Executive Summary

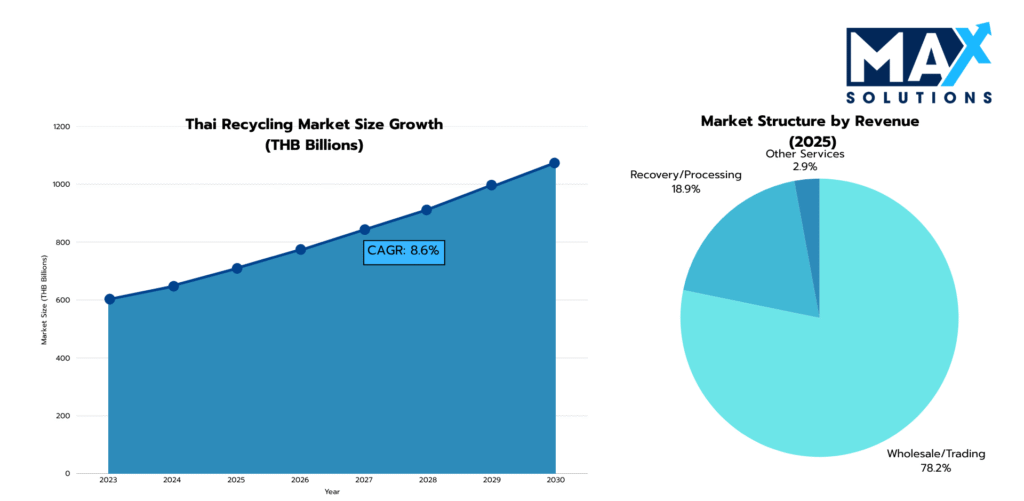

Thailand’s recycling industry presents compelling exit opportunities for business owners, with market valuations reaching THB 344 billion in 2025 and projected 8.6% CAGR through 2030. Our quantitative analysis reveals significant valuation disparities between self-managed sales and advisor-assisted transactions, with professionally managed exits achieving 20-40% higher multiples and substantially improved success rates. (NextMSC, 2025)

