Executive Summary

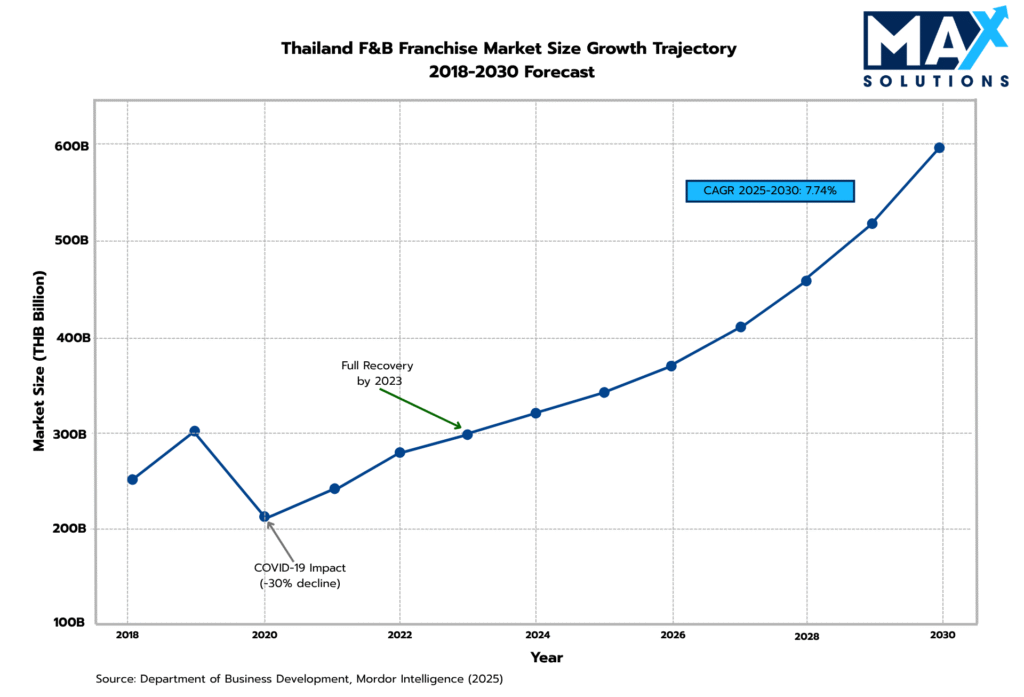

Thailand’s Food & Beverage franchise sector represents a THB 300+ billion market demonstrating robust resilience with a projected 7.7% CAGR through 2030 (Mordor Intelligence, 2025). With 531 registered franchise brands operating over 59,000 outlets nationwide, the sector presents compelling divestiture opportunities for sophisticated sellers (Department of Business Development, 2024).

