Executive Summary

Thailand’s chemical and plastics manufacturing sector represents a ฿1.3 trillion industry accounting for 6-7% of GDP, with robust growth projections of 5.4% revenue CAGR through 2030 (Krungsri Research, 2025). This market expansion, driven by specialty product migration and regional export positioning, has created exceptional exit opportunities for well-prepared owners.

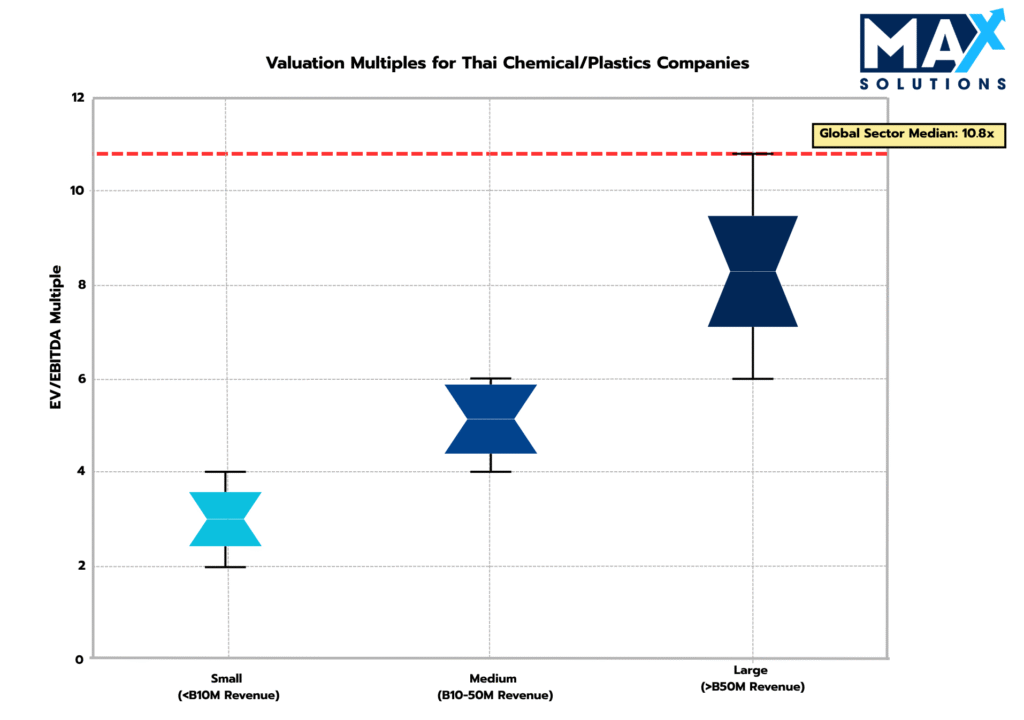

Our analysis reveals that chemical/plastics companies achieving premium valuations—approaching the global sector median of 10.8x EV/EBITDA—systematically address five critical value drivers: revenue quality through recurring contracts, demonstrated growth trajectory, operational differentiation, competitive advantages via IP or strategic location, and diversified customer concentration. Companies in the large enterprise segment (>฿50M revenue) typically command 6-8x+ EBITDA multiples, while Bangkok-based operations achieve 20-30% premiums over provincial counterparts.