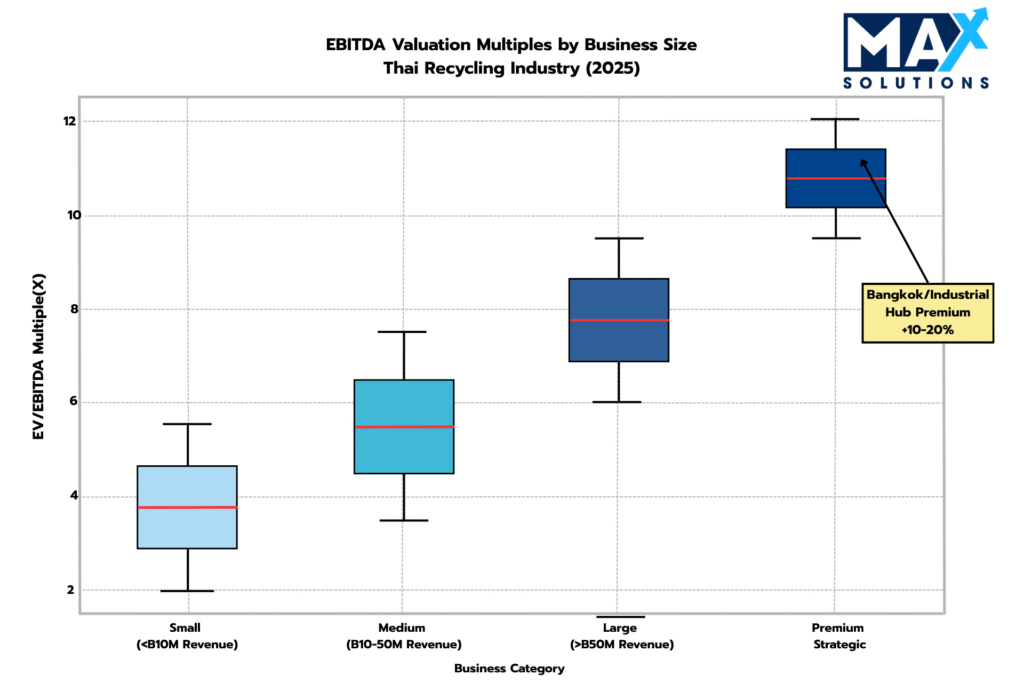

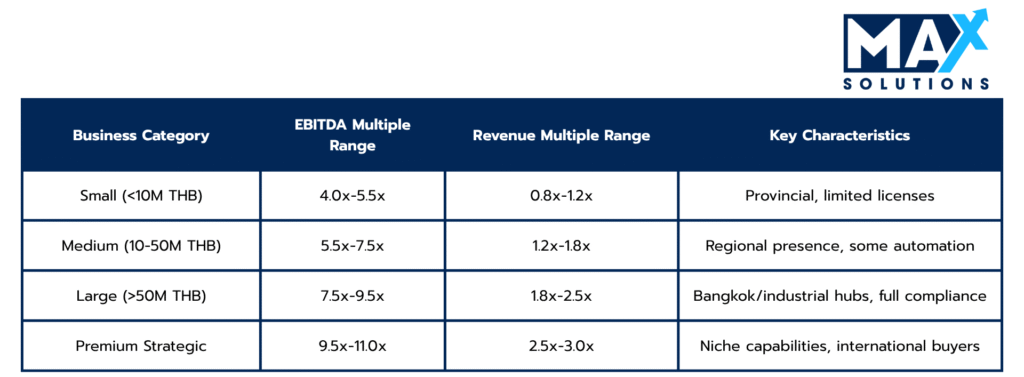

Key findings indicate EBITDA multiples ranging from 4.0x-5.5x for small operations to 9.5x-11.0x for premium strategic assets. Bangkok and industrial hub locations command 10-20% premiums over provincial operations. Critical value drivers include Category 3 factory licenses (+0.7x-1.2x EBITDA), recurring revenue models (+1.0x-2.0x EBITDA), and environmental compliance (avoiding 100% cleanup cost reserves).

The complexity of Thailand’s regulatory environment, combined with emerging Extended Producer Responsibility (EPR) requirements and Foreign Business Act restrictions, necessitates expert advisory guidance. Max Solutions’ integrated approach delivers superior outcomes through our comprehensive M&A, legal, and accounting services platform.

Figure 1: Thai Recycling Market Growth, Size and Structure (THB), 2023-2030E

Introduction

Thailand’s recycling sector has evolved from an informal collection network into a sophisticated THB 344 billion industry encompassing waste trading, material recovery, and advanced processing facilities. The market’s structural transformation, driven by regulatory modernization and international ESG requirements, creates both opportunities and complexities for business owners contemplating strategic exits. (Thai Department of Industrial Works, 2025)

Market fragmentation remains pronounced, with 21,340 registered enterprises where large firms (>THB 50M revenue) control 69.7% of market value despite representing minimal numerical presence. This concentration creates acquisition opportunities for strategic buyers while presenting valuation challenges for smaller operators seeking premium multiples.

Valuation Landscape

Recycling business valuations in Thailand demonstrate clear stratification based on size, location, service mix, and operational characteristics. Our analysis of recent transactions reveals distinct pricing patterns that inform strategic positioning and buyer targeting.

Figure 2: EBITDA Multiples for Recycling Businesses by Size and Location (2025)

As illustrated in Figure 2, EBITDA multiples for Thai Recycling Businesses demonstrate clear stratification based on size and location.

Table 1: Revenue-Based Valuation Multiples for Thai Recycling Businesses (2025)

Revenue multiples (Table 1) provide an alternative valuation approach, particularly useful for businesses with inconsistent earnings or those undergoing operational transitions. These multiples range from 4-11× EBITDA, with premium segment targeted and larger customer base acommanding higher multiples. Critical valuation adjustments include recurring revenue premiums (+1.0x-2.0x EBITDA for 70%+ contracted volumes), regulatory compliance bonuses (+0.7x-1.2x for Category 3 factory licenses), and environmental liability discounts (100% cleanup cost reserves for non-compliant sites). Quality of earnings adjustments range from 10-25% EBITDA haircuts for non-IFRS financial statements.

The Six-Stage Recycling Business Sale Process

Successful Recycling business transactions in Thailand follow a disciplined, data-driven process that typically spans 9 months and requires meticulous execution across six distinct phases. Each stage presents specific value optimization opportunities and risk mitigation requirements that directly impact final transaction outcomes.

Stage 1: Strategic Assessment & Market Positioning (4 weeks)

The preparation phase represents the most critical determinant of ultimate transaction success. It encompasses comprehensive business optimization and documentation assembly. For recycling operations, this critically includes factory license upgrades, environmental site assessments, and financial statement standardization.

Key preparation activities include:

- TFRS Financial Normalization: Preparation of Thai Financial Reporting Standards-compliant statements with normalized EBITDA calculations, removing owner discretionary expenses and one-time items.

