Executive Summary

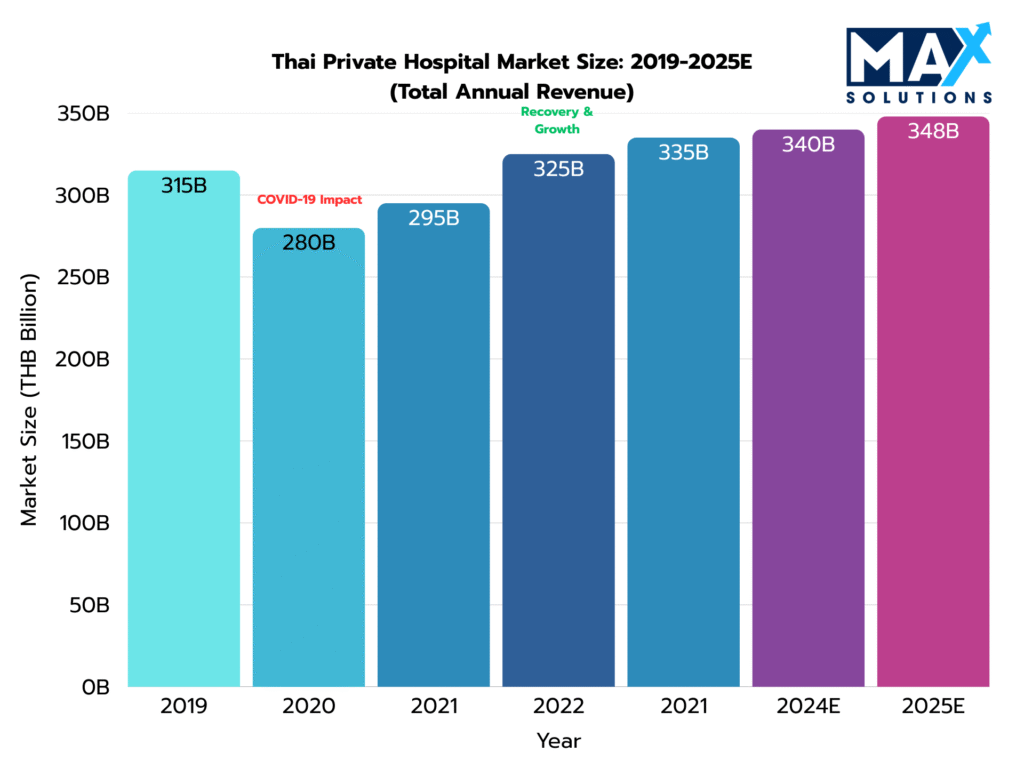

Thailand’s private hospital sector represents a THB 340-348 billion market in 2025, with 370 registered private hospitals nationwide generating significant M&A activity.

Recent market data from Grand View Research (2025) projects a 5.7% CAGR through 2030, driven by demographic shifts, medical tourism recovery, and healthcare infrastructure investment. This report provides hospital owners a quantitative framework for executing strategic exits, synthesizing valuation methodologies, regulatory considerations, and the six-stage M&A process specific to Thailand’s healthcare sector.