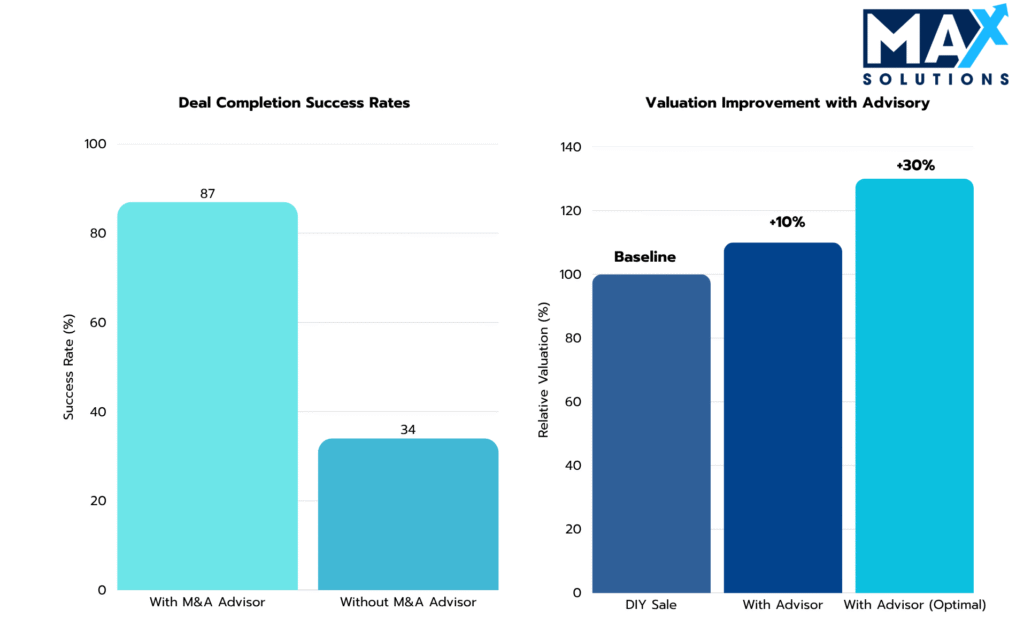

The structured 9-month sale process, when executed with professional M&A advisory, increases completion probability from 34% to 87% while delivering 10-30% valuation premiums. Max Solutions’ integrated offering—combining M&A advisory, legal services through Tanormsak Law Firm (50+ years experience), and accounting expertise—provides the comprehensive support essential for navigating Thailand’s complex regulatory environment and achieving superior exit outcomes.

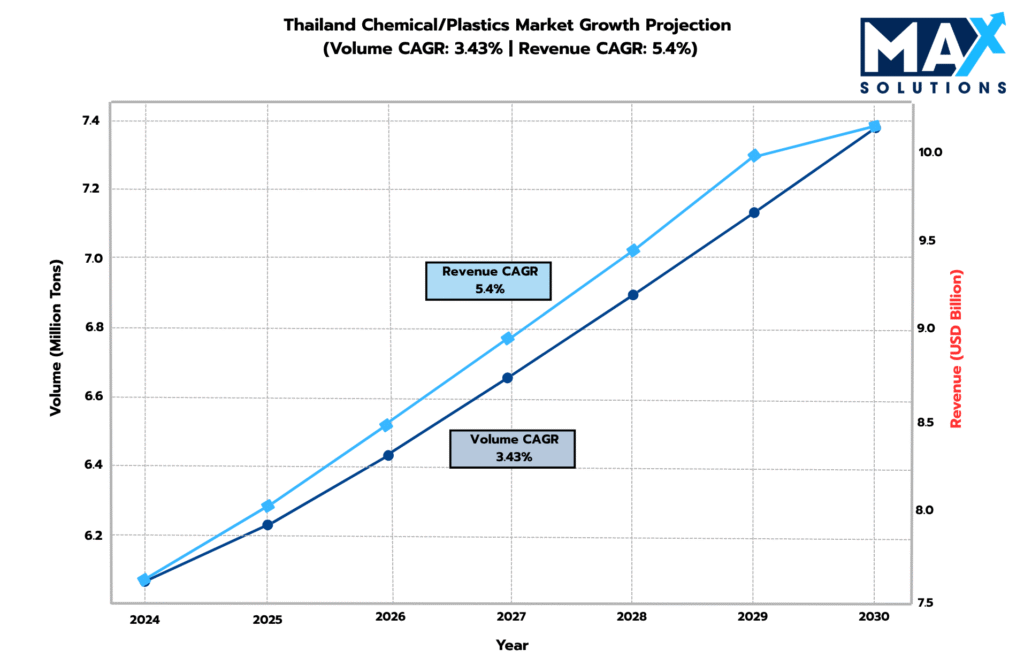

Figure 1: Thai Chemical/Plastics Manufacturing Market Size Growth (THB), 2024-2030E

Introduction

Thailand’s chemical and plastics manufacturing industry has emerged as a cornerstone of Southeast Asia’s industrial economy, with 3,217 registered manufacturers generating approximately ฿1.3 trillion in annual revenue as of 2023 (Krungsri Research, 2025). The sector’s strategic importance extends beyond domestic consumption, with Thailand positioning itself as the region’s leading petrochemical producer and a critical link in global supply chains.