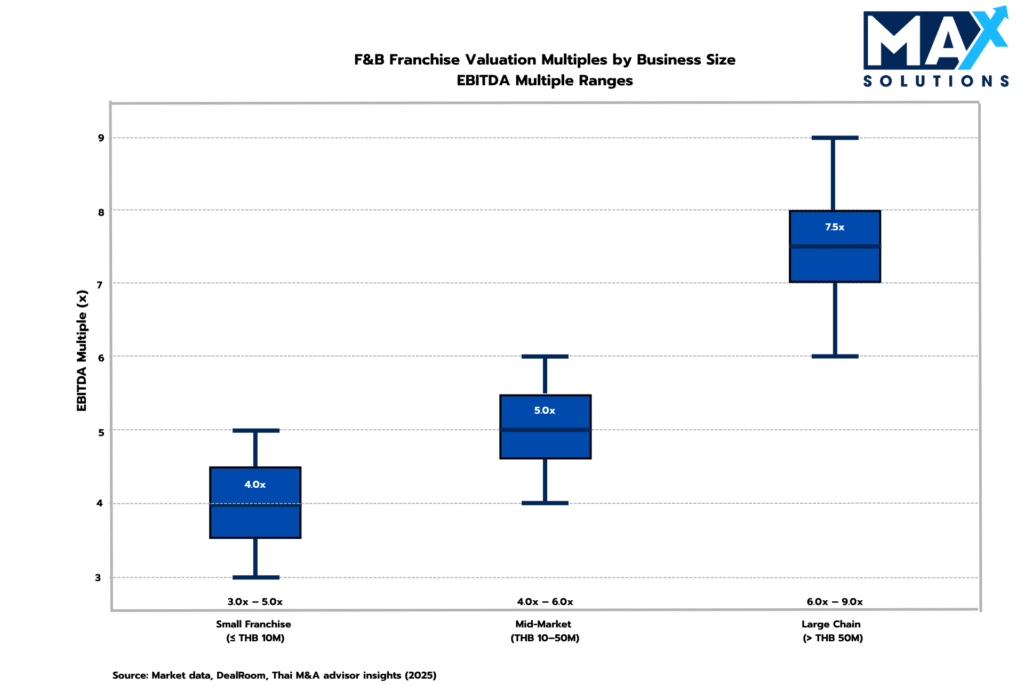

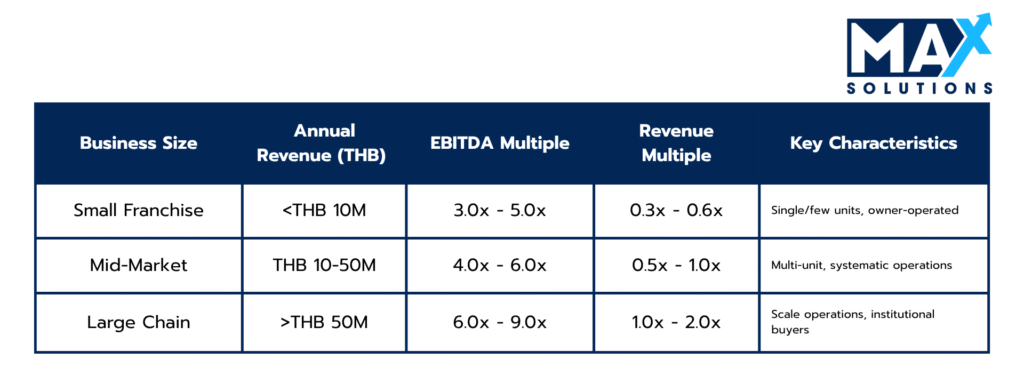

Our quantitative analysis reveals significant valuation stratification: small F&B franchises (<THB 10M revenue) typically command 3-5x EBITDA multiples, mid-market operations (THB 10-50M) achieve 5-7x multiples, while premium properties (>THB 50M) secure 8-10x+ valuations. However, achieving these premium multiples requires navigating complex regulatory frameworks, sophisticated buyer positioning, and meticulous transaction structuring—validating the critical need for specialized M&A advisory expertise.