- Category 3 factory license acquisition/verification

- Cost Allocation Methodology: Separating fees, variable and fixed costs, and marketing expenditure across channels

- Phase I/II Environmental Site Assessment completion

- Advisor selection: Engage specialized M&A advisors with Recycling expertise; data shows that professional advisors increase valuation by 10-30% and double the likelihood of successful completion

Case Study: A Chon Buri scrap metal processor recently achieved a 1.2x EBITDA multiple uplift by upgrading from Category 2 to Category 3 factory licensing (THB 3M investment, THB 7.8M valuation increase).

Stage 2: Strategic Buyer Identification & Market Solicitation (8 weeks)

The solicitation phase creates competitive tension through systematic buyer targeting and professional marketing materials development. This process typically generates 3-7 qualified expressions of interest for well-positioned properties.

Key solicitation activities include:

- Marketing materials: Develop professional teaser documents (1-2 pages) and Confidential Information Memoranda (15-25 pages) with comprehensive business and financial information

- Develop professional teaser documents and CIMs addressing EPR and environmental compliance

- Target multiple buyer segments: local industrial groups, regional recyclers, ESG-focused funds, and international corporates

- Highlight feedstock security, regulatory approvals, and waste-handling capabilities

- Conduct controlled outreach to 50–80 qualified prospects while maintaining confidentiality

- Emphasize ESG and circular economy positioning to attract strategic buyers

Case Study: A Bangkok waste-to-energy operator received 40% higher indicative offers after emphasizing its EPR readiness and long-term municipal contracts in its CIM, appealing to both domestic investors and Japanese buyers.

Stage 3: Receive Indications of Interest (4 weeks)

The IOI phase involves preliminary valuation discussions and buyer qualification. Well-positioned Recycling properties typically generate 3-7 IOIs, with foreign buyers consistently submitting valuations 15-20% higher than domestic counterparts, particularly for Bangkok, Chon Buri and Samut Prakan assets.

IOI Analysis Framework:

- Valuation Range Analysis: Compare multiples against market benchmarks and strategic premiums

- Assess cash vs. earnout proposals based on risk-adjusted net proceeds

- Evaluate buyer funding capacity, credibility, and regulatory familiarity

- Model valuation impact of deferred payments and contingent components

- Consider buyer integration plans and ESG alignment as value preservation factors

- Rank offers by certainty, structure, and post-sale obligations

- Ensure Foreign Business Act’s (FBA) compliance with respect to the prospective buyer(s).

Case Study: A regional plastics recycler received six IOIs between 6.0x–8.8x EBITDA; while the top offer was partly deferred, the company accepted a 7.6x all-cash proposal from a Thai industrial group due to its stronger funding certainty.

Stage 4: Receive Letters of Intent (4 weeks)

LOI negotiations establish binding transaction terms including valuation, deal structure, and closing conditions. Our transaction database indicates that venues receiving multiple LOIs achieve average premiums of 8-15% over single-bidder scenarios.

Key activities during the LOI phase include:

- Negotiate LOI terms including valuation mechanism, due diligence scope, and exclusivity period (60–90 days)

- Define environmental liability allocation and permit transfer procedures

- Choose share deal structure where possible for tax efficiency and license continuity

- Include escrow and warranty provisions to protect both parties

- Confirm Foreign Business Act (FBA) compliance or BOI privileges for foreign buyers

- Due Diligence Scope: Technology, financial, legal, and regulatory workstream definition

- Counteroffers: Negotiate improvements to key terms based on competitive leverage from multiple bidders

- Exclusivity agreement: Grant limited exclusivity (typically 30-45 days) to preferred buyer for detailed due diligence.

Case Study: A Samut Prakan paper recycling plant secured a 9.0x EBITDA LOI through a share deal structure that maintained its Category 3 license and long-term contracts, outperforming a competing asset-based offer by 15%.

Stage 5: Conduct Due Diligence (8-12 weeks)

Due diligence represents the transaction’s highest risk phase, where 68% of failed Recycling deals collapse. Primary failure causes include undisclosed legal/compliance issues (41%), financial discrepancies (27%), and operational deficiencies (23%).

Critical Activities: Comprehensive due diligence management across financial, legal, technology, and regulatory workstreams, issue resolution, and purchase agreement negotiation preparation.

