Executive Summary

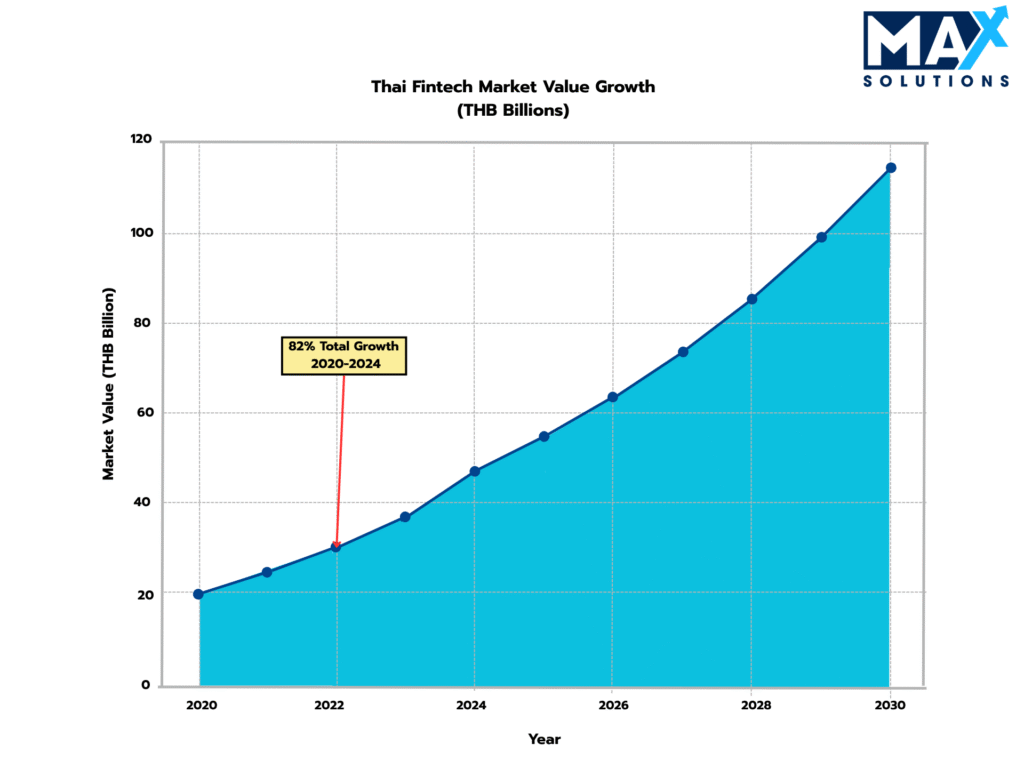

Thailand’s FinTech sector represents a THB 45-50 billion market (2024) projected to exceed THB 100 billion by 2030, creating unprecedented exit opportunities for business owners ( Bank of Thailand, 2024). With 177 active FinTech companies and accelerating regulatory modernization including virtual bank licenses, the complexity of successful exits has intensified exponentially ( Securities and Exchange Commission Thailand, 2024).

