Executive Summary

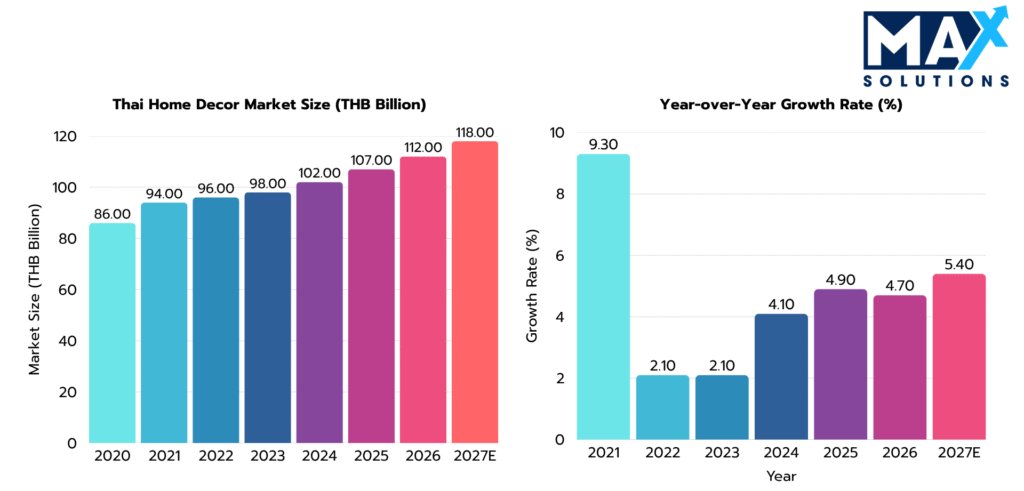

Thailand’s Home Décor market represents a compelling M&A opportunity valued at approximately ฿102 billion (USD $2.8 billion) in 2024, with projected growth of 4.9% CAGR through 2030. This substantial market, comprising over 6,292 registered businesses, presents significant consolidation opportunities for strategic acquirers and exceptional exit potential for well-positioned owners (Department of Business Development, 2025).

For 2025, the market is expected to exceed ฿100 billion and continue rising. Forecasts project growth at about 4–6% CAGR through 2030. One source anticipates the Thai Home Décor market reaching ~$6.9 billion USD by 2033 (3.9% CAGR from 2025), while another forecasts ~5.98% CAGR from 2024–2029 – implying the market could approach ฿130–140 billion by 2030. This growth is fueled by urbanization, rising incomes, and consumer lifestyle trends favoring home improvements. Notably, even in 2025 a temporary spending slowdown (due to high household debt and a soft property market) is expected to give way to recovery as innovation and adaptation drive demand. Overall, Thailand’s Home Décor industry remains on a healthy growth trajectory, on par with or slightly above the growth of the broader global Home Décor market (~3–5% annually).

