Executive Summary

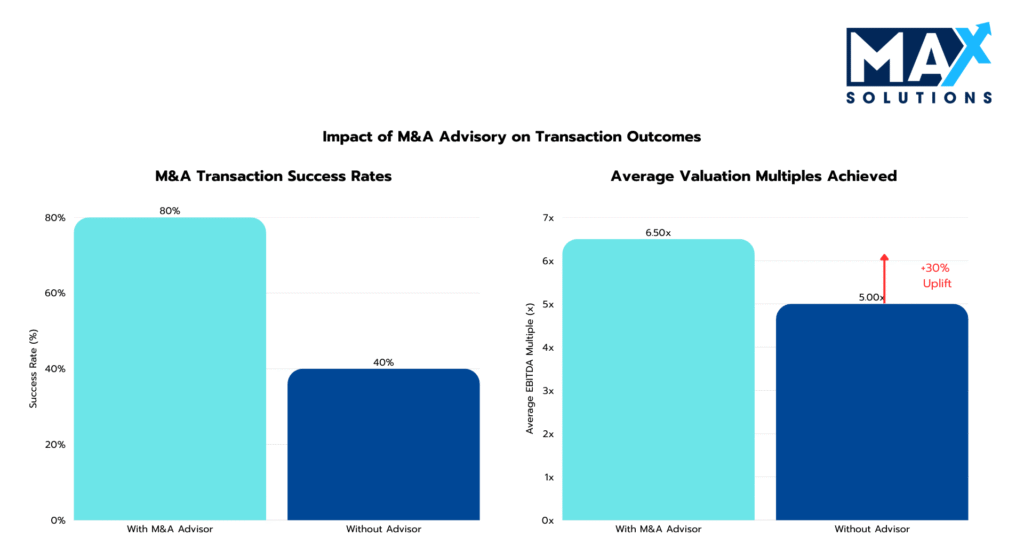

Thailand’s ฿140–150 billion advertising market presents compelling exit opportunities amid digital transformation and regulatory evolution (IMARC Group, 2025). Our analysis reveals that professionally advised transactions achieve 10–30% higher valuations and double the success rate (80% vs. 40%) compared to owner-led negotiations (Benchmark International, 2025). Median EBITDA multiples range from 3.0× (small agencies) to 10.0× (premium digital-focused firms), with technology integration, recurring revenue models, and PDPA compliance serving as primary value drivers.

This framework outlines a systematic nine-month sale process across six stages, revealing that early preparation (12–24 months), client diversification below 30% concentration, and integrated advisory services significantly impact transaction outcomes. MAX Solutions’ distinctive platform combining M&A expertise with Tanormsak Law Firm’s 50+ years of legal experience and comprehensive accounting services provides advertising business owners the strategic advantage necessary to navigate Thailand’s complex regulatory environment while maximizing enterprise value.

