As a dental practice grows, the workload on an owner increases exponentially as your reputation grows with the number of your satisfied customers. While the prospect of selling your business might seem difficult with the troubles of finding interested buyers, professional M&A consultants help increase likelihood of success by at least 40%

Executive Summary: How private equity boosts success for independent dental practices

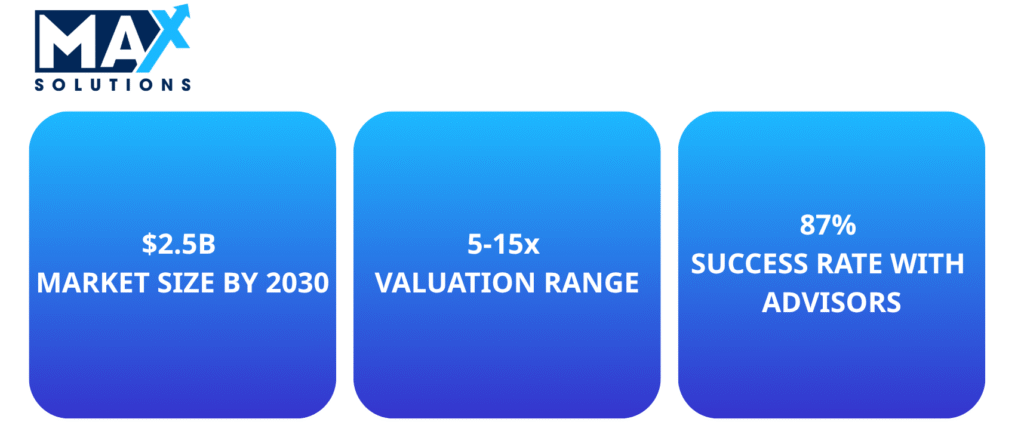

Thailand’s dental services market is highly attractive for investors, with estimates valuing the sector at $2.5 billion by 2030, representing a robust 7-8% compound annual growth rate (CAGR), triggering an uptick in larger firms buying out smaller firms in order to achieve a monopoly. The market’s structure remains highly fragmented, with over 7,000 dental clinics nationwide (NHSO 2024), of which 5,000+ operate as independent single-location practices (PRN Newswire, 2023) creating an incredibly competitive market to find continuous success in. However, this fragmentation also presents an opportunity for business owners to sell into private equity backed Dental Service Organizations (DSO’s), a sub-sector currently experiencing almost double the industry’s average at 17.1% CAGR (Grand View, 2025).

For SME dental clinic owners, strategic exit opportunities have never been more favorable. With many single practices able to find buyers willing to buy their firm for 5-7x their earnings before interest, taxes, depreciation and amortization (EBITDA), while those looking at private equity through DSO integrated platforms are able to find 10-15x EBITDA, representing a 40-60% premium over traditional acquirers on average.

Understanding the market to maximize sale value

Thailand’s dental healthcare sector has experienced remarkable expansion, driven by demographic trends, medical tourism recovery, and increasing healthcare sophistication. The Bangkok metropolitan area concentrates approximately 3,000 dental clinics (43% of national capacity), establishing the capital as the primary hub for both domestic and international dental services.

Figure 1: Thailand Dental Clinic Market Overview – Market Size, Valuation Multiples, and Growth Projections

The market’s growth trajectory reflects several convergent factors. Thailand’s aging population (projected to reach 28% of total population by 2040) drives increasing demand for restorative and maintenance dental services. Simultaneously, the recovery of medical tourism post-COVID-19 has restored high-margin cosmetic and elective procedures, with foreign patient revenue increasing 190% in 2022 for major dental groups, pushing clinics towards proficiencies in multiple languages.

