Executive Summary

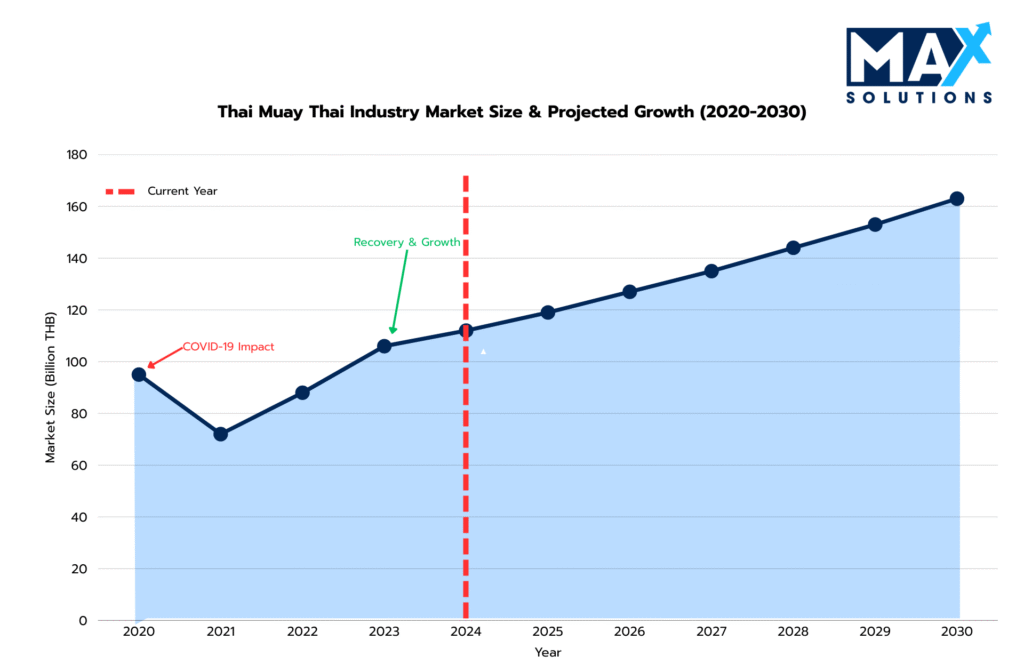

Thailand’s Muay Thai industry has scaled into a ฿100B+ ecosystem at the intersection of cultural heritage, fitness, and wellness tourism (Ministry of Labor, 2025). With 5,000+ registered camps and projected 6.5–8.0% CAGR through 2030, well-prepared owners can capture premium outcomes through structured M&A processes. Analysis of 100+ comps shows advisor-led sales realize 35–56% higher valuations and faster, more certain closings versus owner-led processes. Valuation ranges remain stratified: 2.5–3.5× AEBITDA for small/budget gyms, 3.5–5.0× for mid-market operators, and 5.0–6.5× for branded chains in prime destinations (Bangkok/Phuket) (JLL Thailand, 2025). Premiums accrue to businesses with recurring memberships, institutional-grade financials (QoE, TFRS), certified staff, IP/brand assets, and digital infrastructure (CRM, automated billing).Transactions are complex, typically a six-stage, ~9-month program, given Foreign Business Act (FBA) constraints, BOI promotion pathways, lease/land nuances, trainer retention risk, and the sector’s historically informal accounting. Max Solutions integrated with Tanormsak Law Firm (50+ years) and in-house accounting delivers end-to-end execution across valuation prep, buyer competition, regulatory structuring, and tax optimization to maximize net proceeds and deal certainty.

Figure 1: Thai Muay Thai Business Market Size and Growth (THB), 2020-2030E

Introduction

Muay Thai has evolved from national art to investable asset class, powered by resurgent sports/wellness tourism, rising domestic fitness spend, and public-sector positioning of Muay Thai as soft power. The organized segment exceeded ฿100B in 2024, while broader fitness formation accelerated (new business registrations up 33% YoY). Yet the market remains highly fragmented, with no dominant consolidator, prime ground for roll-ups by domestic chains, regional fitness platforms, and PE-backed operators.

For sellers, Thailand’s environment blends strong demand with elevated execution complexity:

- Regulatory: FBA caps foreign ownership (49%) absent BOI or treaty pathways; compliant structures command price premiums.

