Executive Summary

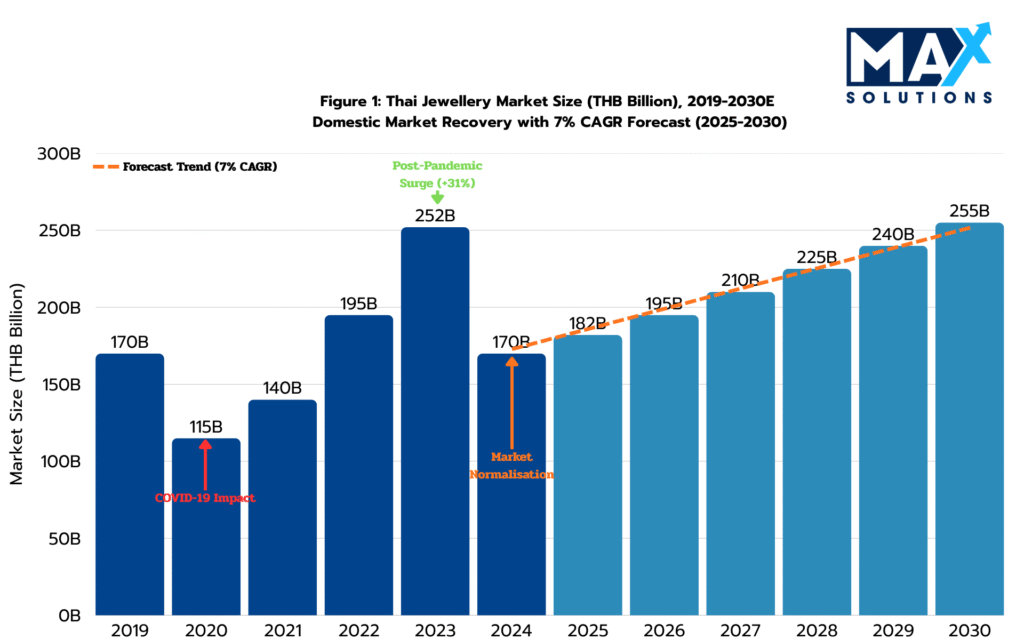

The Thai gems and jewellery sector presents a compelling exit opportunity for business owners, with the market recovering to THB 170 billion in 2024 and projected to grow at 7% CAGR through 2030 (JewelleryNet, 2025). Thailand’s position as a global manufacturing hub—contributing over 80% export orientation and THB 197 billion in non-gold exports in Q1 2025 alone (Thailand Public Relations, 2025)—creates exceptional strategic value for well-positioned businesses. However, successfully navigating the M&A process requires specialized expertise in valuation methodologies, regulatory compliance (particularly Foreign Business Act restrictions), and tax-optimized deal structuring.

