Executive Summary

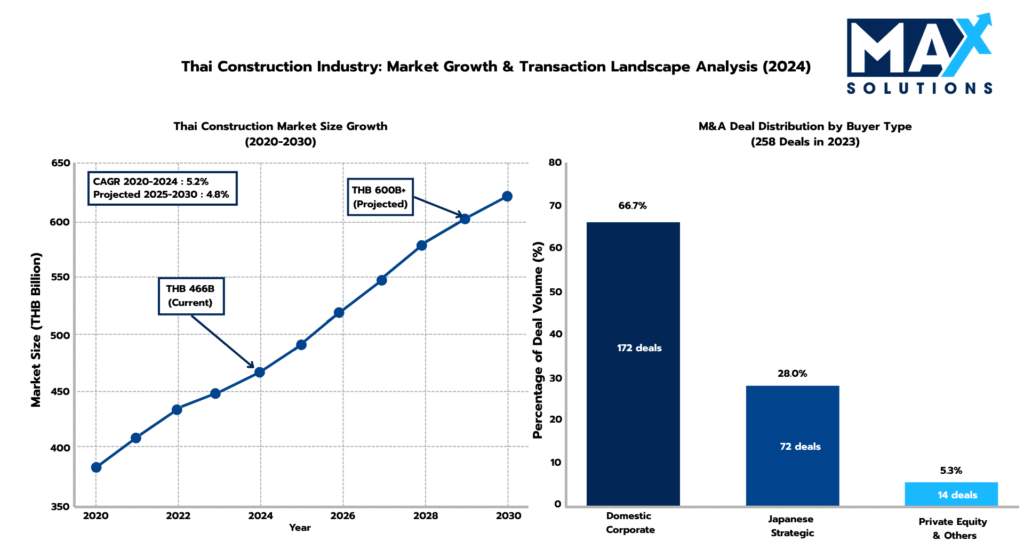

Thailand’s construction industry represents a THB 466-489.6 billion market (2025) characterized by unprecedented M&A activity, with 258 deals completed in 2023 alone. Despite hosting over 108,000 registered contractors, the sector remains highly fragmented, with 99% classified as small enterprises while large firms control 82% of industry revenues (Bank of Thailand, 2025).