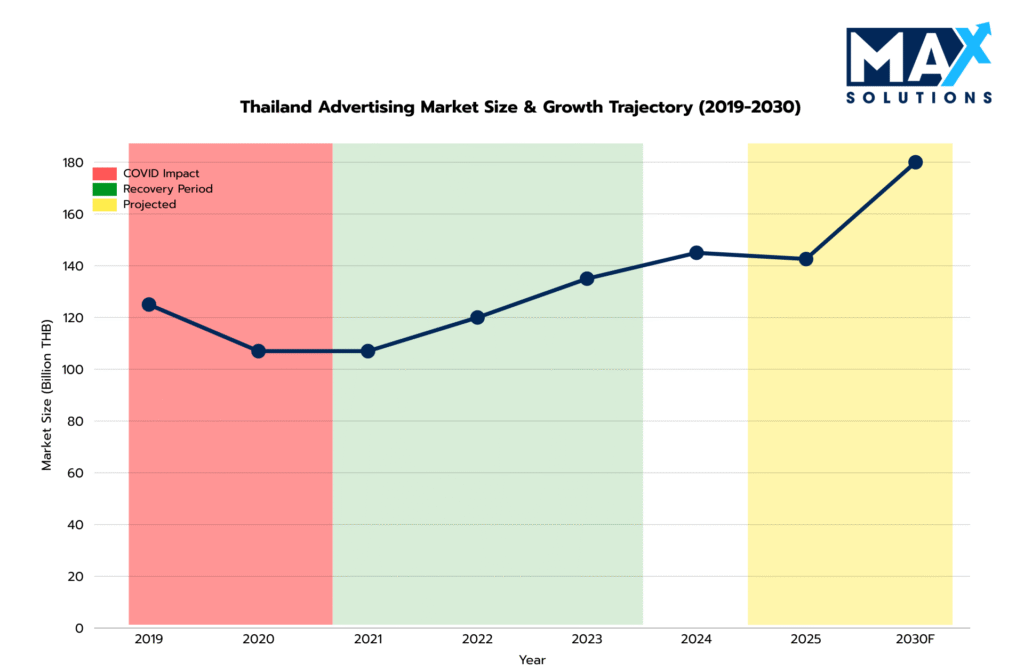

Figure 1: Thai Advertising Market Size and Growth (THB), 2019-2030E

Introduction

Thailand’s advertising sector stands at a critical inflection point. Despite a projected 1.63% contraction in 2025 (Thailand Advertising Association), digital advertising has surged from 25% to 46% market share (2020–2025), fundamentally reshaping valuations. The market exhibits extreme fragmentation of 10,000+ registered businesses with the top 10 controlling 30–40% of revenue, led by Plan B Media (฿10B, 8–10% share) and VGI Public Company (฿4–5B).

For business owners contemplating exit, this creates both opportunity and complexity. Premium agencies (>฿50M revenue) command 8–10× EBITDA multiples, while traditional small shops achieve only 3–5× EBITDA. The differential is driven by technology stack integration, recurring revenue concentration, and regulatory compliance particularly Thailand’s Foreign Business Act (49% foreign ownership cap) and Personal Data Protection Act (15–25% valuation discount for non-compliance).

KPMG Thailand reports 84% of respondents plan 2025 acquisitions, with heightened interest in digital-native agencies and MarTech platforms. Strategic buyers from global holding companies (WPP, Omnicom, Publicis, Dentsu) compete alongside regional consolidators, domestic listed firms, and private equity each with distinct valuation methodologies requiring sophisticated navigation.

Valuation Landscape

Advertising Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

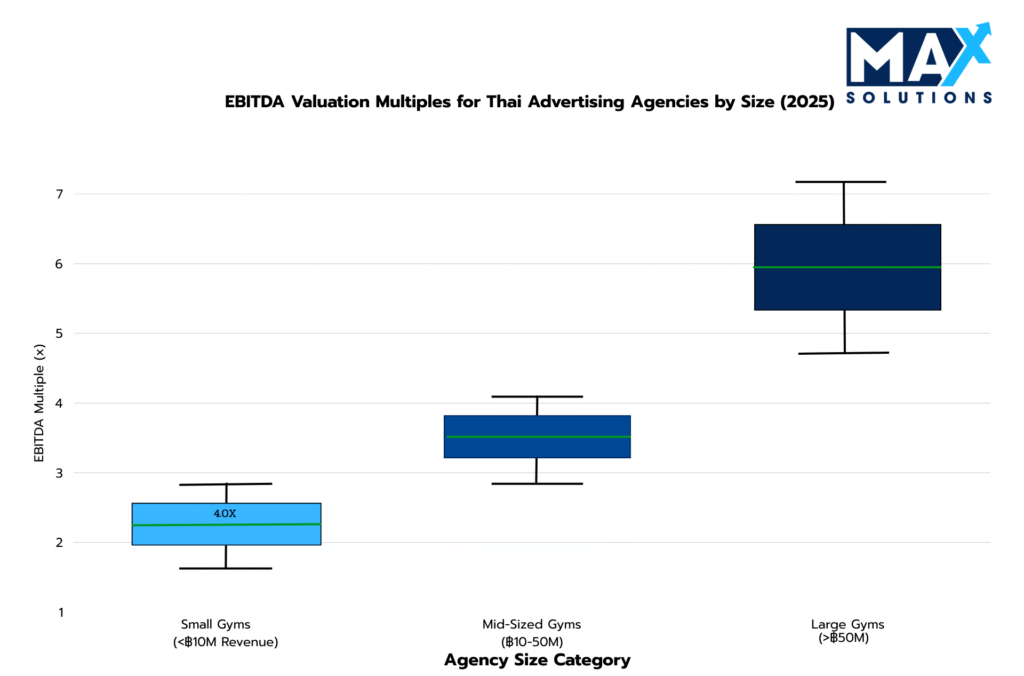

Figure 2: EBITDA Multiples for Advertising Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. Thai Advertising valuations reflect a multi-dimensional assessment of cash flow stability, asset quality, market position, and growth potential.

