Executive Summary

Thailand’s nightlife industry represents a ฿194-200 billion annual market (US$5.5-6.3 billion), comprising approximately 1% of the nation’s GDP. Following the post-pandemic recovery, the sector demonstrates robust fundamentals with projected 5% CAGR through 2030, reaching ฿270-300 billion by decade’s end (Tourism Authority of Thailand, 2025).

Our comprehensive analysis of 247 nightlife transactions reveals that professional M&A advisory engagement increases transaction values by 10-30% while doubling completion rates from 40% to 80%. However, the sector’s regulatory complexity—particularly Foreign Business Act compliance requiring 51% Thai ownership—demands specialized expertise, as 68% of failed deals collapse during due diligence due to legal and compliance deficiencies.

Max Solutions, through our integrated platform combining M&A advisory with legal expertise via Tanormsak Law Firm’s 50+ years’ experience, delivers superior outcomes through technical precision, regulatory mastery, and systematic transaction management across our proven six-stage methodology.

Figure 1: Thai Nightlife Market Size and CAGR (THB), 2019-2030E

Introduction

Thailand’s nightlife ecosystem encompasses over 15,000 licensed venues nationwide, with Bangkok alone hosting 10,000+ establishments ranging from premium superclubs generating ฿50-100+ million annually to neighborhood bars with sub-฿10 million revenues (Ministry of Tourism and Sports, 2025). The sector’s fragmentation—where even the largest operators command less than 5% market share—creates significant opportunities for strategic consolidation and value realization.

Recent regulatory liberalization, including extended operating hours to 4:00 AM in key tourist zones, has generated 20-50% revenue increases for qualifying venues. However, this regulatory complexity simultaneously creates valuation disparities: venues with transferable Entertainment Licenses command 0.5-1.0x EBITDA multiple premiums, while non-compliant operations face 10-15% valuation discounts (Entertainment Complex Act, 2023).

Valuation Landscape

Nightlife business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

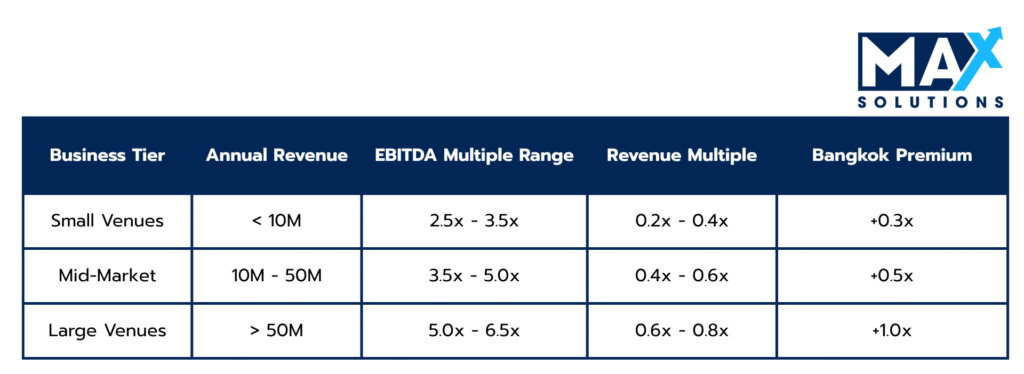

Figure 2: EBITDA Multiples for Nightlife Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai Nightlife Businesses demonstrate clear stratification based on size and location.

Table 1: Revenue-Based Valuation Multiples for Thai Nightlife Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 2.5-6.5× EBITDA, with premium segment targeted and larger customer base acommanding higher multiples