Recent market dynamics have fundamentally shifted the M&A landscape. The notable divergence between volume growth (3.43% CAGR) and revenue expansion (5.4% CAGR) through 2030 indicates a structural transformation toward higher-value, specialized manufacturing—creating premium exit opportunities for strategically positioned companies (Grand View Research, 2025).

This report provides a quantitative framework for chemical and plastics manufacturers contemplating strategic exits, detailing the precise methodologies, timelines, and value optimization strategies that distinguish successful transactions in Thailand’s sophisticated M&A environment.

Valuation Landscape

Chemical/Plastics Manufacturing business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Thai Chemical/Plastics Manufacturing Businesses by Size (2025)

The global sector median of 10.8x EV/EBITDA represents the premium threshold achievable through systematic risk elimination and growth demonstration. Bangkok-based operations consistently command 20-30% valuation premiums due to infrastructure advantages, talent access, and proximity to financial markets.

The Thai chemical and plastics market demonstrates robust fundamentals with projected revenue reaching US$10.13 billion by 2030. The 2.0 percentage point spread between revenue and volume growth indicates successful value migration toward specialty products, directly impacting M&A valuations for companies positioned in high-margin segments (6Wresearch, 2025)

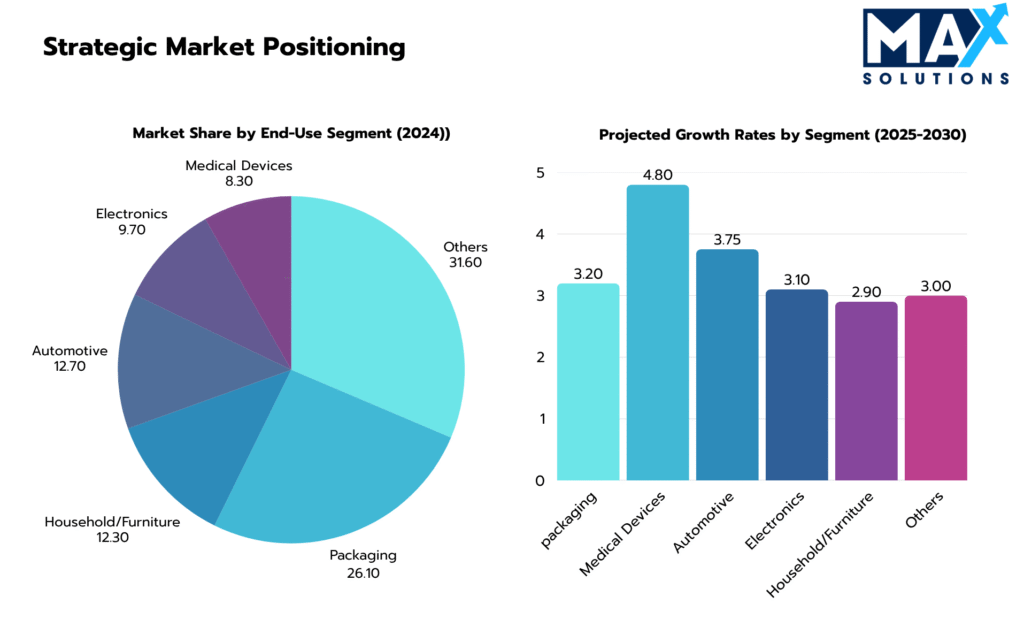

While packaging dominates current market share (26.1%), M&A premium valuations increasingly focus on high-growth specialty segments. Medical devices represent the fastest-growing end-use category, while automotive plastics benefit from Thailand’s ‘30@30 policy‘ targeting 30% EV production by 2030 (Thailand Board of Investment, 2024)

The Six-Stage Chemical/Plastics Manufacturing Business Sale Process

Successful Chemical/Plastics Manufacturing business transactions in Thailand follow a structured 9-month process, with each stage containing specific deliverables, risk mitigation activities, and value optimization opportunities. Professional execution of this framework increases completion probability from 34% to 87% while capturing 10-30% valuation premiums.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. Our analysis of Thai Chemical/Plastics Manufacturing transactions demonstrates that businesses completing comprehensive preparation activities achieve 15-35% higher enterprise values compared to unprepared counterparts.