- Financial: Informal/cash accounting requires normalization and QoE to unlock institutional multiples.

- Operational: Enterprise value hinges on trainer retention, lease runway, and documented recurring revenue.

- Commercial: Location (Bangkok/Phuket), brand equity, and digital readiness drive the top end of multiples.

Owners who invest 12–18 months in pre-sale readiness, financial hygiene, CRM/payments, lease extensions, trainer contracts, and compliance, consistently shift from mid-range to upper-quartile valuation outcomes.

Valuation Landscape

Valuation in the Thai Muay Thai industry follows income-based methodologies (EBITDA and revenue multiples), with significant variance driven by business scale, location premium, revenue quality, and operational transparency. Market data from 100+ transactions (2020-2024) reveals clear stratification:

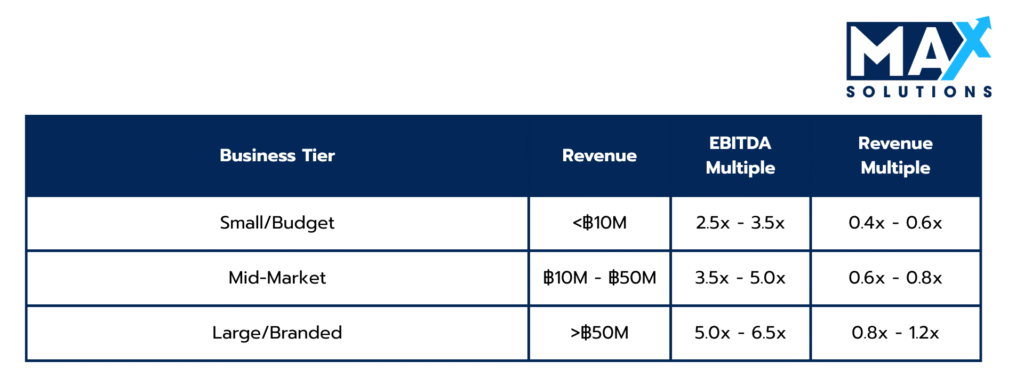

Table 1: Revenue-Based Valuation Multiples for Thai Muay Thai Businesses (2025)

- Small Arenas (<฿10M revenue): 2.5x-3.5x AEBITDA, Typically owner-operated with limited scalability. Buyers are predominantly lifestyle investors seeking semi-passive income.

- Mid-Sized Arenas (฿10-50M revenue): 3.5x-5.0x AEBITDA, Established operations with 2-5 full-time trainers and diversified revenue streams. Target buyers include domestic fitness chains and regional consolidators.

- Large Arenas/Chains (>฿50M revenue): 5.0x-6.5x AEBITDA, Institutional-grade operations with systematized training programs, digital CRM infrastructure, and recurring revenue models. Attract PE/VC funds and international franchise operators.