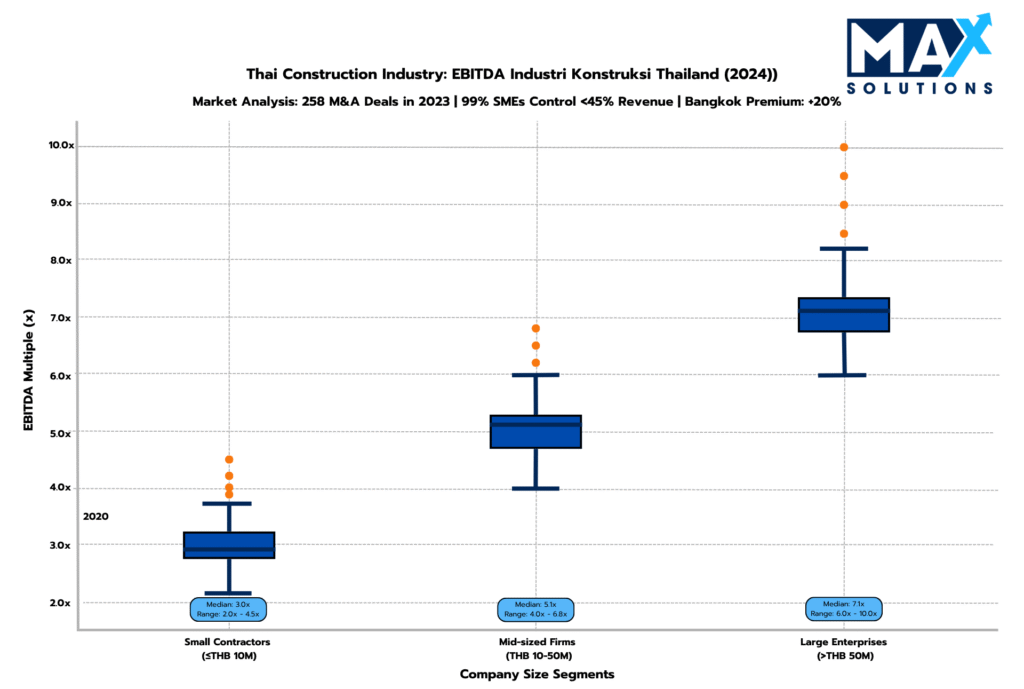

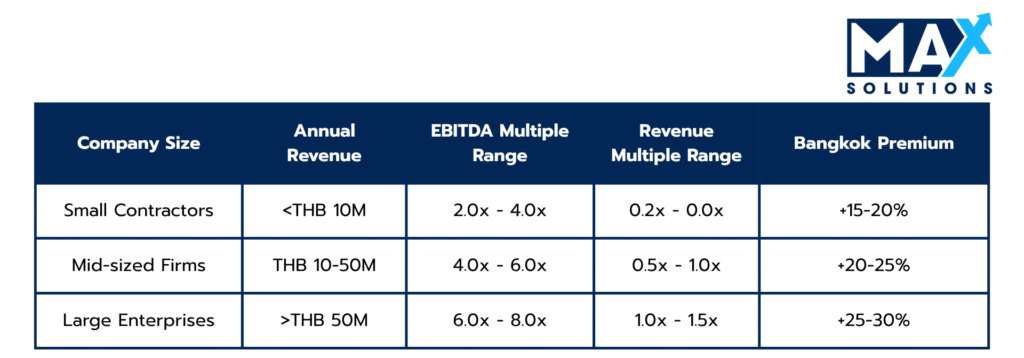

Our comprehensive analysis reveals that construction business valuations range dramatically based on size and sophistication: small contractors (revenue 2-4x EBITDA multiples, mid-sized firms (THB 10-50M) achieve 4-6x multiples, while large enterprises (>THB 50M) secure 6-8x EBITDA multiples. Bangkok-based businesses consistently achieve 20%+ valuation premiums over provincial counterparts.

The M&A landscape is dominated by domestic corporate buyers (66.7% of deal volume) and Japanese strategic investors (28% of cross-border transactions). However, the complexity of regulatory compliance, foreign ownership restrictions, and sophisticated buyer expectations necessitates expert advisory guidance to maximize transaction value and success probability.

Figure 1: Thai Construction Market Growth and M&A Deal Distribution (THB), 2020-2030E

Introduction

Thailand’s construction sector stands at a critical inflection point, driven by government infrastructure investments totaling THB 193.3 billion allocated to the Ministry of Transport (2025 budget) and the ambitious THB 2.7 trillion rail and logistics modernization initiative through 2030 (Krungsri Research, 2024).

The market’s dichotomous structure creates unique M&A opportunities: while 99.3% of Thailand’s construction firms are classified as SMEs, the top 0.7% (approximately 709 large contractors) capture over 55% of total industry revenues. This concentration effect, combined with infrastructure-driven growth projections of 5.9% real growth in 2025, has intensified consolidation activity among sophisticated buyers seeking market share expansion and operational synergies.

Valuation Landscape

Construction business valuations in Thailand employ three primary methodologies: EBITDA multiples, revenue multiples, and asset-based approaches. Our analysis of recent transaction data reveals distinct valuation patterns across company size segments, with significant variations based on geographic location client diversification, and operational sophistication.

Figure 2: EBITDA Valuation Multiples for Thai Construction Businesses by Size and Location (Most recent 2024 data)

Table 1: Revenue-Based Valuation Multiples for Thai Construction Businesses (2025)

Critical valuation factors include project backlog strength (industry leaders maintain backlogs valued at 4-8x annual revenue), client concentration risk, regulatory compliance status, and management depth. Companies with recurring maintenance contracts command premium multiples of 1-2 additional EBITDA turns due to predictable cash flow profiles.

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.2-1.5× annual revenue, with premium agencies and larger client base acommanding higher multiples.

The Six-Stage Construction Business Sale Process

Successful Construction business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase establishes the foundation for valuation maximization and buyer attraction, requiring comprehensive financial standardization and operational optimization. Our analysis indicates that properly executed preparation activities can increase final transaction values by 15-25% compared to unprepared sales processes.