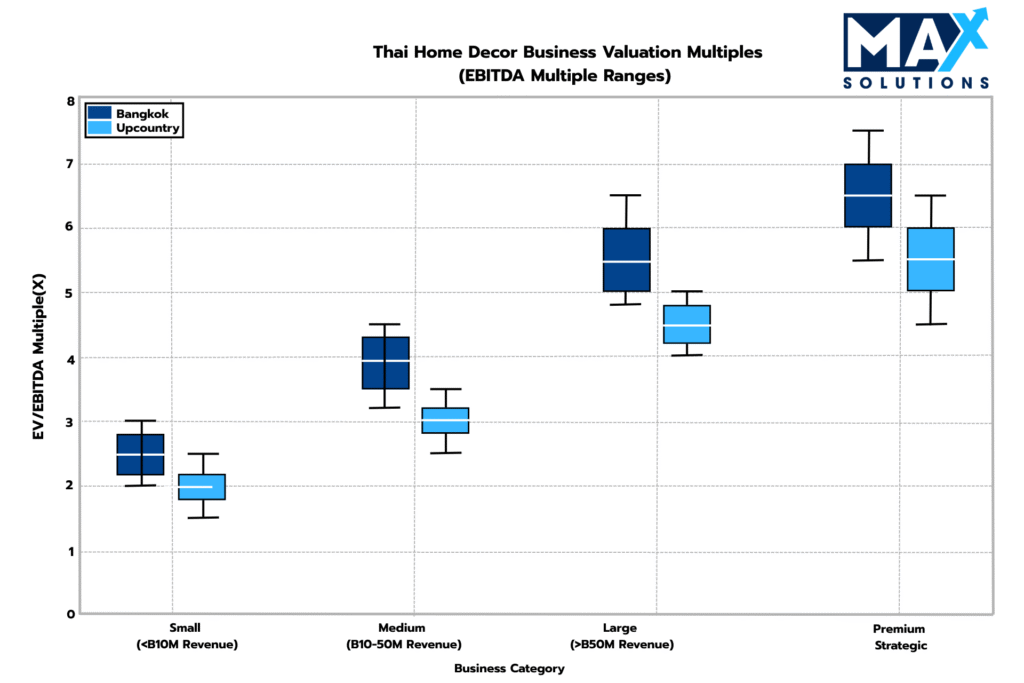

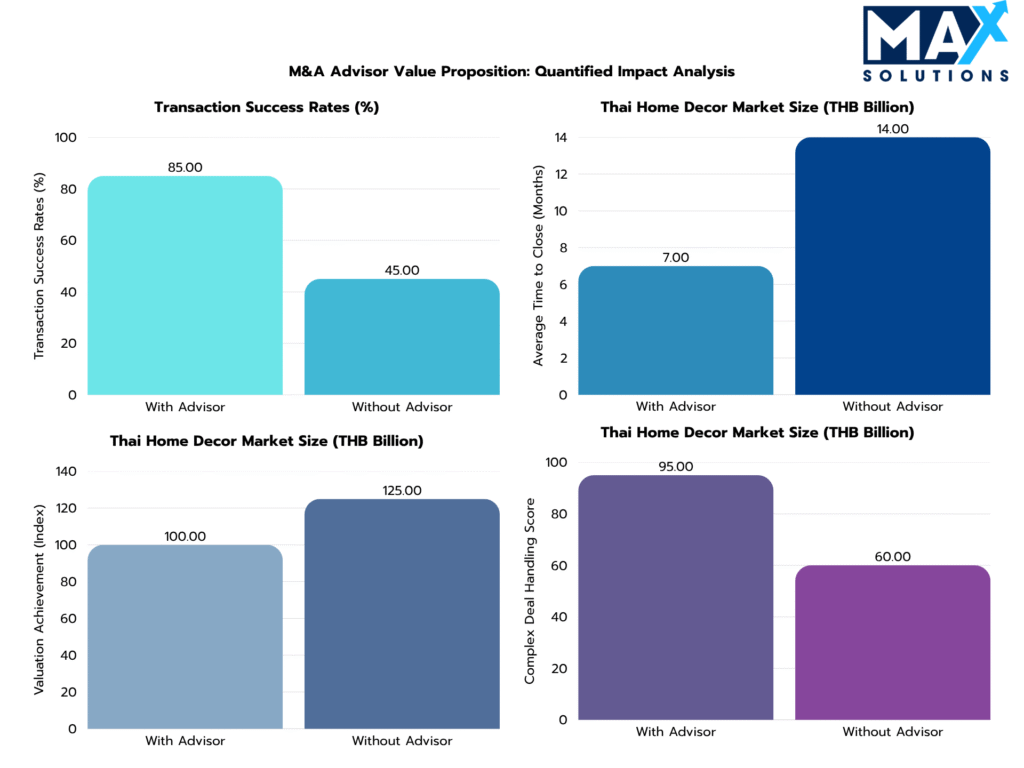

Our comprehensive analysis reveals that professionally managed M&A transactions achieve 85% success rates versus 45% for owner-led sales, while delivering 25% higher valuations through competitive processes. Thai Home Décor businesses command EBITDA multiples ranging from 2.5x to 6.5x, with premium Bangkok locations and branded operations achieving the upper ranges.