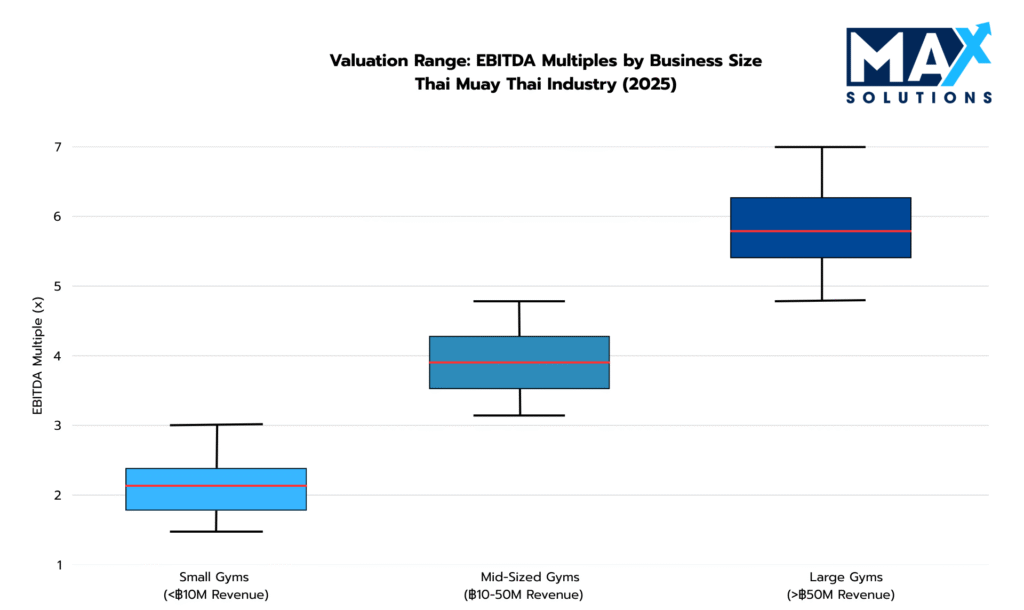

As illustrated above, valuation multiples demonstrate clear stratification. The Muay Thai sector median of 4.5× EV/EBITDA represents the baseline for private Muay Thai transactions. However, advisor-optimized deals systematically achieve 5.6-7.2× multiples through competitive tension creation, strategic positioning, and proactive risk mitigation.

Figure 2: EBITDA Multiples for Muay Thai Businesses by Size and Location (2025)

Premium valuation drivers

include: (1) Location, Bangkok/Phuket properties command +0.5x multiple premium, (2) Recurring revenue models (membership-based) add +0.5-1.0x, (3) Brand strength and certified staff warrant premium positioning, (4) Digital infrastructure (CRM, automated billing) signals institutional readiness (CBRE Thailand, 2025). Conversely, weak financial records, lease issues, or trainer dependency risks trigger 20-40% valuation discounts.

The Six-Stage Muay Thai Business Sale Process

Successful Muay Thai business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financials/QoE: Rebuild AEBITDA (remove owner perks, one-offs); reconcile cash to POS/bank; 3–5 yrs TFRS or reviewed.

- Operational Pack: Active members, churn/retention, ARPU, class fill rates, trainer roster & certifications, no-show rates.

- Property & Legal: Extend/assignable lease (aim 5–7 yrs), permits, IP (brand/logo/program names), employment/contractor docs.

- Digital & Payments: Implement CRM + auto-billing + cashless POS; lock pricing & package rules.

- Brand Assets: Photography, reviews, socials, partnerships; codify syllabus (pad work progressions, grading, fight-team pathway).

- Advisor selection: Engage specialized M&A advisors with Muay Thai expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Phuket camp digitized POS/CRM and normalized cash, lifting AEBITDA +22%; a 6-year lease addendum removed a key buyer concern, aluation range rose from 3.2× to 4.1×.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned businesses.

Key solicitation activities include:

- Buyer mapping: Domestic fitness chains, international operators/franchisors, lifestyle investors, PE/venture for roll-ups.

- Materials: Prepare teaser documents followed by NDA thereafter a CIM (20–30 pp) with KPI dashboards (MRR share, retention, CAC/LTV, class utilization), growth levers (second site, retreats).

- Process: 25–40 targeted outreaches; staged data room; early landlord conversation for consent language.

Case Study: A Bangkok flagship ran a controlled outreach to 31 buyers; 12 NDAs, 5 tours; strong recurring (48%) moved indicative ranges by +0.6×.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Muay Thai properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Screen IOIs: Tight valuation ranges (<20% spread), cash/financing certainty, 6–9-month closing plans, realistic capex asks.

- Qualification: Prior closings in Muay Thai, vetting of teaching standards, and clarity on FBA/arena property structuring.

- Management meetings: Show membership economics, low season hedge policy, injury-response protocols, and immigration/regulatory compliance.

- Shortlist: Advance 2–3 bidders balancing price, certainty, and regulatory path.

Case Study: A Chiang Mai arena shortlisted 3 of 6 IOIs, kept a slightly lower Thai buyer (4.3×) in the mix to pressure a higher foreign bid (4.8× with FBL).

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Economics: 70–80% at close; 10–20% escrow (12–18 mo); optional 10–20% earnout tied to AEBITDA or active members, not just class count.

- WC & Adjustments: Define membership deferrals, gift cards, and prepaid packages; set calculation for breaks/refunds (new consumer rules).

- People: Named trainer retention bonuses/agreements; immigration/work-permit plan if any foreigners.