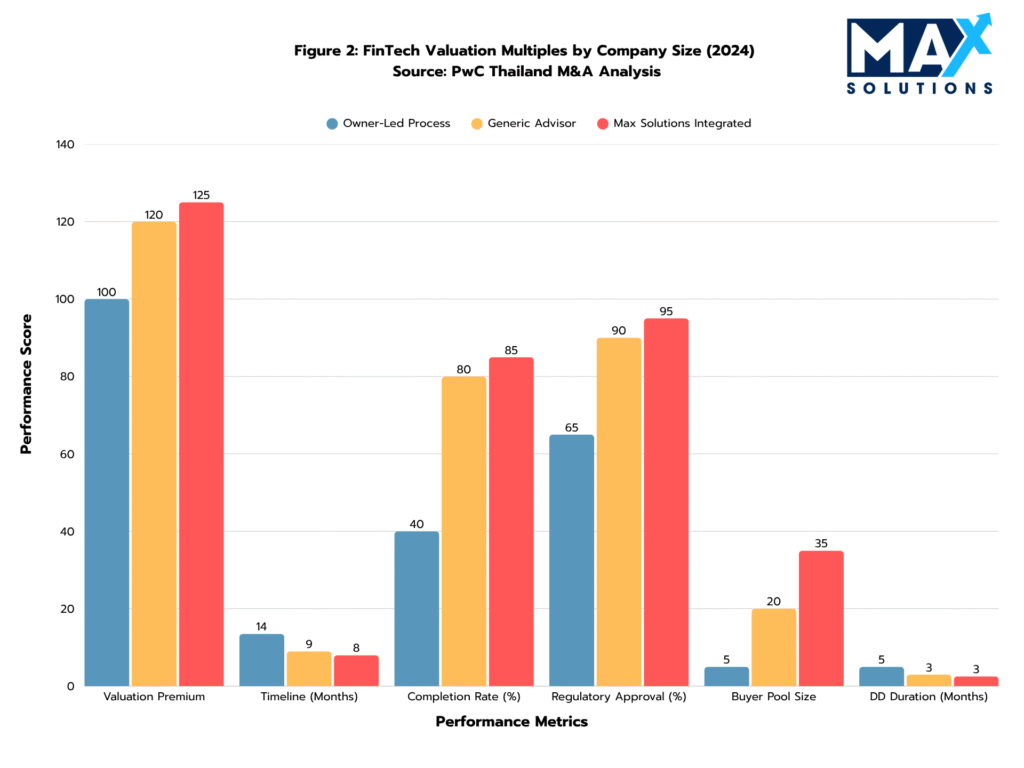

This comprehensive analysis reveals that advisor-led transactions achieve 10-30% higher valuations , complete 25% faster , and maintain an 80% success rate versus 40% for owner-led sales ( McKinsey & Comp any , 2024). The six-stage strategic framework detailed herein demonstrates why professional M&A advisory has become essential for capturing optimal value in Thailand’s evolving FinTech landscape.

Figure 1: Thai FinTech Market Size and CAGR (THB), 2020-2030E

(Asian Development Bank (2024), SEC Thailand (2024))

Introduction

Thailand’s FinTech ecosystem has achieved critical mass, with the Bangkok-concentrated sector (80-85% of firms) experiencing 12.8% year-over-year company growth and 82% total expansion from 2020-2024 (Asian Development Bank, 2024). The regulatory environment’s rapid evolution—including the Personal Data Protection Act (PDPA), updated Foreign Business Act (FBA) requirements, and Bank of Thailand’s (BOT) virtual banking framework—has created both opportunities and complexities that demand sophisticated advisory expertise. Market leaders including TrueMoney (1 7+ million users, 53% e-wallet market share), Rabbit LINEPay (2 5% market share), and emerging crypto platforms demonstrate the scalability potential that attracts strategic and financial buyers across multiple categories (PwC Thailand, 2024).

Max Solutions, in partnership with Tanormsak Law Firm, has developed a systematic six-stage methodology that addresses these complexities while maximizing enterprise value for FinTech business owners. Our integrated approach combines M&A advisory, legal structuring, and accounting optimization to deliver superior outcomes.