Key preparation activities include:

- TFRS Financial Normalization: Preparation of Thai Financial Reporting Standards-compliant statements with normalized EBITDA calculations, removing owner discretionary expenses and one-time items.

- Financial Normalization: Eliminate owner-specific expenses, document EBITDA add-backs, and ensure 3-5 years of audited statements compliant with Thai GAAP/IFRS standards

- Operational Excellence: Implement capacity utilization monitoring, margin stability analysis, and quality certification updates (ISO 9001, ISO 14001)

- ESG Positioning: Document circular economy investments, recycling capabilities, and sustainable feedstock initiatives—increasingly critical for international buyers

- Legal Compliance: Resolve outstanding tax issues, update Board of Investment (BOI) promotions, and ensure complete licensing documentation

- Advisor selection: Engage specialized M&A advisors with Chemical/Plastics Manufacturing expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Rayong specialty plastics maker with ฿45M revenue lifted its exit multiple from 5.8× to 7.2× after a 60-day tune-up: audited TFRS statements with clear add-backs, ISO 9001/14001 recertification, BOI promotion confirmed, and a ฿4M energy-efficiency retrofit that added ฿1.5M EBITDA; the documented ESG gains helped unlock interest from EU buyers.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- Strategic Buyers: Focus on supply chain integration, geographic expansion, or technology acquisition

- Financial Buyers: Private equity groups targeting 25-100% equity stakes in manufacturing platforms

- International Players: Particularly European and Japanese companies seeking ESG-compliant Asian operations

Case Study: A Chonburi compounding plant (automotive + medical mix) profiled its top-10 customers, contract tenors, and capacity headroom in a tight CIM and vendor list; targeted outreach to four categories—Japanese strategics, local petrochemical groups, EU converters, and ASEAN PE—produced 10 qualified NDAs and 6 site visits in five weeks without market rumors.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Chemical/Plastics Manufacturing properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts, particularly for Bangkok, Chon Buri, and Rayong assets.

IOI Analysis Framework:

• Financial Capacity: Confirmed funding sources, balance sheet strength, and transaction history

• Strategic Rationale: Clear articulation of value creation thesis and integration capabilities

• Regulatory Approval: Assessment of Thai foreign investment regulations and sector-specific restrictions

• Management Retention: Expectations for key personnel and operational continuity

Case Study: A packaging films producer (฿80M revenue, 22% EBITDA) received 7 IOIs between 6.0×–8.2×; the top number came from a regional strategic contingent on keeping the technical director for 18 months and securing two 3-year volume contracts; the seller shortlisted 6.9× and 7.4× offers balancing price, funding certainty, and integration fit.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- LOI analysis: Evaluate detailed pricing, payment structure, earnouts, contingencies, and exclusivity terms

- Deal Structure: Share deals preferred by sellers (0.1% stamp duty, no capital gains tax for individuals) versus asset deals preferred by buyers (risk isolation but complex tax implications)

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Regulatory Conditions: BOT/SEC approval requirements and failure fee arrangements

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Case Study A nylon components manufacturer negotiated three LOIs: 6.8× all-cash share deal, 7.5× with 30% earnout, and 7.0× asset deal with tax friction; after modeling net proceeds and timeline risk, the company accepted the 6.8× share LOI with warranty & indemnity insurance, 60-day exclusivity, and a working-capital peg tied to resin inventories.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Chemical/Plastics Manufacturing deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial Due Diligence: Quality of Earnings (QoE) analysis, working capital normalization, and EBITDA sustainability assessment

- Operational Review: Manufacturing efficiency, capacity utilization, supply chain resilience, and technology systems evaluation

- Legal and Regulatory: Environmental compliance, labor law adherence, BOI promotion status, and intellectual property verification

- Commercial Analysis: Customer concentration risk, contract terms, market position, and competitive dynamics

Case Study: An Eastern Seaboard injection molder flagged a potential wastewater permit gap and a single-supplier resin risk during diligence; an independent EIA update and a dual-sourcing agreement were executed within 45 days, avoiding a 0.7× price chip the buyer initially sought and preserving the agreed 7.0× headline multiple.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation requiring precise coordination of legal documentation, regulatory approvals, and closing mechanics. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Final price adjustments for working capital and cash-free/debt-free delivery