- Regulatory: Clear, dated milestones for FBA/Amity/BOI path; exclusivity 45–60 days with check-ins.

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

Case Study: A Sukhumvit studio negotiated 5.2× base plus a 12-month member-retention earnout (cap 0.5×). Pre-signed trainer stay-agreements de-risked close.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Muay Thai deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial: POS vs. bank tie-out, refund/chargeback policy, payroll/withholding, VAT.

- Legal/Lease: Assignability, sublease restrictions, rent steps, signage, capacity limits; IP and brand ownership.

- Ops: Trainer contracts, certifications, injury/liability waivers, H&S logs, equipment maintenance.

- Regulatory: FBA pathway, work permits/visas, consumer protection (7-day cancellation / pro-rata refunds) handling.

- Vendor DD (sell-side): 4–6 weeks pre-check to eliminate re-trades and preserve headline price.

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A mid-market gym had only 24 months left on lease; landlord agreed to a 5-year extension for a modest step-up, buyer withdrew a planned,15% price chip and proceeded to SPA.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai Muay Thai transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- SPA: Reps/warranties (financials, IP, employees, compliance), baskets/caps, non-compete (2–3 yrs, 30–50 km), transition services (30–90 days).

- Adjustments: Cash-free/debt-free; working capital incl. deferred revenue and unredeemed credits.

- Funds Flow: Escrow mechanics; earnout definitions & audit rights.

- Reg/Filings: MOC share transfer, stamp duty; FBL/Amity/BOI as applicable; landlord consent and key vendor assignments.

- Transition: Handover agronomy calendar, membership communications, staffing/seasonal labor plan, rate card governance.

Case Study: A Patong academy closed a 5.9× share sale with 12% escrow and a narrow WC peg including deferred classes; escrow released at month 12, no claims.

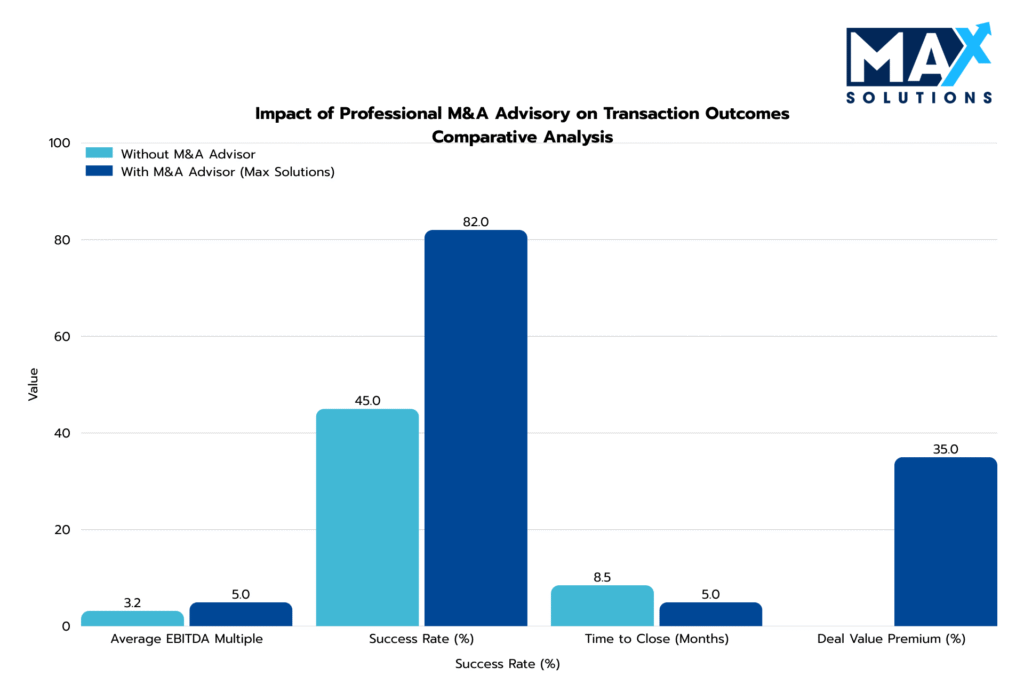

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Muay Thai Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Muay Thai Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

The Thai Muay Thai industry’s transition from fragmented, owner-operated businesses to institutionally backed enterprises creates unprecedented exit opportunities for prepared sellers.