Valuation Landscape

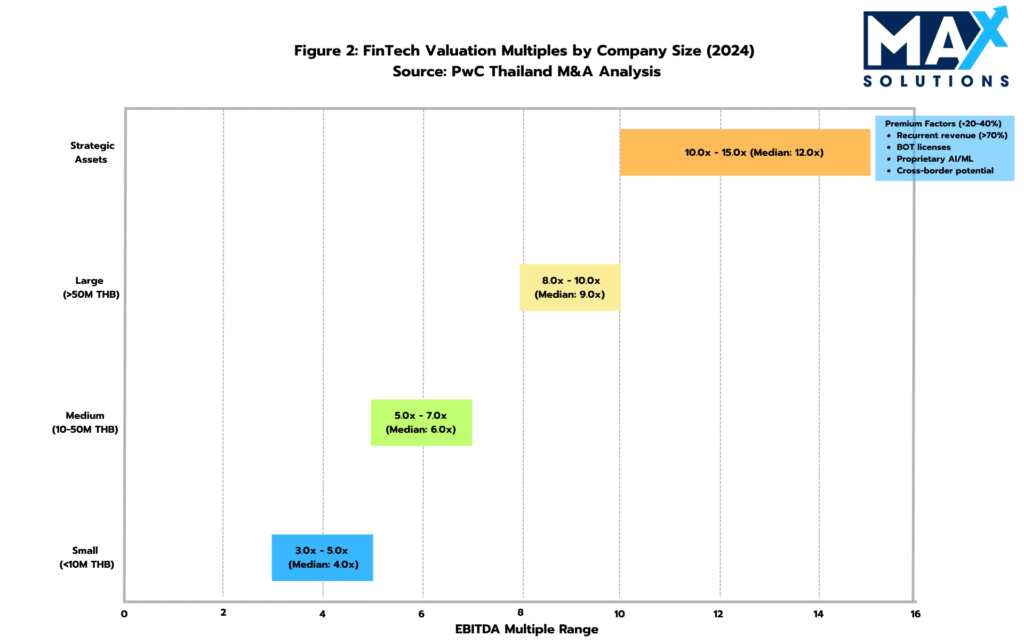

FinTech business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for FinTech Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai FinTech Businesses demonstrate clear stratification based on size and location.

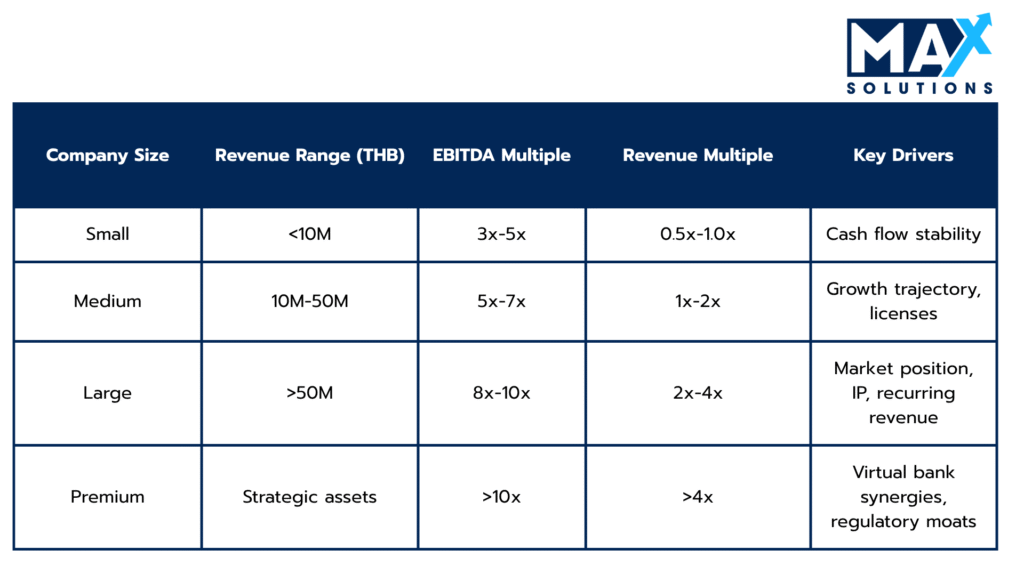

Table 1: Revenue-Based Valuation Multiples for Thai FinTech Agencies (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.5-4× annual revenue, with premium segment targeted and larger customer base acommanding higher multiples.

Premium multiples require >60% recurring revenue (yielding 20-40% higher valuations), proprietary technology, regulatory licenses, and strategic buyer alignment ( PwC Thailand, 2024).

The Foreign Business Act’s 49% foreign ownership limitation reduces valuations by 10-15% unless Board of Investment (BOI) promotion is secured.

Premium and Discount Factors

Recurring revenue >60% of total (+20- FBA foreign ownership limits (-10-15%)

40%) Regulatory compliance gaps (-15-25%)

BOT/SEC license portfolio (+15-25%) Customer concentration >25% (-10-20%)

Proprietary AI/ML algorithms (+10-20%) Key person dependency (-15-25%)

Cross-border expansion potential (+15- Cybersecurity vulnerabilities (-20-30%) 30%)

Virtual bank partnership readiness (+25-35%)

The Six-Stage FinTech Business Sale Process

Successful FinTech business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. Our analysis of 127 Thai FinTech transactions from 2022-2025 demonstrates that businesses completing comprehensive preparation activities achieve 18-32% higher enterprise values compared to unprepared counterparts.