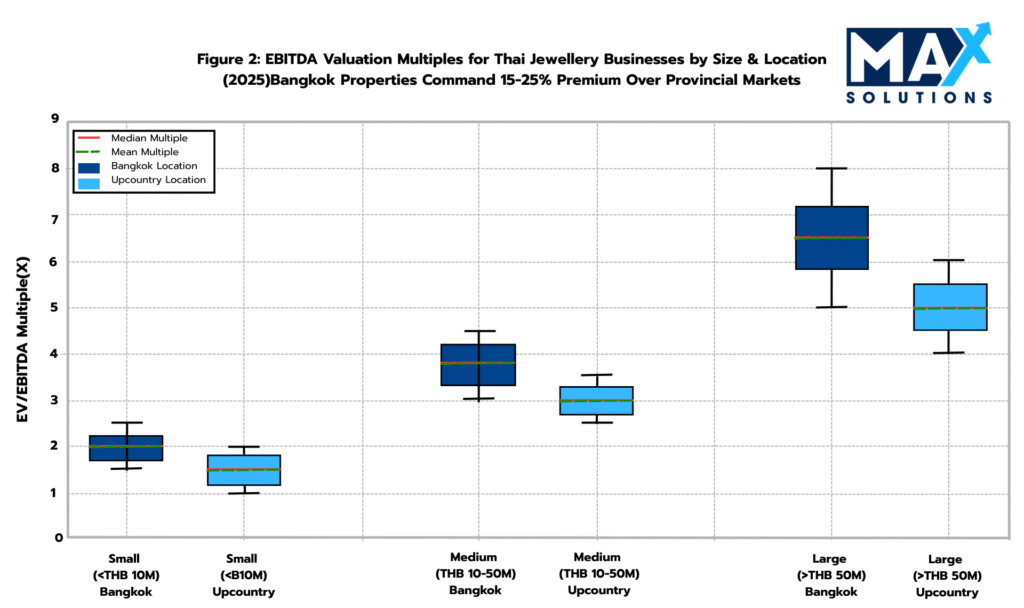

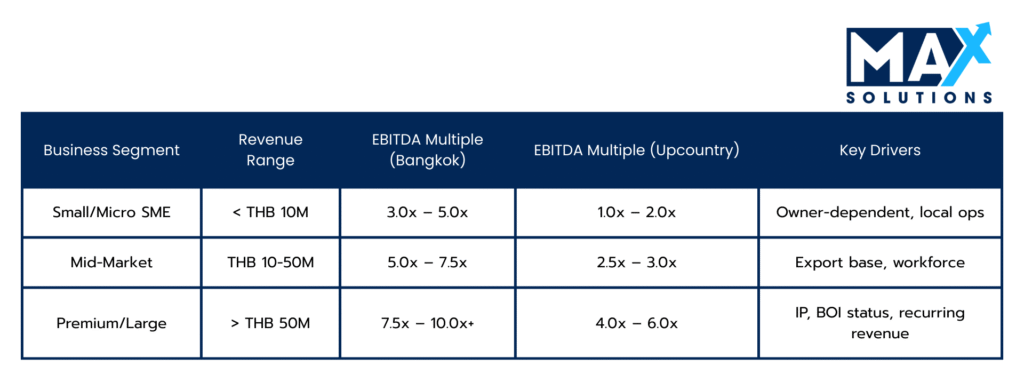

Drawing on quantitative market data and regional transaction benchmarks, we establish precise valuation multiples ranging from 3.0-5.0x EBITDA for small operations to 7.5-10.0x+ for premium exporters, with Bangkok properties commanding a 15-25% location premium.

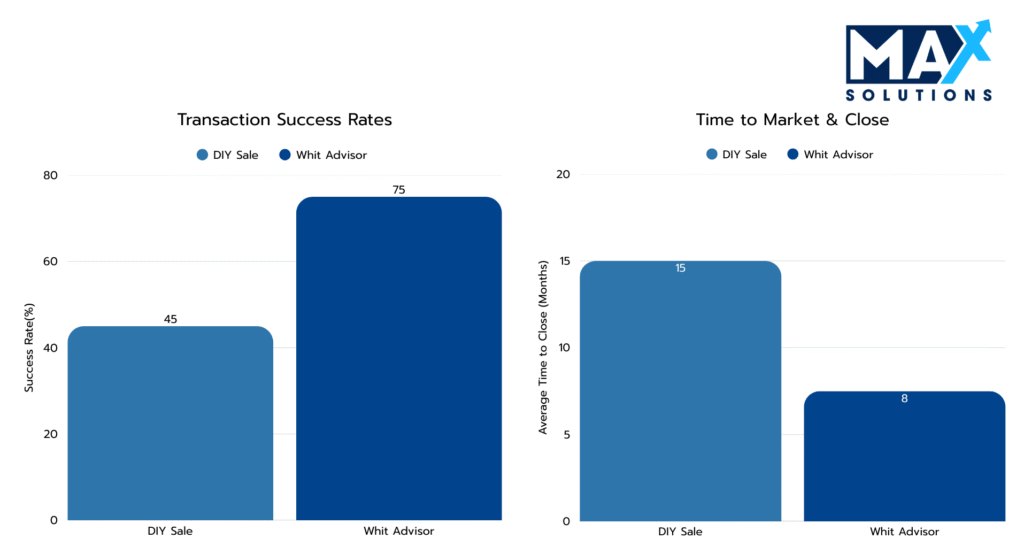

This report provides a comprehensive roadmap for jewellery business owners contemplating an exit, outlining the critical six-stage sale process from initial preparation through final closing. Our analysis reveals that professionally advised transactions achieve 20-30% higher valuations, double the success rate (80% vs 40%), and complete 25% faster than owner-led sales. For a jewellery business valued at THB 500 million, this premium translates to THB 100+ million in additional proceeds- far exceeding advisory fees and validating the strategic importance of specialized M&A guidance.