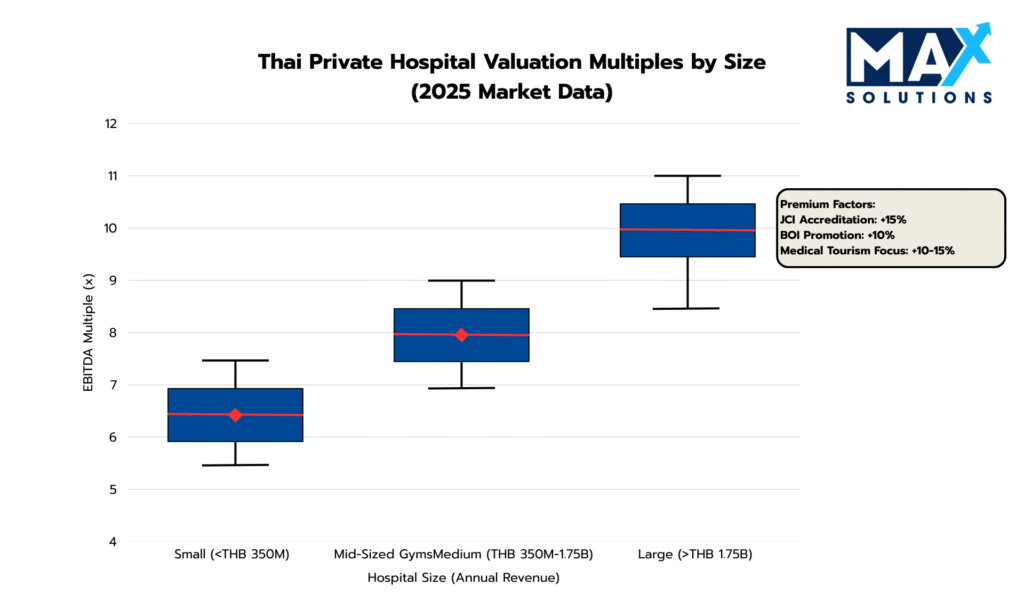

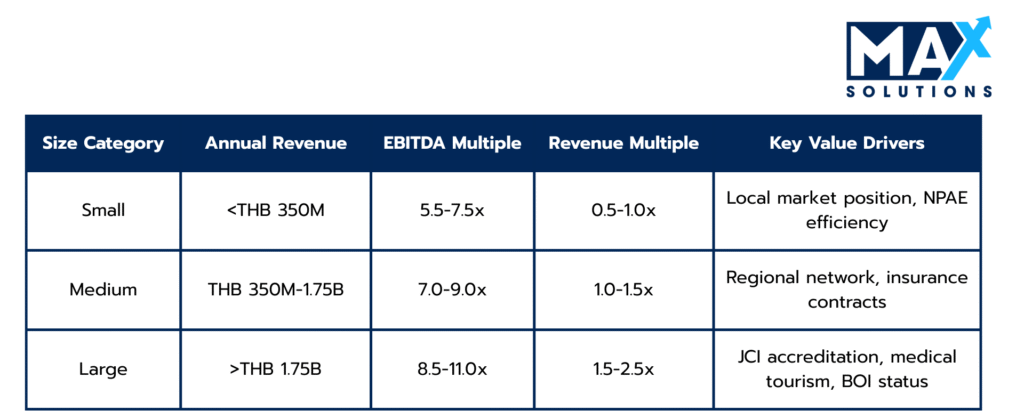

Key findings include:• Valuation multiples ranging from 5.5-11.0× EBITDA depending on size, location, and accreditation status.

• Premium valuations for JCI-accredited facilities (+15%), BOI-promoted entities (+10%), and Bangkok locations (+10-15%).

• Professional M&A advisory services demonstrating 10-30% valuation improvement and 2× higher transaction success rates.

Figure 1: Thai Hospital Market Size and Growth (THB), 2022-2030E

Introduction

Thailand’s private hospital sector occupies a strategic position within Southeast Asia’s healthcare landscape. The U.S. International Trade Administration (2024) identifies Thailand as a regional medical hub with 61 JCI-accredited facilities—substantially exceeding Malaysia (16) and Singapore (7). The market encompasses approximately 370 registered private hospitals ranging from small community facilities (<30 beds) to large tertiary medical centers (>250 beds), with significant concentration in Bangkok, Phuket, and Chiang Mai.

Krungsri Research (2024) reports that the sector experienced robust pre-COVID growth of 7-10% annually, contracted 10-12% in 2020, and has since recovered with moderate 3-5% growth projected through 2025. For hospital owners contemplating exit strategies, this market stabilization presents optimal timing post-recovery valuations have normalized while buyer appetite from domestic chains, international operators, and private equity remains strong.

This report addresses the critical question: How can private hospital owners maximize valuation and successfully navigate Thailand’s complex M&A landscape? By synthesizing regulatory requirements, financial preparation strategies, and structured transaction processes, we provide hospital owners with actionable intelligence for strategic exits. Max Solutions’ integrated approach combining M&A advisory, legal expertise through Tanormsak Law Firm, and specialized accounting services ensures comprehensive transaction management from preparation through closing.

Valuation Landscape

Hospital Business valuations in Thailand primarily utilize three methodologies: EBITDA multiples (most common for profitable operations), revenue multiples (for high-growth or turnaround situations), and asset-based approaches (establishing valuation floors). Our analysis of recent transactions and comparable service sector data reveals distinct valuation bands correlated with business size, location, and operational sophistication.

Figure 2: EBITDA Multiples for Hospital Businesses by Size and Location (2025)

As illustrated above, valuation multiples demonstrate clear stratification. First Page Sage (2025) establishes that private hospital valuations primarily utilize EBITDA multiples, ranging from 5.5-11.0× for Thai assets depending on scale, operational efficiency, and strategic positioning. Unlike pure asset-based valuations common in real estate, hospital businesses command premiums for intangible factors: physician networks, payor contracts, accreditation status, and medical tourism capabilities.