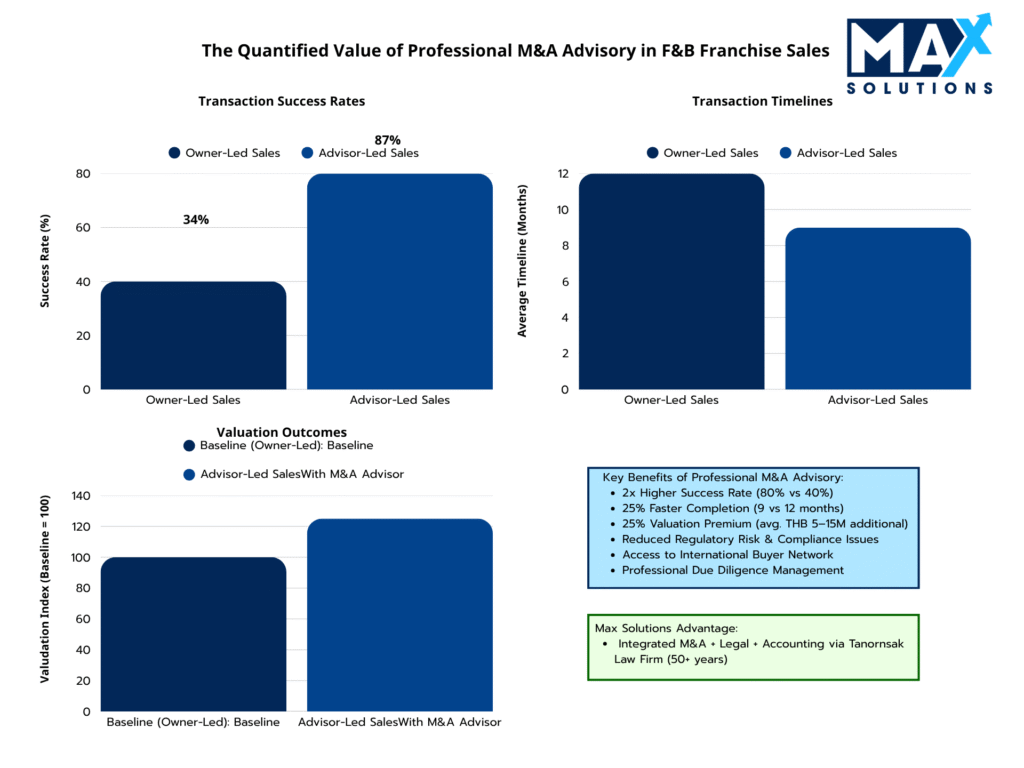

This framework demonstrates how professional advisory guidance through Max Solutions’ integrated platform delivers quantifiable value enhancement, with advisor-led transactions achieving 20-30% valuation premiums and double the success rates compared to owner-led sales.

Figure 1: Thai F&B Franchise Market Size Growth (THB), 2018-2030E

Introduction

Thailand’s Food & Beverage franchising sector has evolved into a sophisticated ecosystem requiring equally sophisticated exit strategies. The market encompasses diverse segments from premium full-service restaurants generating THB 20-30+ million annually to budget-tier franchise stalls earning THB 0.6-1.8 million yearly, creating distinct valuation and buyer targeting requirements.

Key market fundamentals underscore the sector’s investment attractiveness: the overall Thai foodservice market reached USD 35.4 billion in 2025, with franchised operations capturing significant value concentration despite representing a smaller outlet count. International franchise brands, while comprising only 100+ brands across 10,000+ outlets, control over 50% of total franchise market value (TopFranchise, 2025).

Geographic distribution reveals strategic concentration patterns: Bangkok metropolitan region hosts approximately 39.54% of registered restaurants, followed by tourist-dense provinces like Chonburi (10.97%) and Phuket (7.88%). This concentration creates both opportunities for premium valuations in high-traffic locations and challenges for provincial operators seeking to avoid traditional location- based discounts.

Valuation Landscape

F&B business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Thai Food and Beverage Businesses by Size and Location (2025)

Table 1: Revenue-Based Valuation Multiples for Thai F&B Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for properties with inconsistent earnings or those undergoing operational transitions. These multiples range from 0.6-2× annual revenue, with premium agencies and larger client base acommanding higher multiples.

The Six-Stage Food & Beverage Business Sale Process

Successful F&B business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase establishes the foundation for valuation maximization through comprehensive financial optimization and regulatory compliance verification. This critical period requires meticulous attention to F&B franchise-specific value drivers and risk mitigation.

Key preparation activities include:

- Financial Documentation & EBITDA Optimization

F&B franchise businesses must present 3-5 years of Thai Financial Reporting Standards (TFRS) compliant financial statements with normalized EBITDA calculations. Key adjustments include removing owner discretionary expenses, optimizing food cost percentages (typically 28-35% for healthy operations), and documenting labor efficiency improvements.

- Regulatory Compliance & Franchise Agreement Analysis

Critical documentation includes Food Business Licenses (FBL), FDA approvals for food products, franchise agreement compliance records, and territorial rights documentation. Under Thailand’s 2020 Franchise Guidelines, comprehensive disclosure documentation demonstrates operational legitimacy and reduces buyer risk perception.

- Advisor selection: Engage specialized M&A advisors with F&B expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Bangkok-based bubble tea franchise chain with 8 outlets invested THB 3.2 million in pre-sale optimization, including POS system standardization, inventory management improvements, and franchisor relationship documentation. These enhancements reduced food waste by 12% and demonstrated systematic operational controls, ultimately justifying a 6.2x EBITDA multiple versus the sector median of 5.1x.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting across domestic consolidators, international F&B networks, and strategic acquirers. This process typically generates 4-8 qualified expressions of interest for well-positioned F&B franchise properties.