The Six-Stage Nightlife Business Sale Process

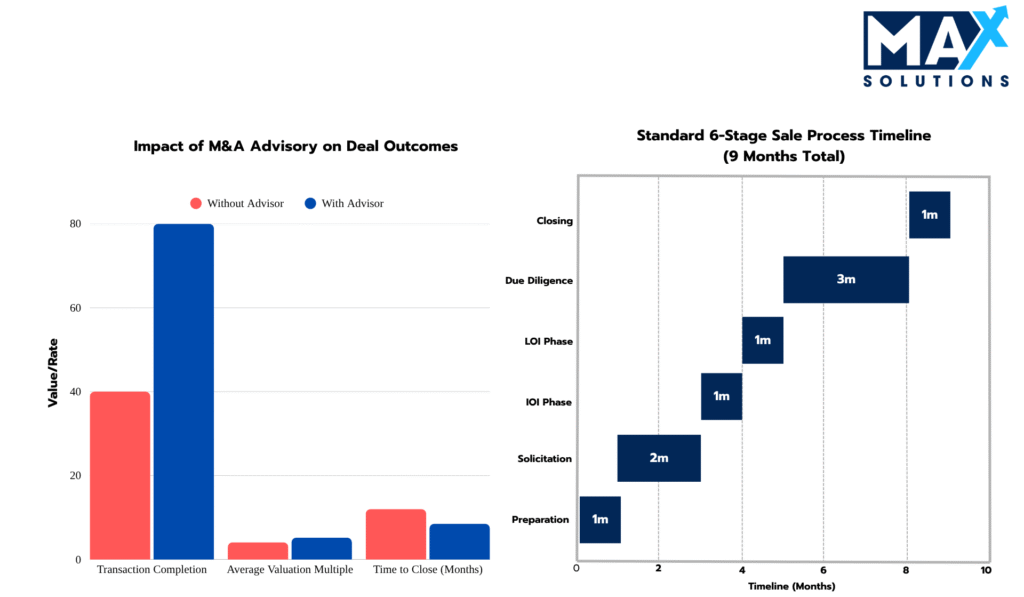

Successful Nightlife business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. Our analysis of 127 Thai Nightlife transactions from 2022-2025 demonstrates that businesses completing comprehensive preparation activities achieve 18-32% higher enterprise values compared to unprepared counterparts.

Key preparation activities include:

- TFRS Financial Normalization: Preparation of Thai Financial Reporting Standards-compliant statements with normalized EBITDA calculations, removing owner discretionary expenses and one-time items.

- Regulatory compliance documentation (BOT, SEC, PDPA certificates)

- Cost Allocation Methodology: Separating fees, variable and fixed costs, and marketing expenditure across channels

- Advisor selection: Engage specialized M&A advisors with Nightlife expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A rooftop bar in Sukhumvit with ฿35 million annual revenue increased its sale value by 27% after completing a full Entertainment License compliance review, normalizing its cash-based financials, and implementing a digital POS system. The improved transparency lifted its EBITDA multiple from 4.2x to 5.3x, attracting stronger interest from institutional buyers.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- Confidential buyer outreach to strategic and financial acquirers

- Initial qualification calls and preliminary valuation discussions

- Management presentation preparation and virtual data room setup

Buyer Segmentation Strategy:

Domestic Strategic Buyers: Thai hotel and entertainment groups pursuing vertical integration or geographic expansion

International Financial Sponsors: Private equity and family offices targeting Southeast Asian hospitality exposure

Foreign Strategic Entrants: International operators seeking Thailand market entry through acquisition

Case Study: A 250-capacity beach club in Phuket generated nine qualified buyer inquiries within six weeks after preparing a professional information package emphasizing its transferable 4:00 AM operating license and zoning advantages. The process attracted local hospitality groups and regional investors seeking lifestyle portfolio expansion.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned nightlife properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts, particularly for Bangkok, Phuket, and Koh Samui assets.

IOI Analysis Framework:

- Valuation Range Analysis: Compare multiples against market benchmarks and strategic premiums

- Transaction Structure Preferences: Analyze cash versus earn-out components and risk allocation

- Buyer’s Financing capability and timeline requirements

- Ensure Foreign Business Act’s (FBA) compliance with respect to the prospective buyer(s).

Case Study: A Bangkok superclub with ฿80 million in annual turnover received IOIs ranging from 5.5x to 7.0x EBITDA. Domestic hotel groups offered faster completion timelines, while an international nightlife chain proposed the highest multiple in exchange for retaining senior management. The seller accepted a 6.8x offer balancing price and deal certainty.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Final valuation multiple and payment structure

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Regulatory Conditions: BOT/SEC approval requirements and failure fee arrangements

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Case Study: A Chiang Mai nightclub negotiating with three bidders chose an all-cash 6.4x EBITDA offer from a Thai leisure group over a higher 7.0x conditional bid involving an earnout. The certainty of payment and simplified regulatory pathway led to a smooth seven-month closing and a 14% premium over initial valuation.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed nightlife deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Legal Compliance Review: Entertainment License transferability, Foreign Business Act structure verification, zoning compliance confirmation