Figure 1: Thai Jewellery Market Growth & Size (THB), 2020-2030E

Introduction

Thailand’s gems and jewelry industry operates as a sophisticated dual economy: an export-driven manufacturing powerhouse serving global luxury brands, supported by a resilient domestic market serving affluent Thai and tourist consumers. With over 13,000 registered businesses employing 800,000-1,200,000 workers (JewelleryNet, 2025), the sector is highly fragmented, with SMEs dominating the landscape—particularly in specialized sub-sectors such as gemstone cutting (Chanthaburi, Trat, Kanchanaburi) and artisanal silver craftsmanship (Chiang Mai). This fragmentation creates significant acquisition opportunities for strategic buyers seeking consolidation, vertical integration, or access to Thailand’s unique manufacturing capabilities.

The market has demonstrated remarkable resilience, rebounding from a COVID-19 downturn (THB 115B in 2020) to peak at THB 252B in 2023 before normalizing to THB 170B in 2024 (IndexBox, 2025). Export performance in Q1 2025 was exceptional, with overall exports surging 111% YoY and platinum exports experiencing unprecedented growth of 135,096% driven by Indian demand (Thailand Public Relations, 2025). While this volatility creates valuation complexity, it also signals strong global demand for Thai jewelry manufacturing capacity. For business owners, this environment presents an optimal exit window- particularly for companies with formalized operations, established export channels, and defensible intellectual property.

Valuation Landscape

Jewellery business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Jewellery Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai Jewellery Businesses demonstrate clear stratification based on size and location.

Table 1: Revenue-Based Valuation Multiples for Thai Jewellery Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 3-10× EBITDA, with premium segment targeted and larger customer base commanding higher multiples.

Thai jewellery businesses utilize hybrid valuation approaches combining Market Multiples (EBITDA/Revenue) and Asset-Based methods. The segregation is critical because balance sheets are dominated by high-value, volatile precious metal inventory (Mercer Capital, 2025). Standard historical cost accounting severely understates true asset value—gold prices rose 38.2% YoY in Q1 2025, peaking at THB 119,000 per ounce (LH Bank, 2025). This creates material unrealized gains that must be captured separately from operational earnings.

The Six-Stage Jewellery Business Sale Process

Successful Jewellery business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Mark-to-Market (MTM) inventory: Independent count + reprice gold/silver/platinum/gems at current market; set Target NWC baseline.

- Financials & normalization: 3–5 years TFRS statements; remove owner/one-time items; present LTM Adjusted EBITDA separately from commodity gains.

- Regulatory audit: Verify FBA ownership structure; document BOI/Amity pathways; confirm no nominee risks.

- IP & brand assets: Register designs, trademarks, process know-how (heat treatment, cutting methods).

- Risk hygiene: AML/KYC records, vendor contracts, key customer files, HR and lease folders prepared

- Advisor selection: Engage specialized M&A advisors with Jewellery expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Bangkok manufacturer (฿35M revenue) ran a full MTM, uncovering ฿18M unrealized gold gains (book ฿42M → market ฿60M). By separating commodity value from ฿5.2M operational EBITDA, the seller secured 6.8× on ops (฿35.4M) plus full NWC at closing (+฿18M)—total ฿53.4M, vs. ~฿42–45M under a blended approach.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- CIM + teaser: 20–30 pp. deck covering history, 3–5 yr financials, capacity/QA, export channels, incentives (duty/VAT relief).

- Buyer mapping: International luxury groups (ESG, IP), domestic consolidators, PE (digital/ops upside), U.S. Amity Treaty buyers (fastest path to control).

- Confidential process: 25–30+ targets, NDA gating, tiered disclosures; emphasize ESG/ethical sourcing and BOI/Amity readiness.

- Positioning angles: Platform capabilities, specialized techniques, surge capacity (export spikes), Bangkok location premium.

Case Study: A Chiang Mai silver workshop reframed as an “IP-anchored platform” with export readiness and artisan depth. Outreach to 28 targets yielded 9 NDAs and 6 site visits; top indications rose from 4.8× to 6.1× EBITDA after buyers saw QA and design vaults.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Jewellery properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Valuation Range Analysis: Compare multiples against market benchmarks and strategic premiums

- Compare economics: Multiples vs. benchmarks; SPA vs. APA net-proceeds modeling; FX, MTM and NWC mechanics.