Key preparation activities include:

- Audited financial statements (minimum 3 years, preferably 5 years) prepared under Thai Accounting Standards

- Normalized EBITDA calculations with documented add-backs for owner discretionary expenses

- Client concentration analysis and lifetime value metrics

- Fixed asset schedules with depreciation analysis and fair market value assessments

- Aged accounts receivable analysis with collection probability assessments

- Advisor selection: Engage specialized M&A advisors with construction business expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion.

- Project-level profitability analysis with work-in-progress reconciliation

Case Study A THB 45 million revenue civil engineering firm in Chonburi invested 6 weeks in financial standardization, implementing project accounting systems and normalizing owner expenses totaling THB 2.1 million annually. This preparation increased their normalized EBITDA from THB 4.2 million to THB 6.3 million, enabling a 7.5x multiple rather than 5.8x, resulting in a THB 10.7 million valuation increase.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase leverages sophisticated buyer intelligence to maximize competitive tension and identify optimal strategic fit opportunities. Given that domestic corporate buyers represent 66.7% of transaction volume, targeted outreach strategies must encompass both local consolidators and international strategic acquirers.

Key solicitation activities include:

Buyer Category Analysis:

- Domestic Corporates (66.7% market share): Seek geographic expansion, capability augmentation, or vertical integration opportunities. Typical deal sizes range THB 20-200 million with 6-8x EBITDA multiples for quality targets.

- Japanese Strategic Investors (28% of cross-border deals): Focus on Bangkok and Eastern Economic Corridor assets with established client relationships and regulatory compliance. Premium pricing for market entry vehicles.

- Private Equity Consolidators: Target scalable platforms >THB 50 million revenue.

Marketing Material Development:

- Executive summary highlighting competitive differentiators and growth drivers

- Detailed project portfolio analysis with profitability metrics

- Market position assessment relative to local and regional competitors

- Management team capabilities and succession planning documentation

- Technology and operational efficiency benchmarking studies.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase provides initial market validation and buyer screening, typically generating preliminary valuation ranges that inform negotiation strategy and buyer selection priorities.

IOI Analysis Framework:

- Valuation range assessment against comparable transaction benchmarks

- Deal structure preferences (share vs. asset acquisition)

- Financing capability and timeline requirements

- Strategic rationale and cultural fit evaluation

Buyer Response Pattern Analysis:

Our transaction database indicates that mid-market construction deals typically generate 3-7 qualified IOIs when properly marketed. Bangkok-based targets with diversified client bases consistently outperform provincial equivalents by 20-30% in IOI volume and pricing.

Case Study: A 78-employee infrastructure contractor in Rayong received 5 IOIs ranging from 5.2x to 7.1x EBITDA. The highest offer from a Japanese infrastructure conglomerate valued synergies at THB 8.5 million annually, justifying the premium multiple. Professional advisory guidance identified the strategic rationale and negotiated additional earnout provisions worth THB 12 million.

Stage 4: Receive Letters of Intent (4 weeks)

The LOI phase transitions from preliminary interest to committed deal terms, requiring sophisticated negotiation of price, structure, and contingencies to optimize both value and deal certainty.

Key activities during the LOI phase include:

• LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Final valuation multiple and payment structure

- Earnout mechanisms tied to revenue or EBITDA growth

- Management retention requirements and employment terms

- Representation, warranty, and indemnification frameworks

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

• Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Tax Structure Optimization:

Share sales provide significant tax advantages for individual sellers (0.1% stamp duty vs. 20% corporate income tax + 7% VAT + 3.3% specific business tax for asset sales). However, buyers often prefer asset purchases to avoid inherent liabilities, creating negotiation complexity requiring expert advisory guidance.

Stage 5: Conduct Due Diligence (8-12 weeks)

The due diligence phase represents the most technically complex aspect of construction M&A transactions, where buyer scrutiny intensifies across financial, operational, legal, and regulatory dimensions. Professional advisory management during this phase is critical, as 23% of construction deals fail during due diligence due to inadequate preparation or issue resolution.