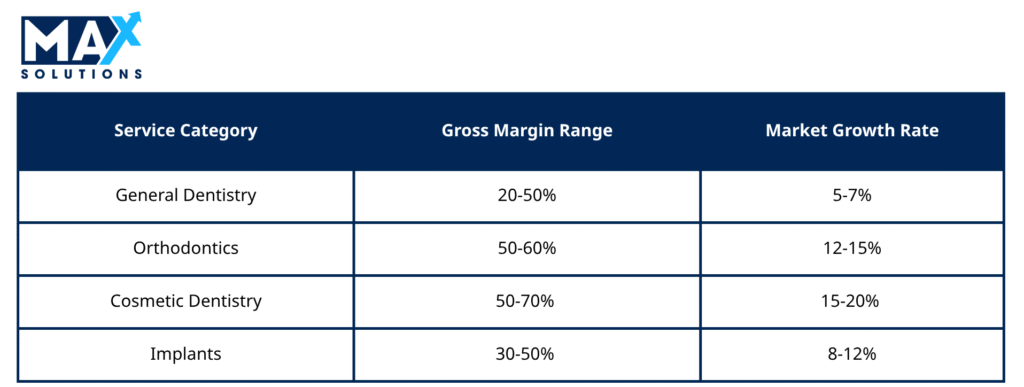

How do different service categories can affect your final sales value?

Revenue performance varies significantly across clinic types and service offerings. Solo practices typically generate 5-30 million THB annually, depending on location and specialization. In contrast, established dental groups like Dental Corporation PCL reported 954.4 million THB revenue in 2024, demonstrating the scalability advantages of consolidated operations. As a seller, having strong and diversified revenue streams will greatly enhance the attractiveness of your business, pushing up the ultimate sales value of your firm.

What can you do to enhance the sales value of your company?

Dental clinic owners can significantly impact valuation through strategic restructuring. For instance, the adoption of new technologies such as digital imaging and practice management systems is able to boost valuations. Having clear and comprehensive patient management systems, documented clinical protocols, and standardized operational procedures appeal to institutional buyers seeking scalable platforms.

Revenue diversification through specialty services presents another value enhancement opportunity. Clinics offering orthodontics, cosmetic dentistry, and implant services achieve higher multiples due to superior margins and reduced insurance dependency. The integration of medical tourism services, particularly relevant for Bangkok-based practices, creates additional value through higher per-patient revenue and international market access.