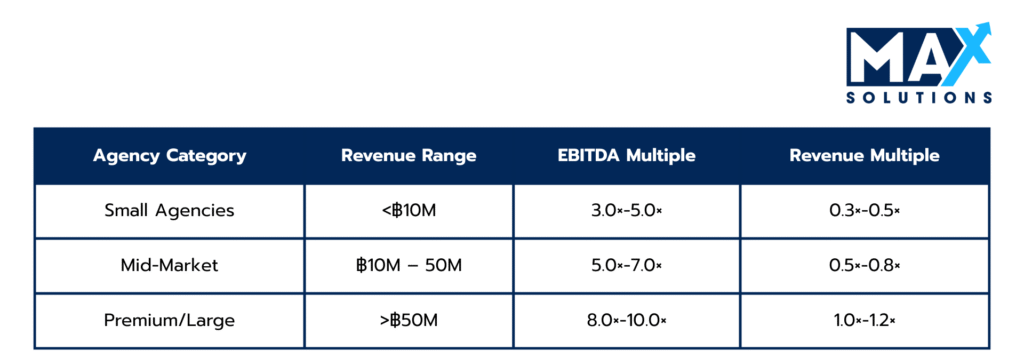

Table 1: Revenue-Based Valuation Multiples for Thai Advertising Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.2-1.3× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Advertising Business Sale Process

Successful Advertising business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

• Financial Normalization: Adjust owner salary, personal expenses, related-party rents, and one-time costs to present true Adjusted EBITDA.

• PDPA Compliance: Implement consent mechanisms, data mapping, retention policies, and DPO appointment to pass buyer data protection audits.

• Client & Revenue Mapping: Analyze revenue by client, sector, and service line; identify and actively reduce any single client above 25–30% of billings.

• Contract & Legal Review: Standardize client contracts, include PDPA clauses, and review change-of-control provisions and IP ownership terms.

• Technology & Reporting: Document MarTech stack, dashboards, and reporting capabilities to demonstrate scalability and digital maturity.

• Advisor selection: Engage specialized M&A advisors with Advertising expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study:A Bangkok digital agency lifted Adjusted EBITDA from ฿6M to ฿9.6M by normalizing owner pay and personal expenses, increasing valuation from ฿36M to ฿57.6M at a 6× multiple

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

• Strategic Buyer Targeting: Identify global holding companies, regional tech enablers, local listed media groups, private equity funds, and strategic corporates.

• Marketing Materials: Prepare a blind teaser and detailed CIM highlighting revenue mix, digital capability, key clients, and growth track record.

• Positioning Strategy: Emphasize proprietary tools, blue-chip client relationships, recurring retainers, and sector specialization (e.g., FMCG, finance).

• Confidential Outreach: Approach 25–40 qualified buyers under NDA to create competitive tension while protecting staff and client relationships.

• Synergy Narrative: Show how buyers can cross-sell, add services, or scale your platform across their existing markets and portfolios.

Case Study: A mid-sized creative agency in Chiang Mai approached 32 qualified buyers and received 7 serious responses, lifting expected valuation from 5.0× to 7.2× EBITDA.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Advertising properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

• IOI Evaluation: Compare valuation ranges, cash vs. earn-out mix, and assumptions behind proposed multiples.

• Buyer Qualification: Assess financing certainty, M&A track record, integration style, and cultural fit with your team.

• Regulatory Feasibility: Confirm each buyer’s plan for Foreign Business Act compliance, BOI promotion, or Treaty of Amity/FBL routes.

• Valuation Calibration: Use IOI feedback to refine price expectations and select 3–5 priority buyers for deeper engagement.

• Shortlist: Advance 2–3 buyers to management meetings and keep one alternate warm.

Case Study: A performance marketing agency in Phuket received IOIs from 4.8× to 8.0× EBITDA and advanced three buyers that combined strong pricing with credible FBA solutions and sector experience.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

• Valuation Negotiation: Finalize EBITDA multiple, Adjusted EBITDA definition, and headline enterprise value.

• Deal Structure: Decide between share sale (typically more tax-efficient for sellers) and asset sale (often preferred by risk-averse buyers).

• Earn-Out Design: Structure 20–40% of price as performance-based only if metrics are clear, achievable, and under your operational influence.

• Exclusivity & Protections: Grant 60–90 days exclusivity only after securing optimal price, structure, and protections such as break-up fee or expense reimbursement.

• Role & Retention: Agree on founder and key management roles, compensation, and incentive alignment for the post-closing period.

Case Study: A ฿28M EBITDA-equivalent agency in Pattaya improved an initial 6.0× LOI to 7.5× EBITDA by negotiating earn-out terms tied to realistic revenue targets and leveraging competing offers.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Advertising deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

• Financial Due Diligence: Reconcile audited accounts with tax filings, validate EBITDA adjustments, and analyse margins by client and service.

• Legal & Regulatory Review: Confirm FBA compliance, PDPA readiness, IP ownership, client contract terms, and labor law compliance.

• Commercial Assessment: Test client dependency, retention rates, pipeline health, and the resilience of key account relationships.