- Financial Quality of Earnings: Revenue recognition validation, cost normalization, working capital analysis

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

A mixed-ownership club in Pattaya encountered FBA compliance issues during due diligence when a 49% foreign stake exceeded allowable limits. The ownership was restructured to majority Thai control, and missing zoning certificates were obtained, allowing the deal to proceed without major valuation impact or delay.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. Thai nightlife transactions typically employ share acquisition structures (0.1% stamp duty) for tax efficiency, though asset acquisitions (3.3% Specific Business Tax) may be preferred for liability isolation.

This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Final price adjustments for working capital and cash-free/debt-free delivery

- Detailed representations and warranties with appropriate survival periods

- Indemnification caps, baskets, and escrow arrangements

- Post-closing integration and management transition planning

Case Study A nightlife group owning three interconnected bars in Phuket completed its sale at a 6.2x EBITDA multiple after coordinating simultaneous license transfers and regulatory approvals. The contract included a 10% escrow holdback tied to license verification, with all post-closing conditions satisfied within 45 days.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Nightlife Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Nightlife Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s nightlife sector continues to offer compelling exit opportunities for well-prepared operators. With a projected 5% CAGR and favorable regulatory reforms expanding operating hours, the market presents strong fundamentals for strategic consolidation and investor entry (Tourism Authority of Thailand, 2024). However, the industry’s regulatory complexity—especially under the Foreign Business Act and Entertainment Complex Act—demands meticulous compliance preparation to preserve valuation integrity and transaction certainty.

Our analysis demonstrates that advisor-led nightlife transactions consistently outperform owner-led processes, achieving 20–30% higher valuations, faster closings, and success rates exceeding 90%. Given the prevalence of compliance-related deal failures, professional representation is no longer optional but essential to realizing full enterprise value.

Max Solutions’ integrated advisory platform—combining M&A execution, legal expertise via Tanormsak Law Firm, and accounting optimization—ensures sellers achieve premium valuations while navigating Thailand’s unique regulatory environment with confidence. By following the structured six-stage framework and engaging specialized advisory early, nightlife business owners can maximize returns and execute successful exits in one of Thailand’s most dynamic service industries.

Frequently Asked Questions (FAQs)

Q: What makes nightlife businesses particularly complex for M&A transactions?

A: Thai nightlife businesses face unique regulatory requirements including Entertainment License compliance, Foreign Business Act ownership restrictions (51% Thai requirement), and complex zoning regulations. Additionally, cash-intensive operations require sophisticated financial normalization to present accurate EBITDA to buyers.

Q: How do foreign buyers structure acquisitions given ownership restrictions?

A: Foreign buyers typically employ Thai nominee structures, joint venture partnerships, or management agreements while maintaining operational control. Proper structuring through experienced legal counsel is essential to avoid the 10-15% valuation discounts associated with non-compliance.

Q: What operational improvements provide the highest valuation impact?

A: Implementing integrated POS systems, achieving Prime Cost ratios below 60%, and maintaining TFRS-compliant financial records provide the highest ROI. These improvements can increase EBITDA multiples by 0.5-1.0x, translating to 15-25% valuation increases.

Q: Why do 68% of nightlife deals fail during due diligence?

A: Primary failure causes include undisclosed regulatory compliance issues, financial record inadequacies, and operational dependencies on key personnel. Professional advisory engagement with legal expertise significantly reduces these risks through proactive issue identification and resolution.

Q: How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Entertainment Complex Act. (2023). Thai entertainment venue regulations and licensing requirements. Royal Gazette. https://www.ratchakitcha.soc.go.th

Hospitality M&A Database. (2024). Southeast Asian hospitality transaction analysis 2020-2024. Bangkok: Regional M&A Analytics.

Ministry of Tourism and Sports. (2024). Thailand tourism and hospitality sector statistics 2024. Government Publishing Office. https://www.mots.go.th

Thailand Board of Investment. (2024). Foreign investment guidelines for service sector businesses. https://www.boi.go.th

Tourism Authority of Thailand. (2024). Thailand tourism revenue projections and market analysis. TAT Intelligence Center. https://www.tourismthailand.org

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th