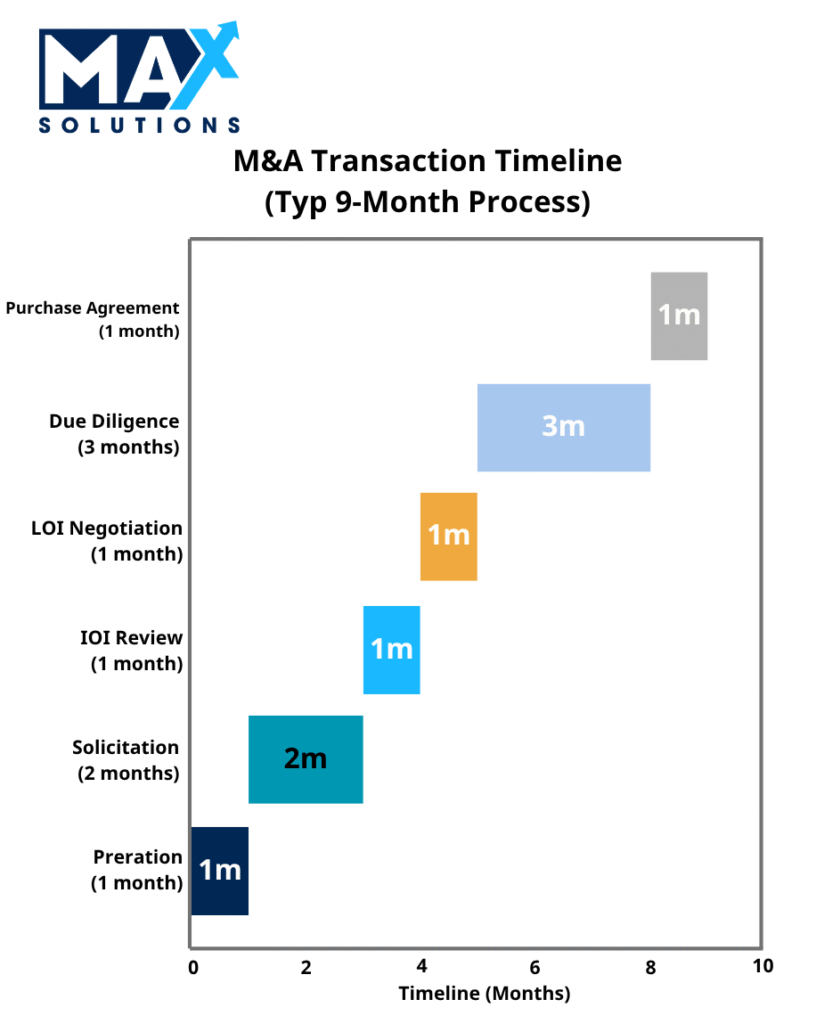

The Six-Stage M&A Process: A Comprehensive Guide

The selling of a dental clinic involves a six stage process, with each phase requiring specialized expertise and careful execution. The total timeline typically spans 9 months, with successful completion dependent on thorough preparation and professional guidance. We will outline each individual step of the way, as well as the estimated duration for each phase to complete

Step 1: Preparation Phase Duration: 1 Month

The preparation phase establishes the foundation for successful transaction execution. For dental clinics, this involves comprehensive financial audit, regulatory compliance review, and operational assessment. A typical Bangkok dental clinic must organize patient databases, verify equipment ownership, analyze staff contracts, and ensure compliance with Ministry of Public Health regulations. In Thailand some of the critical activities include preparing financial statements (3-year history); equipment and depreciation valuation; patient database organization and privacy compliance verification; staff contract and licensing review; regulatory compliance audit; and intellectual property assessment for unique branding materials. These are not taking into consideration the unique regulatory requirements expected from healthcare providers, failure to comply with usually resulting in a sales failure.

Step 2: Solicitation Phase Duration: 2 Months

The solicitation phase focuses on buyer identification and initial engagement. For dental clinics, potential acquirers from private individuals to traditional conglomerates. The complexity of healthcare M&A requires the development of a network of potential buyers, all while ensuring the proper steps are taken to maintain confidentiality into the businesses practices and between buyers on sales prices, through the enforcement of non-disclosure agreements, and memorandum preparations.

The key to success lies in effective solicitation that requires understanding buyer motivations. PE-backed DSOs prioritize scalable operations and technology integration, while strategic buyers focus on geographic expansion and service line enhancement. Having an established network beforehand of qualified buyers allows for success at this step is crucial for the owner to find the best possible price.

Step 3: Indication of Interest (IOI) Review Duration: 1 Month

The IOI phase involves preliminary offer evaluation and buyer qualification. Dental clinic transactions typically generate 3-7 IOIs, with significant variation in structure and valuation. Professional evaluation requires analysis of purchase price, transaction structure, management retention requirements, and closing conditions. It is critical to have the experience in negotiations to discover the best IOI through analysis and comparison. In addition, it is important to ensure the buyer’s financial qualifications to make sure the deal goes smoothly, while also negotiating on behalf of the business owner to maximize sales value through complex earnout structures.

Step 4: Letter of Intent (LOI) Negotiation Duration: 1 Month

LOI negotiation establishes definitive transaction terms and exclusivity arrangements. For dental clinics, key negotiation points include purchase price allocation, working capital adjustments, management retention terms, and regulatory approval requirements. Due to complex regulatory requirements, independent owners might have difficulty safeguarding themselves from predatory buyers. In addition, failure to comply with unique regulatory requirements accounts for 35% of deals failing

Step 5: Due Diligence Duration: 3 Months

Due diligence represents the most critical and complex phase of dental clinic transactions. Healthcare due diligence encompasses financial, legal, operational, and regulatory analysis. The comprehensive nature of healthcare regulation creates multiple potential deal termination points. This involves many difficult steps for those inexperienced with M&A such as financial verification and quality of earnings analysis, legal and regulatory compliance review, operational assessment and clinical protocol evaluation, information technology systems analysis, and human resources and licensing verification.

Step 6: Purchase Agreement Execution Duration: 1 Month The final phase involves definitive agreement negotiation and transaction closing. Healthcare purchase agreements require specialized provisions addressing regulatory compliance, professional licensing transfers, and patient care continuity. This final phase includes the purchase agreement negotiation, regulatory approval obtaining, closing preparation and coordination, and post-closing integration planning, creating a great deal of complexity right before the end of a sale occurs,