- Qualify buyers: Funding proof, prior deals, regulatory plan (BOI/FBL/Amity), closing track record.

- Management presentations: Focus on QC, throughput, skilled labour retention, and export documentation.

- Shortlist: Rank by price, certainty, structure, and post-close obligations (retention, covenants).

Case Study: A Bangkok exporter (฿52M revenue, 17% margin) received 5 IOIs at 5.4×–7.0×; the highest came from a foreign buyer without a clear FBA plan. The company shortlisted a 6.6× all-cash SPA from a U.S. Amity buyer for superior certainty and timeline.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Negotiate LOI terms including valuation mechanism, due diligence scope, and exclusivity period (60–90 days)

- Payment design: 70–80% cash at closing; 20–30% earn-out tied to margin-aware metrics (normalized gross margin, retained export revenue), not volume only.

- Exclusivity: 45–60 days with milestone checkpoints (financial DD by Day 30; BOI/Amity filing by Day 45).

- Working capital & MTM: Define Target NWC and MTM methods for precious metals/gems; dollar-for-dollar adjustments.

- Tax & structure: Confirm share deal in LOI; outline W&I insurance intent to limit escrow.

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Case Study:A silver exporter (฿28M revenue) pushed a competitive LOI round to 7.2× EBITDA from a U.S. strategic (Amity route) plus full MTM inventory settlement, beating a domestic 5.2× offer by 48% on total consideration.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Jewellery deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial DD: Rebuild LTM EBITDA; QoE on add-backs; validate MTM with third-party appraisals; Target NWC testing.

- Regulatory & legal: FBA/BOI papers, Amity evidence, labor law, leases, AML/transaction trails.

- IP & assets: Chain of title for designs/marks; equipment condition; artisan process documentation.

- ESG & sourcing: Ethical gemstone certificates, audit trails, environmental controls.

- Financial Quality of Earnings: Revenue recognition validation, cost normalization, working capital analysis

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A Chanthaburi gemstone cutter faced buyer re-trade risk over undocumented processes. In 6 weeks they filed design registrations, documented heat-treatment SOPs, and produced traceability certificates; the buyer withdrew a 0.6× price chip and closed at the original 7.0×

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- SPA terms: Reps/warranties (inventory, IP, compliance), 5–10% escrow (12–18 months), W&I insurance where cross-border.

- Closings & filings: BOI/Amity/FBL steps as applicable; FX arrangements; customer/supplier notices.

- Adjustments: Cash-free, debt-free; NWC and MTM true-ups; post-closing covenants (artisan retention, IP assignments).

- Transition: Handover plan for master artisans/design leads; brand and catalog migration.

- Coordinate fund transfers, permit transitions, and customer communications

Case Study: A Bangkok atelier closed a 7.5× EBITDA SPA with 7% escrow and W&I insurance; BOI notifications cleared in 30 days, MTM/NWC adjustments reconciled T+10, and escrow released at month 12 with no claims.

Valuation Enhancement Factors

Strategic pre-sale initiatives in Thailand’s Jewellery sector can deliver 1.0x–3.0x EBITDA multiple uplifts and 20–45% higher enterprise valuations when properly implemented. The examples below summarize the most impactful levers across financial, operational, and regulatory domains.

MTM Inventory Discipline: Separate commodity gains from ops; capture full value via NWC at closing.

Bangkok/Prime Location: 15-25% premium vs. provincial sites for showrooms/export access.

BOI / U.S.-Thai Amity Pathway: Expands foreign buyer pool; cuts execution risk and time.

Protected IP (designs/process): Converts craftsmanship into defensible assets which leads to higher strategic multiples.

Ethical Sourcing & ESG Proof: Mandatory for luxury buyers; absence often discounts 15-25%.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Jewellery Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Jewellery Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s gems & jewellery sector offers a strong window for premium exits, underpinned by resilient global demand, export-led growth, and Bangkok’s enduring location premium. In a market where inventory value can fluctuate with commodity cycles, sellers who separate mark-to-market inventory gains from operational earnings, document clean LTM adjusted EBITDA, and evidence defensible IP (designs, processes, trademarks) consistently command upper-quartile multiples. Success also hinges on regulatory clarity—FBA/BOI/Amity pathways, ESG/ethical sourcing credentials, and audit-ready financials—so buyers can underwrite value with confidence.