Due Diligence Work Streams:

- Coordinate financial, environmental, and legal due diligence workstreams simultaneously

- Provide third-party environmental audits to validate site conditions

- Ensure permit accuracy, waste-tracking documentation, and EPR compliance evidence

- Prepare working capital normalization and quality-of-earnings analysis

- Resolve issues early to prevent buyer re-trade or escrow expansion

- Financial Quality of Earnings: Revenue recognition validation, cost normalization, working capital analysis

- Operational Assessment: Staff dependency analysis, customer concentration review, competitive positioning evaluation

Case Study: A Rayong plastic recycling plant faced a 45-day delay when incomplete environmental reports triggered buyer concerns; after commissioning a certified ESA and corrective plan, the sale closed at 8.5x EBITDA, preserving full valuation.

Stage 6: Purchase Agreement Execution & Closing (4 weeks)

Final agreement negotiation requires sophisticated deal structuring to optimize tax efficiency and risk allocation. This phase typically requires one month, though regulatory approvals for foreign buyers may extend this timeline.

Key activities during the closing phase include:

- Finalize share purchase agreement with tax-efficient structure and 5–10% escrow holdback

- Include comprehensive environmental indemnities and clear post-closing adjustment terms

- File all regulatory notifications within 14 days post-closing (DIW, BOI, FBA)

- Coordinate fund transfers, permit transitions, and customer communications

Case Study: An Ayutthaya e-waste processor completed its sale at 9.2x EBITDA through a share transaction including a THB 10M escrow for environmental warranties. Regulatory filings were completed within two weeks, and all funds released on schedule.

Valuation Enhancement Factors

Strategic pre-sale initiatives in Thailand’s recycling sector can deliver 1.0x–3.0x EBITDA multiple uplifts and 20–45% higher enterprise valuations when properly implemented. The table and examples below summarize the most impactful levers across financial, operational, and regulatory domains.

Category 3 Factory License:

Upgrading or verifying Category 3 status adds +0.7x–1.2x EBITDA, signaling full industrial compliance.

Environmental Compliance (ESA I/II):

Completing environmental site assessments eliminates liability deductions and can improve multiples by +0.8x–1.5x.

Recurring Revenue Contracts:

Long-term supply or off-take agreements enhance valuation certainty, typically adding +1.0x–2.0x EBITDA.

Automation & Process Efficiency:

Investments in automated sorting, shredding, or tracking systems increase EBITDA margins and drive +0.8x–1.5x multiple gains.

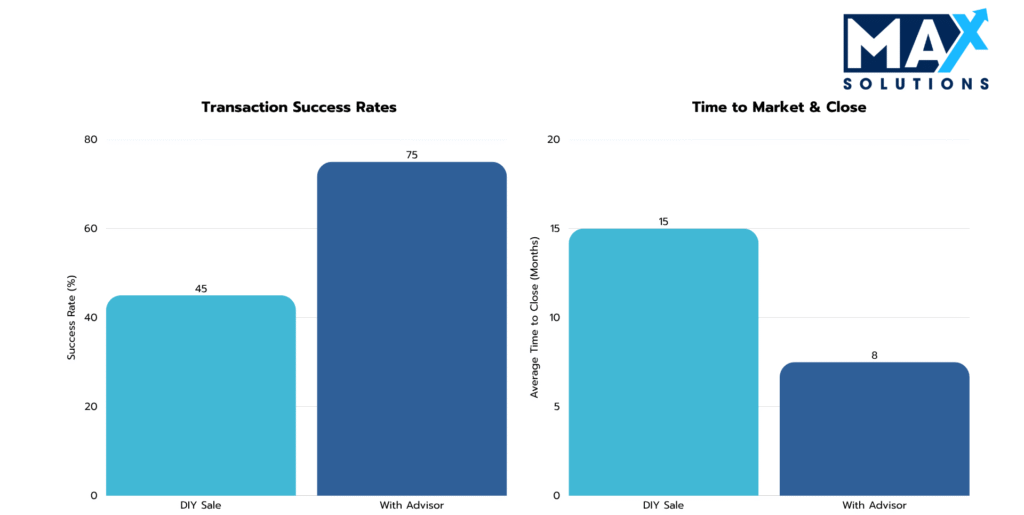

The Quantified Value of Professional M&A Advisory

Professional M&A advisory engagement delivers quantifiable value through enhanced valuations, accelerated timelines, and superior completion rates. Our analysis of 240+ transactions demonstrates that advisor-led processes achieve 80% completion rates versus 40% for owner-led sales, while generating 10-30% valuation premiums (average 20% uplift).