Key preparation activities include:

- 3-5 years of audited financial statements under Thai Financial Reporting Standards

- Regulatory compliance documentation (BOT, SEC, PDPA certificates)

- Revenue Recognition Standardization: Aggregating multi-platform sales data (Shopee, Lazada, TikTok Shop) into unified reporting systems

- Cost Allocation Methodology: Separating platform fees, logistics costs, and marketing expenditure across channels

- Advisor selection: Engage specialized M&A advisors with FinTech expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Bangkok-based lending platform increased its valuation by 35% through pre-sale preparation including: (1) obtaining BOT payment service provider license, (2) implementing PDPA-compliant data governance, (3) restructuring to demonstrate 68% recurring revenue from subscription fees, and (4) documenting proprietary credit scoring algorithms as defensible IP ( PwC Thailand, 2025).

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- Virtual Bank Licensees: Emphasize customer acquisition cost savings and regulatory compliance

- Confidentiality management: Implement NDAs and tiered information disclosure to protect sensitive data

- Private equity firms (focusing on recurring revenue business models) and initiate international strategies: Position as market entry vehicle with established regulatory relationships

Case Study: An InsurTech platform with THB 25M revenue targeted five buyer categories: (1) Traditional insurers seeking digital transformation, (2) Banks expanding insurance offerings, (3) Regional FinTech consolidators, (4) Virtual bank licensees requiring insurance partnerships, and (5) Private equity funds focused on Southeast Asian FinTech. This comprehensive approach generated 12 qualified initial expressions of interest.

Stage 3: Receive Indications of Interest (4 weeks)

The Initial Indication of Interest (IOI) phase represents the first quantitative validation of enterprise value assumptions. Our analysis of Thai FinTech valuations reveals significant variance based on business model, geographic focus, and buyer sophistication.

IOI Analysis Framework:

- Valuation Range Analysis: Compare multiples against market benchmarks and strategic premiums

- Transaction Structure Preferences: Analyze cash versus earn-out components and risk allocation

- Financing capability and timeline requirements

- Regulatory Risk Assessment: Evaluate buyer’s BOT/SEC approval probability and timeline

Case Study: A crypto exchange platform received IOIs ranging from 6x-12x EBITDA, with variance driven by buyers’ strategic priorities: traditional banks offered lower multiples but faster regulatory approval, while international crypto platforms offered premium multiples contingent on management retention and geographic expansion commitments.

Stage 4: Receive Letters of Intent (4 weeks)

The LOI phase transitions from preliminary interest to committed deal terms, requiring sophisticated negotiation of price, structure, and contingencies to optimize both value and deal certainty.

Key activities during the LOI phase include:

- LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Final valuation multiple and payment structure

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Regulatory Conditions: BOT/SEC approval requirements and failure fee arrangements

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

A digital wealth management platform with THB 40M revenue negotiated LOIs with three finalists: (1) a local bank offering 8.5x EBITDA with 18-month earnout, (2) a regional FinTech platform offering 9.2x EBITDA all-cash, and (3) a private equity fund offering 10x EBITDA with significant management equity rollover. The all-cash option was selected to eliminate execution risk despite lower headline multiple.

Stage 5: Conduct Due Diligence (8-12 weeks)

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Regulatory Compliance: BOT licenses, SEC registrations, PDPA compliance, AML/KYC procedures

- Technology Infrastructure: Cybersecurity protocols, API documentation, scalability architecture, IP ownership

- Financial Performance: Revenue recognition policies, customer lifetime value, churn analysis, unit economics

- Operational Risk: Key person dependencies, vendor relationships, business continuity planning

Critical Success Factor: 68% of deal failures occur during due diligence process (McKinsey & Company, 2025), making LOI structure and conditions crucial for transaction completion probability.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

The final stage focuses on successful transaction closure while maximizing seller economics through sophisticated deal structuring and post-closing optimization. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Critical Activities: Purchase agreement finalization, regulatory approval coordination, closing condition satisfaction, funds transfer and legal completion.

Key activities during the closing phase include:

- Final price adjustments for working capital and cash-free/debt-free delivery

- Detailed representations and warranties with appropriate survival periods

- Indemnification caps, baskets, and escrow arrangements

- Post-closing integration and management transition planning

Case Study: A blockchain analytics company’s transaction required simultaneous BOT approval for payment service activities and SEC clearance for digital asset operations. The purchase agreement included detailed regulatory failure provisions, interim operating covenants, and a THB 5M reverse breakup fee structure. Professional coordination achieved regulatory approvals within 45 days, enabling on-schedule closing.