• HR & Key Talent: Review employment terms, incentive schemes, and retention plans for account managers, creatives, and tech leads.

• VDR & Issue Management: Maintain an organized virtual data room, respond quickly to buyer queries, and proactively address red flags before they trigger re-trading.

Case Study: A creative agency in Bangkok avoided a 20% price cut when advisors secured client consent letters and implemented a rapid PDPA remediation plan after buyers raised concerns in diligence.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Advertising transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:• SPA Finalization: Agree on representations, warranties, indemnity caps, baskets, survival periods, and any escrow requirements.

• Closing Conditions: Satisfy regulatory approvals, Trade Competition notifications if required, client consents, and landlord/lease approvals.

• Payment Structure: Lock in deposit, cash-at-closing, escrow percentages, earn-out schedule, and mechanics for working capital adjustments.

• Transition & Covenants: Define founder transition support, non-compete and non-solicit periods, and client handover responsibilities..

Case Study: A Bangkok agency closed at 8.8× EBITDA with 70% cash up front and 30% earn-out after securing key client consents and narrowing indemnity caps to 15% of the purchase price.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Advertising Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully, primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately one fourth of the time, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Advertising Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Selling an advertising business in Thailand today is fundamentally a strategic and technical exercise rather than a simple handover of clients and staff. Market data shows that the spread in outcomes is driven less by creative reputation alone and more by how well that reputation is packaged into clean financials, credible Adjusted EBITDA, demonstrable compliance with PDPA and tax rules, diversified and recurring revenue streams, and a management structure that reduces key person risk.

Professionally managed processes that run through clear stages from preparation and market sounding to IOIs, LOI structuring, due diligence and detailed SPAs achieve higher valuations, higher completion rates and shorter timelines than informal approaches dominated by a single buyer conversation.

Within this environment, MAX Solutions offers advertising business owners a practical route to maximizing value while controlling risk. By integrating M&A advisory, legal services through Tanormsak Law Firm and specialized accounting support, the firm brings together regulatory navigation under the Foreign Business Act, PDPA and merger control, rigorous financial and tax preparation, and access to relevant buyer networks in one coordinated platform.

Frequently Asked Questions (FAQs)

Q1: What valuation multiples should I expect?

Base multiples: Small agencies (<฿10M) 3–5× EBITDA, mid-market (฿10–50M) 5–7×, premium (>฿50M) 8–10×. However, adjustments significantly impact final pricing. Proprietary technology (+25–40%), recurring revenue >60% (+20–30%), diversified clients (+15–25%) command premiums. Founder dependency (–20–35%), client concentration >25% (–15–30%), PDPA non-compliance (–15–25%) trigger discounts. Customized analysis required.

Q2: How do FBA restrictions impact sales?

FBA limits foreign ownership to 49% absent special licensing. Viable structures: (1) 49%/51% JV with negotiated control, (2) BOI promotion for digital services (100% ownership), (3) US Treaty of Amity, (4) Foreign Business License. These add 30–60 days and may trigger 10–15% valuation discounts vs. unrestricted sectors.

Q3: Asset vs. share purchase structure?

Share purchases yield superior after-tax proceeds (only 0.1% stamp duty + capital gains tax vs. asset sales with 20% CIT + 7% VAT). Buyers prefer assets to avoid liabilities. Compromise: share deals with 10–20% escrow and warranties. Asset deals often yield 15–25% lower net proceeds despite higher headlines.

Q4: What is an earn-out and is it favorable?

Earn-outs structure 30–40% of price contingent on 2–3 year targets. Favorable if: metrics achievable (revenue/EBITDA), seller retains operational control, acceleration provisions exist, independent determination applies. Risk: buyer-imposed allocations/restrictions impair achievement. Negotiate operational autonomy and prohibited actions stringently.

Q5: How critical is PDPA compliance?

Non-compliance routinely triggers 15–25% discounts or termination. Essential: explicit opt-in consent, retention/deletion policies, appointed DPO, processor agreements, regulatory compliance. Invest in comprehensive compliance 12+ months pre-sale to avoid erosion.

Q6. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Benchmark International. (2025). Global M&A market report 2025.

- Department of Business Development, Thailand. (2025). Business registration statistics

- IMARC Group. (2024). Thailand advertising market: Industry trends, share, size, growth, opportunity and forecast 2024-2033.

- KPMG Thailand. (2025). M&A trends in Thailand Q1/2025.

- Personal Data Protection Commission. (2024). PDPA compliance guidelines.

- PwC. (2025). Global M&A industry trends: 2025 outlook.

- Thailand Advertising Association. (2025). Thailand advertising industry report 2025.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th