Across comparable transactions, professionally managed sales outperform owner-led processes on every dimension: 20–30% higher valuations, roughly double the success rate (≈80% vs ≈40%), and faster completions. These outcomes are driven by disciplined six-stage execution: rigorous preparation (MTM, compliance, IP), broad but confidential buyer outreach (including Amity Treaty and BOI-qualified strategics), competitive offer shaping, tax-efficient share sale structuring, and proactive diligence management that preserves price through closing.

Max Solutions’ integrated platform—M&A process leadership, regulatory and tax structuring via Tanormsak Law Firm, and jewellery-specific valuation expertise—enables owners to convert craftsmanship, export relationships, and brand equity into optimal financial outcomes. By applying this framework early and running a controlled auction to qualified domestic and international buyers, jewellery business owners can capture strategic premiums and close with certainty.

Frequently Asked Questions (FAQs)

Q: What valuation multiple should I expect for my jewellery business?

A: Valuation multiples depend on size, location, and operational quality. Small businesses (<THB 10M revenue) typically achieve 1.5-2.5x EBITDA in Bangkok, while premium exporters (>THB 50M) with formalized IP and BOI status command 7.5-10.0x+. Bangkok properties consistently achieve 15-25% premiums over provincial locations due to stronger markets and buyer interest. Key value drivers include recurring revenue streams, protected intellectual property, export diversification, and independence from owner operations.

Q: How do Foreign Business Act restrictions affect my sale to international buyers?

A: The FBA typically limits foreign ownership to 49% in retail businesses. However, three pathways enable majority/100% foreign control: (1) Board of Investment (BOI) Promotion for qualified manufacturing/export activities, (2) U.S.-Thai Treaty of Amity for American entities (the optimal pathway), and (3) Foreign Business License applications (complex, time-intensive). Sellers should target U.S. buyers or ensure target companies have active BOI promotion certificates—these structures dramatically reduce execution risk and accelerate timelines (60-90 days vs. 6+ months for FBL approvals).

Q: Should I structure my sale as a Share Purchase or Asset Purchase?

A: Share Purchase Agreements (SPAs) strongly favor sellers from a tax perspective. Thai resident individual shareholders face 0% capital gains tax on private company share sales; non-resident sellers pay 15% withholding tax (often reducible to 0-10% via Double Taxation Agreements). Asset sales trigger 20% Corporate Income Tax on gains plus 7% VAT on inventory transfers—reducing net proceeds by 20-25%. Unless specific circumstances require asset structure (e.g., buyer refuses to assume certain liabilities), SPAs are optimal.

Q: How important is the Mark-to-Market inventory adjustment?

A: Critically important. Jewellery businesses carry substantial precious metal inventory that appreciates significantly (gold rose 38.2% YoY in Q1 2025). Historical cost accounting understates true value, creating unrealized gains that must be captured separately from operational earnings. MTM adjustments prevent buyers from conflating commodity price appreciation with operational performance—enabling sellers to command appropriate operational multiples (6-8x EBITDA) while capturing full commodity gains via Net Working Capital adjustments at closing. Failure to implement MTM typically costs sellers 15-25% of potential proceeds.

Q: How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Department of International Trade Promotion (DITP). (2025). Thailand’s gems and jewelry industry. Retrieved from https://files-website.ditp.go.th/Thailand_Gems_and_Jewelry_Industry_11243adf2b.pdf

Emerhub. (2025). Mergers and acquisitions in Thailand: A guide for investors. Retrieved from https://emerhub.com/thailand/mergers-and-acquisitions/

IndexBox. (2025). Thailand jewelry market size and forecast. Retrieved from https://news.jewellerynet.com/en/jnanews/features/25177/053123-The-changing-landscape-of-Thailands-jewellery-and-gem-trade

JewelleryNet. (2025). The changing landscape of Thailand’s jewellery and gem trade. Retrieved from https://news.jewellerynet.com/en/jnanews/features/25177/053123-The-changing-landscape-of-Thailands-jewellery-and-gem-trade

KPMG Thailand. (2025). Taxation of cross-border mergers and acquisitions: Thailand. Retrieved from https://assets.kpmg.com/content/dam/kpmg/xx/pdf/2017/01/mergers-and-acquisitions-country-report-thailand.pdf

Thailand Public Relations Department. (2025). 110% surge in gem and jewelry exports boosts Thailand as a global hub. Retrieved from https://thailand.prd.go.th/en/content/category/detail/id/2078/iid/397520