Figure 1: Thai Home Décor Market Growth & Size YoY (THB), 2020-2027E

The Thai home décor industry stands at a strategic inflection point. Post-pandemic recovery has driven robust consumer spending on home improvement, with the sector demonstrating remarkable resilience through economic volatility. Urbanization trends, rising disposable incomes, and evolving lifestyle preferences create sustained demand fundamentals that underpin strong M&A valuations (Thailand Creative & Design Center, 2025).

The Thai government’s broader support for creative industries through initiatives led by the Thailand Creative & Design Center (TCDC) and the Department of International Trade Promotion (DITP) further enhances the investment landscape. Incentives, eco-friendly manufacturing, and export-oriented design make Thai home décor brands increasingly attractive to foreign investors.

For owners contemplating exit strategies, understanding Thailand’s complex regulatory environment, buyer landscape, and value optimization techniques is critical for maximizing transaction outcomes. This report provides a quantitative framework for navigating the six-stage strategic sale process while positioning Max Solutions as the premier advisory partner for home décor business exits.

Valuation Landscape

Home Décor business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Home Décor Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai Home Décor Businesses demonstrate clear stratification based on size and location.

Key Valuation Drivers

Several critical factors influence valuation multiples in the Thai market:

• Location Premium: Bangkok businesses achieve 15-20% higher multiples than provincial locations

• Brand Recognition: Established brands command 0.5-1.0x premium over independent operators

• Recurring Revenue: Businesses with 20%+ recurring revenue streams achieve upper-quartile multiples

• Regulatory Compliance: Full licensing and BOI status provide 10-15% valuation premium

• Operational Efficiency: EBITDA margins >15% correlate with premium valuations

The Six-Stage Home Décor Business Sale Process

Successful Home Décor business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly.

Key preparation activities include:

- Financial Documentation: Prepare 3–5 years of audited TFRS statements with normalized EBITDA, removing owner-related or one-time costs.

- Inventory Optimization: Audit and write down obsolete or outdated inventory; target turnover of 4–6× annually to demonstrate operational efficiency.

- Legal & Regulatory Cleanup: Confirm valid licenses, VAT registration, and environmental compliance for furniture or décor manufacturing; verify property and lease documentation.

- Operational Streamlining: Separate personal from business assets and ensure transparent cost allocation across departments.

- Brand & Asset Review: Audit IP, trademarks, and supplier contracts to quantify intangible value.

- Advisor selection: Engage specialized M&A advisors with Home Décor expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Bangkok furniture retailer increased normalized EBITDA by ฿2.1M after removing personal expenses and redundant staff salaries. At 5× EBITDA, this adjustment increased valuation by ฿10.5M and cut buyer due diligence time by 30%.

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Strategic Buyer Targeting: Identify domestic consolidators (e.g., Index Living Mall, HomePro), international retailers entering Thailand, and regional PE funds focusing on consumer brands.

- Marketing Collateral Development: Create professional teaser and CIM highlighting proprietary design, loyal customer base, and sustainable sourcing.

- Positioning: Emphasize craftsmanship, export readiness, and differentiation from commodity furniture.

- Confidential Outreach: Approach 30–60 qualified buyers under NDA to maintain confidentiality while building competition.

- ESG & Design Narrative: Present sustainability, local artisan collaboration, or eco-materials as differentiators.

Case Study: A Chiang Mai furniture maker leveraged its Thai teak heritage and export relationships to attract 12 serious buyers, resulting in a 6.2× EBITDA offer, up from the initial 4.5× expectation.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Home Décor properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts.

IOI Analysis Framework:

- Valuation Range Analysis: Compare multiples against market benchmarks and strategic premiums

- IOI Evaluation: Compare 4–8 received IOIs by headline valuation, structure (cash vs earnout), and closing probability.