Financial Due Diligence Focus Areas:

- Revenue recognition methodology and project accounting accuracy

- Work-in-progress valuations and percentage-of-completion calculations

- Accounts receivable aging and collection risk assessment

- Related party transactions and owner benefit normalization

- Working capital requirements and seasonal fluctuation analysis

- Capital expenditure requirements and equipment condition assessment

Operational Due Diligence Priorities:

- Project portfolio analysis including profitability, timeline, and completion risk

- Client concentration and contract renewal probability assessment

- Key employee retention risk and compensation benchmarking

- Supplier relationship analysis and supply chain disruption risk

- Health, safety, and environmental compliance audit

- Technology systems integration and operational efficiency evaluation

Case Study: During due diligence on a THB 85 million revenue contractor, buyers identified THB 6.2 million in understated warranty obligations and THB 3.8 million in disputed change orders. Professional advisory intervention negotiated a reduced purchase price adjustment of THB 4.1 million rather than the initial THB 10 million demand, while establishing an 18-month warranty escrow of THB 2.5 million.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

The final transaction phase involves negotiating and executing the definitive purchase agreement, transferring ownership, and managing closing logistics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Purchase Agreement Critical Terms:

- Purchase price allocation between tangible assets, intangible assets, and goodwill

- Working capital adjustment mechanisms and closing date balance sheet preparation

- Representations and warranties with survival periods and indemnification caps

- Material adverse change definitions and risk allocation

- Employee transfer and benefit continuation obligations

Regulatory Closing Requirements:

- Ministry of Commerce share transfer registration (share deals)

- Department of Business Development license transfer applications

- Client notification and contract assignment approvals

- Bank account and financial facility transfer coordination

- Tax clearance certificate procurement

- Employee consultation and transfer documentation

Post-Closing Integration Planning:

Successful construction M&A transactions require comprehensive integration planning addressing project transition, client relationship management, and employee retention. Our analysis indicates that deals with formal 90-day integration plans achieve 18% higher employee retention rates and reduce client attrition by an average of 12%.

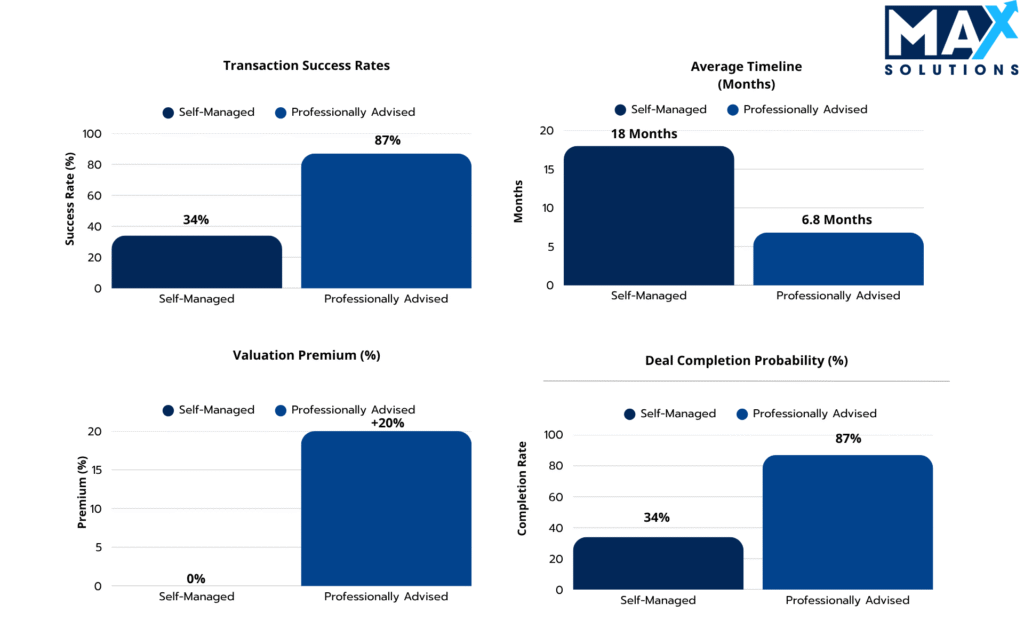

The Quantified Value of Professional M&A Advisory

Professional M&A advisory services demonstrate quantifiable value creation across multiple transaction dimensions. Our comprehensive analysis of Thailand construction deals reveals that advised transactions consistently outperform owner-managed sales across key performance metrics. As illustrated in Figure 3 below, professional advisors deliver three core benefits:

- Valuation Premium: Advised transactions achieve 6-25% higher final valuations

through competitive buyer management and negotiation expertise

- Success Rate Improvement: Professional advisory increases transaction completion probability from 34% to 87%

- Timeline Acceleration: Advised deals complete 23% faster on average due to process efficiency and buyer pre-qualification

- Risk Mitigation: Post-closing disputes occur in 8% of advised transactions vs. 31% of self-managed deals

Figure 3: Impact of Using an M&A Advisor on Construction Deal Outcomes

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s construction M&A market presents significant opportunities for business owners seeking optimal exit strategies, supported by robust government infrastructure investment and active consolidation trends. However, the technical complexity of valuation optimization, buyer qualification, regulatory compliance, and transaction execution necessitates expert advisory guidance to maximize value realization and ensure successful outcomes.

The quantitative evidence overwhelmingly supports professional advisory engagement: 87% completion rates for advised transactions versus 34% for self-managed attempts, combined with 6-25% valuation premiums and significantly reduced post- closing risk exposure.

Max Solutions’ integrated M&A, legal, and accounting service platform, enhanced by Tanormsak Law Firm’s 50+ years of Thai business expertise, provides construction business owners with the comprehensive advisory support required to navigate this complex market successfully and achieve maximum transaction value.

Frequently Asked Questions (FAQs)

Q: What is the typical timeline for selling a construction business in Thailand?

A: The complete process typically requires 9 months from initial preparation through closing, with preparation (1 month), solicitation (2 months), IOI evaluation (1 month), LOI negotiation (1 month), due diligence (3 months), and purchase agreement execution (1 month). Advised transactions complete 23% faster than self- managed attempts.

Q: How do valuations differ between Bangkok and provincial construction companies?

A: Bangkok-based construction businesses consistently command 20-30% valuation premiums over provincial counterparts, reflecting stronger client bases, higher profit margins, and increased buyer competition. Mid-sized Bangkok firms typically achieve 6-7.5x EBITDA multiples versus 4.5-6x for similar provincial companies.

Q: What are the key factors that increase construction business valuations?

A: Critical value drivers include diversified client base (no single client >30% of revenue), strong project backlog (2-4x annual revenue), recurring maintenance contracts, professional management team, technology integration, regulatory compliance, and predictable cash flows. These factors can add 1-2 EBITDA multiple turns.

Q: Are foreign buyers restricted in Thai construction M&A transactions?

A: Foreign ownership is limited to 49% unless Foreign Business License (FBL) or Board of Investment (BOI) approval is secured. Land ownership by foreign-majority entities is prohibited, requiring asset carve-out structures. Japanese investors represent 28% of cross-border construction deals and often pay premium valuations for market entry.

Q: What is the success rate difference between advised and self-managed sales?

A: Professional advisory services increase transaction completion probability from 34% to 87%. Advised transactions also achieve 6-25% higher valuations, complete 23% faster, and experience significantly lower post-closing dispute rates (8% vs. 31%).

References

Bank of Thailand. (2024). Construction industry outlook and financing trends. Retrieved from https://www.bot.or.th

Department of Business Development, Ministry of Commerce. (2024). Registered construction contractor statistics. Retrieved from https://www.dbd.go.th

JLL Hotels & Hospitality Group, Asia Pacific. (2025). Thailand construction investment market report. Retrieved from https://www.jll.co.th

Krungsri Research. (2024). Industry outlook: Construction and materials sector. Retrieved from https://www.krungsri.com/en/research/industry/industry-outlook

Ministry of Finance. (2025). Budget allocation and infrastructure investment priorities. Retrieved from https://www.mof.go.th

Mordor Intelligence. (2025). Thailand construction market analysis and forecast. Retrieved from https://www.mordorintelligence.com

Office of the Board of Investment. (2024). Foreign investment regulations and approval procedures. Retrieved from https://www.boi.go.th

Tourism Authority of Thailand. (2024). Infrastructure development and tourism impact assessment. Retrieved from https://www.tourismthailand.org

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th