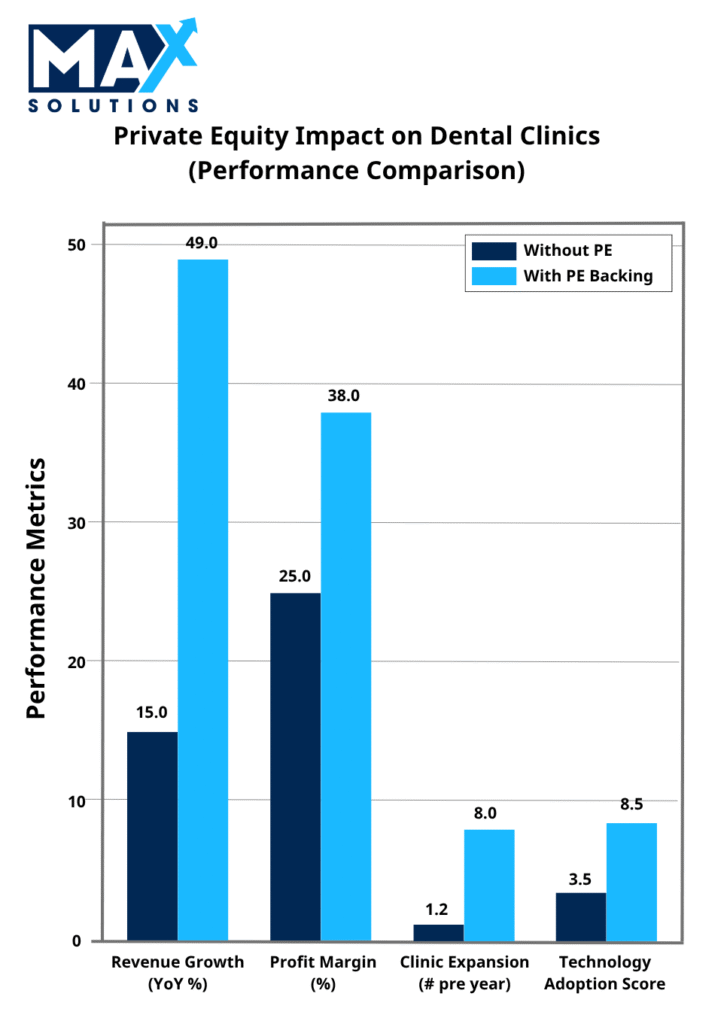

The Strategic Value of Professional M&A Advisory

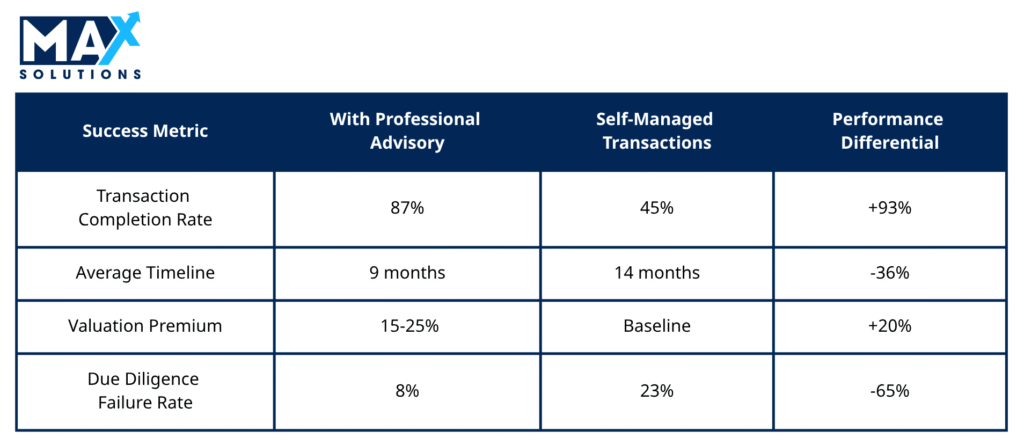

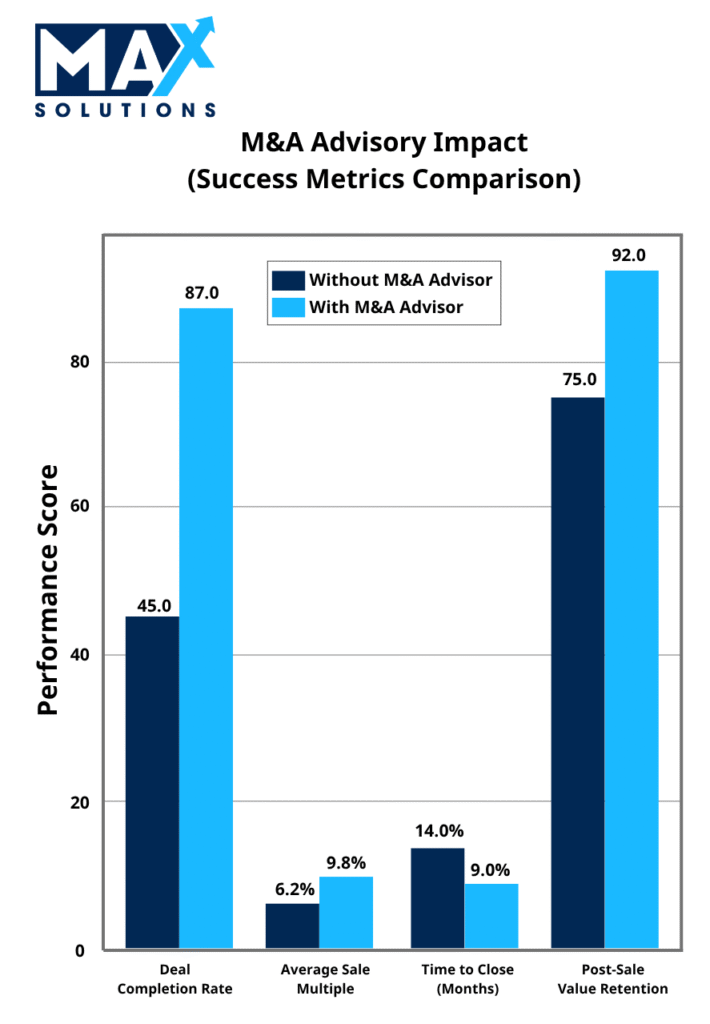

The complexity of healthcare M&A transactions creates compelling value propositions for specialized advisory services. Quantitative analysis demonstrates significant performance advantages for professionally advised transactions across multiple metrics.

Max Solutions: Integrated Healthcare M&A Excellence

Max Solutions represents Thailand’s premier healthcare M&A advisory firm, combining specialized sector expertise with comprehensive service integration. Our partnership with Tanormsak Law Firm provides clients with 50+ years of combined legal and financial advisory experience, creating unique value through seamless service delivery.

Integrated Service Advantage:

• M&A Advisory: Comprehensive transaction management from preparation through closing

• Legal Services: Healthcare regulatory compliance and transaction documentation • Accounting Services: Financial due diligence and valuation analysis

• Post-Transaction Support: Integration planning and operational optimization

Our integrated approach eliminates coordination challenges that plague multi-advisor transactions while providing cost-effective service delivery. The combination of M&A expertise, legal specialization, and accounting proficiency creates comprehensive transaction management capabilities unmatched in the Thai market.