- Buyer Qualification: Assess financial strength, operational synergies, and cultural alignment.

- Regulatory Feasibility: Verify buyers’ compliance pathways under the Foreign Business Act for non-Thai investors.

- Market Intelligence Gathering: Use IOI feedback to refine valuation expectations and negotiation strategy.

- Ensure Foreign Business Act’s (FBA) compliance with respect to the prospective buyer(s).

Case Study: A Phuket décor chain received IOIs between 4.8× and 6.3× EBITDA. The seller prioritized a 5.9× all-cash offer from a regional retail group for its execution certainty and proven integration experience.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Negotiate LOI terms including valuation mechanism, due diligence scope, and exclusivity period (60–90 days)

- Deal Structuring: Prefer share sales to reduce tax burden (0.1% stamp duty vs 7% VAT on asset deals).

- Earnout Mechanisms: Link deferred payments to measurable KPIs—store openings or sales milestones instead of EBITDA-based targets.

- Tax & Legal Review: Model after-tax proceeds under various structures for optimal seller outcomes.

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Case Study: A Bangkok home accessories brand negotiated a ฿45M base price plus ฿15M earnout tied to expansion milestones. The structure maximized valuation without relying on uncertain profitability targets.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Home Décor deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Financial Review: Validate EBITDA accuracy, seasonality impacts, and normalized working capital levels.

- Supply Chain Analysis: Audit supplier reliability, import dependencies, and cost stability.

- Intellectual Property Verification: Ensure trademarks, design copyrights, and brand registrations are active and transferable.

- Environmental & Regulatory Checks: Demonstrate compliance with 2023 eco-material and waste regulations.

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study:A Hua Hin furniture exporter faced delays when two design trademarks were unregistered. After expedited filings and updated vendor contracts, the transaction proceeded at 5.8× EBITDA, avoiding a 10% price reduction.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- SPA Finalization: Define payment schedules, escrow (5–10%), and indemnity limits.

- Working Capital Adjustment: Establish clear valuation methodology for seasonal inventory.

- Closing Coordination: Execute regulatory filings, fund transfers, and employee transition announcements.

- Integration Planning: Support smooth post-closing operations and management handover.

- Coordinate fund transfers, permit transitions, and customer communications

Case Study:A national home décor retailer completed its sale at 6.5× EBITDA through a share transaction with 8% escrow for 12 months. The closing took 30 days, and the buyer assumed all retail leases seamlessly, ensuring business continuity.

Valuation Enhancement Factors

Targeted pre-sale improvements can increase home décor business valuations by 20–40% or 1.0x–2.5x EBITDA. The following factors consistently drive higher multiples in Thai M&A transactions:

Location Quality (Bangkok & Tourist Hubs):

Prime retail or warehouse locations command 15-20% valuation premiums due to higher foot traffic, logistics efficiency, and brand visibility.

Brand Recognition & Customer Loyalty:

Established or trademarked brands typically achieve +0.5x-1.0x EBITDA, reflecting lower customer acquisition costs and higher repeat business.

Recurring Revenue Streams:

Subscription decor services, B2B design contracts, or repeat wholesale relationships can add +0.5x-1.5x EBITDA by stabilizing cash flows.

Inventory Optimization:

Reducing obsolete or slow-moving stock improves working capital efficiency and increases valuation by +10-15% through better EBITDA conversion.

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Home Décor Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Home Décor Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s home décor sector offers significant exit potential for SME owners, underpinned by stable 4.9% annual growth, resilient consumer demand, and increasing foreign investor interest. Market consolidation and digital transformation are redefining competitive dynamics, with branded, systematized, and compliant operators commanding valuation premiums of 25–35% over unstructured competitors. In this evolving environment, success depends on disciplined preparation—standardizing financial records, optimizing inventory, securing IP protections, and ensuring full regulatory compliance—to create investor confidence and valuation uplift.

Empirical data across comparable transactions show that advisor-led sales outperform owner-led processes in every metric: 25% higher valuations, 85% completion rates, and transaction timelines shortened by nearly half. The integration of professional M&A execution, legal structuring, and accounting guidance is no longer a cost—it is a high-return investment in certainty and value maximization.