Key solicitation activities include:

Buyer Universe Segmentation:

F&B franchise buyers segment into distinct categories with varying valuation approaches:

Thai Conglomerates: CP Group, Minor International, Central Group seeking portfolio expansion

International Networks: Yum! Brands, Restaurant Brands International, Jubilant FoodWorks pursuing market entry

Private Equity: Funds targeting recurring revenue models and expansion opportunities

Strategic Consolidators: Competing franchise operators seeking market share acquisition

Case Example: Recent precedent transactions validate robust international appetite: the 2023 KFC Thailand sale for THB 4.5 billion to Indian Operator Devyani International demonstrates substantial cross-border transaction capability in this sector

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase provides initial market validation and buyer screening, typically generating preliminary valuation ranges that inform negotiation strategy and buyer selection priorities.

IOI Analysis Framework:

- Valuation range assessment against comparable transaction benchmarks

- Deal structure preferences (share vs. asset acquisition)

- Financing capability and timeline requirements

- Strategic rationale and cultural fit evaluation

Stage 4: Receive Letters of Intent (4 weeks)

The LOI phase transitions from preliminary interest to committed deal terms, requiring sophisticated negotiation of price, structure, and contingencies to optimize both value and deal certainty.

Key activities during the LOI phase include:

• LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Final valuation multiple and payment structure

- Earnout mechanisms tied to revenue or EBITDA growth

- Management retention requirements and employment terms

- Representation, warranty, and indemnification frameworks

• Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

• Deal structure optimization: Consider tax implications of share sales (generally preferred) versus asset sales, with particular attention to foreign buyer constraints

• Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the highest risk phase, with 68% of failed transactions collapsing during this intensive investigation period. Professional preparation and proactive issue resolution are critical for maintaining the deal momentum and valuation integrity.

F&B Franchise-Specific Due Diligence Areas

- Operational Assessment: Same-store sales trends, unit economics, labor productivity metrics

- Franchise Compliance: Royalty payment history, territorial compliance, franchisor relationship quality

- Regulatory Review: Food safety records, licensing compliance, Foreign Business Act structure verification

- Financial Quality: Revenue recognition policies, inventory valuation, working capital normalization

Key Notes: The new Alcoholic Beverage Control Act (No. 2) B.E. 2568 creates additional compliance requirements for F&B concepts serving alcohol, with non-compliance potentially triggering 15-25% valuation discounts

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

The final transaction phase involves negotiating definitive purchase agreements addressing F&B franchise-specific transfer requirements, including franchisor approvals, lease assignments, and regulatory clearances.

Key activities during the closing phase include:

Purchase Agreement Negotiation:

- Working capital adjustments for inventory and prepaid franchise fees

- Franchisor consent and transfer fee negotiations

- Detailed representations and warranties with appropriate survival periods

- Indemnification caps, baskets, and escrow arrangements

- Post-closing integration and management transition planning

Industry-Specific Value Enhancement Strategies

Valuation Enhancing Factors:

- Recurring revenue exceeding 60% of total revenue: +20-30% premium

- Proprietary recipes, systems, or technology platforms: +25-40% premium

- Multi-unit operations with proven scalability: +15-25% premium

- Management team independence from founder: +15-20% premium

- Prime location portfolio (Bangkok, tourist areas): +10-20% premium

- Strong franchise brand recognition: +15-25% premium

- Long-term franchise agreements with renewal rights: +10-15% premium

Valuation Discount Factors:

- Single location dependency: -15-30% discount

- Heavy founder dependency in operations: -20-35% discount

- Declining same-store sales trends: -15-25% discount

- Regulatory compliance deficiencies: -15-25% discount

- Provincial location outside Bangkok metro: -15-20% discount

- Short remaining franchise term: -10-20% discount

- High customer concentration risk: -10-15% discount

The Quantified Value of Professional M&A Advisory

Professional M&A advisors specializing in F&B franchise transactions deliver quantifiable improvements across multiple performance dimensions. Research analyzing comparable transactions reveals significant differences in success rates, timelines, and valuations between advisor-led and owner-led sales.