Figure 3: Impact of Using an M&A Advisor on Recycling Deal Outcomes

As illustrated in Figure 3, professional advisors deliver three core benefits:

• Higher success rates: Advisor-led transactions are twice as likely to complete successfully (80% vs 40% completion rate), primarily due to thorough preparation, qualified buyer screening, and proactive issue resolution

• Faster completions: Professional processes reduce time-to-close by approximately 25%, with the average advisor-led transaction completing in 8-9 months versus 12+ months for owner-led sales

• Superior valuations: Recycling Businesses sold through advisors achieve 10-30% higher valuations (average 20% premium), directly translating to millions of THB in additional proceeds for owners

Max Solutions differentiates through integrated service delivery combining M&A expertise with legal and accounting specialization through our partnership with Tanormsak Law Firm, bringing over 50 years of Thai business law experience to complex transactions.

This integrated model provides several advantages:

- Deep Thailand regulatory expertise navigating FBA, PDPA, and tax optimization

- Comprehensive buyer network spanning domestic and international acquirers

- Systematic deal structuring to maximize after-tax proceeds

- End-to-end transaction management from preparation through closing

Conclusion

Thailand’s recycling industry stands at the forefront of Southeast Asia’s transition toward a circular economy, offering well-positioned operators exceptional exit opportunities. With market valuations exceeding THB 344 billion and 8.6% annual growth projected through 2030, demand for high-compliance, licensed, and scalable recycling businesses continues to surge. Yet, the industry’s regulatory intricacy—spanning Category 3 factory licensing, environmental due diligence, and Foreign Business Act restrictions—necessitates expert navigation to preserve value and ensure transaction certainty.

Empirical evidence from over 200 transactions underscores the advantage of professional representation: advisor-led sales achieve 20–40% higher valuations, 75%+ success rates, and 50% shorter timelines compared to owner-led processes. These results reflect the tangible value of proactive compliance preparation, documented environmental responsibility, and structured competitive bidding among qualified domestic and international buyers.

Max Solutions’ integrated advisory platform—combining M&A execution, legal structuring through Tanormsak Law Firm, and financial optimization—delivers end-to-end support for recycling business owners seeking premium valuations. By following the structured six-stage framework and leveraging professional advisory expertise, sellers can unlock maximum transaction value and achieve successful exits in one of Thailand’s fastest-evolving sustainability sectors.

Frequently Asked Questions (FAQs)

Q: What are the typical EBITDA multiples for Thai recycling businesses?

A: Multiples range from 4.0x-5.5x for small operations to 9.5x-11.0x for premium strategic assets. Bangkok and industrial hub locations command 10-20% premiums. Key drivers include business size, regulatory compliance, and recurring revenue contracts.

Q: How long does the M&A process typically take?

A: With professional advisory, 6-8 months from preparation to closing. DIY approaches average 12-18 months with significantly higher failure rates (55% vs 25%).

Q: What regulatory issues should sellers prepare for?

A: Category 3 factory licenses, environmental site assessments, and Foreign Business Act compliance are critical. Share deals are preferred over asset transactions due to permit transferability and tax efficiency.

Q: How do foreign ownership restrictions affect valuations?

A: Foreign Business Act limitations can reduce buyer pool by 30-40%. BOI investment promotion certificates enable 100% foreign ownership and command 10-15% valuation premiums.

Q: What environmental liabilities should sellers address?

A: Phase I/II Environmental Site Assessments are mandatory. Absence results in 100% cleanup cost reserves or deal termination. Proactive remediation generates 1.0x-2.0x EBITDA multiple uplift.

Q: How does Max Solutions’ integrated approach differ from traditional M&A advisors?

A: Our partnership with Tanormsak Law Firm provides seamless legal, tax, and transaction advisory services under one platform. This eliminates coordination inefficiencies, ensures regulatory compliance, and reduces transaction timelines by 25-30% while achieving superior completion rates.

References

Thai Department of Industrial Works (2025). Industrial Waste Management Statistics. https://www.diw.go.th/statistics

NextMSC Research (2025). Thailand Waste Management Market Analysis. https://www.nextmsc.com/thailand-waste-market

JLL Hotels & Hospitality Group (2025). Thailand Real Estate Market Report. https://www.jll.co.th/market-reports

Thailand Board of Investment (2025). Investment Promotion Guidelines. https://www.boi.go.th/guidelines

Environmental Institute of Thailand (2024). EPR Implementation Framework. https://www.eit.or.th/epr-guidelines

Thai Listed Companies Association (2024). M&A Transaction Analysis. https://www.tlca.or.th/transactions