The following benchmarks synthesize transaction data from Grand View Research (2025), SET (2025), and healthcare M&A databases:

Table 1: Revenue-Based Valuation Multiples for Thai Hospital Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.5-2.5× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

The Six-Stage Hospital Business Sale Process

Successful Hospital business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financial Documentation: Prepare 3–5 years of audited financial statements and normalize EBITDA to reflect true operating performance

- Regulatory Compliance: Confirm all Ministry of Public Health licenses, sub-licences, and permits are valid and transferable.

- Quality of Earnings: Use third-party QoE review to validate earnings consistency and strengthen valuation justification.

- Working Capital Management: Reduce Days Sales Outstanding by improving insurance and government claim collection.

- Technology Infrastructure: Implement or upgrade Electronic Health Records to improve billing accuracy and operational efficiency.

- Advisor selection: Engage specialized M&A advisors with Hospital expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: 120-bed hospital increased normalized EBITDA by THB 14M after EHR installation reduced billing delays, raising valuation by THB 112M at 8× EBITDA.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

• Strategic Buyer Targeting: Identify domestic hospital chains, international operators, and private equity funds seeking healthcare assets.

• Marketing Materials: Create a professional teaser and CIM detailing service lines, patient mix, and specialty capabilities.

• Positioning Strategy: Highlight accreditation status, medical tourism readiness, and stable corporate health contracts.

• Confidential Outreach: Contact 25–40 qualified buyers under NDA to build competitive tension.

• Synergy Narrative: Demonstrate opportunities for network expansion, specialty integration, and operational efficiency.

Case Study: A Phuket hospital received 12 buyer inquiries due to its location and specialties, lifting expected multiples from 6.5× to 8.0× EBITDA.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Hospital properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

• IOI Evaluation: Compare valuation ranges, cash components, earnout terms, and closing certainty.

• Buyer Qualification: Assess financial capacity, healthcare experience, and cultural fit with medical staff.

• Regulatory Review: Confirm potential foreign buyers’ ability to comply with the Foreign Business Act or obtain BOI promotion.

• Valuation Calibration: Use IOI feedback to refine negotiation strategy before entering LOI stage.

Case Study: A Bangkok medical center received IOIs ranging from 7.2× to 9.0× EBITDA and selected an 8.6× all-cash offer with strong execution certainty

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

• Valuation Negotiation: Finalize EBITDA multiple, adjusted EBITDA definition, and cash-at-closing terms.

• Deal Structure: Select between share sale (tax-efficient) or asset sale (preferred by some foreign buyers).

• Physician Retention: Define retention bonuses or agreements for key doctors to ensure stability.

• Exclusivity Agreement: Grant exclusivity only after securing optimal valuation and favorable terms.

Case Study: A 150-bed hospital increased an initial 9.0× LOI to 11.2× EBITDA by leveraging competing offers and securing clinical team retention commitments.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Hospital deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

• Financial Due Diligence: Validate revenue sources, reimbursement schedules, working capital needs, and equipment CAPEX.

• Legal & Regulatory Review: Confirm license transferability, BOI status, zoning compliance, and environmental approvals.

• Operational Assessment: Evaluate physician dependency, accreditation status (HA/JCI), and clinical service strengths.

• Facility Inspection: Review building integrity, equipment condition, and required maintenance or upgrades.

Case Study: A Chiang Mai hospital avoided a THB 38M price reduction by renewing an expired radiology license before buyer due diligence uncovered it.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Hospital transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

• SPA Finalization: Agree on representations, warranties, indemnity caps, and working capital adjustments.

• Regulatory Approvals: Complete Ministry of Public Health license change and any BOI updates needed.

• Payment Structure: Finalize deposit, cash-at-closing, escrow terms, and deferred payments.

• Transition Services: Arrange 6–12 months of founder or physician involvement for continuity.

Case Study: A 200-bed Eastern Thailand hospital closed at 9.4× EBITDA with 85% cash upfront after securing early license transfer approval.

Value Enhancement Factors

• Accreditation (HA/JCI): Improves buyer confidence and supports 10–15% valuation premiums.

• Medical Tourism Revenue: Enhances margins and attracts international buyers.

• Technology Adoption: EHR and telemedicine systems increase operational efficiency and EBITDA reliability.

• Physician Stability: Strong specialist retention reduces buyer risk and maintains earnings quality.

• Payor Mix Optimization: Expanding private pay reduces reliance on low-margin government schemes.