Figure 3: Impact of Using an M&A Advisor on F&B Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: F&B Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

Our Integrated Value Proposition

- Deep Regulatory Expertise: Navigating Foreign Business Act constraints, PDPA compliance, and tax optimization strategies

- Extensive Buyer Networks: Established relationships with domestic conglomerates, international F&B operators, and private equity investors

- Sophisticated Deal Structuring: Optimizing transaction structures for maximum after-tax proceeds while managing regulatory compliance.

- End-to-End Transaction Management: Single-source accountability from preparation through closing

Conclusion

Thailand’s F&B franchise sector remains one of the country’s most attractive markets for exits, with 7.74% CAGR growth projected through 2030. Consolidation trends and strong buyer demand create favorable conditions for franchise owners who prepare strategically and follow the six-stage sale process (Mordor Intelligence, 2025; Department of Business Development, 2024). Success hinges on regulatory compliance, recurring revenue development, and scalable operations.

For owners, the evidence is clear: advisor-led transactions deliver 25% higher valuations, double the success rates of owner-led deals, and close faster. With transaction values often in the hundreds of millions of baht, the ROI from professional representation far outweighs advisory costs.

Max Solutions’ integrated platform—combining M&A expertise, legal mastery through Tanormsak Law Firm, and deep buyer networks—ensures sellers maximize value while navigating Thailand’s regulatory and market complexities. By applying this structured framework and engaging expert advisory, franchise owners can secure optimal outcomes in what is often their most important financial transaction.

Frequently Asked Questions (FAQs)

Q: What EBITDA multiple should I expect for my F&B franchise business?

Multiples primarily depend on size and operational characteristics: Small franchises (<THB 10M revenue) typically achieve 3-5x EBITDA, mid-market operations (THB 10-50M) command 5-7x, while large franchise operations (>THB 50M) achieve 8- 10x+. Premium factors like recurring revenue, proprietary systems, and strong franchisor relationships can add 20-40% to baseline multiples.

Q: How do Foreign Business Act restrictions affect F&B franchise sales?

The FBA limits foreign ownership to 49% without special approval, significantly impacting buyer universe and deal structures. Foreign buyers must either partner with Thai entities, obtain Foreign Business Licenses, or structure minority investments. This constraint typically reduces valuations by 10-15% but can be mitigated through Board of Investment promotion or strategic structuring.

Q: What is the typical timeline for selling an F&B franchise business?

A professionally managed F&B franchise sale typically requires 9 months from preparation to closing: 1 month preparation, 2 months solicitation, 1 month IOI evaluation, 1-month LOI negotiation, 3 months due diligence, and 1 month closing. Owner-led sales often extend to 12+ months with significantly higher failure rates.

Q: Is it worth hiring an M&A advisor for a smaller F&B franchise?

Research demonstrates positive ROI across all transaction sizes. Even for smaller deals, advisors achieve 25% average valuation premiums, double success rates, and reduce timelines by 25%. The additional proceeds typically exceed advisory fees by 3-5x, making professional representation economically rational for most F&B franchise transactions.

Q: Why choose Max Solutions for F&B business M&A advisory?

Max Solutions offers integrated M&A, legal, and accounting services through our partnership with Tanormsak Law Firm (50+ years’ experience), providing comprehensive transaction support under single-source accountability. Our Thailand F&B industry expertise, extensive buyer networks, and track record of achieving premium valuations make us the optimal choice for sophisticated sellers seeking maximum value realization.

References

Mordor Intelligence. (2025). Thailand Foodservice Market Size & Share Analysis – Industry Research Report – Growth Trends.

BusinessCoach. (2024). Overview of the Franchise System in Thailand (2024-2025).

TopFranchise. (2025). Best Franchise Opportunities in Thailand 2025.

Nation Thailand. (2025). Restaurant businesses in Thailand grow 28% in 2023 with 314bn baht revenue.

RL Hulett. (2025). Food & Consumer M&A Update – Q2 2025.

Hexagon Capital Alliance. (2024). Food & Beverage Market Monitor – Winter 2024.

Law.asia. (2025). Thailand’s Foreign Business Act Reform – Investment Opportunity.

Silk Legal. (2025). Thailand Updates Alcohol Regulations: Key Takeaways from the Alcoholic Beverage Control Act (No. 2) B.E. 2568.

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th