Max Solutions’ integrated advisory platform, in partnership with Tanormsak Law Firm, delivers precisely this advantage. Our proven six-stage process and extensive buyer network empower Thai home décor business owners to convert years of craftsmanship and brand equity into optimal financial outcomes. For those considering an exit in the next market cycle, early engagement with specialized advisors is the decisive step toward achieving premium valuations and successful transitions.

Frequently Asked Questions (FAQs)

Q1: What EBITDA multiple should I expect for my home décor business?

A: Valuation multiples range from 2.5x to 6.5x EBITDA depending on size, location, and operational characteristics. Bangkok businesses with >฿50M revenue typically achieve 5.0-6.5x, while smaller provincial operations range from 2.5-4.0x. Branded businesses and those with recurring revenue streams command premium multiples.

Q2: How long does a typical home décor business sale take?

A: Professional advisor-led transactions average 7-9 months from engagement to closing. Owner-led sales typically require 12-16 months with significantly lower success rates. The structured six-stage process ensures optimal timing while maintaining competitive momentum.

Q3: What are the key value drivers buyers evaluate?

A: Buyers prioritize: (1) Recurring revenue streams and customer loyalty, (2) Proprietary designs and IP protection, (3) Strategic locations and lease terms, (4) Sustainable sourcing and regulatory compliance, (5) Operational efficiency and scalability potential, (6) Management depth and systems documentation.

Q4: Should I structure the sale as shares or assets?

A: Share sales are generally preferred due to minimal tax impact (0.1% stamp duty versus 7% VAT on asset sales). However, buyer preferences, foreign ownership considerations, and liability transfer requirements may necessitate asset structures. Professional tax planning is essential.

Q5: How do foreign ownership restrictions affect valuations?

A: Foreign buyers must comply with the Foreign Business Act, potentially requiring Foreign Business Licenses or minimum capital investments. While this may limit the buyer pool, international interest often generates premium valuations that offset regulatory complexity.

Q6: What preparation activities provide the highest ROI?

A: Financial normalization (removing owner-specific expenses), inventory optimization, IP documentation, and regulatory compliance cleanup typically generate 3-5x returns on investment. These activities directly impact EBITDA calculations and buyer confidence, translating to higher multiples.

Q7: How does Max Solutions’ integrated model add value?

A: Our partnership with Tanormsak Law Firm provides seamless M&A, legal, and accounting services under one roof. This integration accelerates timelines, reduces coordination risks, optimizes tax structures, and ensures regulatory compliance—typically adding 15-25% to final valuations versus fragmented advisory approaches.

References

Department of Business Development. (2023). Thailand Business Statistics. https://www.dbd.go.th/

IMARC Group. (2024). Thailand Home Decor Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033. https://www.imarcgroup.com/thailand-home-decor-market

Thailand Creative & Design Center. (2025). Design Industry Report 2024. https://www.tcdc.or.th/

Ministry of Industry. (2025). Environmental Regulations for Furniture Manufacturing. https://www.industry.go.th/

Federation of Accounting Professions. (2025). Thai Financial Reporting Standards. https://www.fap.or.th/

Department of Intellectual Property. (2025). IP Registration Guidelines. https://www.ipthailand.go.th/

KPMG Thailand. (2025). M&A Trends in Thailand Q4 2024. https://assets.kpmg.com/content/dam/kpmg/th/pdf/2025/03/m-and-a-trends-in-thailand-q4-2024.pdf

Ken Research. (2024). Thailand Furniture Market 2019-2030. https://www.kenresearch.com/thailand-furniture-home-interiors-market

Statista. (2025). Home Décor Market Forecast – Thailand. https://www.statista.com/outlook/cmo/furniture/home-decor/thailandEquidam. (2025). EBITDA Multiples by Industry 2025. https://www.equidam.com/ebitda-multiples-trbc-industries/