• Equipment Upgrading: New medical equipment eliminates buyer CAPEX deductions.

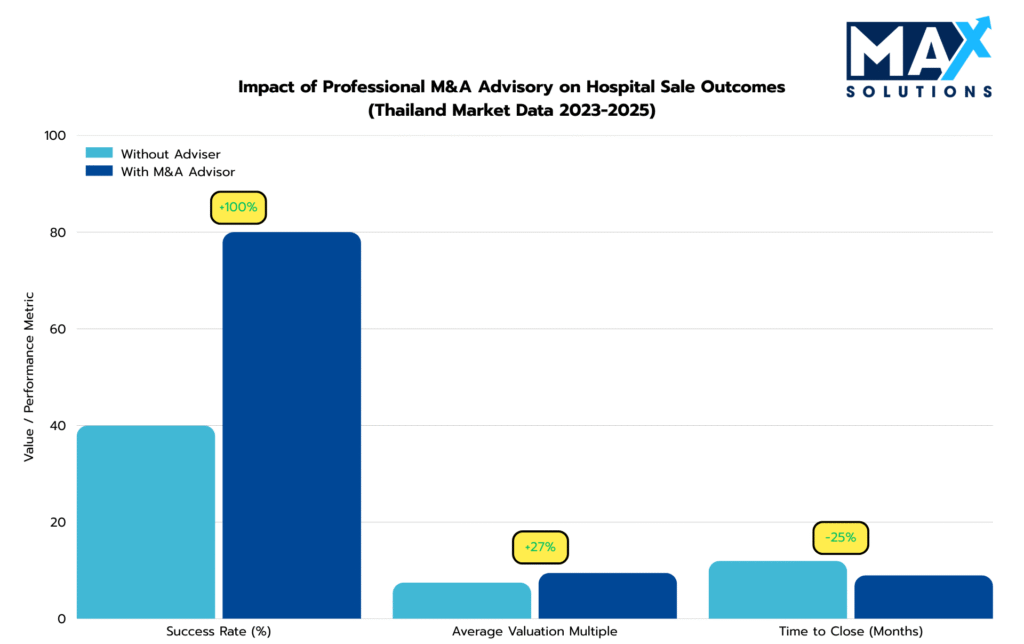

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Hospital Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Hospital Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s private hospital sector offers strong exit opportunities for owners who are prepared, accurately positioned, and supported by specialized advisory capabilities. The difference between a mid-range and premium valuation of 5.5× versus 11.0× EBITDA depends not on market timing alone but on the seller’s ability to demonstrate financial transparency, regulatory cleanliness, clinical quality, and operational scalability.

Given the sector’s regulatory environment particularly Foreign Business Act restrictions, MOPH licensing requirements, and BOI promotion pathways, transaction success depends on an integrated advisory approach combining M&A, legal, and financial expertise. Professional advisory support not only raises value but also improves certainty of closing, shortens timelines, and minimizes tax leakage through optimized structure selection.

For hospital owners considering an exit within the next 12–24 months, early preparation is the most strategic step. Aligning financials, documentation, and regulatory positioning ahead of a sale materially increases valuation and reduces execution risk. With its specialized healthcare M&A experience and long-standing partnership with Tanormsak Law Firm, Max Solutions offers a comprehensive, sector-specific platform to guide owners through every stage of the transaction, from readiness to final closing with confidence and clarity.

Frequently Asked Questions (FAQs)

Q1: What is the optimal timing for selling a private hospital in Thailand?

A: Optimal timing aligns with multiple factors: (1) peak financial performance demonstrating consistent EBITDA growth over 2-3 years, (2) completion of strategic investments (EHR systems, equipment modernization) that justify premium multiples, (3) market conditions favoring seller leverage—currently strong given post-COVID recovery and active buyer appetite, and (4) personal readiness including management succession planning. Ideally, begin preparation 12-18 months before target closing to address compliance issues, optimize working capital, and position for maximum valuation.

Q2: How do foreign ownership restrictions impact hospital sales?

Thailand Foreign Business Act (FBA) limits foreign ownership of healthcare businesses to 49% unless exempted. This significantly constrains the buyer pool and deal structuring options. However, hospitals can pursue Board of Investment (BOI) promotion—qualifying projects receive 100% foreign ownership rights plus tax incentives. BOI eligibility criteria include: specialized medical services, advanced technology utilization, or strategic regional medical hub positioning. Obtaining BOI status pre-sale commands ~10% valuation premium due to expanded buyer access. Alternatively, foreign buyers may structure joint ventures with Thai partners or utilize complex nominee structures (though the latter carries legal risks). Max Solutions’ legal team specializes in BOI applications and FBA-compliant structuring.

