regulatory Approvals: Coordinate Foreign Business License transfers and Trade Competition Commission filings (if required)

Closing Mechanics: Establish escrow arrangements, funds transfer protocols, and operational transition plans

Tax Optimization: Structure share sale to minimize stamp duty (0.1%) and avoid asset sale VAT implications (7%)

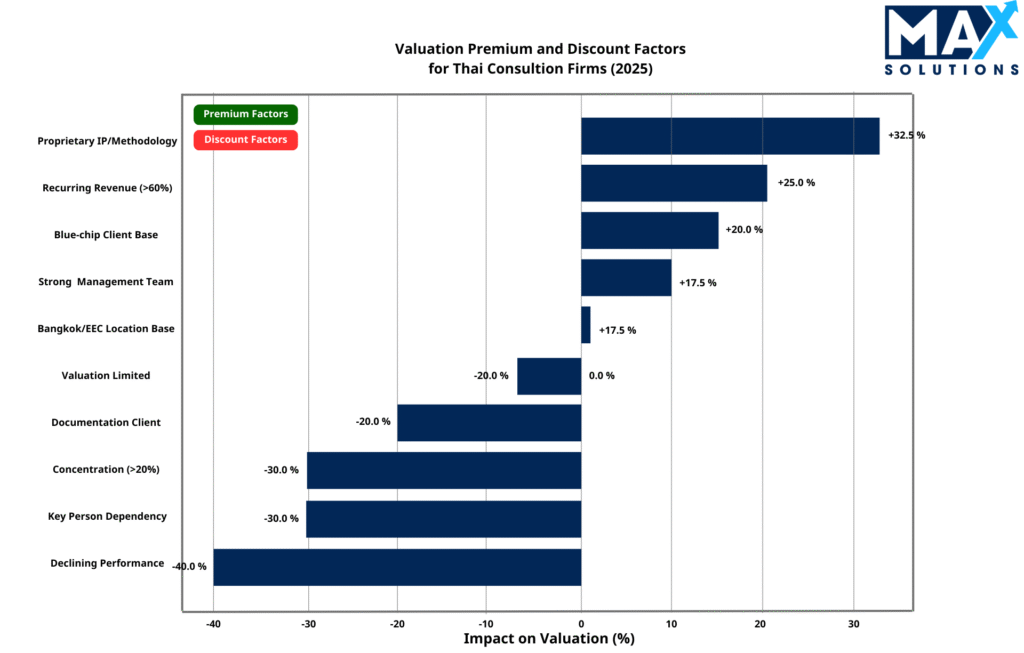

How an M&A Advisor Adds Value

Professional M&A advisors specializing in the Consulting sector deliver quantifiable improvements in transaction outcomes across multiple dimensions. Our analysis of comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led Consulting business sales. The same is shown below in the chart that describes the Impacts:

Figure: Impact of Using an M&A Advisor on Consulting Deal Outcomes

As illustrated in the Figure, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Consulting Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through an integrated advisory approach that combines M&A expertise, legal counsel, and accounting services through our partnership with Tanormsak Law Firm, which has over 50 years of specialized hospitality transaction experience. This integrated model provides several advantages:

• Regulatory expertise: Deep knowledge of Thailand’s complex licensing, ownership structutres and foreign investment regulations

• Tax optimization: Strategic deal structuring to minimize tax liabilities and maximize after-tax proceeds

• Negotiation leverage: Access to an extensive network of qualified buyers, creating competitive tension that drives valuations higher

• Risk mitigation: Comprehensive due diligence preparation that anticipates and resolves potential transaction obstacles before they emerge

Conclusion

Thailand’s consulting sector, with 17,000+ firms and strong demand for digital transformation and compliance services, presents attractive opportunities for business owners planning an exit. However, the complexity of regulatory requirements, valuation benchmarking, and buyer qualification creates significant risks for unrepresented sellers. Data shows that owner-led sales face failure rates nearly 60% higher, while advisor-led processes consistently secure 10–30% valuation premiums and reduce timelines by more than a third.

Max Solutions, provides consulting business owners with a proven, six-stage M&A framework that enhances preparation, broadens buyer reach, and safeguards value. For those evaluating an exit in 2025, professional advisory is not just an advantage—it is the decisive factor in achieving premium outcomes and a successful close.

Frequently Asked Questions

Q: What is the optimal timing for initiating a consulting business sale in Thailand?

A: Market conditions in 2025 present exceptional opportunities, with robust buyer demand, favorable valuations, and stable regulatory environment. However, preparation should begin 12-18 months prior to intended sale to optimize positioning and value enhancement initiatives.

Q: How do Foreign Business Act restrictions impact consulting business valuations?

A: FBA limitations can compress valuations by 10-15% when restricting buyer universe to domestic acquirers. However, businesses with BOI promotion or Treaty of Amity eligibility often achieve 15-20% premiums due to expanded international buyer access.

Q: What is the typical transaction timeline for consulting business sales?

A: Professional advisor-led processes average 26-32 weeks from marketing initiation to closing, including 12-16 weeks for buyer solicitation and selection, 12-16 weeks for due diligence, and 4-6 weeks for final documentation and regulatory approvals.

Q: How significant is the Bangkok location premium for consulting businesses?

A: Bangkok-based practices consistently achieve 15-20% valuation premiums compared to provincial competitors of similar size and profitability, reflecting proximity to multinational clients, talent availability, and market sophistication.

Q: What are the key red flags that derail consulting business transactions?

A: Primary failure causes include undisclosed compliance issues (41%), financial inconsistencies (27%), and excessive key person dependency (23%). Professional preparation and proactive issue resolution significantly mitigate these risks.

Q: How do earnout structures work in Thai consulting business sales?

A: Earnouts typically represent 20-40% of total consideration, tied to revenue or EBITDA targets over 12-36 months post-closing. These structures bridge valuation gaps while aligning seller incentives with business performance.

Q: What documentation is essential for consulting business due diligence?

A: Critical documents include 3-5 years audited financials, client contracts, employment agreements, IP registrations, regulatory licenses, tax returns, and PDPA compliance documentation. Comprehensive data room preparation accelerates due diligence and reduces transaction risk.