Sources:

1. Patients conveniently access dental care through “UCS upgrade.” (2024). สำนักงานหลักประกันสุขภาพแห่งชาติ (สปสช.). https://eng.nhso.go.th/view/1/DescriptionNews/Patients-conveniently-access-dental-care-through-UCS-upgrade/613/EN-US

2. Research, K. (2023, January 11). The Thailand Dental Services Market is expected to contribute ~$1.7 Bn owing to ageing population, rising dental tourism and government’s initiatives in healthcare: Ken Research. Prnewswire.co.uk; PR Newswire UK. https://www.prnewswire.co.uk/news-releases/the-thailand-dental-services-market-is-expected-to-contribute-1-7-bn-owing-to-ageing-population-rising-dental-tourism-and-governments-initiatives-in-healthcare-ken-research-301719015.html

3. Thailand Dental Service Organization Market Size & Outlook, 2030. (2025). Grandviewresearch.com. https://www.grandviewresearch.com/horizon/outlook/dental-service-organization-market/thailand

This analysis is prepared by Max Solutions in partnership with Tanormsak Law Firm. For additional information regarding dental clinic M&A opportunities, please contact our specialized healthcare advisory team.

Disclaimer: This document contains forward-looking statements based on current market conditions and available data. Actual results may vary based on market conditions and individual circumstances.