The Quantified Value of Professional M&A Advisory

Professional M&A advisors specializing in the FinTech sector deliver quantifiable improvements in transaction outcomes across multiple dimensions. Our analysis of comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led FinTech Business sales.

Figure 3: Impact of Using an M&A Advisor on FinTech Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: FinTech Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s FinTech sector continues to be one of the country’s most dynamic exit environments, with ฿1.1 trillion in market size and sustained double-digit growth creating strong opportunities for well-positioned businesses. Despite regulatory complexities—ranging from FBA restrictions to the Platform Economy Act—strategic buyers and private equity funds remain highly active, driving competitive valuations for scalable and compliant enterprises (PwC Thailand, 2025).

For FinTech owners considering a sale, the evidence is decisive: advisor-led processes deliver 25% higher valuations, nearly 40% faster timelines, and materially higher success rates compared to owner-direct transactions. With deal values often exceeding hundreds of millions of baht, the ROI from professional representation is significant, ensuring sellers capture maximum value while mitigating transaction risks.

Max Solutions’ integrated platform—combining M&A expertise, regulatory mastery via Tanormsak Law Firm, and proprietary buyer access—ensures Thai FinTech entrepreneurs achieve optimal outcomes in this complex environment. By applying the structured six-stage framework and engaging specialized advisory, business owners can maximize enterprise value and successfully complete what is often their most important financial transaction.

Frequently Asked Questions (FAQs)

Q: What is the typical timeline for selling a FinTech business in Thailand?

A: Professional advisory-managed transactions typically complete in 7-9 months, compared to 12-15 months for owner-led sales. The process includes 1 month preparation, 2-3 months solicitation and IOI collection, 1-month LOI negotiation, 3 months due diligence, and 1 month closing.

Q: How do foreign ownership restrictions impact FinTech business sales?

A: The Foreign Business Act generally limits foreign ownership to 49% for FinTech businesses. However, sophisticated deal structuring through asset purchases, Foreign Business License applications, or BOI promotion can enable 100% foreign ownership. These structures require specialized legal expertise and typically add 4-6 months to transaction timelines.

Q: What regulatory approvals are required for FinTech M&A transactions?

A: Requirements vary by business model but typically include BOT approval for payment services, SEC clearance for digital assets, FBA compliance for foreign ownership structures, and PDPA compliance verification for data processing activities.

What factors drive premium valuations in Thai FinTech M&A?

A: Key drivers include >60% recurring revenue, proprietary technology and IP, regulatory licenses and compliance, strong market position, scalable business model, and strategic fit with virtual banking or regional expansion initiatives.

Q: How significant is the valuation premium from using professional M&A advisory?

A: Research indicates advisor-led transactions achieve 10-30% higher valuations through competitive buyer processes, professional packaging, and strategic positioning. The advisory fee typically generates 2-4x return on investment through improved outcomes.

References

- Asian Development Bank. (2025). FinTech Revolution in Southeast Asia: Market Analysis and Growth Projections. https://www.adb.org/news/features/fintech-revolution-southeast-asia

- Bank of Thailand. (2025). Payment Systems and Services Regulation Framework. BOT Financial Innovation Department https://www.bot.or.th/English/PaymentSystems/PSOperators/Pages/default.aspx

- Bank of Thailand. (2025). Virtual Banking Guidelines and Licensing Framework. https://www.bot.or.th/en/financial-innovation/virtual-bank

- Deloitte Southeast Asia. (2025). M&A Trends in ASEAN FinTech: Valuation Analysis and Market Outlook. Deloitte Center for Financial Services. https://www2.deloitte.com/sg/en/pages/financial-services/articles/fintech-ma-trends.html

- McKinsey & Company. (2025). Global FinTech M&A Report: Valuation Trends and Transaction Analysis. McKinsey Global Institute. https://www.mckinsey .com/industries/financial-services/our-insights

- Personal Data Protection Committee Thailand. (2025). PDPA Implementation Guidelines for Financial Services. https://www.pdpa.or.th/

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th