Q3: What pre-sale improvements generate the highest ROI?

A: Data-driven ROI leaders include: (1) Electronic Health Record (EHR) implementation (cost THB 2-5M, generates +5% EBITDA improvement via reduced errors and faster billing, justifies +1.0× multiple premium = THB 50-100M valuation uplift on mid-size hospital), (2) Working capital optimization through aggressive accounts receivable collection (reducing DSO by 15 days can free THB 10-20M in trapped capital), (3) Third-party Quality of Earnings review (cost THB 1-3M, eliminates buyer uncertainty and accelerates DD timeline, supports 0.5-1.0× multiple premium), and (4) JCI accreditation pursuit for qualified facilities (+15% valuation premium). Conversely, avoid extensive physical renovations with long payback periods unless addressing critical deficiencies that would trigger buyer CAPEX deductions.

Q4: Should I accept an earnout structure to bridge valuation gaps?

A: Earnouts can be valuable tools when: (1) seller has genuine conviction in near-term growth prospects (new service line launching, expanded insurance contracts), (2) valuation gap exceeds 15-20% between parties, and (3) seller willing to maintain operational involvement during earnout period. Critical success factors include: tightly defined metrics (avoid subjective measures), accounting rule clarity preventing buyer manipulation, reasonable timelines (12-24 months typical), and dispute resolution mechanisms. Hospital-specific earnout KPIs might include: achieving Revenue Per Patient Day targets, JCI accreditation completion, or medical tourism volume thresholds. However, earnouts introduce execution risk—if growth doesn’t materialize, seller accepts lower effective multiple. Generally preferable for sellers to secure maximum upfront consideration through competitive auction processes rather than rely on uncertain future payments.

Q5: How long does due diligence typically last and what are common failure points?

A: Due diligence for mid-market Thai hospitals typically requires 90-120 days. Wolters Kluwer (2025) research indicates 68% of hospital transaction failures occur during DD. Primary failure causes: (1) undisclosed legal/compliance issues (41%)—particularly MOPH license violations, pending malpractice litigation, or environmental non-compliance, (2) financial discrepancies (27%)—revenue recognition irregularities, working capital adjustments exceeding 10% of EV, or unsustainable EBITDA margins, and (3) physical property deficiencies (23%)—major deferred maintenance or equipment obsolescence requiring immediate CAPEX. Mitigation strategies include proactive ‘dry run’ audits 6 months pre-sale, comprehensive virtual data room preparation with indexed documentation, and transparent disclosure of known issues with remediation plans. Sellers benefit from advisor-managed DD coordination, ensuring timely buyer information access while protecting confidentiality.

5. How can I maximize my business valuation before sale?

A) Pre-sale value enhancement focuses on: (1) EBITDA normalization and 3-5 year financial documentation, (2) achieving CLV:CAC ratios >3:1 through marketing optimization, (3) regulatory portfolio cleanliness (100% current FDA notifications), (4) e-commerce conversion improvement (target 4%), (5) reducing customer concentration, and (6) securing BOI promotion for 100% foreign ownership eligibility.

6. How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A) Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Grand View Research. (2025). Thailand hospital services market size & outlook, 2030. Retrieved from https://www.grandviewresearch.com/horizon/outlook/hospital-services-market/thailand

Herrera & Partners. (2025). Legal framework in Thailand for the medical business. Retrieved from https://www.herrera-partners.com/2025/11/10/legal-framework-in-thailand-for-the-medical-business/

Krungsri Research. (2024). Industry outlook 2020-2022: Private hospital. Retrieved from https://www.krungsri.com/en/research/industry/industry-outlook/services/private-hospitals/io/io-private-hospitals

PIM Legal. (2024). A step-by-step guide to mergers and acquisitions in Thailand. Retrieved from https://www.pimlegal.com/2024/11/18/a-step-by-step-guide-to-mergers-and-acquisitions-in-thailand/

SET. (2025). Bangkok Chain Hospital Public Company Limited factsheet. Retrieved from https://www.set.or.th/en/market/product/stock/quote/bch%20/factsheet

Thailand Law Online. (2024). Condo contract payment and terms. Retrieved from https://www.thailandlawonline.com/article-older-archive/condo-contract-payment-and-termsU.S. International Trade Administration. (2024). Healthcare resource guide: Thailand. Retrieved from https://www.trade.gov/healthcare-resource-guide-thailand