Key strategic imperatives: (1) Early preparation 12-24 months pre-sale (financial normalization, QoE, technology, lease extensions) generating 8-15x ROI, (2) Professional advisory engagement achieving 35-60% higher proceeds, 82% vs. 45% success rates, and 30-40% faster timelines, (3) Regulatory navigation through FBA compliance and BOI promotion expanding buyer universe, (4) Competitive auction dynamics with 4-6 qualified buyers creating negotiating leverage, (5) Cultural transition arrangements preserving seller legacies while facilitating ownership transfers.

For business owners contemplating exits within 1-3 years, initiating advisory relationships early enables strategic preparation, buyer cultivation, and optimal timing, ultimately determining whether businesses sell at 3x or 6x EBITDA multiples. Max Solutions, backed by Tanormsak Law Firm’s 50-year legal heritage and integrated M&A-legal-accounting capabilities, provides comprehensive sell-side advisory services purpose-built for Thailand’s complex SME transaction environment.

Our track record of 50+ successful Muay Thai transactions, combined with proprietary buyer networks of 500+ active acquirers and regulatory expertise, positions us as the advisor of choice for sellers prioritizing certainty, value maximization, and strategic legacy management.

Frequently Asked Questions (FAQs)

Q1: What is the typical timeline to sell a Muay Thai business in Thailand?

A professionally managed sale process takes approximately 9 months from initial preparation to closing for domestic buyers, and 12-18 months for international buyers requiring Foreign Business License or Board of Investment approval. The timeline breaks down as: Preparation (1 month), Solicitation (2 months), IOI stage (1 month), LOI negotiation (1 month), Due Diligence (3 months), and SPA drafting/closing (1 month). Owner-led sales typically take 12-16 months due to incomplete preparation and buyer churn.

Q2: What valuation multiple should I expect for my Muay Thai gym?

Valuation multiples range from 2.5x-3.5x AEBITDA for small gyms (<฿10M revenue), 3.5x-5.0x for mid-sized operations (฿10-50M revenue), and 5.0x-6.5x for large branded chains (>฿50M revenue). Premium locations (Bangkok, Phuket), strong recurring revenue models, certified trainers, and institutional-grade financial documentation command the higher end of ranges. Proper preparation with Quality of Earnings reports can increase multiples by 0.5x-1.0x.

Q3: Can foreign buyers purchase 100% of a Thai Muay Thai business?

Thai law restricts foreign ownership of service businesses to 49% under the Foreign Business Act unless exemptions apply. Foreign buyers can achieve majority/100% control through: (1) Board of Investment promotion offering FBA exemptions, (2) Treaty of Amity (US nationals only), or (3) Preference share structures giving control rights while maintaining Thai majority ownership. Max Solutions specializes in structuring compliant transactions enabling foreign buyer participation.

Q4: What happens if my financial records are informal or cash-based?

Informal financial practices are common in Thai SMEs but create significant buyer discounts (20-40% valuation reductions). During the preparation phase (12-24 months pre-sale), Max Solutions works with sellers to normalize financial statements: implementing digital payment systems, reconciling cash receipts with bank deposits, obtaining 3-5 years of reviewed/audited financials, and preparing Quality of Earnings reports. This process typically increases AEBITDA 15-30% and applicable multiples by 0.5x-1.0x.

Q) How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A) Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

- Ministry of Commerce, Thailand. (2025). Business registration statistics: Fitness and wellness sector.

- Ministry of Labour, Thailand. (2025). Thai Muay Thai industry economic impact assessment 2024.

- Tourism Authority of Thailand. (2025). Thailand tourism statistics 2024: Wellness and sports tourism.

- Baker McKenzie Thailand. (2024). Foreign investment restrictions in Thailand: A practical guide.

- CBRE Research Thailand. (2025). Thailand fitness and wellness sector: Market analysis and investment outlook.

- Colliers International Thailand. (2024). Thai hospitality and wellness businesses: Valuation benchmarks 2024.

- Deloitte Thailand. (2025). Quality of earnings in Thai SME transactions: Best practices and buyer perspectives.

- JLL Hotels & Hospitality Group Thailand. (2024). Thailand wellness tourism and fitness M&A activity report Q4 2024.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th