- Detailed representations and warranties with appropriate survival periods

- Indemnification caps, baskets, and escrow arrangements

- Post-closing integration and management transition planning

Case Study A Bangkok masterbatch producer closed a 7.3× EBITDA sale via a share purchase with a 10% escrow (18 months), specific indemnities for historical environmental matters, and a 90-day post-closing working-capital true-up; BOI notifications and FBA compliance were cleared on schedule, and funds settled T+2 with no price adjustment.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Chemical/Plastics Manufacturing Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Chemical/Plastics Manufacturing Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s chemical and plastics sector offers lucrative exit opportunities for business owners, underpinned by a ฿1.3 trillion market, steady demand, and a structural shift toward higher-margin specialty products. In this environment, premium outcomes accrue to businesses that demonstrate recurring revenue via long-term contracts, credible growth trajectories, operational differentiation, defensible advantages (IP, cluster/location), and diversified customer bases. Executing a disciplined six-stage process—with rigorous financial normalization, ESG and compliance readiness (ISO, BOI, environmental), and a controlled auction to qualified strategics and financial sponsors—consistently lifts valuations by 10–30% and raises completion probability from the mid-30% range to ~85%+.

For owners weighing a sale, the path to the global premium band (approaching ~10.8× EV/EBITDA) is clear: showcase stable margins and capacity utilization, document specialty/product-mix migration, codify long-term offtake agreements, and evidence ESG progress. Bangkok and Eastern Seaboard positions further enhance pricing via infrastructure, talent access, and petrochemical cluster effects.

Max Solutions’ integrated platform—M&A execution, legal structuring through Tanormsak Law Firm, and accounting advisory—aligns tax-efficient deal structures (share vs. asset, W&I solutions), de-risks diligence, and orchestrates competitive tension across domestic, regional, and international buyers. By applying this framework early, manufacturers can convert operational strengths into premium multiples and close with confidence.

Frequently Asked Questions (FAQs)

Q: What is the typical timeline for selling a chemical/plastics business in Thailand?

A: The complete process typically requires 9 months, broken down into: Preparation (1 month), Solicitation (2 months), IOI Review (1 month), LOI Negotiation (1 month), Due Diligence (3 months), and Purchase Agreement execution (1 month). Professional M&A advisory can compress this timeline by 20-30%.

Q: How do valuations for Thai chemical companies compare to global benchmarks?

A: Thai chemical/plastics companies typically trade at 4-8x EBITDA depending on size and operational characteristics, while the global sector median reaches 10.8x EBITDA. Companies achieving premium valuations demonstrate recurring revenue, operational excellence, ESG compliance, and strategic positioning.

Q: What are the key value drivers that maximize sale prices?

A: Premium valuations require: (1) Recurring revenue through long-term contracts, (2) Demonstrated growth trajectory, (3) Operational differentiation and margins, (4) Competitive advantages via IP or location, and (5) Diversified customer base reducing concentration risk.

Q: How important is ESG compliance for chemical company sales?

A: ESG factors are increasingly critical, particularly for international buyers. Investment in circular economy initiatives, recycling capabilities, and sustainable feedstocks has become mandatory for premium valuations, especially from European and Japanese acquirers.

Q: How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

6Wresearch (2025). Thailand Chemicals Market Report 2025-2031. https://www.6wresearch.com/industry-report/thailand-chemicals-market-outlook

Grand View Research (2025). Thailand Plastics Market Size & Growth Report. https://www.grandviewresearch.com/horizon/outlook/plastic-market/thailand

Krungsri Research (2025). Thailand Petrochemicals and Plastics Industry Outlook. https://www.krungsri.com/en/research/industry/industry-outlook/petrochemicals/plastics/io/io-plastics-2025-2027

Thailand Board of Investment (2024). Electric Vehicle Policy and Incentives. https://www.boi.go.th/un/boi_event_detail?module=news&topic_id=136261&language=zh

For more information, contact Max Solutions on +66 2 123 4567 or visit www.maxsolutions.co.th